Trump CEA Projections Tracker

Before the passage of the One Big Beautiful Bill Act (OBBBA), the White House Council of Economic Advisers (CEA) released economic and fiscal projections showing considerable expected economic and budgetary improvements. Importantly, these estimates are far more optimistic than those of the Congressional Budget Office (CBO) and other credible estimates.

To compare these projections to future outcomes, the below tracker maps each of CEA’s predictions1 on an annual basis. It also shows CRFB's Adjusted August 2025 Baseline, which adjusts CBO’s January baseline to account for the passage of OBBBA, tariffs, and other legislative and administrative changes that have occurred throughout the year, and it includes economic projections from CBO’s September 2025 View of the Economy from 2025 to 2028.

Where possible, the tracker also shows projections from the Office of Management and Budget’s (OMB) Fiscal Year 2026 Mid-Session Review (MSR) that incorporates OBBBA and tariffs as enacted as well as proposed discretionary cuts. These economic and fiscal forecasts are far rosier than consensus.

Including assumed macroeconomic effects, CEA estimated that when incorporating the effects of OBBBA, tariffs, discretionary cuts, energy reforms, and deregulation:

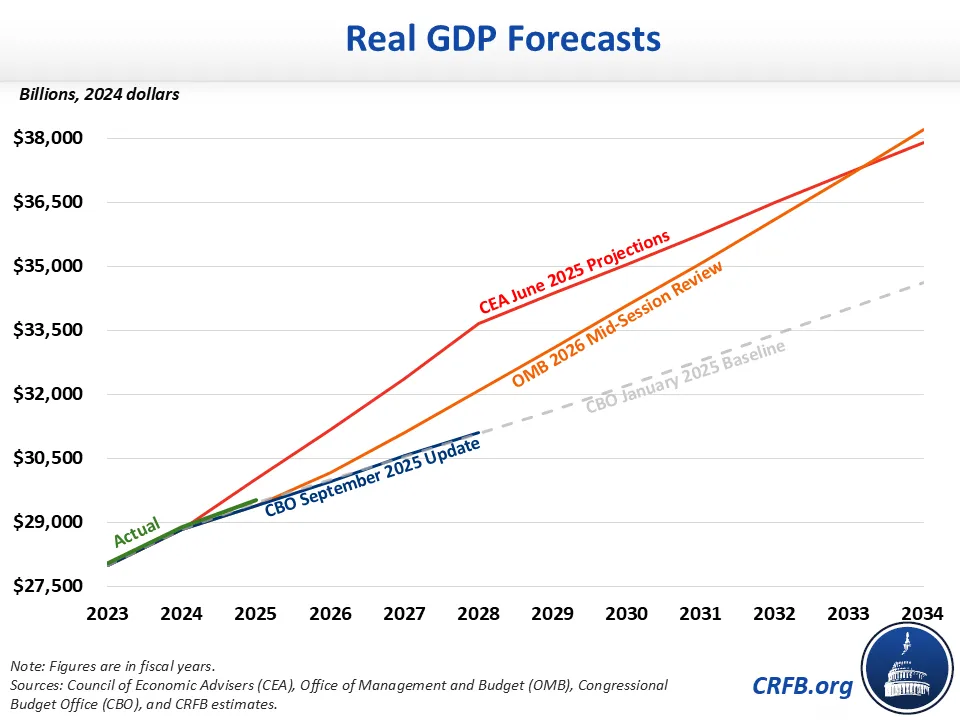

- Real Gross Domestic Product (GDP) will grow about 4% annually through 2028 and 2% per year thereafter.

