Top 13 Fiscal Charts of 2025

It was an eventful year for fiscal policy in 2025. With large parts of the Tax Cuts and Jobs Act (TCJA) set to expire, lawmakers used the reconciliation process to pass the One Big Beautiful Bill Act (OBBBA) that extended the provisions in the Tax Cuts and Jobs Act permanently using the current policy gimmick and added new tax cuts and spending increases. In addition, we launched our Trust Fund Solutions Initiative and continued to grow our Budget Offsets Bank. In total we published over 250 analyses, and from those we have selected our top 13 charts below.

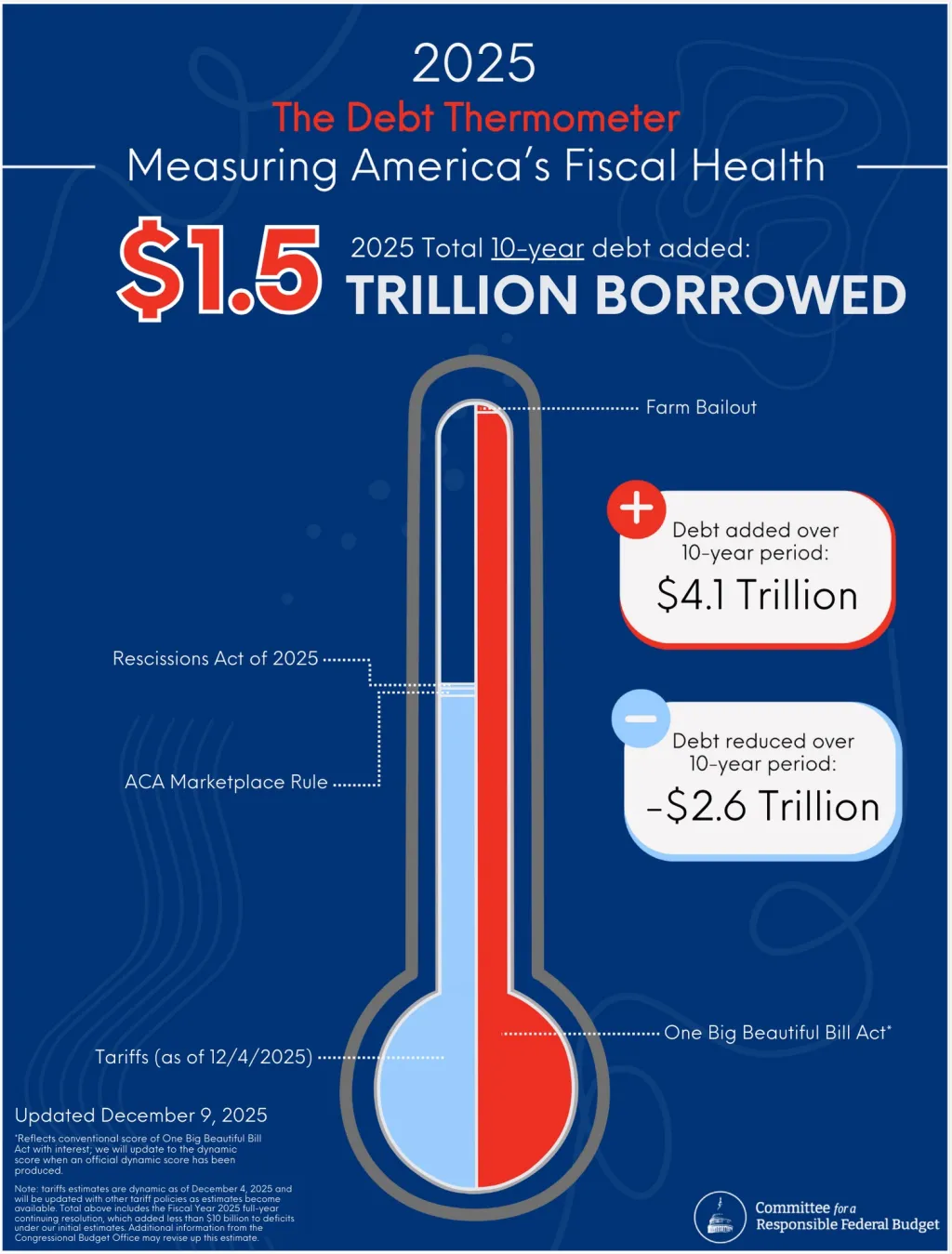

1. The 2025 CRFB Debt Thermometer Shows a Net $1.5 Trillion of Ten-Year Debt Increases

The 2025 CRFB Debt Thermometer tracks legislation and executive actions enacted in 2025. Policymakers added $4.1 trillion in new ten-year debt in 2025, most of which came from the One Big Beautiful Bill Act along with some from the recent announcement of a $12 billion farm aid package. Partially offsetting this is $2.6 trillion of ten-year debt reduction, most of which comes from the Administration's tariff policies along with smaller savings from the Rescissions Act of 2025 and the Administration’s 2025 marketplace rule. All told, policymakers added $1.5 trillion in net new ten-year debt in 2025 – the largest since 2022.

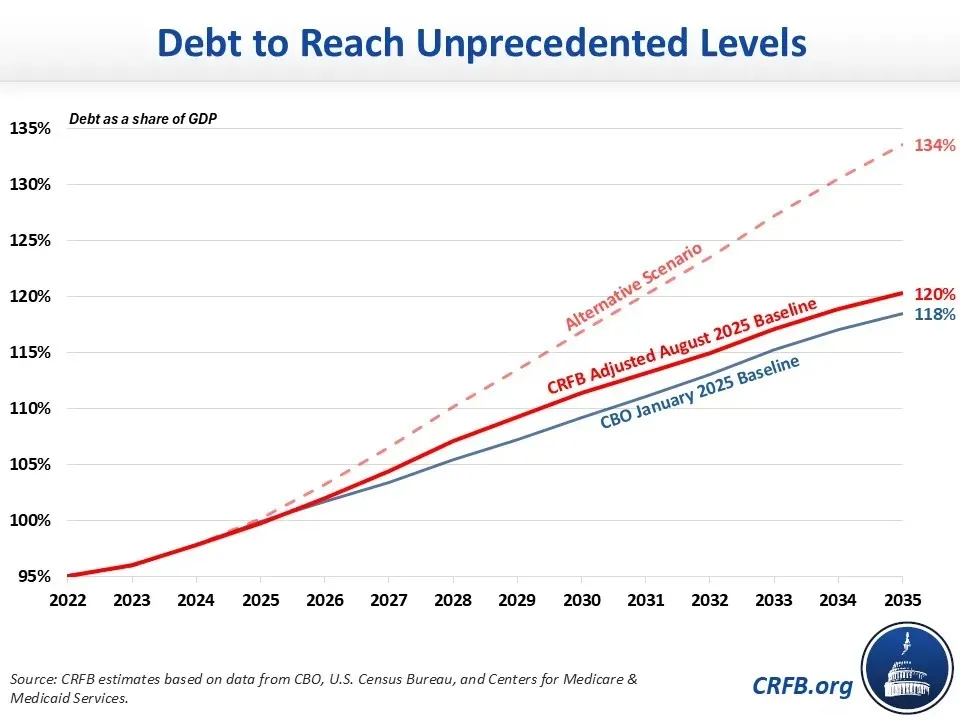

2. The National Debt is Approaching Record Levels

As a result of the above discussed added debt this year, our national debt will now grow higher and at a faster pace than the Congressional Budget Office (CBO) estimated in January. Under the CRFB August Adjusted Baseline, debt will reach 120% of Gross Domestic Product (GDP) and deficits will rise to $2.6 trillion by Fiscal Year (FY) 2035. Under our alternative scenario, which assumes many tariffs ruled illegal are removed, temporary provisions of OBBBA are made permanent, and yields on Treasury securities remain at their current level above CBO’s January baseline, debt will reach 134% of GDP by 2035.

3. What is in the One Big Beautiful Bill Act?

The OBBBA is a massive, sweeping piece of federal legislation. CBO estimates that the law will add $3.4 trillion to primary deficits, $718 billion of interest costs, and a total $4.1 trillion to the debt through 2034, all on a conventional (not dynamic) basis. We break down the law by its components, sorting the tax provisions, immigration and border spending, defense spending, and other spending into $5.9 trillion of costs. The offsets – including health care savings, energy credit repeals, and other spending cuts and revenue increases – total $2.5 trillion. If all of the law’s temporary provisions were made permanent, we estimate the law would instead add $5.5 trillion to the debt through 2034.

