Meeting Fiscal Goals Under CRFB’s August Baseline

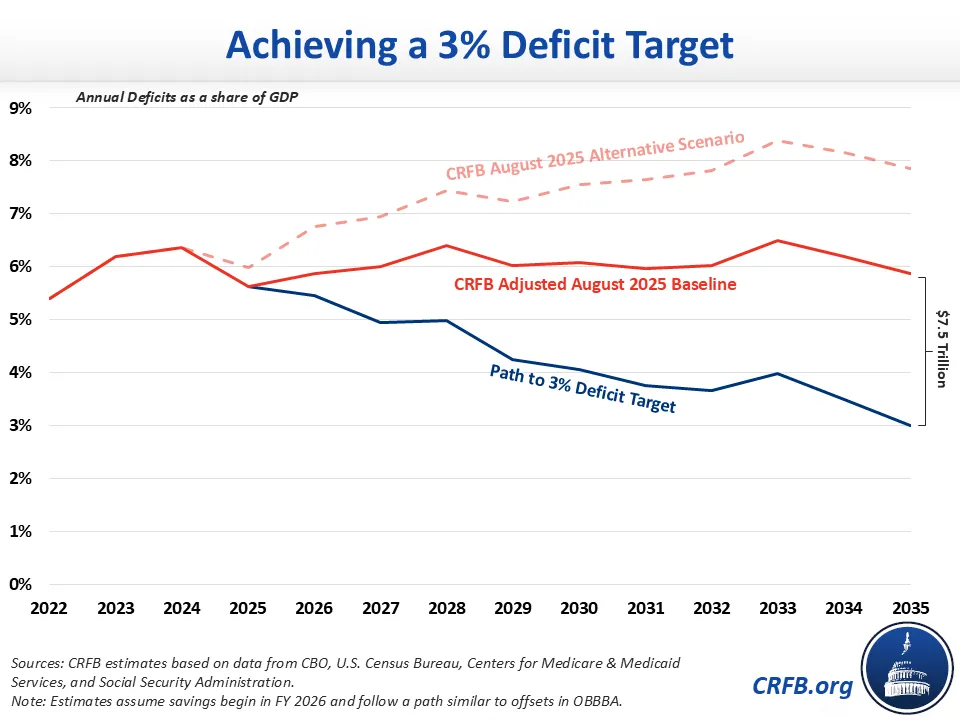

It would take roughly $7.5 trillion of deficit reduction over the next decade to bring the deficit down to 3 percent of GDP by 2035, and $9 trillion to hold debt to 100 percent of Gross Domestic Product (GDP).

Based on our new CRFB Adjusted August 2025 Baseline, the national debt is on course to rise from 100 percent of GDP today to 120 percent by 2035, while deficits are projected to remain above 6 percent of GDP through most of the decade - that’s more than twice as high as the thoughtful 3 percent of GDP deficit target supported by Treasury Secretary Scott Bessent and others.

Gradually reducing deficits to 3 percent of GDP would require about $3.5 trillion of deficit reduction (including interest) if done over five years, or $7.5 trillion if done over ten years – depending on the path of savings. Required savings would rise to $5 trillion over five years and $12.5 trillion over ten years relative to the CRFB August 2025 Alternative Scenario, which assumes many of the tariffs are ruled illegal, temporary OBBBA provisions are extended, and interest rates remain at their current levels.

Under a plan to gradually reduce deficits to 3 percent of GDP on a permanent basis, debt would rise modestly over the next few years before very slowly trending downward to below 105 percent of GDP by 2035 and below 90 percent of GDP over the long-term. To keep debt at its current level of 100 percent of GDP, the U.S. would need about $4 trillion of deficit reduction over five years and $9 trillion over a decade.

Total Savings to Meet Fiscal Goals Under

CRFB Adjusted August 2025 Baseline

| Fiscal Goal | FY 2026-2030 | FY 2026-2035 |

|---|---|---|

| Deficit Targets* | ||

| 4 percent of GDP | $2.5 trillion | $5.0 trillion |

| 3 percent of GDP | $3.5 trillion | $7.5 trillion |

| 2 percent of GDP | $4.5 trillion | $10.0 trillion |

| Primary Balance | $3.0 trillion | $5.5 trillion |

| On-Budget Balance' | $6.0 trillion | $12.0 trillion |

| Full Budget Balance | $7.0 trillion | $15.5 trillion |

| Debt Targets | ||

| 110 percent of GDP | $0.5 trillion | $4.5 trillion |

| 100 percent of GDP | $4.0 trillion | $9.0 trillion |

| 90 percent of GDP | $8.0 trillion | $13.5 trillion |

| 80 percent of GDP | $11.5 trillion | $17.5 trillion |

Notes: All figures are rounded to the nearest $0.5 trillion. Actual ‘deficit target’ savings will depend on the deficit reduction path.

Savings targets include debt service (interest).

*Estimates assume savings begin in FY2026 and follow a path similar to offsets in OBBBA.

‘Estimates for the on-budget deficit impact of OBBBA are adjusted using data from SSA.

More aggressive goals would require greater levels of savings. For example, it would require over $15 trillion of ten-year savings to balance the budget by 2035, and over $17 trillion to reduce debt to 80 percent of GDP by that year. Meanwhile, it would require about $12 trillion to achieve on-budget balance (excluding Social Security and the postal service), or $13.5 trillion to bring debt down to 90 percent of GDP.

Less aggressive goals would require lower amounts of savings. For example, it would require $4.5 trillion of ten-year savings to keep the debt at 110 percent of GDP in 2035, or $5 trillion to reduce deficits to 4 percent of GDP by that year. Achieving primary deficit balance, which excludes interest, would require roughly $5.5 trillion of deficit reduction (including interest).

Achieving any of these targets will require substantial new deficit reduction. Our Budget Offsets Bank offers numerous options on both the tax and spending side of the budget. Policymakers can start by adopting Super PAYGO and committing to more than offset future spending and tax cuts, embracing trust fund solutions, and adopting other spending and revenue changes that push the debt on a downward sustainable path.

Although economic growth will not allow policymakers to avoid enacting substantial deficit reduction, faster growth can make these fiscal goals easier – especially goals measured relative to the size of the economy. Where possible, thoughtful pro-growth deficit reduction and reform is likely the best way to put the country on a sustainable fiscal path.