An August 2025 Budget Baseline

The enactment of the One Big Beautiful Bill Act (OBBBA), new tariffs framework, and other changes have meaningfully changed the fiscal outlook since the Congressional Budget Office’s (CBO) January 2025 baseline. In this piece, we present the CRFB Adjusted August 2025 Baseline, which accounts for most legislative and administrative changes but not economic and technical changes.

We estimate under the CRFB Adjusted August 2025 Baseline that runs from Fiscal Year (FY) 2026 through FY 2035 and assumes all current tariffs and trade deals remain in effect:

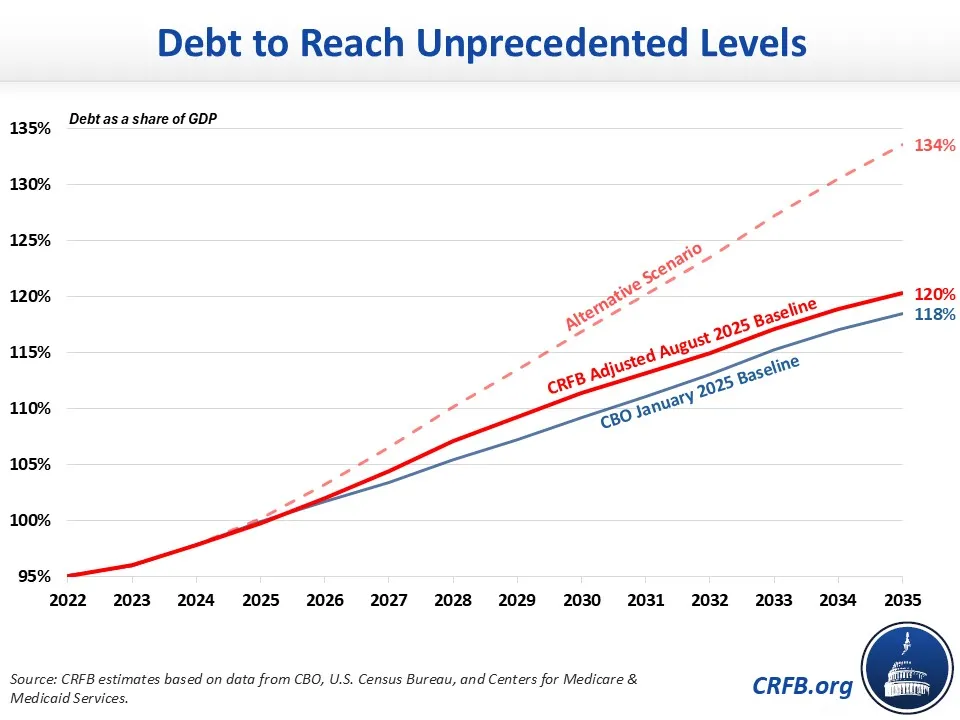

- Debt held by the public will rise from about 100 percent of Gross Domestic Product (GDP) ($30 trillion) today to 120 percent of GDP ($53 trillion) by 2035.