Fiscal Effects of the One Big Beautiful Bill Act (FY 2025-34)

| Provision (click on subcategories to expand/collapse the table) | As Passed | If Permanent |

|---|---|---|

| Deficit Increasing Provisions | -$5,883 billion | -$7,176 billion |

| +Extend & Expand TCJA Individual Provisions | -$3,886 billion | -$4,051 billion |

| +Revive TCJA Business Provisions | -$772 billion | -$772 billion |

| +New Individual Tax Cuts | -$418 billion | -$826 billion |

| +New Business Tax Cuts | -$285 billion | -$502 billion |

| +Immigration & Border Spending | -$176 billion | -$293 billion |

| +Defense Spending | -$173 billion | -$457 billion |

| +Other Spending | -$173 billion | -$277 billion |

| Deficit Reducing Provisions | $2,489 billion | $2,489 billion |

| +Health Care Provisions | $1,102 billion | $1,102 billion |

| +Repeal & Reform IRA Credits | $540 billion | $540 billion |

| +Other Revenue Increases & Tax Credit Reductions | $197 billion | $197 billion |

| +Education Reforms | $295 billion | $295 billion |

| +Other Offsetting Receipts | $149 billion | $149 billion |

| +SNAP, Agriculture, & Other Savings | $206 billion | $206 billion |

| PRIMARY DEFICIT EFFECT | -$3,394 billion | -$4,687 billion |

| Interest | -$718 billion | -$836 billion |

| TOTAL DEFICIT EFFECT | -$4,113 billion | -$5,523 billion |

* "If Permanent" figures for these provisions were calculated as a group

Note: figures may not sum due to rounding

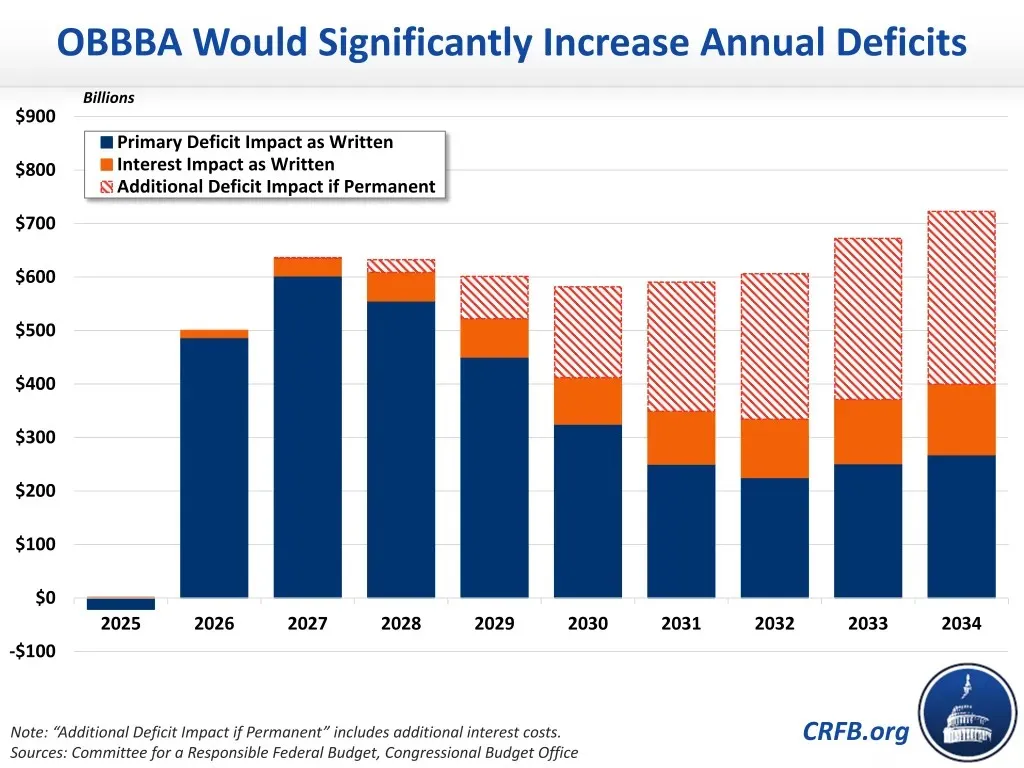

4. OBBBA Will Significantly Increase Annual Deficits

Because of its large tax cuts and spending increases being only partially offset, OBBBA will add significantly to annual deficits over the next decade. We estimate that while OBBBA slightly decreased the FY 2025 deficit – largely as a result of the savings logged from its student loan changes – it will add $500 billion to the deficit in 2026, $635 billion in 2027, and add $4.1 trillion to deficits over the decade including interest. If its temporary tax cuts and spending provisions were extended permanently, the deficit impact would average $615 billion per year and increase by $723 billion in 2034.

