It's Time for Trust Fund Solutions

Some of the nation’s largest and most important programs are financed through government trust funds that collect dedicated revenues and then distribute those funds. This includes Social Security’s Old-Age and Survivors Insurance (OASI) and Disability Insurance (SSDI) programs, Medicare’s Hospital Insurance (HI) program, and the Highway Trust Fund (HTF).1

These programs provide direct benefits to nearly 70 million Americans and serve or insure at least 200 million more through either cash benefits in case of retirement, disability, or death; health insurance for older Americans and those with disabilities; or construction and maintenance of interstate surface transportation.

Unfortunately, program costs have been outstripping dedicated revenue, and three of the four trust funds are within seven years of insolvency. Once the trust funds run out of reserves, the law requires an across-the-board cut in benefits or spending to match costs with revenue.2

Changes are needed to rescue these trust funds from insolvency. Our new Trust Fund Solutions Initiative will put forward concrete and novel policy ideas for each of the major trust funds.3 In this piece, we explain that trust fund solutions can:

- Prevent insolvency of the Social Security retirement, Medicare hospital, and Highway trust funds, otherwise expected within seven years.

- Avert deep across-the-board cuts, including a 24 percent Social Security benefit cut – about $18,400 for a typical couple turning 60 this year – a 12 percent Medicare cut, and a 46 percent highway spending cut.

- Improve the nation’s fiscal outlook and help stabilize the debt-to-GDP ratio.

- Accelerate economic growth and increase incomes and wealth.

- Offer an opportunity to better target benefits, encourage work and support savings, strengthen retirement security, support workers with disabilities, lower health care costs, maximize efficiency, and improve public investments.

With the insolvency of three major trust funds only seven years away or less, policymakers are running out of time to act. The longer policymakers delay, the fewer options will be available and the more painful the choices will be.

The looming insolvency of the trust funds is a major challenge but also offers an important opportunity. It’s time for trust fund solutions.

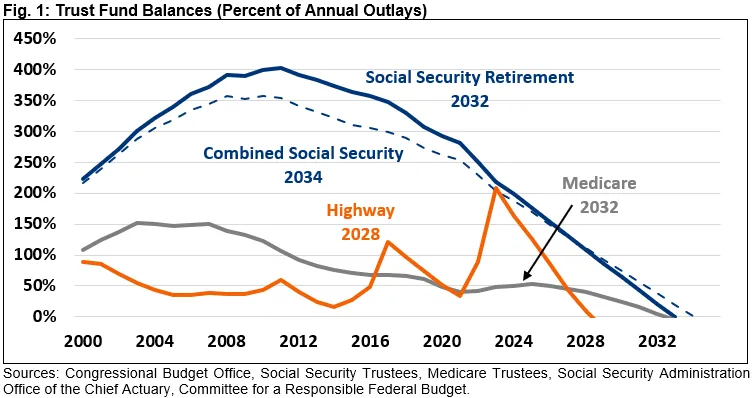

Trust Fund Solutions Can Prevent Looming Insolvency

Three of the government’s largest and most important trust funds are within seven years of insolvency. Based on projections from the Congressional Budget Office (CBO), the Highway Trust Fund – which is mainly financed with a gas tax – will run out of reserves in 2028. Meanwhile, the Social Security retirement trust fund and Medicare Hospital Insurance trust fund, based on estimates from the programs’ own Trustees, will be insolvent by late 2032.4 And on a theoretically combined basis, the Social Security retirement and disability trust funds will run out in 2034.

CBO reaches similar conclusions on Social Security, estimating the retirement trust fund would run out in 2033 and the theoretically combined trust funds in 2034. Although CBO previously estimated the Medicare trust fund would run out in fiscal year 2052, that insolvency date is likely to be much sooner in light of the effects of the One Big Beautiful Bill Act and other changes.5

In any case, legislative action is needed to prevent insolvency and continue to pay full benefits.

Expected insolvency dates are looming in the very near future. The Highway Trust Fund is less than three years from insolvency – before many recently-approved projects even break ground.6

Meanwhile, Social Security’s and Medicare’s depleting trust funds are only seven years from exhaustion. In other words, the funds will run out when today’s 60-year-olds reach the Normal Retirement Age and when today’s youngest retirees turn 69. Most seniors on the program today will still be collecting benefits when the trust fund is exhausted.

