Offsetting ACA Enhanced Subsidy Extensions

9/26/25: Updated to reflect new CBO estimate of the cost of enhanced ACA subsidies.

With early marketplace premium estimates rolling out, there is increasing talk of extending the Affordable Care Act (ACA) subsidy enhancements scheduled to expire at the end of this calendar year. A full extension could cost up to $350 billion through 2035. If lawmakers choose to extend these subsidies, they should ensure they don’t add to the country’s already massive debt burden and preferably work to lower overall health care costs and reduce the debt. Fortunately, there are numerous available modifications and offsets – some of which we outline below.

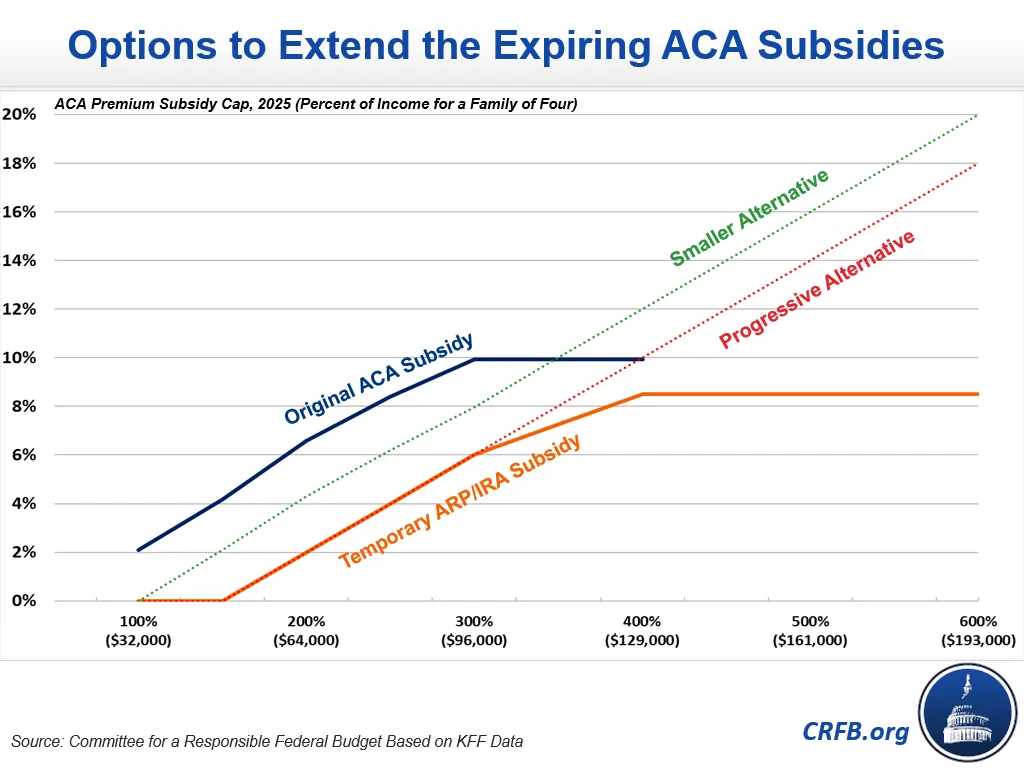

The Affordable Care Act established exchanges where individuals can purchase health insurance with an income-based subsidy that effectively caps the typical premium as a share of income. The American Rescue Plan and Inflation Reduction Act expanded these subsidies across the board, fully subsidizing a typical premium for those below 150 percent of the poverty line and expanding the subsidies for most others. The expanded subsidies removed the cap on eligibility for subsidies for people with incomes at 400 percent of the federal poverty level and limited premiums to a maximum of 8.5 percent of household income. These expanded subsidies expire at the end of 2025.

Based on recent estimates from the Congressional Budget Office (CBO), permanently extending the expanded subsidies would cost roughly $350 billion between Fiscal Year (FY) 2026 and FY 2035.1 Well over $50 billion of those costs are likely to go to households making more than five times the poverty threshold (about $160,000 for a family of four in 2025), and some evidence suggests that tens of billions more will flow through to higher health care prices and net revenues for insurers.

To address some of these concerns while continuing to provide enhanced coverage and address the pre-enhancement “subsidy cliff” at 400 percent of the poverty level, lawmakers could consider an alternative formula. For example, limiting the extension to those below 600 percent of the poverty level (about $200,000 for a family of four) would reduce the cost to about $325 billion. Extending enhanced subsidies up to 300 percent of poverty and extending the income-based premium phase up (the “Progressive Alternative” in the graph above) beyond that would reduce the cost to about $280 billion. And setting new subsidies about halfway between the base and enhanced rate (the "Smaller Alternative" in the graph above - an idea conceptually similar to a plan put forward by the Progressive Policy Institute - would reduce the cost to approximately $175 billion over ten years.

There are also a variety of health-related policy options available to offset any extension, including many outlined in our Budget Offsets Bank and discussed below. Importantly, estimates are extremely rough – meant to convey an order of magnitude – and are mainly based on pre-reconciliation data.