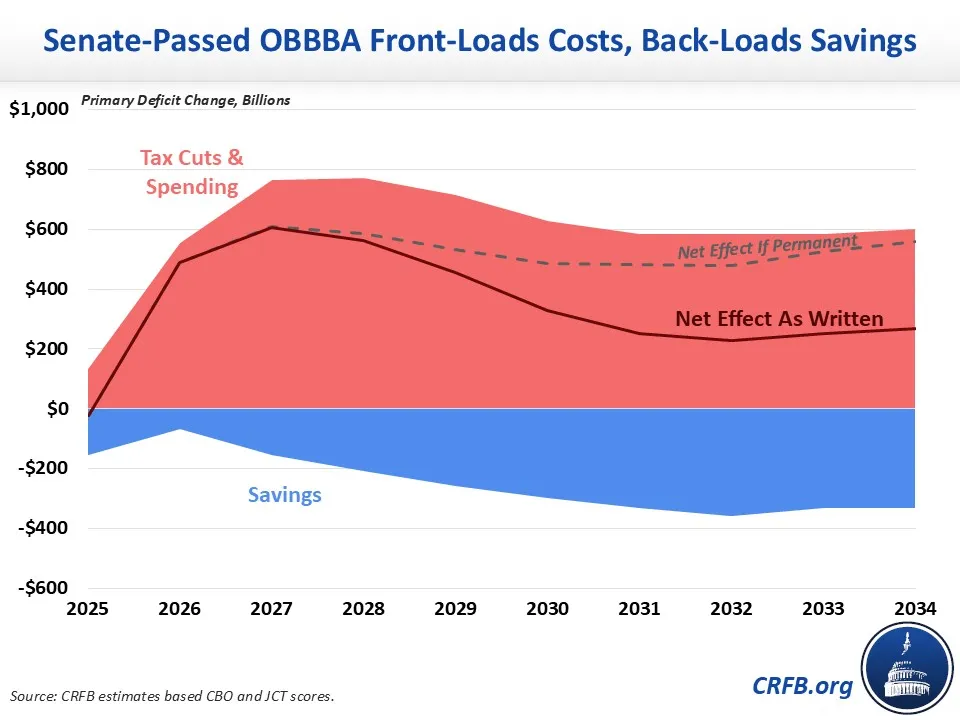

5. OBBBA Boosts Near-Term Deficits With Front-Loaded Costs

OBBBA front-loads it costs and back-loads its savings, with several temporary tax cuts expiring in 2028 or 2029 and the savings beginning to accumulate later in the budget window. The costs peak in 2027, while the savings peak in 2032. Costs could end up being even higher if lawmakers extend the law’s expiring tax cuts and spending increases.

