Health Savings Can Help Pay for Reconciliation

Policymakers are continuing to negotiate the "Build Back Better Act" reconciliation package and the overall size and scope of both the tax and spending portions are in flux. Much of the discussion so far has focused primarily on using tax increases to finance new spending and tax breaks, but there is also discussion of paying for some of the proposals with health care savings. In addition to reducing prescription drug costs – an area policymakers already plan to address – savings could come from reforms to Medicare provider reimbursements and Medicare Advantage (MA) payments, changes to the Affordable Care Act (ACA), and/or scaling back health spending proposals. Already, a number of health savings options exist – including some with bipartisan support – that would generate hundreds of billions for the federal government while also lowering premiums and out-of-pocket costs for private payers.

While reductions in health care spending should go primarily to shoring up Medicare's finances, some could be used to fund new spending. We walk through several policy areas below.

Reduce Prescription Drug Costs: The federal government spent over $500 billion on prescription drugs in 2019. The House reconciliation package would substantially reduce future spending by establishing annual negotiations between the federal government and drug manufacturers and capping drug prices based on an international average, as proposed in the Elijah E. Cummings Lower Drug Costs Now Act (H.R.3). The package also includes policies from H.R.3 that limit drug price growth to the rate of inflation and reform the Medicare Part D payment formula. The legislation also proposes to cancel a Trump Administration drug rebate rule set to take effect in 2022. Depending on scoring and what happens with the bipartisan infrastructure plan, these policies could save the federal government as much as $700 billion over ten years and go a long way toward paying for the reconciliation package. While these policies failed to advance out of the House Energy and Commerce Committee, they were later approved as part of the Ways and Means Committee’s portion of the reconciliation package.

Policymakers have additional options to reduce prescription drug costs. Through our Health Savers Initiative, we found that injecting price competition into Medicare Part B drugs could reduce gross Medicare spending by $122 billion over ten years, while preventing evergreening delays of generic drug competition through Food and Drug Administration (FDA) exclusivity rules could save at least $10 billion. Lawmakers could also look to proposals in the bipartisan Prescription Drug Pricing Reduction Act (Grassley-Wyden) and elsewhere such as redesigning the Part D formula, expanding Medicare and Medicaid drug rebates, reducing reimbursements for physician-administered drugs, and encouraging the introduction of generic drugs onto the market.

Reduce or Reform Medicare Provider Payments: One way to reduce the cost of Medicare is to reduce or reform excessive payments to medical providers. Historically, there has been bipartisan support for ideas like reducing reimbursements for bad debts, lowering post-acute care payments, and reforming payments for Graduate Medical Education (GME) and other payments. Policymakers could also modify reimbursements for uncompensated care, which would become less necessary in the context of a plan to further expand health care coverage.

Perhaps most importantly, policymakers could identify payment disparities that exist when hospitals and outpatient clinics are paid different amounts for the same services. Through our Health Savers Initiative, we found that equalizing Medicare payments regardless of site-of-care could save the federal government between $217 billion to $279 billion over a decade, while generating up to $95 billion in savings for beneficiaries. CBO estimated a similar proposal in President Trump’s Fiscal Year (FY) 2021 budget would save over $150 billion.

Options to Boost Health Savings in Reconciliation Package

| Policy | Ten-Year Savings |

|---|---|

| Reduce Prescription Drug Costs | |

| Require drug price negotiations with international cap | Up to $500 billion |

| Enact Part D formula re-design | $5 to $75 billion |

| Cap drug price growth at inflation | $35 to $80 billion |

| Transition Medicare Part B payments to a system that fosters competition among clinically comparable drugs | $120 billion |

| Expand Medicare and Medicaid Drug Rebates | up to $150 billion |

| Prevent evergreening delays of generic drug competition through FDA exclusivity rules | $10 billion |

| Reduce or Reform Medicare Provider Payments | |

| Equalize Medicare payments regardless of site-of-care | $150 to $280 billion |

| Reduce and reform payments for uncompensated care | up to $90 billion |

| Reduce and reform Medicare post-acute care payments | $50 to $100 billion |

| Reduce and reform payments for Graduate Medical Education | $35 to $90 billion |

| Reduce or repeal Medicare payments for bad debts | $25 to $80 billion |

| Expand use of bundled payments | $10 to $50 billion |

| Reduce or Reform Medicare Advantage (MA) Payments | |

| Adjust Medicare Advantage payments for accurately for coding intensity | $45 to $355 billion |

| Set Medicare Advantage payments using competitive bidding | $55 to $230 billion |

| Modify risk adjustment payments in Medicare Advantage | $50 to $80 billion |

| Reduce excessive quality bonus payments to Medicare Advantage plans | $30 to $165 billion |

| Enact Affordable Care Act (ACA) Savings | |

| Establish a public option for the health exchanges | ~$150 billion |

| Restore cost-sharing reductions funding | ~$100 billion |

| Recapture excessive premium subsidies | $50 billion |

Sources: Congressional Budget Office, Health Savers Initiative, and Committee for a Responsible Federal Budget. All numbers rounded to the nearest $5 billion.