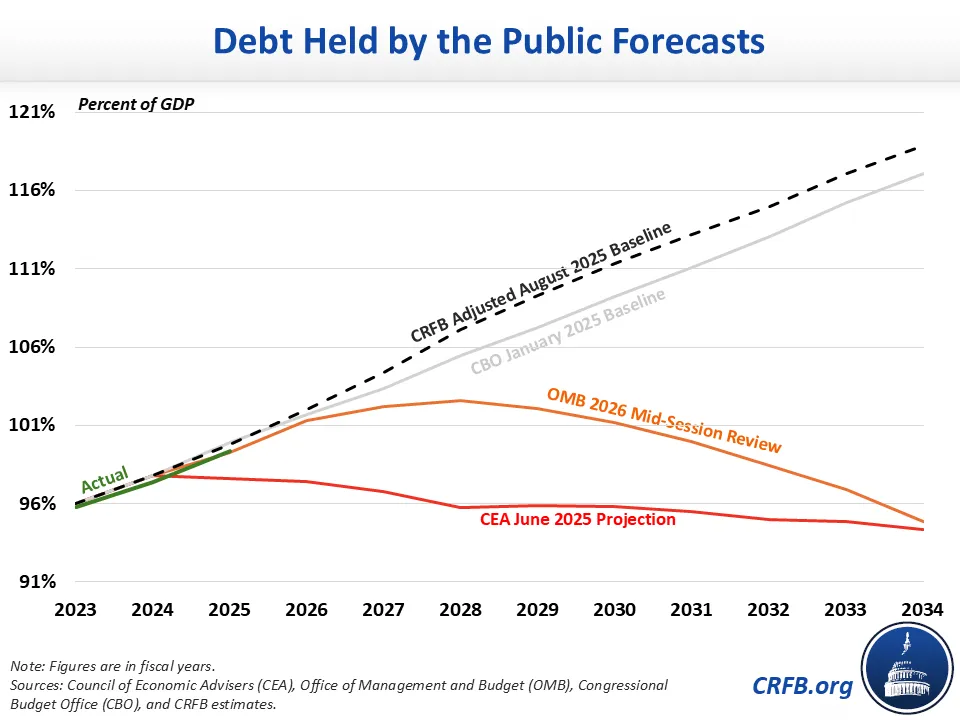

- Debt will fall to 97% of GDP by the end of Fiscal Year (FY) 2026 and 94% by 2034.