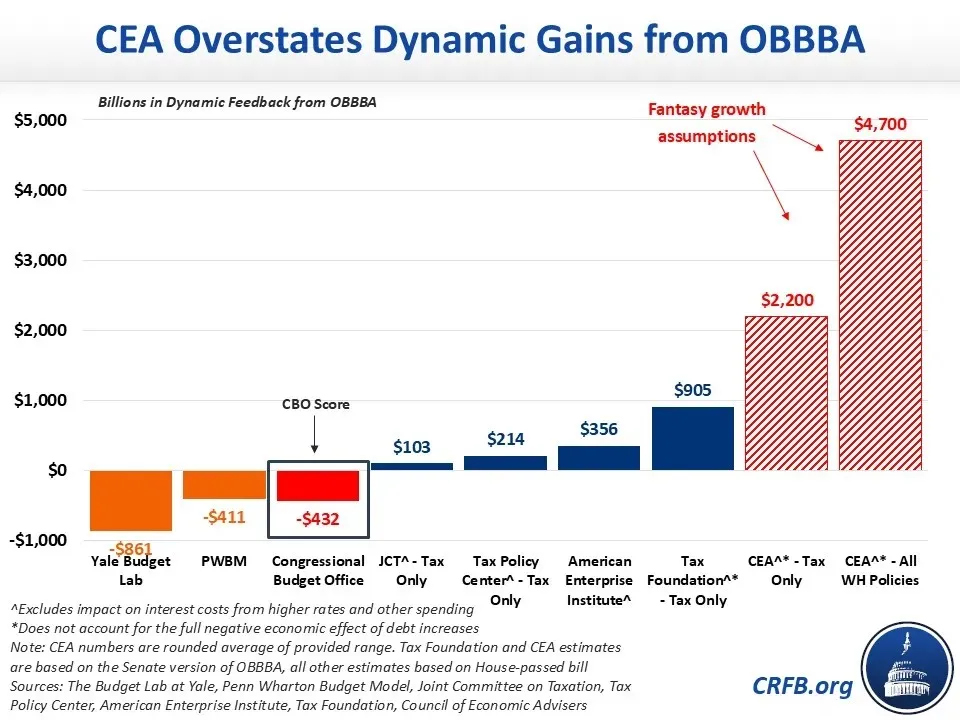

6. OBBBA’s Dynamic Gains Will Likely Be Limited

While CBO has not yet published a dynamic estimate of OBBBA as enacted, it scored the House-passed version as having negative dynamic feedback due to its significant increase in borrowing resulting in higher interest rates. That estimate is in line with several other organizations, which have a large range of moderately negative to moderately positive dynamic feedback. Meanwhile, the White House Council of Economic Advisers (CEA) released an estimate that implies the law will result in $4.7 trillion of dynamic feedback based on fantasy growth assumptions.

We show these projections in our CEA Tracker which continues to be updated to compare these projections to future outcomes.

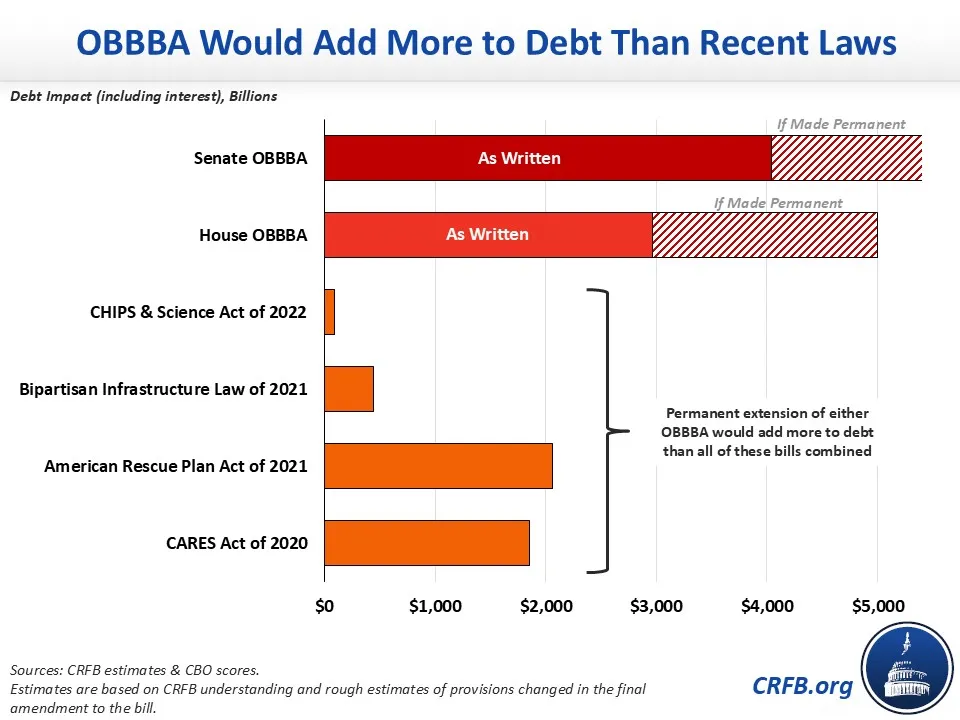

7. OBBBA Will Add More to Debt Than Recent Laws

The $4.1 trillion debt increase enabled by OBBBA is significantly higher than any recent piece of expensive legislation. OBBBA is roughly double the size of the American Rescue Plan Act in dollars, and a permanent extension of the law’s temporary provisions would end up adding more to the debt than the 2022 CHIPS and Science Act, the Bipartisan Infrastructure Law of 2021, the American Rescue Plan Act of 2021, and the CARES Act of 2020 combined.