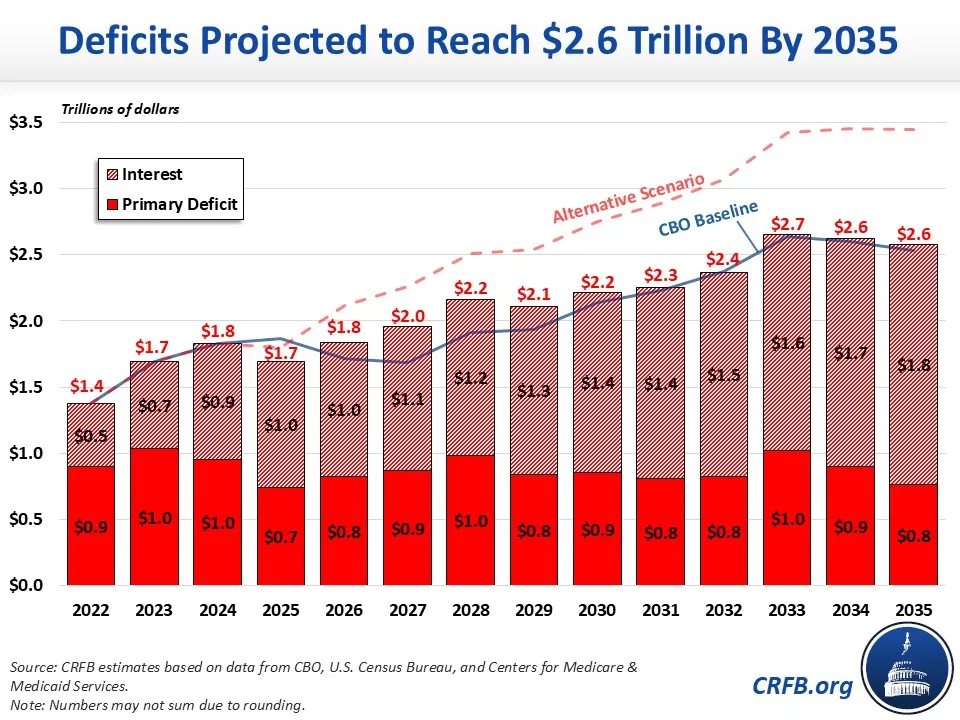

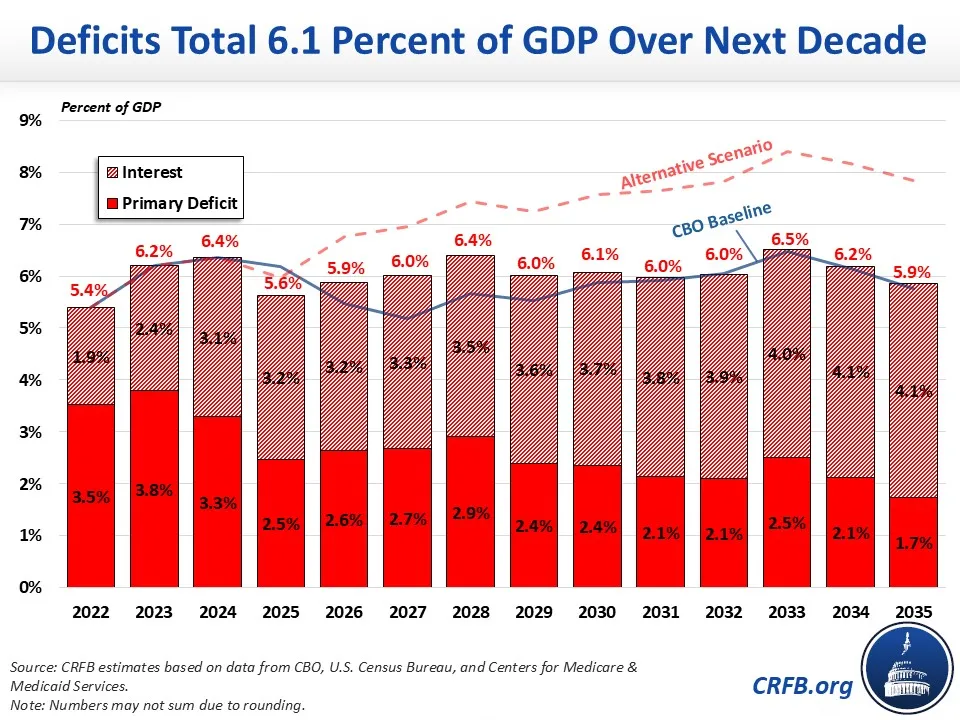

- Deficits will total $22.7 trillion (6.1 percent of GDP) over a decade and rise from $1.7 trillion (5.6 percent of GDP) in 2025 to $2.6 trillion (5.9 percent of GDP) in 2035.

- Net interest payments on the national debt will total $14.0 trillion (3.8 percent of GDP), rising from nearly $1 trillion (3.2 percent of GDP) in 2025 to $1.8 trillion (4.1 percent of GDP) in 2035.