Trust Fund Solutions Can Prevent Sharp Benefit Cuts

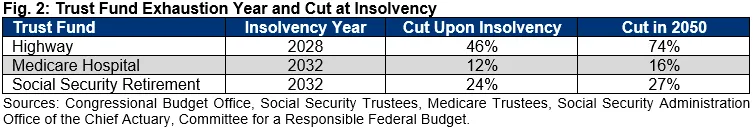

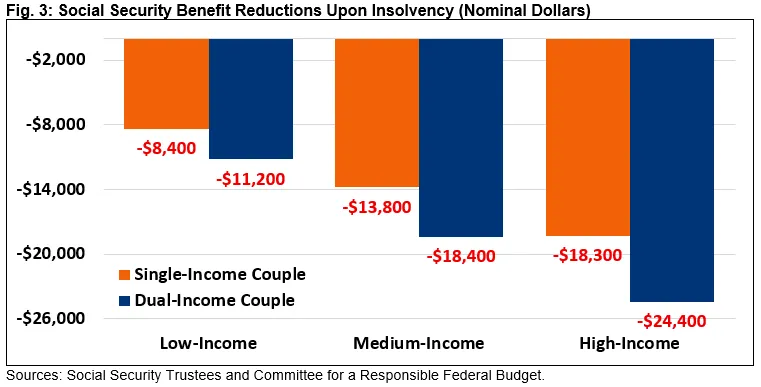

Under the law, trust fund program outlays cannot exceed revenues after reserves are exhausted, meaning insolvency of each of the major trust funds threatens massive benefit and service cuts. Upon trust fund depletion, highway spending faces a 46 percent cut, Medicare providers face a 12 percent cut, and Social Security retirees face an across-the-board 24 percent benefit cut. By 2050, we estimate those cuts will grow to 74, 16, and 27 percent, respectively.

To put these cuts in context, the Social Security cuts would equal an $18,400 loss in annual benefits for a typical couple retiring at the start of 2033. The actual benefit reduction will differ based on earning history, family structure, and collection age, but will be large in almost all cases.

At around the same time that Social Security runs dry, Medicare’s hospital fund will run out, forcing a 12 percent reduction in outlays. This could lead to a major disruption in access to care as Medicare stops or delays payments to hospitals, skilled nursing facilities, and other providers.

Federal highway and transportation spending, meanwhile, would be cut in half. As a practical matter, this would result in a freeze for all new projects and a slowdown in existing ones which could threaten the government’s ability to maintain safe and open highways, buses, ferries, and railways for many of the nation’s commuters, commercial drivers, and train passengers.

Trust Fund Solutions Can Improve the Nation’s Fiscal Outlook

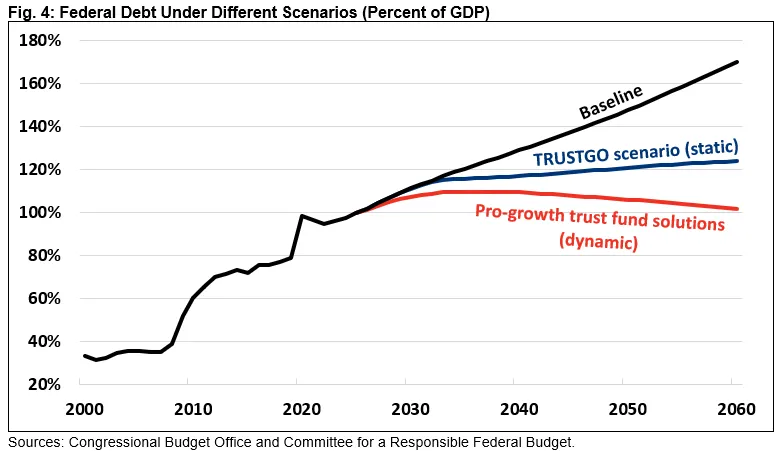

In addition to preserving solvency and preventing deep across-the-board benefit cuts, trust fund solutions can reduce unified budget deficits and improve the nation’s fiscal outlook – at least relative to a scenario where scheduled spending continues regardless of available trust fund reserves, as in the CBO baseline (which by law is required to assume continued spending).7

Based on CBO’s projections, the Social Security, Medicare, and Highway trust funds are projected to spend $4.3 trillion – or 1.1 percent of GDP – more than they collect in revenue over the next ten years.8 Their combined annual shortfall will grow to 1.7 percent of GDP by 2050 and continue to rise thereafter. This borrowing is a major driver of the country’s projected national debt.