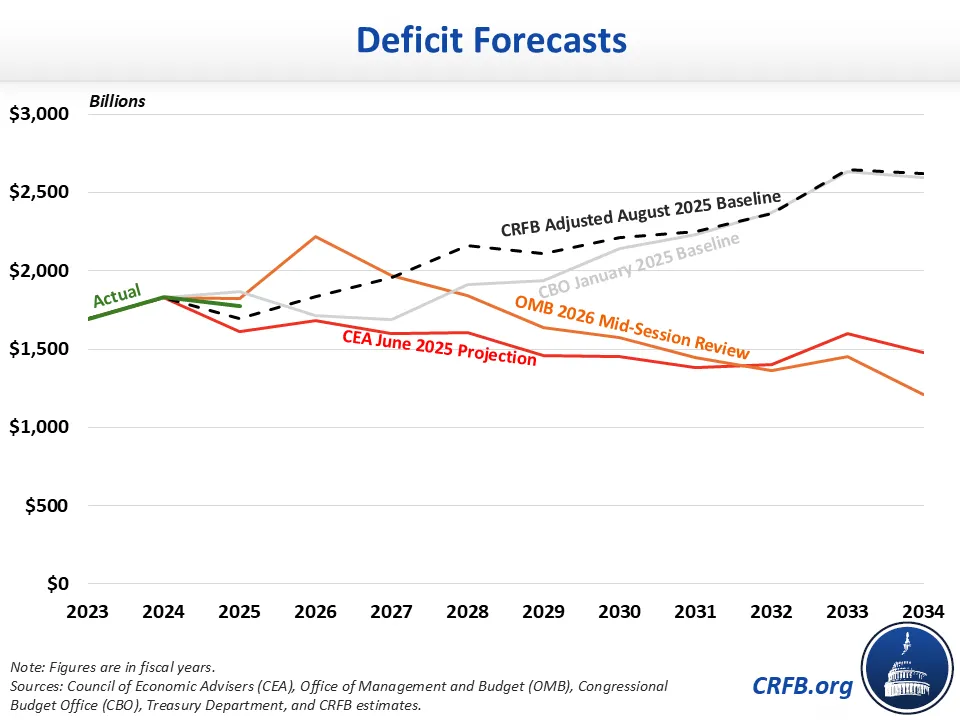

- Deficits will fall to $1.7 trillion (5.2% of GDP) by 2026 and $1.5 trillion (3.2% of GDP) by 2034.

- Primary deficits will fall to $660 billion (2.0% of GDP) by 2026 and turn to a $30 billion primary surplus (0.1% of GDP) by 2034.

- Implied nominal revenue will grow to above $5.5 trillion (17.0% of GDP) by 2026 and $8.2 trillion (17.7% of GDP) by 2034.

- The reconciliation bill will be responsible for adding $1.8 trillion to deficits between 2025 and 2034, net of dynamic effects.

CRFB will track these claims over time in the blog below, as well as in the linked Google Sheet. We will update this tracker and public spreadsheet in real time as new projections and data are released.

Importantly, whether actual outcomes are similar or different from projections is not necessarily indicative of the quality or accuracy of projections – in particular, the projected impact of specific legislative changes. Many changes unrelated to OBBBA or tariff policy – including legislative, administrative, and economic changes – can lead to different fiscal and economic outcomes.

Last Updated: January 26, 2026

Gross Domestic Product

CEA projected that the economy, as measured by real GDP, will grow roughly 4% per year for the next four years (2025 through 2028) and 2% per year thereafter.2

Although the annualized growth rate in the 3rd quarter of 2025 was in line with this projection – 4.4% under the Bureau of Economic Analysis' (BEA) revised estimate – overall growth was around 2.2% for fiscal year 2025.

CBO updated it’s quarterly economic projections for CY 2026 in January, and now project growth of 2.2% between the fourth quarter of 2025 and the fourth quarter of 2026. However, growth is expected to fall below 2% by late 2026 – and roughly align with projections CBO made in September for 2027 and 2028, when they predicted 1.9% per year growth. These projections are in line with Federal Reserve forecasts. Beyond 2028, CBO has previously projected growth will average 1.8% per year.

OMB has projected that real GDP would grow by 2.7% in fiscal year 2026, and increase to 3.1% a year in 2027 through 2029, before falling to 3.0% in 2030 and 2.9% from 2031 through 2035.

Roughly speaking, CEA foresees that real GDP will be 4% above CBO’s forecast (at $31 trillion in 2024 dollars) by the end of 2026 and 8% above that forecast (at $34 trillion) by the end of 2028. CEA’s projections are 5% above OMB’s by 2028, though below OMB’s by 2034.

Debt-to-GDP

CEA projected that debt held by the public as a share of the economy will hold steady around 98% of GDP for the next couple of years, decline to 96% by FY 2028, and further fall to 94% of GDP by 2034. We estimate that debt held by the public reached 99% in FY 2025, based on figures reported by Treasury and BEA, and project it will grow beyond that.

Under CRFB’s Adjusted August 2025 Baseline that considers the estimated budgetary effects of OBBBA, tariffs, and other regulatory changes – but no changes to expected GDP – debt will grow to 102% by 2026, and 119% by 2034. Assuming the President’s discretionary cuts, OMB projected debt held by the public will begin to fall as a percent of GDP by 2029 and reach 95% by 2034.