Options to Extend and Offset Enhanced ACA Subsidies

| Policy | 2026-2035 Cost (-)/Savings |

|---|---|

| Extend Enhanced ACA Subsidies | |

| Make Current Subsidies Permanent | -$350 billion |

| Extend Subsidies Below 600% of Poverty | -$325 billion |

| Extend Subsidies Below 300% of Poverty, Extend Phase Up Above (Progressive Alternative) | -$280 billion |

| Extend Roughly Half of Subsidies (Smaller Alternative) | -$175 billion |

| Reduce ACA Costs | |

| Extend Trump ACA Rules (Currently in Effect for Only 2026) | $50 billion |

| Fund Cost-Sharing Reduction (CSR) Appropriations | $50 billion |

| Cap ACA Plan Hospital Reimbursement at 200% of Medicare | $50 billion |

| Move Medicaid Enrollees Above the Poverty Line to Exchanges | $50 billion |

| Reduce Medicare Costs | |

| Adopt Site-Neutral Payments for Most Services | $175 billion |

| Reduce MA Risk Score "Upcoding" (No UPCODE Act) | $125 billion |

| Increase MA Coding Adjustment from 5.9% to 7% | $100 billion |

| End Reimbursement of Bad Debts | $60 billion |

| Rebase Medicare Payments to Current (Sequester) Level | $75 billion |

| Reduce Federal Medicaid Costs | |

| Reduce All Medicaid Administrative Matching Rates to 50% | $80 billion |

| Apply OBBBA Provider Tax Limits to All States and Providers | $50 billion |

| Restrict State Abuse of Intragovernmental Transfers (IGTs) | $50 billion |

| Lower Medicaid Drug Prices Through Rebates or Negotiations | $20 billion |

| Increase Health-Related Tax Revenue | |

| Apply 3.8% NIIT to Pass-Through Entities | $450 billion |

| Cap ESI Income Tax Exclusion at the 80th Percentile of Premiums | $300 billion |

| Increase Taxes on Alcoholic Beverages to $16 per Proof Gallon | $90 billion |

| Rationalize and Increase Tobacco Taxes by 50% | $50 billion |

| Enact Temporary Extension of Enhanced Subsidies | |

| 1-Year Extension | -$30 billion |

| 2-Year Extension | -$60 billion |

| 4-Year Extension | -$125 billion |

Source: CRFB estimates based on CBO data. Note: Most estimates are based on pre-reconciliation data and may differ against current law.

Policymakers could offset extending the ACA enhanced subsidies in part through changes within the ACA itself. For example, they could save $50 billion by making permanent the provisions of the Trump Administration ACA rules in effect in 2026 that were not made permanent under OBBBA. These include ensuring only those who are eligible for subsidies are enrolled through annual eligibility redeterminations, standardizing open enrollment periods for both the state and federal exchanges, and disallowing applicants to self-attest to their income. Lawmakers could save an additional $50 billion by directly funding ACA cost-sharing reductions (CSRs) in order to end costly “silver-loading.” And further savings could be generated by limiting plan payments for hospitals or drugs or by moving some populations from Medicaid into the exchanges.

There are also trillions of dollars of potential Medicare savings available – many of which would reduce costs for beneficiaries and the federal government at the same time. For example, adopting site-neutral payments to pay the same rate for services offered within and outside hospitals could save $175 billion over the decade. Modest reforms to address Medicare Advantage (MA) upcoding – which lead to as much as $1.2 trillion of overpayments – could save tens or hundreds of billions more. And further savings could come from common-sense provider limits supported by both parties such as extending existing payment rate reductions (from “sequestration”) and ending bad debts reimbursements.

Lawmakers could also look to enact additional Medicaid reforms on top of the significant savings enacted under the OBBBA. For example, lawmakers could save roughly $50 billion by building on OBBBA’s important provider tax limits by ending exemptions for non-expansion states and nursing home taxes that could open new loopholes. They could save another $50 billion by restricting schemes related to intragovernmental transfers (IGTs) that allow states to pay higher rates to state and publicly-owned providers. Further savings could come from reducing the federal matching rates for administrative activities ($80 billion), limiting prescription drug prices within Medicaid ($20 billion), or other changes.

On the revenue side, policymakers could generate $450 billion by applying the current 3.8 percent Net Investment Income Tax (NIIT) to pass-through entities that currently pay neither the NIIT nor the 3.8 percent Medicare payroll tax. Limiting the tax exclusion for employer sponsored insurance (ESI) could generate additional revenue while also putting downward pressure on health care costs. For example, limiting the ESI income tax exclusion to the 80th percentile of the previous year could save up to $300 billion. Policymakers could also impose taxes on goods that promote unhealthy behavior ~ alcohol and tobacco taxes could each raise tens of billions of dollars or more.

There are of course hundreds of additional options to modify or offset any enhanced ACA subsidy enhancement either within or outside of health care.

Extending the enhanced subsidies without offsets would worsen an already unsustainable debt outlook. If lawmakers choose to extend these enhanced credits, they should do so in a fiscally responsible way while also working to lower health care costs where possible. Using super PAYGO to more than offset the costs would extend coverage expansions while helping put our country on a better fiscal path.

1 The recently enacted One Big Beautiful Bill Act (OBBBA) included significant changes to the ACA subsidies as well as Medicaid. The Trump Administration has also issued new regulations which will reduce the cost of the ACA in 2026. On net, we expect these changes to reduce the cost of extending the enhanced subsidies but do not have good basis for estimating by how much.