Under CBO’s baseline, we project that debt will rise from nearly 100 percent of GDP today to 170 percent by 2060.9 If each trust fund program’s spending was limited to available revenue after reserves run out, debt would grow much more slowly to about 125 percent of GDP by 2060.10 In other words, simply avoiding borrowing or general revenue funding to finance Social Security, Medicare, and highways would close about two-thirds of the fiscal gap over the next 35 years.

More thoughtful and pro-growth reforms could go even further and fully stabilize the debt (albeit at too high a level). Such trust fund solutions could begin to phase in policy changes immediately, fully address 75-year shortfalls, put downward pressure on interest rates, and accelerate economic growth. One illustrative package we modelled would slow and then reverse the growth of debt, putting debt on a downward path toward 100 percent of GDP in the early 2060s.11

Trust Fund Solutions Can Grow the Economy and Boost Incomes

Restoring solvency to the major trust funds would not only prevent a deep benefit cut under current law and avoid massive borrowing in the event that the law is ignored, but it could also significantly improve economic growth and thus boost household income and wealth.

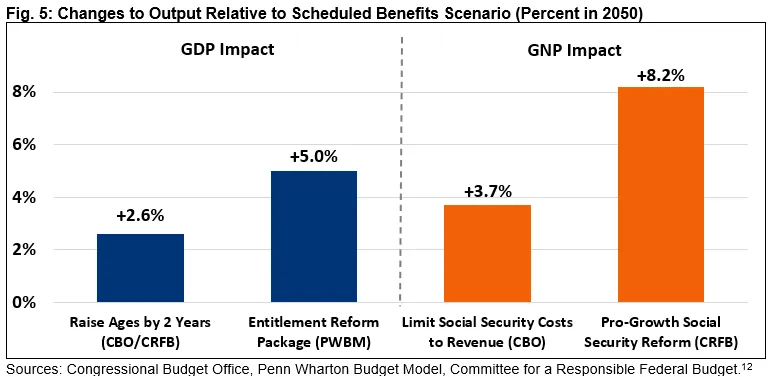

In 2023, CBO estimated that the very crude and simple policy of limiting Social Security benefits to available revenue – after a painful near-term disruption – would boost real Gross National Product (GNP) in 2050 by 3.7 percent as a result of smaller deficits relative to CBO’s baseline and more precautionary work and saving as Americans adjusted to lower benefits. This is the equivalent of a 0.2 percentage point increase in annual real GNP growth.

More thoughtful reforms could generate additional economic growth and do so with far less disruption. In 2019, CRFB’s Marc Goldwein, Maya MacGuineas, and Chris Towner released a pro-growth Social Security framework with revenue and benefit reforms that they estimated would boost real GNP growth by more than 8 percent – about 0.25 percent per year – by promoting work and saving while reducing deficits and improving economic certainty.

In 2021, staff of the Penn Wharton Budget Model (PWBM) put out an entitlement reform framework to increase revenue, slow the growth of Social Security benefits, and reduce Medicare costs. They estimated their plan would boost GDP by 5 percent by 2050 – about 0.2 percent per year – and presumably it would boost GNP significantly more.

And based on a 2012 CBO analysis, simply raising the major Social Security and Medicare ages by two years would boost output by 2.6 percent by 2060. Other reforms – from investing more efficiently in infrastructure to lowering the cost of health care – could generate further growth.

Time for Novel Solutions

Restoring solvency to the Social Security, Medicare, and Highway trust funds will mean identifying a combination of policies to lower costs, increase dedicated revenue, or both.

Those policies could go beyond simply saving money by also helping to achieve other important policy goals such as better targeting benefits, improving retirement security, lowering health care costs, reducing work disincentives, promoting savings, encouraging productive aging, supporting workers with disabilities, cutting waste and abuse, more efficiently raising revenue, investing in higher-return infrastructure, improving program administration, and more broadly promoting stronger growth and higher standards of living.

Already, there are many well-known ideas to reduce Medicare costs, slow the growth of Social Security, secure highway funding, and improve revenue collection. Unfortunately, many of these ideas have become politicized, and most were developed decades ago and thus don’t fully reflect recent changes to the economy and health care systems.

The Trust Fund Solutions Initiative aims to supplement the existing library of options with a series of novel solutions that may help to re-invigorate discussion over how to best rescue the trust funds. Over the next two years, we will release a series of white papers introducing these novel solutions and using independent modeling to analyze their effects. Some of the proposals we will introduce may include:

- A broad-based Employer Compensation Tax to replace employer-side payroll taxes. (Published 10/15/2025)

- A Social Security COLA Cap to limit benefit growth for wealthy seniors. (Published 10/21/2025)

- Medicare’s post-acute care payments and coverage reforms.