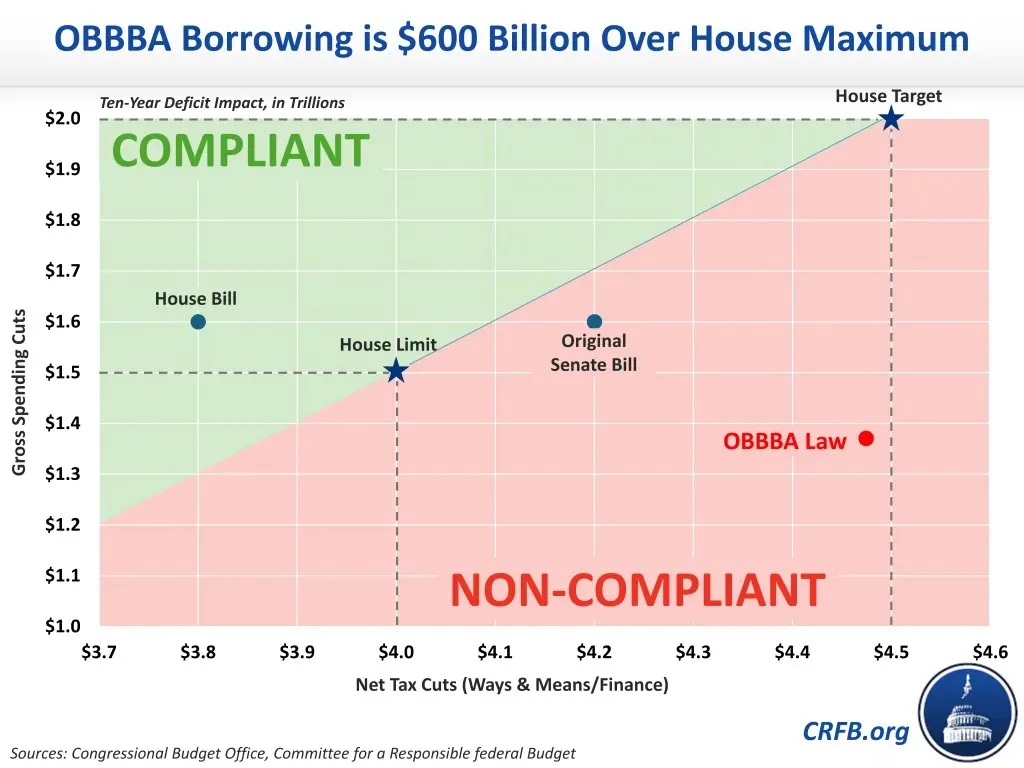

8. OBBBA Spending Cuts Were Too Small, Tax Cuts Too Large Compared Against Target

The FY 2025 budget resolution called for the reconciliation law in the House to enact a maximum of $4.5 trillion of tax cuts against $2 trillion of gross spending cuts, with the tax cuts being reduced dollar for dollar in the event that the spending cuts didn’t meet this goal. The limit for tax cuts was set at $4 trillion alongside $1.5 trillion of spending cuts. However, the final version that became law exceeded its target by a combined $600 billion – since it only has $1.4 trillion of spending cuts.

