CEA’s Fantastical Economic Assumptions

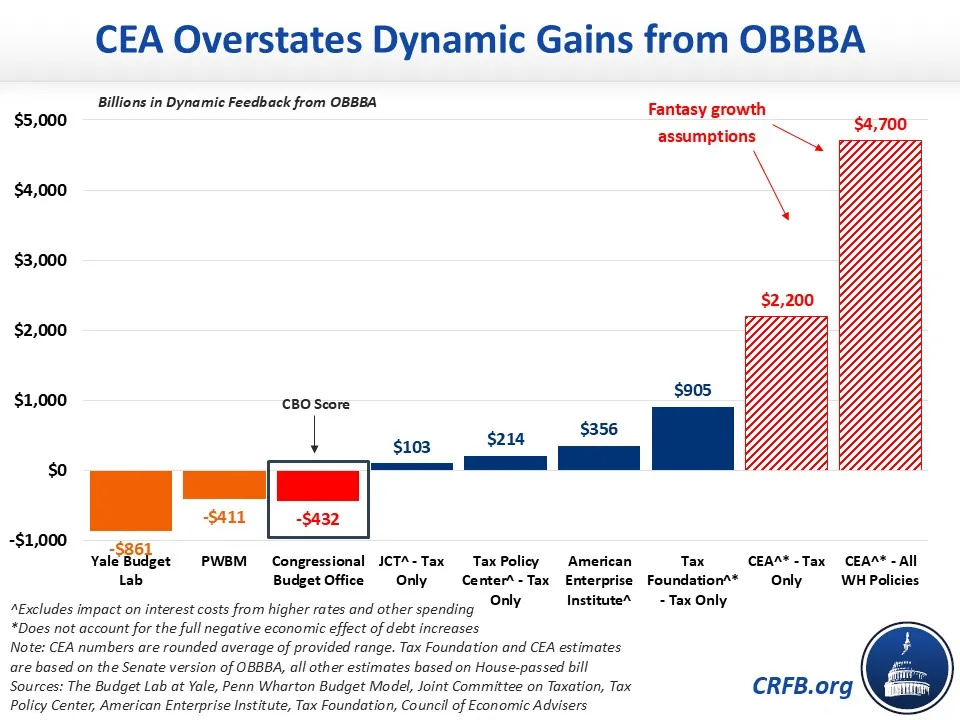

The White House Council of Economic Advisers (CEA) released a report today claiming the Senate’s proposed version of the One Big Beautiful Bill Act (OBBBA) would generate $2.1 to $2.3 trillion of dynamic feedback and boost output by 2.4 to 4.9 percent. These claims are based on fantasy growth assumptions are many times higher than other estimators.

In a coming analysis, we will explain the many flaws in CEA’s analysis. Below, we show how far off CEA’s estimates are from the Congressional Budget Office (CBO), the Joint Committee on Taxation, and five other credible modelers – many which find negative dynamic feedback.

As we have shown before, dynamic estimates find that the OBBBA would produce anywhere from $860 billion of negative dynamic feedback to $900 billion of positive dynamic feedback. The most comprehensive and official dynamic analysis, from CBO, finds the House-passed version of the bill would increase deficits by $430 billion more on a dynamic basis as a result of higher interest rates.

CEA’s claim of $2.1 to $2.3 trillion of dynamic feedback is nearly 2.5 times as large as the next highest estimate, more than 50 times as high as the average of outside modelers, and the opposite sign of CBO and others that conducted a comprehensive analysis of the bill. CEA’s assumption of $4.7 trillion when including additional policies addressing energy and deregulation is even more fantastical.

CEA’s incredible feedback assumptions come from ignoring the effects of OBBBA on spending and interest costs, ignoring the negative impact of rising national debt, and assuming unrealistically high positive growth effects from the tax portions of the bill. By 2028, CEA claims OBBBA would increase the level of economic output by 4.6 to 4.9 percent above baseline estimates – other modelers range from 0.1 to 1.3 percent. In 2034, CEA claims the bill would boost the level of output by 2.4 to 2.7 percent above baseline estimates. Most other modelers estimate it would boost 2034 output by 0.4 percent – with a range of negative 0.1 to positive 1.1 percent. In other words, CEA’s growth claims likely overstate the positive economic impact of the reconciliation bill by six times or more.

While OBBBA is likely to provide a large near-term boost to the economy by providing one-time stimulus, the medium-term effects are likely to be modest – as stronger incentives to work and invest are at least partially offset by the negative impact of a higher national debt. Over the very long term, most modelers estimate the bill would shrink output.

These fantastical assumptions and incredibly optimistic estimates only serve to obfuscate the very real deficit impact of enacting OBBBA in its current form. Instead of attempting to paper over OBBBA’s debt increase with phony analysis, policymakers should work towards ensuring that OBBBA reduces debt with offsets that cover its entire sum of tax cuts and spending increases.

Dynamic Estimates of OBBBA (FY 2025-2034, billions)

| Conventional Estimate | Dynamic Estimate | Dynamic Feedback | % Dynamic Feedback | GDP Impact (2034) | |

|---|---|---|---|---|---|

| Council of Economic Advisers - Tax Only^ | -$4,200 | -$2,000 | +$2200 | 52% | +2.6% |

| Congressional Budget Office | -$2,967 | -$3,399 | -$432 | -15% | +0.4% |

| Joint Committee on Taxation – Tax Only^ | -$3,819 | -$3,716 | +$103 | 3% | +0.2%* |

| Yale Budget Lab | -$2,677 | -$3,538 | -$861 | -32% | -0.1% |

| Penn Wharton Budget Model | -$2,787 | -$3,198 | -$411 | -15% | +0.4% |

| Tax Foundation - Tax Only^ | -$4,695 | -$3,790 | +$905 | 19% | +1.1%* |

| American Enterprise Institute^ | -$2,416 | -$2,060 | +$356 | 15% | +0.4%* |

| Tax Policy Center - Tax Only^ | -$3,798 | -$3,584 | +$214 | 6% | +0.4% |

Sources: CBO, JCT, The Budget Lab at Yale, Penn Wharton Budget Model, Tax Foundation, the American Enterprise Institute, and the Tax Policy Center. Estimates are of primary deficit, unless specified otherwise.

Note: CEA and Tax Foundation estimates are based on the Senate version of OBBBA, all other estimates based on House-passed bill

*JCT's GDP impact is over 2030-2034, Tax Foundation's GDP impact is "long-run, and AEI GDP impact is in 2035.

^Estimates exclude interest costs from higher rates on new debt for OBBBA.