- A new Earn-As-You-Go benefit formula for Social Security that credits all years of work equally toward benefits and ends most existing work disincentives.

- A fee-based system to fund highway investments.

- Limits to six-figure benefits from the Social Security program.

- A new cost-effective program to fund medical residents and encourage primary care.

- Retirement age increases coupled with protections for vulnerable seniors.

- Reforms to the income taxation of Social Security benefits.

It is unlikely that any of these novel solutions will fix the financial imbalances of the major trust funds on their own. But in combination with each other or other thoughtful adjustments and reforms, these ideas could meaningfully advance solvency. Policymakers should add them to the existing menus of potential reforms and urgently begin the work of saving our trust funds.

New solutions will be published on the Trust Fund Solutions Initiative website.

Conclusion

Within the next seven years, Americans are likely to face the insolvency of the Social Security, Medicare, and Highway trust funds, at which point the law requires deep across-the-board cuts. This includes a 46 percent cut in highway spending in just three years, a 12 percent cut to Medicare payments when today’s youngest Medicare beneficiaries are 72, and a 24 percent cut to Social Security retirement benefits when today’s youngest retirees are 69 and today’s 60-year-olds reach the normal retirement age.

Policymakers should urgently begin work to avoid these cuts and rescue the trust funds. Restoring trust fund solvency provides lawmakers with an opportunity to enact reforms while ensuring that these programs continue to function as intended. Thoughtful trust fund solutions can reduce deficits, stabilize the national debt, accelerate economic growth, reduce interest rates, lower health care costs, strengthen retirement security, support work, improve program administration, and enhance public investment.

There are numerous ways to achieve these goals. Unfortunately, excessive demagoguing, insufficient candor, and lack of political will have too often prevented policymakers from enacting well-known and thoroughly-vetted policy solutions.

At the same time, new realities call for new ideas. The Trust Fund Solutions Initiative will put forward a series of novel solutions that could help rescue the trust funds and perhaps reinvigorate the solvency debate. Our new trust fund solutions will aim to provide practical ways to restore financial balance to the trust funds and help address the economic and health challenges facing the country today. We encourage others to put forward solutions as well.

With the major trust funds only a few years from insolvency, there is little time to waste.

The Committee for a Responsible Federal Budget does not endorse any particular solution to restore solvency to the Social Security, Medicare, and Highway trust funds. The novel policies presented in this series should be added to the library of potential options policymakers consider when crafting a broader reform package. The insolvency of each of the major trust funds is only seven years away or less, and trust fund solutions are urgently needed.

1 The Social Security Old-Age and Survivors Insurance and Disability Insurance trust funds are funded by a dedicated 12.4 percent payroll tax – 10.6 percent to the retirement fund and 1.8 percent to the disability fund – on wages up to a cap currently set at $176,100, as well as partial income taxation of Social Security benefits. The Medicare Hospital Insurance trust fund receives revenue primarily from a 2.9 percent payroll tax on wages, a 0.9 percent surtax on wages above $200,000 ($250,000 for couples), and partial income taxation of Social Security benefits. The Highway Trust Fund, meanwhile, is primarily funded by excise taxes on gasoline, diesel, and other motor fuels, including an 18.4 cent per gallon tax on gasoline, as well as taxes on heavy vehicles, a tax on tires and tread rubber, and other sources.

2 Each trust fund is only permitted to invest revenues in excess of outlays in special non-tradable government-backed securities. To learn more, please see Huston, Barry F. 2023. “Social Security Trust Fund Investment Practices.” Congressional Research Service In Focus 10564. https://www.congress.gov/crs-product/IF10564; and Congressional Budget Office. 2022. “The Budget and Economic Outlook: 2022 to 2032, Appendix B: The 10 Year Outlook for Major Federal Trust Funds.” Congressional Budget Office. https://www.cbo.gov/publication/58147#_idTextAnchor244.

3 The Trust Fund Solutions Initiative is a project of the Committee for a Responsible Federal Budget to develop new policy options for policymakers to address financing challenges, highlight existing options, and elevate and prioritize the discussion. The Committee for a Responsible Federal Budget does not endorse the options published as part of this initiative.