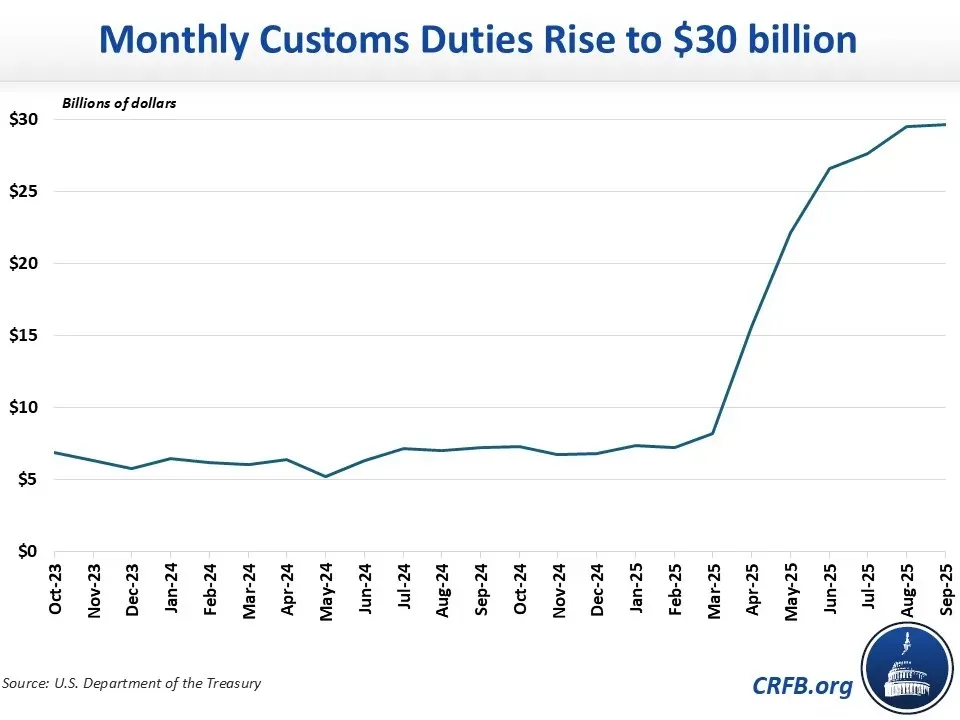

9. Tariff Revenue Increased in 2025

The Trump Administration’s significant changes in tariff policy have resulted in a large increase in tariff revenue. Tariff revenue totaled $195 billion in FY 2025 – more than 250% of the previous year. CBO currently estimates the tariffs will reduce deficits by $3 trillion through 2035. Should the Supreme Court affirm earlier rulings that many tariffs are illegal, tariff revenue will fall significantly. We estimate the deficit reduction would fall to roughly $900 billion through FY 2035. If that happens, policymakers have other options to replace lost revenue.

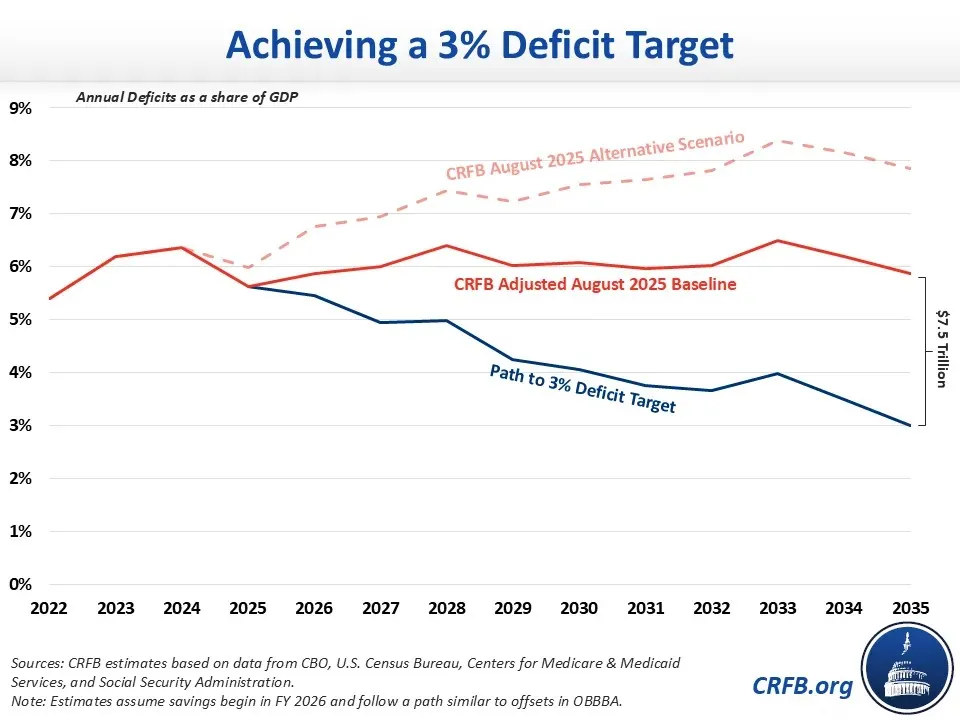

10. We Need Trillions of Deficit Reduction to Meet the 3% Goal

After accounting for OBBBA, the tariffs, and other legislation and executive actions enacted in 2025, we estimate that under the CRFB Adjusted August 2025 Baseline it would take around $7.5 trillion of deficit reduction over the next decade to reduce deficits to 3% of GDP by 2035. This target – which has been promoted by a wide array of leaders ranging from former President Obama to current Treasury Secretary Scott Bessent – would stabilize the debt. However, we are significantly off track to get there under current law.

