Analysis of the 2025 Medicare Trustees' Report

The Medicare and Social Security Trustees released their annual reports on the financial status of the trust funds. Our report on the Social Security trust funds can be found here.

The Medicare Trustees project that the Medicare Hospital Insurance (HI) trust fund will be insolvent in 2033 with a 75-year shortfall of 0.42 to 1.28 percent of payroll. Meanwhile, total gross Medicare spending will continue to grow.

This year’s report finds:

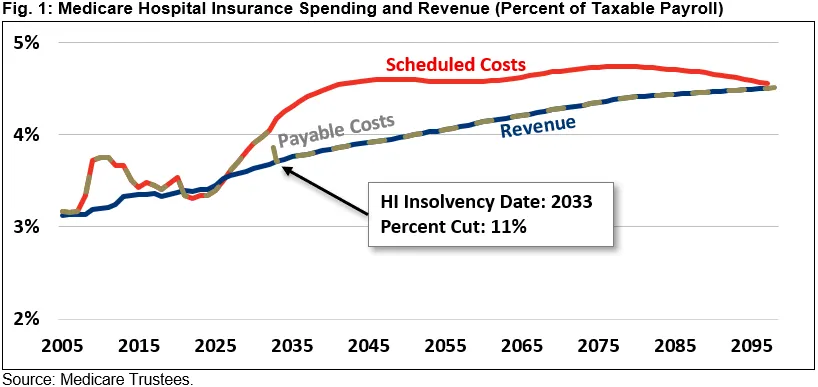

- The HI trust fund will run out of reserves in eight years, with a projected insolvency date of 2033. That’s when today’s 57-year-olds first become eligible for the program and today’s youngest retirees turn 70. Upon insolvency, spending will be cut by 11 percent, which could reduce access to health care for many seniors.

- The HI trust fund faces a significant shortfall, totaling 0.42 percent of payroll (0.18 percent of GDP) over 75 years, with annual deficits approaching 0.7 percent of payroll (0.3 percent of GDP) in the early 2040s.

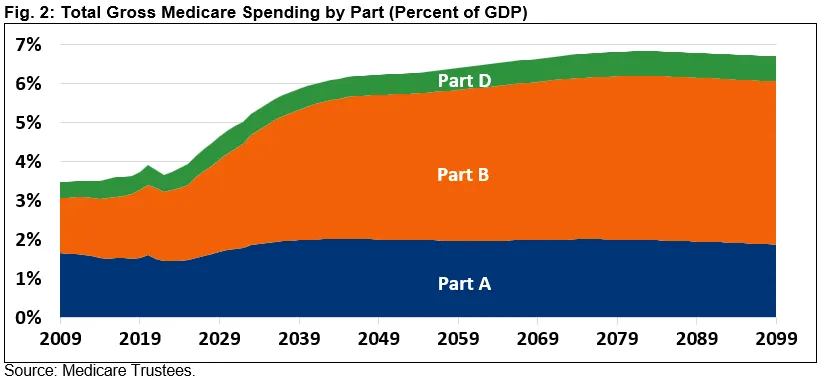

- Medicare costs will continue to grow rapidly. Gross Medicare costs have risen from 2.2 percent of GDP in 2000 to a projected 3.9 percent in 2025, and are expected to increase further to 6.2 percent of GDP in 2050 and 6.7 percent of GDP in 2099.

- Medicare’s outlook has worsened since last year, with the insolvency date moved up by three years, the shortfall increased by 20 percent (0.07 percent of payroll), and total spending in 2098 is 0.5 percent of GDP higher. The deterioration is largely due to higher-than-expected expenditures for hospitals and hospice services as well as spending on physician-administered drugs.

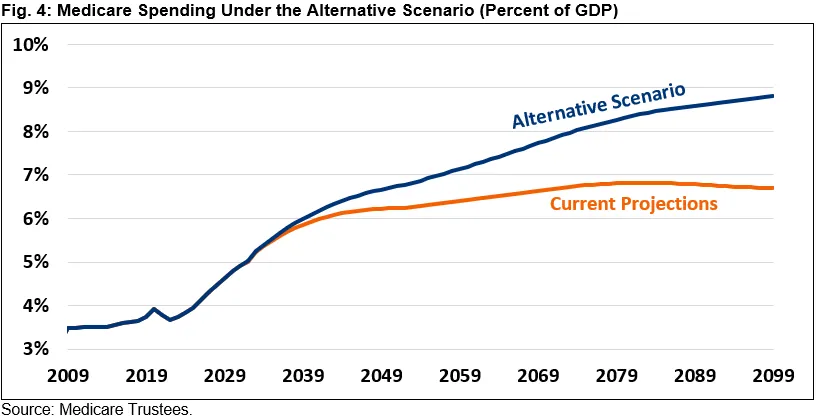

- Medicare’s outlook might be far worse than projected. Under the alternative scenario crafted by the Chief Actuary, Medicare spending will rise to 8.8 percent of GDP in 2099 rather than 6.7 percent, and the HI 75-year shortfall would total 1.28 percent of payroll rather than 0.42 percent of payroll.