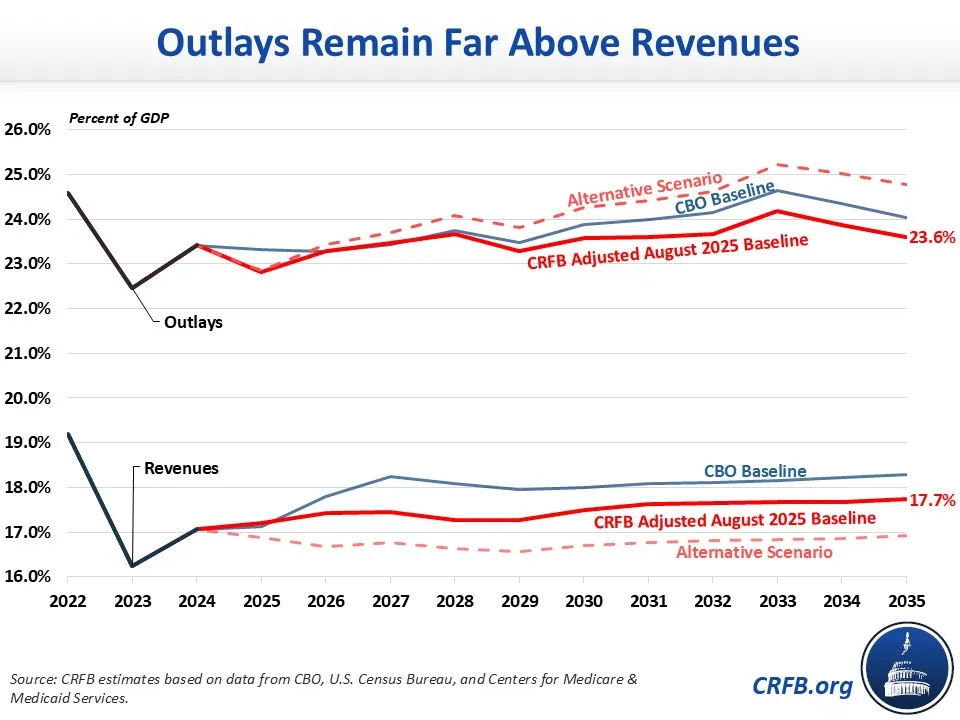

- Spending will total $88 trillion (23.6 percent of GDP) over a decade, while revenue will total more than $65 trillion (17.5 percent of GDP).

- Total deficits are about $1 trillion higher than in CBO’s January baseline, with debt-to-GDP rising by an extra 2 percentage points, as the high cost of OBBBA is partially offset by new tariffs and other reforms over the first five years and mostly offset in the next five.

Note: On August 22, CBO estimated recent tariffs would generate $4.0 trillion of total deficit reduction from 2025 through 2035 on a conventional basis, which is the equivalent to roughly $3.5 trillion from 2026 through 2035 on a dynamic basis. Incorporating these figures would slightly but not meaningfully reduce our deficit and debt projections.

Under an alternative scenario – the CRFB August 2025 Alternative Scenario – where the U.S. Trade Court’s ruling that much of the tariffs are illegal is upheld, temporary provisions of OBBBA are made permanent, and yields on Treasury securities remain at their current level – debt will reach 134 percent of GDP; the total ten-year deficit will exceed $28 trillion; and interest payments will rise to $2.2 trillion by 2035 – above 5 percent of GDP.

Importantly, the CRFB Adjusted August 2025 Baseline does not incorporate the dynamic effects from OBBBA nor other changes to the economy. Absent a new baseline from CBO, CRFB will update this baseline later in the year to account for these effects as well as new policies and estimates.

Debt under the CRFB Adjusted August 2025 Baseline

Under the CRFB Adjusted August 2025 Baseline, we estimate debt will climb from 100 percent of GDP at the end of 2025 to a record 107 percent of GDP by 2028 and 120 percent of GDP by 2035 – 2 percent of GDP higher than under CBO’s January 2025 baseline. Debt could climb to as high as 134 percent of GDP under CRFB’s August 2025 Alternative Scenario that assumes a permanent OBBBA, tariff revenues only from legal tariffs, and long-term interest rates remain around current levels.

Deficits and Interest under the CRFB Adjusted August 2025 Baseline

We estimate deficits will total $22.7 trillion (6.1 percent of GDP) over the FY 2026 through 2035 period, rising from $1.7 trillion in 2025 to $2.6 trillion by 2035. As a share of the economy, deficits will rise from 5.6 percent of GDP in 2025 to 6.4 percent in 2028, dip to about 6.0 percent for a few years before climbing to a high of 6.5 percent in 2033, and then fall to 5.9 percent by 2035.

Interest in particular is slated to rise rapidly, both due to rising debt and growing average interest rates on total debt. Debt service costs have already doubled from less than $500 billion in 2022 to a projected $1.0 trillion this year, and they are projected to nearly double again to $1.8 trillion in 2035. As a share of the economy, interest costs will rise from 3.2 percent of GDP in 2025 to a record 4.1 percent in 2035.

