CBO’s New Projections Show $1 Trillion Less in Tariff Savings

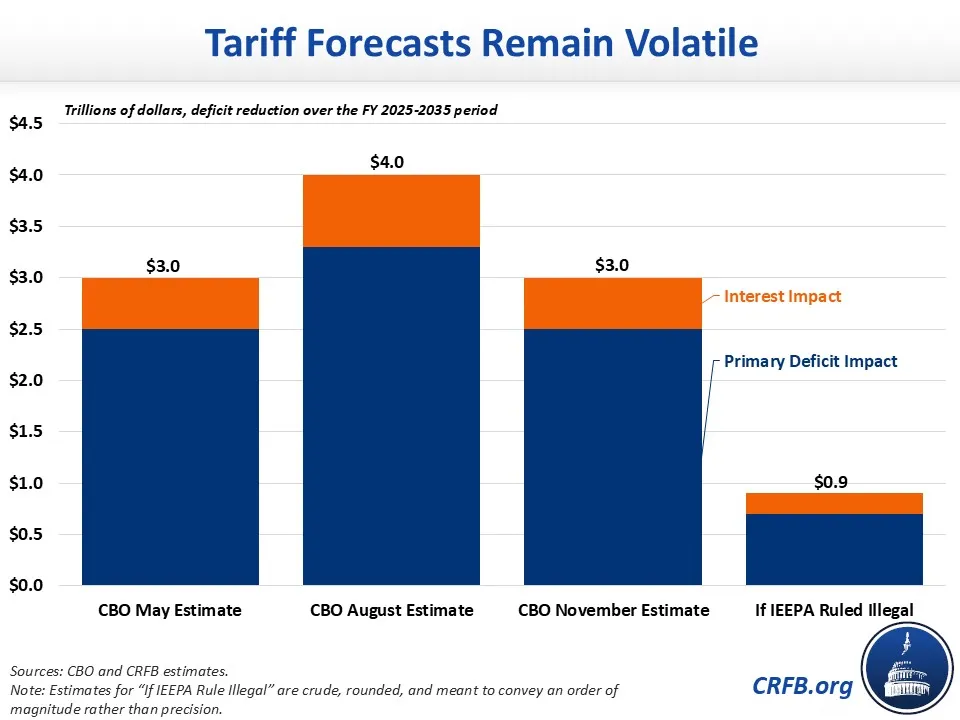

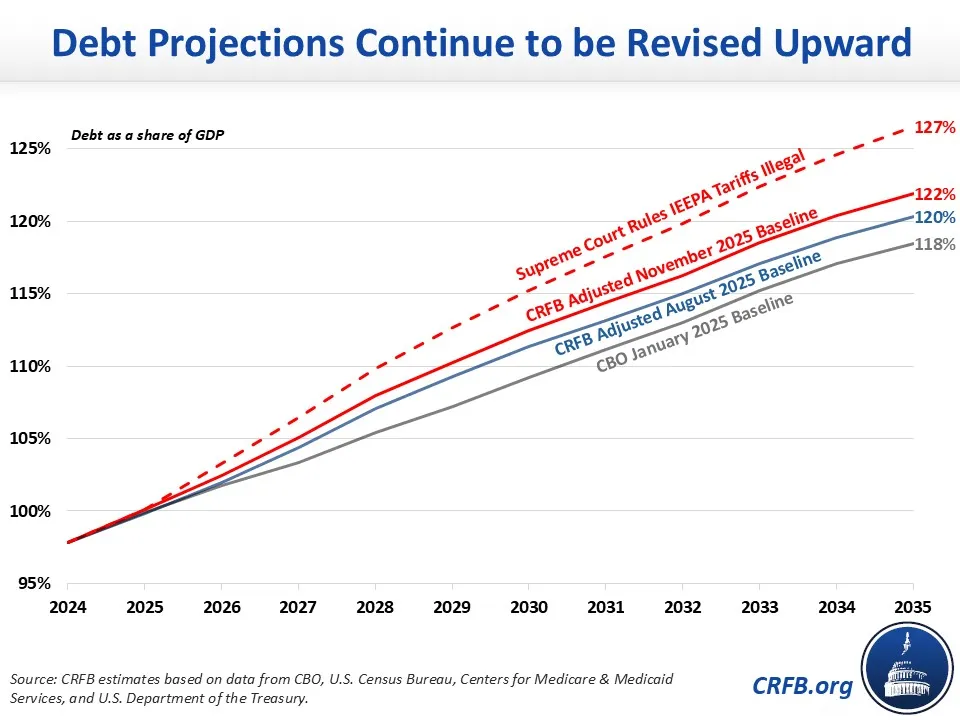

Updated projections from the Congressional Budget Office (CBO) show that tariffs enacted this year will reduce debt (including interest) by $3.0 trillion through Fiscal Year (FY) 2035, down from the $4.0 trillion projected in August. Excluding dynamic effects, CBO now projects $2.5 trillion of revenue as opposed to $3.3 trillion – with one-third of the difference driven by announced policy changes and the other two-thirds due to updated estimates based on improved methods and the latest data. Accounting for CBO’s updated tariff estimates, our debt projections rise from 120% of GDP in 2035 under the CRFB Adjusted August 2025 Baseline to 122% of GDP.

The significant adjustment to CBO’s tariff projections is mostly due to changes in methodology. Specifically, CBO states that roughly two-thirds of the downward revisions since August are from increasing the estimated share of imports from Canada and Mexico that can access lower or zero duty rates under the United States-Mexico-Canada Agreement (USMCA), reducing estimates of the value of steel and aluminum in goods that are subject to tariffs on derivative products, and increasing the projected share of tariff costs absorbed by foreign exporters from 0% to 5% of the increase in the tariff rate.

The remaining one-third of the projections update was due to policy changes since August, such as the recent 10 percentage point reduction in tariffs on Chinese goods, product-specific tariffs on certain vehicles and vehicle parts and certain lumber and derivative products, reduced rates for goods from the European Union and Japan, and additional tariffs on India. If accounting only for policy changes, CBO’s updated estimates would have been roughly $3.0 trillion – down from $3.3 trillion and aligned with CRFB estimates. Going forward, we will update our tariff modeling to better reflect CBO’s methodology revisions.

If the Supreme Court upholds the ruling that tariffs enacted under the International Emergency Economic Powers Act (IEEPA) are illegal, then the primary deficit impact would likely drop to around $0.7 trillion, or roughly $0.9 trillion after interest. Importantly, this is a crude estimate meant to convey an order of magnitude rather than a precise figure; CRFB's projections of non-IEEPA tariffs will become more precise after modeling updates.

In light of CBO’s updated tariff estimates and the incorporation of actual 2025 budget data from Treasury, we now project debt to rise to 122% of GDP by 2035, roughly 2% of GDP higher than the CRFB Adjusted August Baseline and 4% of GDP higher than CBO’s January 2025 baseline. If the Supreme Court rules IEEPA tariffs illegal, debt would rise further to 127% of GDP.1

Debt would rise even higher – to 128% of GDP – if tariffs were repealed in full or used for deficit-neutral rebates. If the rebates were set at $2,000 annually regardless of tariff revenue coming in, debt could rise to 138% to 143% of GDP, depending on if IEEPA tariffs are ruled illegal or not.

Debt projections have continued to rise beyond CBO’s January 2025 budget outlook, deepening a fiscal outlook that was already worrisome. Lawmakers should replace any lost tariff revenue and work to put the debt on a sustainable path. The longer they wait, the heavier the burden will be on future generations to restore fiscal stability.

1 This includes the expectation that the government would pay back any tariffs collected that were ruled illegal.