Putting the Reconciliation Resolution in Context

The House Fiscal Year (FY) 2025 budget resolution would allow policymakers to add $2.8 trillion to primary deficits through 2034 via a reconciliation package. Such a bill would be historically large and set the stage for far too much borrowing at a time when interest costs are already at record highs and deficit reduction is needed.

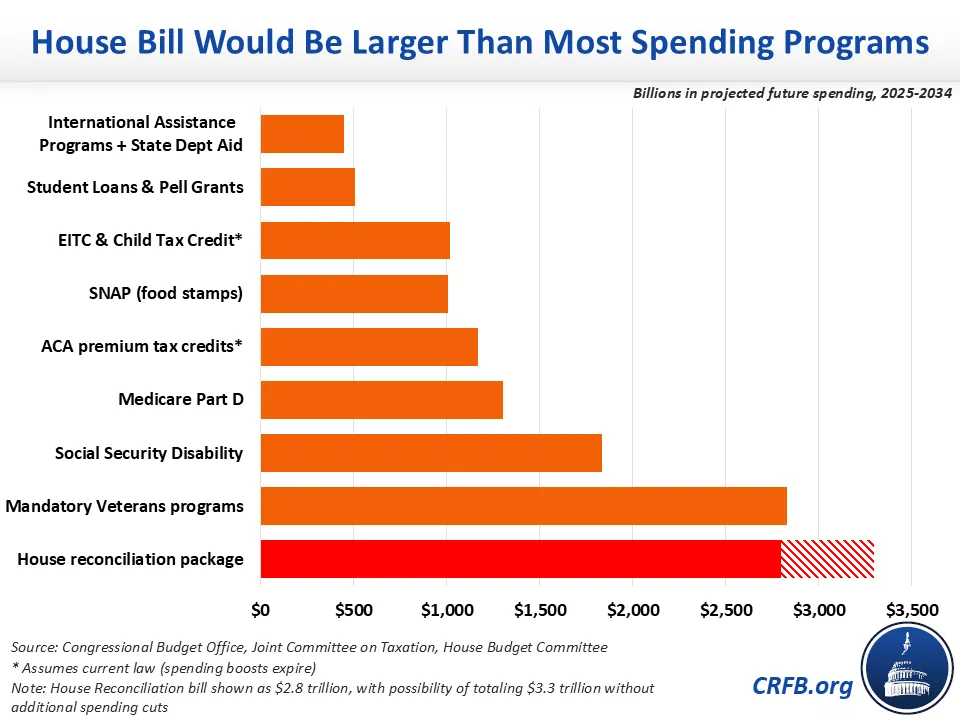

For context, a $2.8 trillion reconciliation bill – with nearly all the borrowing between 2026 and 2034 – would:

- Equal more than all spending programs except for the Social Security retirement program, Medicare, Medicaid, net interest, veterans’ and defense spending.

- Equal two times as much as Medicare Part D, almost three times as much as the Child Tax Credit and Earned Income Tax Credit, and five times as much as foreign aid from USAID and the State Department.

- Add more to the deficit than any legislation enacted in the past decade, including 50 percent more than the American Rescue Plan Act, twice as much as the original Tax Cuts and Jobs Act, and seven times as much as the bipartisan infrastructure law.

Without the unspecified $500 billion of savings, a reconciliation package could add even more – up to $3.3 trillion – to projected deficits. In that case, its fiscal impact would be three times as large as all Supplemental Nutrition Assistance Program (SNAP) benefits, twice as large as the 2020 CARES Act, and eight times as large as the bipartisan infrastructure law.

How Would the Reconciliation Bill Compare to Current Programs?

While the House budget’s reconciliation instructions cover deficit changes from 2025 through 2034, few spending or tax changes would take place before 2026. Over that nine-year period, a $3.3 trillion reconciliation bill would add more in deficits than all the projected spending on student loans, Pell Grants, international assistance and State Dept foreign aid programs, the Child Tax Credit, the Earned Income Tax Credit and SNAP combined.

Even at $2.8 trillion, the bill would have as large of a fiscal impact as all anticipated spending on mandatory veterans’ programs ($2.8 trillion), five times as much as Pell grants and student loans, two-and-a-half times as much as SNAP, and five times as much as all International Assistance Programs and State Department foreign aid.

How Would the Reconciliation Bill Compare to Recent Legislation?

The proposed reconciliation package also has a large deficit impact compared to recently enacted legislation. The $2.8 trillion deficit impact of this bill is larger than the deficit impact of any other recent bill passed into law on a ten-year nominal cost basis (and would remain so even after accounting for inflation).

A $2.8 trillion reconciliation bill would add nearly twice as much to the deficit as the original TCJA ($1.5 trillion) and seven times as much as the bipartisan infrastructure law. These comparisons are before extra interest on the debt is included.

A $3.3 trillion reconciliation bill would have nearly twice the deficit impact of the next most expensive recent law, the 2021 American Rescue Plan Act ($1.8 trillion), eight times the impact of the Bipartisan Infrastructure Law ($400 billion), and would also be twice as large as the CARES Act ($1.7 trillion), which was passed at the beginning of the COVID-19 pandemic.

Caveats do apply when comparing bills. We present standard ten-year cost estimates here, even though the costs of bills are incurred over different timeframes. For example, this bill would have impacts for nine years, while the American Rescue Plan Act and Infrastructure Investment and Jobs Act (IIJA) were designed to be completely spent over five years. And comparisons are also in nominal dollars, as opposed to in real dollars or percent of Gross Domestic Product.

Though these comparisons do not reflect inflation, the results are not driven by inflation. In the most extreme example, the deficit impact of the Tax Cuts and Jobs Act would only be $1.8 trillion in today’s dollars (up from $1.4 trillion at passage). Renewing the TCJA is more expensive than its initial passage not because of inflation, but because the original TCJA included many revenue raising provisions that lowered the net impact of the tax cuts, muting the impact on the deficit. Some policymakers are discussing modifying or eliminating the original TCJA revenue offsets when they should be strengthening them and finding new offsets to pay for this tax cut extension.

$2.8 Trillion is $10 Trillion Too Much

Under current law, debt is projected to grow from less than 100 percent of GDP today to 117 percent by 2034. Reconciliation based on the House budget resolution would likely boost debt to 125 percent of GDP – a nearly 50 percent increase in the rate of growth of the debt.

Stabilizing the debt at current levels would require roughly $7 trillion of primary deficit reduction through 2034. Reconciliation should at least make a down payment on these savings, rather than make our debt problems worse

There are tens of trillions in offsets in our Budget Offsets Bank that can cover the cost of the reconciliation bill and reduce deficits at the same time. Instead of passing a bill with a historically large fiscal impact, lawmakers should use this opportunity to rein in borrowing with a fiscally responsible package that can set the stage for a permanent package of thoughtful tax extensions and budget savings that grows the economy and improves our debt outlook.