Deficits are projected to be about $900 billion higher than CBO’s January baseline between 2026 and 2030. Beyond that, deficits will be similar to the January levels as large parts of the reconciliation law (for example, ‘no tax on tips’ and increased spending on defense) expire and tariffs and other offsets continue to generate substantial savings.

If those parts of OBBBA are extended, the trade court ruling that many tariffs are illegal is upheld, and interest rates remain high, deficits could grow to $3.4 trillion (7.8 percent of GDP) by 2035 and interest to $2.2 trillion (5.1 percent of GDP).

Spending and Revenue under the CRFB Adjusted August 2025 Baseline

Large deficits under CBO’s baseline are driven by the disconnect between spending and revenue. Specifically, spending will total $88 trillion (23.6 percent of GDP) over the decade while revenue will total $65 trillion (17.5 percent of GDP).

Spending, which has risen from 20.9 percent of GDP in 2019 to 23.4 percent in 2024, is falling in 2025 due to one-time adjustments for student debt policies but will trend upward over the decade from 22.8 percent of GDP in 2025 to 23.6 percent in 2035. Revenue will also trend upward over the decade. Revenue has increased from 16.3 percent of GDP in 2019 to 17.2 percent in 2025 and will rise further to 17.7 percent of GDP by the end of the decade as tariffs replace some of the revenue from the OBBBA tax cuts and many of the temporary OBBBA tax cuts expire.

Both spending and revenue are projected to be lower than in CBO’s January baseline – revenue more so – as recent policy changes have reduced both taxes and spending. Relative to CBO’s baseline, in 2035 revenue will be about 0.5 percent of GDP lower and spending 0.4 percent of GDP lower.

Under CRFB’s August 2025 Alternative Scenario, spending would be higher (24.8 percent of GDP in 2035) while revenue would be lower (16.9 percent of GDP in 2035), due to a combination of less tariff revenue, extending tax cuts, extending spending increases, and higher interest costs.

For context, spending has averaged 21.1 percent of GDP over the last 50 years, while revenue has averaged 17.3 percent.

Changes from CBO’s January 2025 Baseline

Under the CRFB Adjusted August 2025 Baseline, total deficits will be about $1 trillion higher relative to CBO’s January baseline while debt in 2035 will be 2 percent of GDP higher. This does not account for the dynamic effects of OBBBA, reduced net immigration, recent higher-than-expected interest rates, discretionary changes that may have come from legislative or executive actions, nor other recent changes to the economy. On net, we expect these effects will further increase deficits.

Our estimates begin with CBO’s January baseline and then add the conventional cost of OBBBA, the revenue impact of tariffs, the extrapolated effect of the rescissions package, and the effect of regulatory changes.

The reconciliation law – the One Big Beautiful Bill Act – is projected to increase deficits (including interest) by $4.6 trillion over the next decade and boost debt by more than 10 percent of GDP by 2035. This includes the $4.1 trillion CBO estimates through 2034, plus the additional costs in 2035.

Partially offsetting these costs over the next five years and largely offsetting them over the five years after that, the Trump Administration has introduced significant tariffs since January, which we estimate will reduce deficits by $3.4 trillion over the next decade and debt by 8.0 percent of GDP. This includes $2.7 trillion of tariffs as of May 13 based on estimates from CBO and an additional $700 billion from subsequent tariffs.

A finalized rule targeting eligibility for Affordable Care Act (ACA) subsidies, that was partially extended and codified in OBBBA, will reduce deficits by about $100 billion through 2035 (this includes some savings not included in the official OBBBA score for technical reasons). The Rescissions Act of 2025 saves about an additional $10 billion but will reduce baseline spending by about $100 billion through 2035 if the cuts are retained.

CRFB’s Adjusted August 2025 Baseline

| 2026-2035 Deficits | 2035 Debt-to-GDP | |

|---|---|---|

| CBO's January Baseline | $21.8 trillion | 118% |

| OBBBA as Enacted | +$4.6 trillion | +10.4% |

| Tariffs Enacted from January 6 through May 13 | -$2.7 trillion | -6.4% |

| Additional Tariffs Enacted & Announced Since May 13 | -$0.7 trillion | -1.7% |

| ACA Marketplace Rule | -$0.1 trillion | -0.2% |

| Rescissions and Assumed Extensions | -$0.1 trillion | -0.2% |

| CRFB’s Adjusted August 2025 Baseline | $22.7 trillion | 120% |

Sources: CRFB estimates based on data from CBO, U.S. Census Bureau, and Centers for Medicare & Medicaid Services.