4 The Congressional Budget Office releases ten-year financial projections for the Highway Trust Fund – which consist of a highway account and a transit account – every year. Based on their January 2025 projections, we estimate the combined Highway Trust Fund accounts will be exhausted in calendar year 2028. The 2032 insolvency date of the Social Security retirement fund and the Medicare Hospital Insurance fund is based on estimates from the 2025 Social Security and Medicare Trustees Reports, updated to reflect revised projections published by the Social Security Chief Actuary in response to the passage of the One Big Beautiful Bill Act, which reduced revenue into the Social Security and Medicare funds through its effects on income taxation of Social Security benefits. The 2034 estimated insolvency of the theoretically combined Social Security trust funds are based on these updated projections as well.

5 CBO currently projects the Social Security retirement fund will become insolvent in calendar year 2033, the Social Security disability fund in calendar year 2060, and the Medicare hospital fund in Fiscal Year (FY) 2052. The recent passage of the One Big Beautiful Bill Act means the exhaustion dates for each fund are likely earlier than CBO currently estimates. The Act, by extending income tax rate cuts and enacting a temporary bonus senior deduction, will reduce revenue from the income taxation of Social Security benefits into the Social Security and Medicare trust funds. Accounting for these changes, we estimate using CBO’s methodology that the Medicare hospital fund will go insolvent in FY 2045, seven years earlier than originally projected. Other factors, such as changes in immigration policy, may further accelerate the insolvency date.

6 For examples, please see Federal Lands Highway Projects.

7 Under the law, trust fund outlays cannot exceed revenues once a fund become insolvent. However, the Balanced Budget and Emergency Deficit Control Act of 1985 requires CBO and other scorekeepers to assume scheduled Social Security benefits, Medicare hospital payments, and surface transportation obligations will be paid in full after trust fund insolvency.

8 These figures are based on CBO’s 2025 Long-Term Projections for Social Security, its 2025 Long-Term Budget Outlook, and its ten-year baseline projections for the Highway Trust Fund, adjusted for recent legislation to match CRFB’s August 2025 budget baseline and extrapolated forward beyond 2055 where necessary.

9 Estimates are based on CBO’s Long-Term Budget Outlook: 2025 to 2055, modified as in our August 2025 budget baseline and extended out to 2060. The update reflects the passage of the One Big Beautiful Bill Act, recent tariff policies, a finalized rule targeting Affordable Care Act marketplace subsidies, and certain rescissions and assumed extensions. Estimates incorporate lost trust fund revenue from taxation of benefits and extrapolate other data where not made available by CBO.

10 Under this “static” approach, we assume trust fund spending is reduced to revenue upon insolvency but do not assume any subsequent impact on output, employment, interest rates, or inflation.

11 The Pro-Growth Trust Fund Solutions scenario assumes policy changes begin to phase in in 2026 and are large enough to avoid any trust fund from having a negative balance, and to restore 75-year solvency to all four major trust funds. We assume a Social Security plan similar to the one laid out in the Goldwein-MacGuineas-Towner Pro-Growth Social Security Reform framework, a Medicare plan that relies largely on lower health care costs, and a highway plan that relies mainly on replacing the gas tax with more efficient and robust user-fee-based revenue sources. For illustrative purposes, we assume the plan will boost economic growth by 0.25 percent per year relative to CBO’s baseline.

12 The first option would raise Social Security’s Full Retirement Age and Earliest Eligibility Age as well as Medicare’s Eligibility Age by two years to 69, 64, and 67, respectively. Estimates are based on CBO’s, 2012 issue brief “Raising the Ages of Eligibility for Medicare and Social Security.” Figures are for 2060. The second reflects the Penn Wharton Budget Model’s 2021 estimates of a comprehensive entitlement reform package, which would raise Social Security’s Full Retirement Age by three years and Medicare’s Eligibility Age by two years, index Social Security benefits after initial claiming to the Chained CPI (C-CPI-U), make Social Security’s benefit formula more progressive, double Social Security’s taxable maximum threshold, raise the Social Security payroll tax rate to 14.4 percent, and allow Medicare to negotiate drug prices. Our third option comes from a 2023 CBO analysis of alternative budget scenarios, and reflect their projections of the change in Gross National Product (GNP) under a scenario in which Social Security outlays are restricted to revenue after trust fund insolvency. The last option comes from the Goldwein-MacGuineas-Towner Pro-Growth Social Security Reform plan, which would raise Social Security’s retirement ages, enact an age-62 Poverty Protection Benefit, replace Social Security’s current benefit formula with one that counts all years of work equally (Mini-PIA), create Supplemental Retirement Accounts, and implement other measures to restore solvency. The figures presented here represent the average of their high and low estimates of the projected effects of their plan on real GNP in 2050.