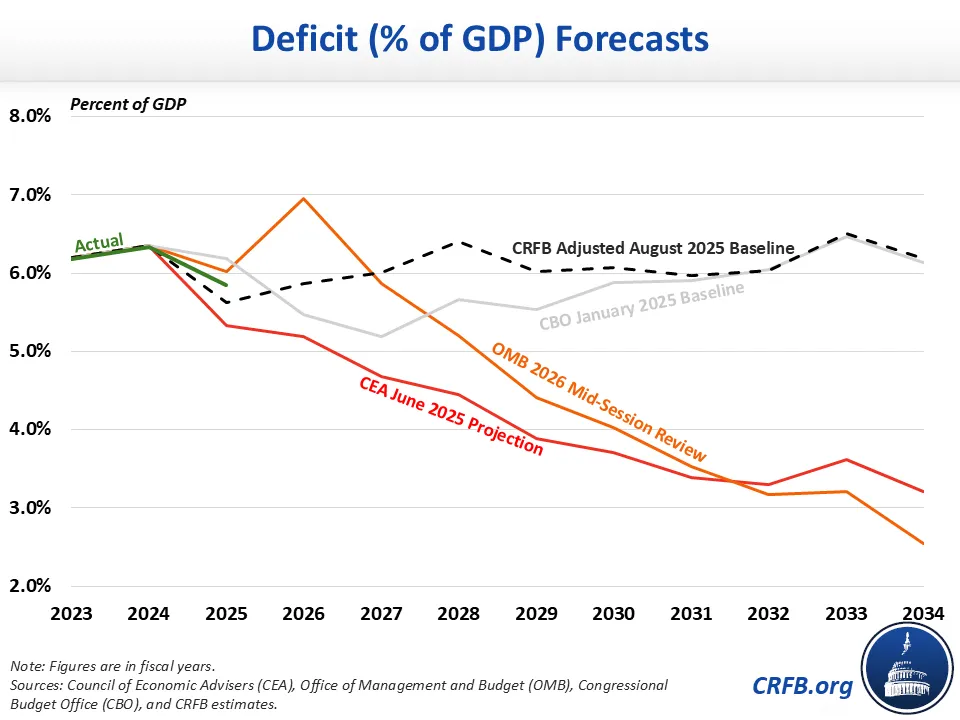

Deficits

CEA projected deficits would fall from $1.8 trillion in FY 2024 to $1.6 trillion in 2025, $1.7 trillion by 2026, and $1.5 trillion by 2034. The Treasury Department reported the actual deficit for FY 2025 was $1.8 trillion.

Under CRFB’s Adjusted August 2025 Baseline, deficits will remain at $1.8 trillion in 2026 and rise to $2.6 trillion by 2034. Under the MSR, OMB projected deficits will approach $2.0 trillion by 2027 before declining to $1.2 trillion by 2034.

As a share of the economy, CEA projected deficits will decline from 6.4% of GDP in FY 2024 to 5.2% in 2025 and 3.2% by 2034. We estimate deficits were 5.8% of GDP in FY 2025, based on figures reported by Treasury and BEA.

Under CRFB’s Adjusted August 2025 Baseline, we project deficits will rise to 5.9% in 2026, and 6.2% by 2034. Under the MSR, OMB projected deficits will reach 7.0% of GDP by 2026 before falling to 2.5% by 2034.