Reduce or Reform Medicare Advantage (MA) Payments: Per-capita costs in MA plans are higher and growing more rapidly than in traditional fee-for-service Medicare, while the federal government pays more for each MA beneficiary than in fee-for-service Medicare. As a result of this cost growth and projected increases in MA enrollment, policymakers should consider examining the program to slow cost growth. Savings could be obtained by setting MA payments using competitive bidding ($55 billion to $230 billion), modifying risk adjustment payments in MA ($50 billion to $80 billion), and reducing excessive quality bonus payments to MA plans ($30 billion to $165 billion), among other options.

One reason MA costs are so high is diagnostic upcoding which makes MA enrollees appear less healthy than they actually are. Through our Health Savers Initiative, we found that adjusting MA payments more accurately for coding intensity could reduce Medicare spending by $198 billion to $355 billion over ten years, while also reducing Medicare premiums by $32 billion to $57 billion. More modest versions of this policy, as scored by CBO, would save $45 billion to $70 billion.

Enact Affordable Care Act (ACA) Savings: The House reconciliation bill would expand the ACA by permanently extending the ACA premium subsidy enhancements passed as part of the American Rescue Plan, closing the Medicaid coverage gap in states that chose not to adopt the ACA Medicaid expansion, and creating a new reinsurance program. This spending could be partially financed by identifying savings within the ACA itself. For example, restoring appropriations for cost-sharing reductions terminated by the Trump Administration would actually save money (at least $100 billion) by ending the practice of "silver-loading" which drives up the costs of premium subsidies. Lawmakers could also consider adding a public option to the exchanges, which could save money (perhaps $150 billion) through lower administrative costs and provider payments. Other options, such as allowing the purchase of "copper plans" or improving excess subsidy recapture, could also save federal dollars.

Scale Back Proposed Health Spending: The House reconciliation package would expand Medicare to include vision, hearing, and dental benefits starting in 2022, 2023, and 2028, respectively. It also extends temporarily enhanced ACA premium subsidies beyond 2022 and creates a federal program to close the Medicaid coverage gap. While CBO has not released an official score of these policies, they could cost upwards of $1 trillion over a decade, and much more when fully phased in. Reducing the costs of these expansions can help limit the overall cost of the reconciliation legislation.

As we’ve recently shown, policymakers could reduce the cost of expanded Medicare benefits by roughly two-thirds by including new benefits in Part B premium calculations and excluding them from MA benchmarks (as proposed by Matt Fielder of the USC-Brookings Schaeffer Initiative for Health Policy). Costs could be reduced further by offering them as a separate benefits, means-testing benefits, or by prioritizing between dental, vision, and hearing benefits.

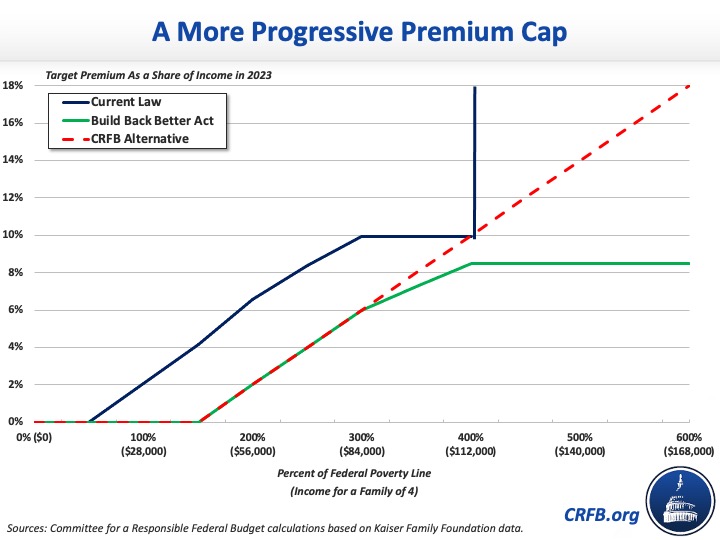

Lawmakers could also scale back the cost of extending the enhanced ACA subsidies beyond 2022. The current proposal would limit premiums to a sliding scale of income target up to 400 percent of the Federal Poverty Line (FPL) while limiting premiums for enrollees at and above that level to a cap of 8.5 percent of income. Continuing to increase the cap with income could reduce costs. One alternative would be to continue the same pace of the phase up above 300 percent of the FPL so that the cap reaches 8 percent of income by 350 percent of the FPL, 10 percent by 400 percent of the FPL, 12 percent by 450 percent of the FPL, and so on.

Lawmakers could also identify proposals to more affordably address the Medicaid coverage gap and expand long-term care benefits.

*****

With significant increases in health care spending under consideration, policymakers should look for savings elsewhere in the health care space to help pay for the Build Back Better Act. Over the long term, we need to reduce, not increase, total health care spending and costs.

Read more options and analyses on our Reconciliation Resources page.