As the Trustees show, the Medicare program remains costly and is on an unsustainable path. Policymakers should adopt reforms soon to improve the financial health of the program, especially by reducing wasteful spending and lowering the overall cost of health care under the program.

The Hospital Insurance Trust Fund will be Insolvent in 2033

Medicare’s HI trust fund, also known as Medicare Part A, finances inpatient hospital care for beneficiaries. Funds come primarily from a 2.9 percent payroll tax on wage income. Currently, the trust fund has roughly $240 billion in reserves and is projected to run small surpluses through 2027. After that, the program will be required to draw down funds from the reserves to pay its costs and eventually will run out of funds in 2033.

Upon insolvency, the program would only be able to pay 89 percent of its costs, necessitating an abrupt 11 percent payment cut. That cut would grow to 14 percent by 2049, likely leading to a disruption of services for seniors and individuals with disabilities who rely on the program.

As the population ages and health care costs rise, the Trustees project current modest HI surpluses will turn into deficits, growing to 0.27 percent of payroll (0.12 percent of GDP) by 2030 and 0.68 percent of payroll (0.30 percent of GDP) by 2045. Beyond that, the annual shortfall will begin to shrink, and under current projections the annual shortfall will disappear by 2099.

HI costs, which have grown from 2.63 percent of payroll in 2000 to 3.40 percent of payroll in 2025, will rise to 4.31 percent of payroll by 2035, peak at 4.74 percent in 2080, and slowly decline to 4.52 percent in 2099. Revenue, which has also grown from 3.11 percent of payroll in 2000 to 3.45 percent in 2025, will grow slowly to 4.51 percent of payroll in 2099.

Over the full 75 years, the HI trust fund faces a 0.42 percent of payroll (0.18 percent of GDP) funding gap. Restoring solvency would require the equivalent of boosting the HI payroll tax rate by 14 percent or reducing spending by 9 percent. Under the Chief Actuary’s alternative scenario (discussed below), the gap totals 1.28 percent of payroll, which would require raising the HI payroll tax by 44 percent or reducing spending by 24 percent.

Total Medicare Costs are High and Rising

The total gross cost of Medicare – including Parts A, B, and D – has grown significantly, from 2.2 percent of GDP in 2000 to 3.9 percent in 2025. The Trustees project continued cost growth, rising to 6.2 percent of GDP in 2050 and 6.7 percent of GDP in 2099.

Medicare Part B continues to be the source of significant cost growth over the next 75 years. These costs are projected to rise from 1.9 percent of GDP in 2025, to 3.7 percent in 2050, and 4.2 percent in 2099. The cost of Part A is expected to rise at a slower rate from 1.5 percent of GDP in 2025, to 2.0 percent in 2050, and slowly decline to 1.9 percent of GDP due to slow growth in provider payments. The cost of Medicare Part D, the prescription drug program, is projected to rise from 0.5 percent of GDP in 2025 to 0.6 percent of GDP by 2099.

A significant contributor to Medicare spending growth is the Medicare Advantage (MA) program. MA offers a privately managed but government funded alternative to traditional Medicare and currently covers over half of all beneficiaries. By 2034 it will cover 58 percent of beneficiaries. As we have written before, the federal government pays significantly more for each individual enrolled in MA than it does for individuals enrolled in traditional Medicare – mainly due to a tactic known as upcoding. Total spending on MA is expected to grow from 1.8 percent of GDP in 2025 to 2.9 percent in 2034.

Lawmakers have many options to reduce Medicare spending, many of which have been discussed in our Health Savers Initiative. These include implementing site-neutral payments, reducing MA overpayments, improving the Quality Bonus Program, and implementing policies that would further reduce the cost of prescription drugs.