11. Medicare Spending Continues to Grow

Medicare, the health insurance program for seniors and people with disabilities, continues to grow in cost. The June 2025 Medicare Trustees report shows total Medicare spending has grown from 2.2% of GDP in 2000 to 3.9% in 2025. By 2050, Medicare spending will hit 6.2% of GDP and rise further to 6.7% by 2099.

Our Health Savers Initiative continues to identify policy proposals to increase efficiency in the health care system and decrease costs for individuals, businesses, and the federal government.

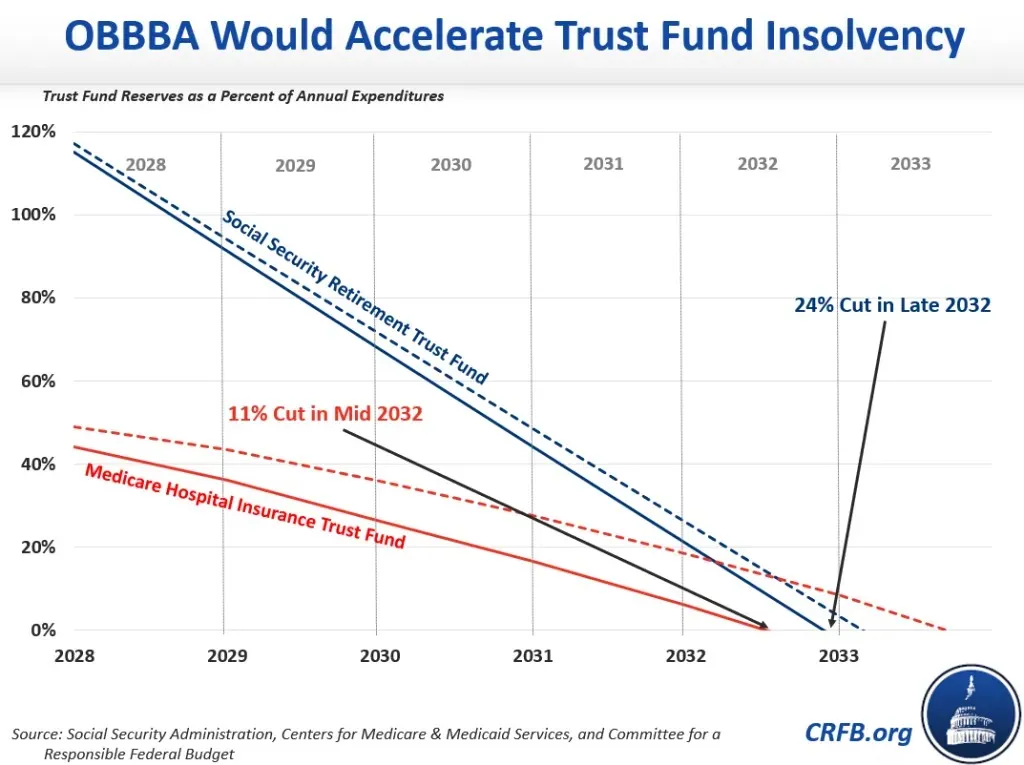

12. Our Major Trust Funds Will Be Insolvent in Seven Years

The trust funds for Social Security and Medicare remain on an unsustainable path, made worse by the enactment of OBBBA. OBBBA accelerated the already looming insolvency date for Social Security’s retirement trust fund and Medicare’s Hospital Insurance (HI) trust fund from 2033 to 2032. As a result, in just seven years – by late 2032 – the Social Security retirement trust fund will be insolvent, resulting in a 24% across-the-board cut, and Medicare’s HI trust fund will also be insolvent, resulting in a 12% cut in payments.

Throughout this year, we released proposals to address insolvency of these programs and we will continue to update those throughout 2026 on our page, Trust Fund Solutions.

13. Beneficiaries Could See $18,400 Cut at Social Security Insolvency

Inaction to prevent insolvency of the Social Security retirement trust fund will lead to a 24% across-the-board benefit cut in 2032, when today’s 60-year-olds reach their normal retirement age and when today’s youngest retirees turn 69. A 24% cut in benefits would be equal to an $18,400 benefit cut for a typical couple retiring shortly after the trust fund runs out.

***

The year 2025 was a consequential year for fiscal policy. Unfortunately, the national debt remains on an upward and unsustainable path. Heading into 2026, we hope policymakers abide by Super PAYGO, offsetting every $1 of new costs with $2 of offsets, and come together to take seriously our fiscal situation and the looming insolvency of the trust funds.