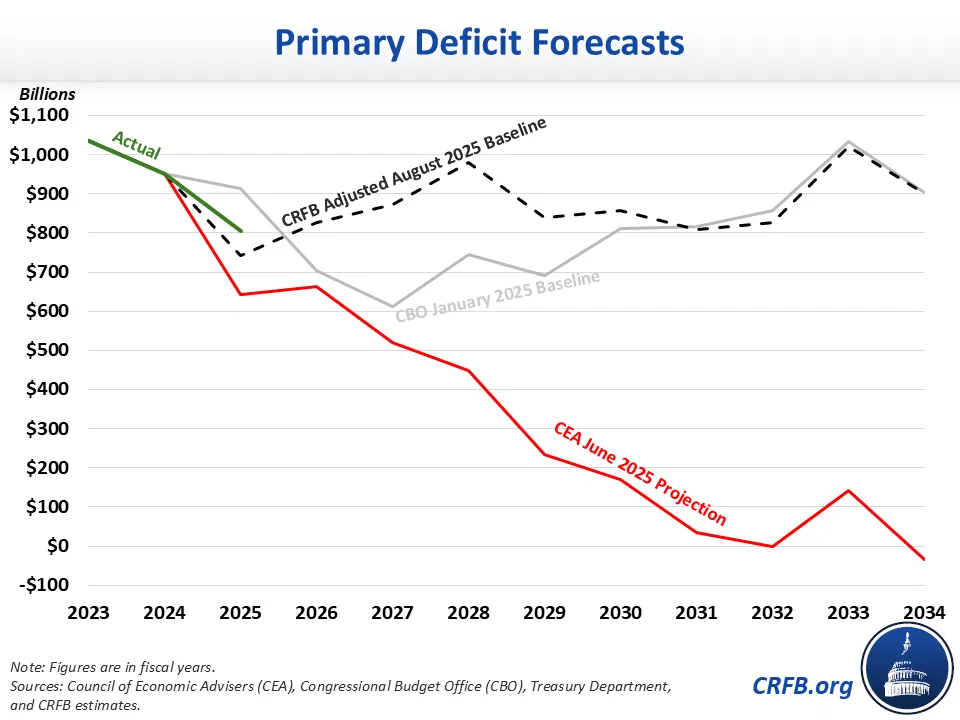

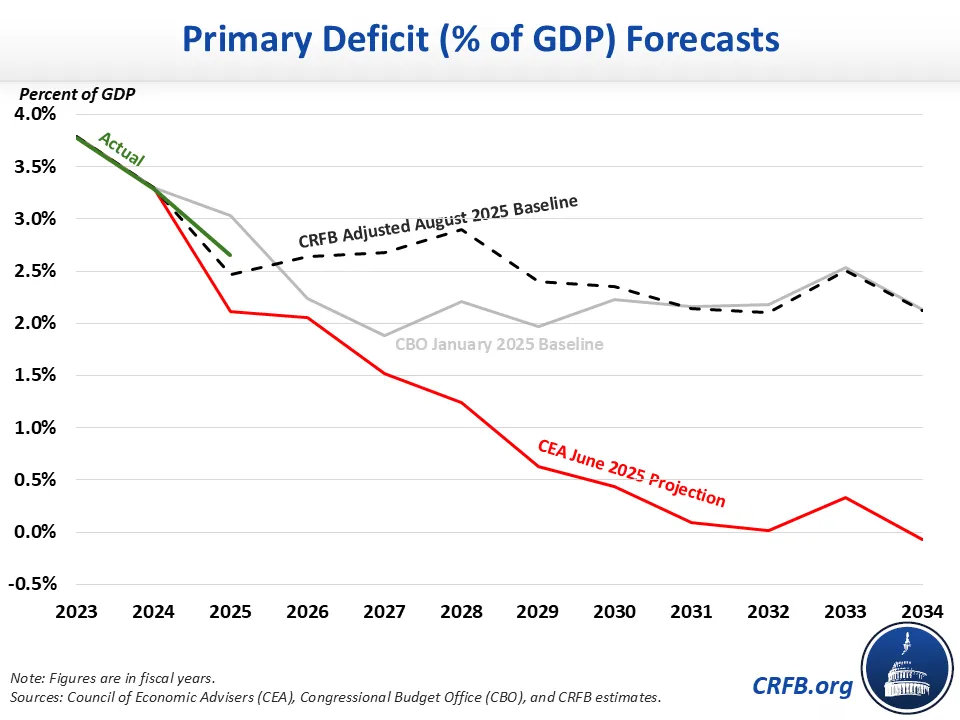

Primary Deficits

CEA projected primary deficits – that is, deficits excluding interest – will fall from $950 billion in FY 2024 to $640 billion in 2025 and $660 billion by 2026; by 2034, CEA projected a $30 billion primary surplus. Based on the Treasury Department’s data, the primary deficit was $805 billion in FY 2025.