Medicare's Outlook has Worsened Since Last Year

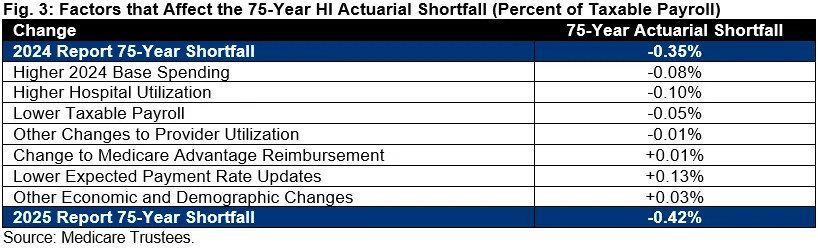

The financial outlook for the Medicare program has noticeably worsened since last year’s report, both in terms of the HI trust fund and overall Medicare costs.

The projected HI insolvency date of 2033 is three years earlier than last year’s projection of 2036. And the 75-year shortfall has worsened by 0.07 percentage points from 0.35 percent of payroll in the 2024 report to 0.42 percent in this year’s report.

The earlier insolvency date is due to higher expenditures than previously estimated for 2024, higher use of hospital services, lower taxable payroll, and other changes. While these differences worsened the actuarial shortfall by 0.24 percent, they were partially offset by 0.17 percent of payroll in improvements due to lower MA reimbursement, lower expected payment rates, and other changes.

In addition to HI facing a larger deficit, the Trustees project overall Medicare costs to be higher. In 2026, they expect gross Medicare spending costs to total 4.13 percent of GDP, up from 4.06 percent in last year’s report. More significantly, they project costs in 2098 to total 6.70 percent of GDP as opposed to 6.20 percent in their previous projections.

More than the entire increase, on net, can be explained by larger spending on Medicare Part B, which covers outpatient services. That program is now projected to cost 4.18 percent of GDP in 2098, nearly 0.6 percentage points higher than previous projections of 3.61 percent. The increase is due to higher projected spending for outpatient hospital and physician-administered drugs.

Spending on Medicare Part A (hospital insurance) is projected to be higher in the early years but very similar by 2098 – about 1.89 percent of GDP. Meanwhile, spending for Medicare Part D (drug benefits) is now projected to be lower, at 0.64 percent of GDP in 2098 as opposed to 0.69 percent, due mainly to lower projected enrollment.

The Overall Outlook is Far Worse Under the Trustees' Alternative Scenario

Medicare Trustees’ official projections are based on currently scheduled payment rates. However, it is unclear whether these rates will continue over the next few decades, as provider payments are set to grow more slowly than the underlying medical costs.

Each year the Chief Actuary provides an alternative scenario in which provider payments eventually begin to grow at a rate that is more consistent with underlying medical costs.

In the Chief Actuary’s alternative scenario, gross Medicare costs would grow from 3.9 percent of GDP today to 6.7 percent of GDP in 2050 and 8.8 percent in 2099. By comparison, costs would grow to 6.7 percent of GDP by 2099 under the official projections.

Specifically, Part A costs would grow to 2.9 percent of GDP by 2099 under the alternative scenario, compared to 1.9 percent in the official projections. And Part B costs would grow to 5.3 percent of GDP in 2099 under the alternative, compared to 4.2 percent in the official projections. Part D costs do not differ between the official projections and the alternative.

Due to the higher spending on Part A, the HI funding gap would be three-times as large under the alternative scenario – 1.28 percent of payroll as opposed to 0.42 percent of payroll. Whereas under the official projections, HI spending and revenue would balance by 2099, the program would face a 2.4 percent of payroll deficit in that year under the alternative scenario.

Conclusion

The Medicare Trustees project that the HI trust fund will be insolvent in just eight years, three years sooner than previously projected. At that point, payments under the law would need to be cut by 11 percent, which could jeopardize access to care. In that same year, seniors will face a 23 percent cut to their Social Security benefits as that program also enters insolvency.

Medicare’s long-term forecast is similarly dire, with the overall cost of Medicare high and rising relative to the size of the economy. Under the Chief Actuary’s alternative scenario, the outlook is even worse.

With the national debt approaching record levels and interest costs surging, policymakers should consider meaningful changes to reduce the projected cost of the Medicare program – both for the program’s own sake and for the federal budget.

Fortunately, policymakers have numerous options available to slow Medicare spending growth by cutting waste in the program, lowering the overall cost of health care, making the program more efficient, and improving incentives for providers and beneficiaries alike.

Lawmakers should adopt changes sooner rather than later to get health care spending under control and ensure adequate revenue so that the Medicare program can continue to serve its beneficiaries over the long run without imposing massive debt on future generations.