Note: Numbers may not sum due to rounding.

Importantly, the CRFB Adjusted August 2025 Baseline does not account for economic changes since CBO’s January baseline nor most of the dynamic effects of recent policy. We will incorporate those effects in a future baseline update.

CRFB’s August 2025 Alternative Scenario

The CRFB Adjusted August 2025 Baseline is generally based on CBO’s January economic assumptions, current law for legislation, and tariffs currently in effect or announced as part of a trade deal. Deficits and debt could be far higher if temporary provisions in the law are extended, tariffs are scaled back, and interest rates remain higher than previously projected.

Under the CRFB August 2025 Alternative Scenario, deficits would total $28.5 trillion over the 2026 to 2035 period – nearly $7 trillion higher than CBO’s January baseline – and debt could reach 134 percent of GDP.

In May the U.S. Court of International Trade ruled much of Trump’s new tariff framework illegal. If that ruling is upheld, the current tariffs could result in less than $1 trillion of total deficit reduction – adding $2.4 trillion to deficits under the CRFB Adjusted August 2025 Baseline and increasing debt by 5.7 percent of GDP.

Meanwhile, OBBBA included a number of arbitrary expirations to lower its official costs that include tax cuts on overtime, tips, and car loan interest; a larger deduction for seniors; a higher State and Local Tax (SALT) deduction cap; full expensing for factories; increased spending on defense and Homeland Security; a rural hospital fund; and other provisions. Extending these measures would add $1.7 trillion to deficits over the next decade and increase debt by almost 4 percent of GDP.

Finally, Treasury yields have remained higher than projected and may rise more as a result of growing debt. Specifically, the 10-year Treasury yield is about 4.3 percent today, compared to CBO’s January projection that showed it would be 4.0 percent and decline gradually to 3.8 percent over the decade. If the 10-year yield were to remain around its current level and other yields kept their projected difference with the 10-year, interest costs would increase $1.6 trillion over the next decade and increase debt by 3.6 percent of GDP.

CRFB’s August 2025 Alternative Scenario

| 2026-2035 Deficits | 2035 Debt-to-GDP | |

|---|---|---|

| CRFB’s Adjusted August 2025 Baseline | $22.7 trillion | 120% |

| Trade Court Tariffs Ruling is Upheld | +$2.4 trillion | +5.7% |

| Temporary OBBBA Provisions are Made Permanent | +$1.7 trillion | +3.9% |

| 10-Year Treasury Yields Remain at 4.3% | +$1.6 trillion | +3.6% |

| CRFB’s August 2025 Alternative Scenario | $28.5 trillion | 134% |

| Memo: CBO's January Baseline | $21.8 trillion | 118% |

Sources: CRFB estimates based on data from CBO, U.S. Census Bureau, and Centers for Medicare & Medicaid Services.

Notes: Numbers may not sum due to rounding. The impact of higher Treasury yields is calculated separately; other assumptions exclude the higher yields from their effects on deficits and debt.

In some ways, the CRFB August 2025 Alternative Scenario may be too pessimistic since the Trump Administration would likely be able to replace at least some of the tariffs ruled illegal using other authorities. On the other hand, the outlook could be even worse than under the CRFB August 2025 Alternative Scenario. For example, back-loaded offsets in OBBBA, such as restrictions on provider taxes, work requirements, and Inflation Reduction Act (IRA) phaseouts, could be delayed or cancelled. Proposed deficit-increasing initiatives like tariff rebates could also be implemented. And the economy could weaken, slowing revenue collection. A recession or crisis over the next decade could further boost deficits and debt.

***

The nation’s finances have deteriorated since CBO’s January 2025 budget outlook, which already showed a worrisome fiscal outlook. Any further changes to tax and spending policy should be at a minimum paid for on a pay-as-you-go (PAYGO) basis – but preferably under Super PAYGO, where each dollar of new tax cuts or spending is offset twice over. Furthermore, with debt approaching record levels, lawmakers should proactively pursue trust fund solutions and enact a combination of revenue and spending options that put the nation’s budget on a sustainable path.