Under CRFB’s Adjusted August 2025 Baseline, primary deficits will rise to $830 billion in 2026, and $900 billion by 2034.

As a share of the economy, CEA projected primary deficits will decline from 3.3% of GDP in FY 2024 to 2.1% in 2025, 2.0% by 2026, and a 0.1% primary surplus by 2034. We estimate primary deficits were 2.7% of GDP in FY 2025, based on figures reported by Treasury and BEA.

Under CRFB’s Adjusted August 2025 Baseline, primary deficits will total 2.6% in 2026, and 2.1% by 2034.

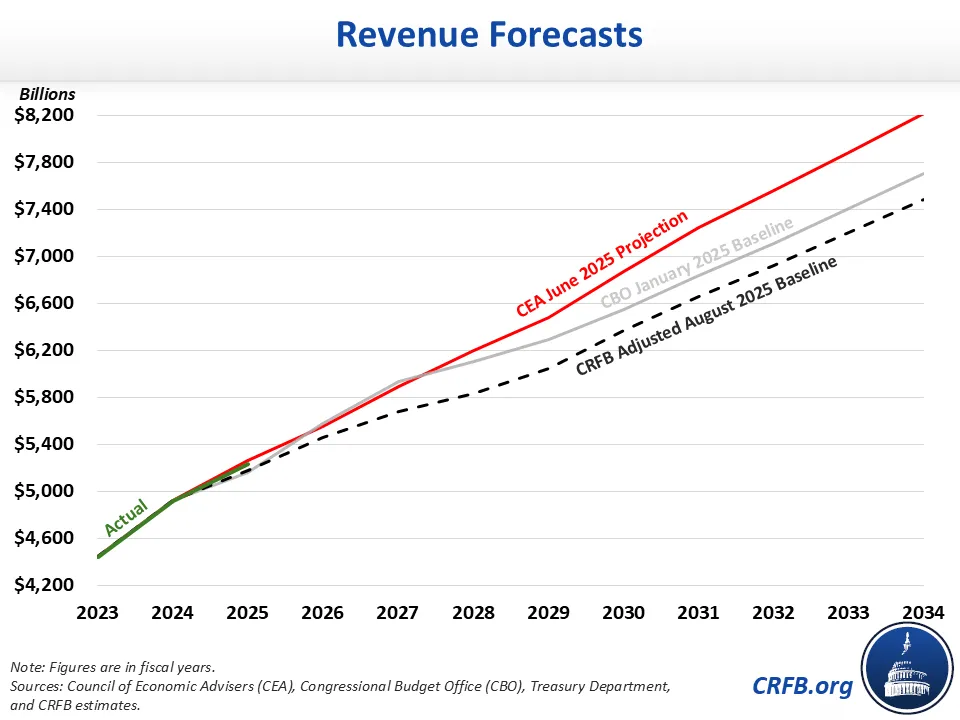

Implied Revenue Levels

Although CEA did not project revenue levels explicitly, we can approximate them based on CEA’s projected changes in primary deficits and the details behind those projections.3

Based on this approximation, CEA projected nominal revenue levels would grow from $4.9 trillion in 2024 to $5.3 trillion in 2025, $5.5 trillion by 2026, and $8.2 trillion by 2034. Actual revenue in 2025 was $5.2 trillion, according to Treasury figures.

Under CRFB’s Adjusted August 2025 Baseline, nominal revenue will grow to $5.5 trillion in 2026, and $7.5 trillion by 2034. CEA’s projections do not account for tariffs imposed in July or later, and neither CEA’s nor CRFB’s projections account for any changes in inflation.

As a share of the economy, CEA projections implied revenue will remain steady around 17% of GDP through 2029 and grow to 17.7% of GDP by 2034. These figures are in line with actual revenue – an estimated 17.2% of GDP in 2025 – and CRFB’s Adjusted August 2025 Baseline, driven by the fact that higher assumed output boosts both the numerator (revenue) and denominator (GDP) in the equation.

Deficit Impact of OBBBA

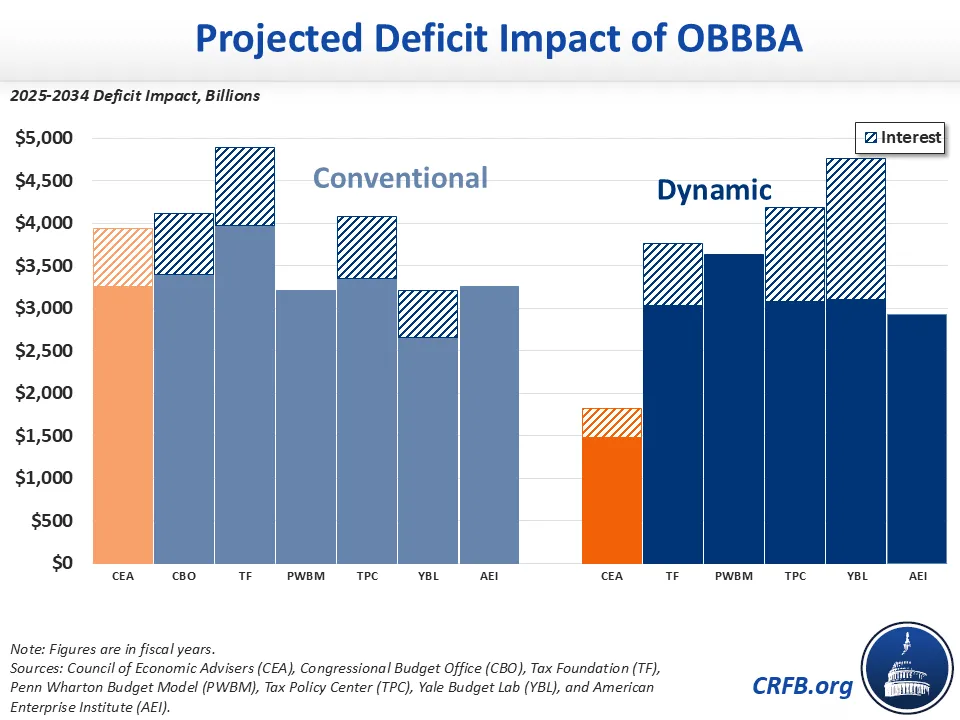

CEA estimated OBBBA will increase deficits by $1.8 trillion on a dynamic basis through 2034, with dynamic feedback covering over half of the $4.0 trillion conventional cost. Other dynamic scores have ranged from $3.5 trillion to $4.0 trillion through 2034. Although CBO has not yet produced a dynamic score of the final bill, we expect their estimates will be above the $4.1 trillion conventional score, based on their dynamic score of the House bill.

* * *

As new projections and data become available, we will continue to update our CEA Tracker and make adjustments where appropriate. The data will also remain available on our CEA Tracker Google Sheet, which will be updated as well.

1 CRFB's calculations are derived from the CEA’s “One Big Beautiful Chart Book.” Numeric values were reconstructed from the published graphics using hand measurement and thus might not precisely match CEA’s exact numbers, as CEA has not released the underlying data. In some cases, the figures do not appear to match stated numbers exactly -- for example, CEA’s graphics imply primary deficit reduction of more than $5.2 trillion through 2034, while they claim $5.1 trillion. Our figures are based on the graphs and not the claims.

2 These annual growth rates are inferred from CEA’s report using constructed nominal and percent of GDP values. This method introduces an additional level of uncertainty when it comes to growth rates, so individual year figures may prove inexact, though estimates should be close over multi-year periods.

3 We assume deficit reduction from economic growth only effects revenue – this is a conservative assumption, as additional economic growth is likely to boost both revenue and spending and therefore increase revenue by more than the total deficit reduction.