Five Ways to Improve the FY 2022 Reconciliation Package

Congress is attempting to enact a large and ambitious agenda of new programs through the reconciliation process. While President Biden has made the admirable commitment that the legislation will be fully paid for and not add to the national debt, the numbers do not yet add up.

According to reports, the House intends to enact $3.5 trillion of spending increases and tax breaks and about $2.9 trillion of tax increases and health care savings to offset the cost, leaving a roughly $600 billion hole. Actual spending and tax breaks may end up being higher, and some offsets might not pass, and arbitrary expirations could further hide the cost. Previously, we estimated the intended spending and tax breaks could cost between $5.0 trillion and $5.5 trillion over a decade if made permanent – well short of the $2.9 trillion of intended offsets.

Policymakers will need to scale back some of their proposals, identify additional offsets, or do some combination of both to ensure the legislation is responsibly paid for.

Five options to achieve this goal are to:

- Better target spending and tax cuts

- Scale back new spending on seniors

- Resize tax breaks

- Boost health savings

- Raise more revenue

#1: Better Target Spending and Tax Cuts

The House legislation includes or is likely to include a number of policies that distribute new benefits to higher-earning households. This includes universal pre-K, paid leave, and tuition-free community college; new health and child care benefits; expanded tax credits; and possibly State and Local Tax (SALT) deduction cap relief. In a recent analysis, we showed how policymakers could scale back, better target, or remove policies that direct new resources where they aren’t most needed. Such targeting would not only save money but ensure that policies generate greater returns on investments and do more to promote economic growth.

For example, paid family and medical leave does not need to offer a maximum monthly benefit that's two-thirds higher than the maximum Social Security monthly benefit. Furthermore, universal pre-K could either be means-tested or federal funding to states could rely on an income-based formula, while limits on health care premiums and child care costs could increase more based on income. Moreover, proposed expansions of the Child Tax Credit (CTC) and the Child and Dependent Care Tax Credit (CDCTC) could phase out more rapidly by income. Other policies such as tuition-free community college and tax credits for electric vehicles (EV) could also be better targeted based on income (Read our full analysis on better targeting in reconciliation here).

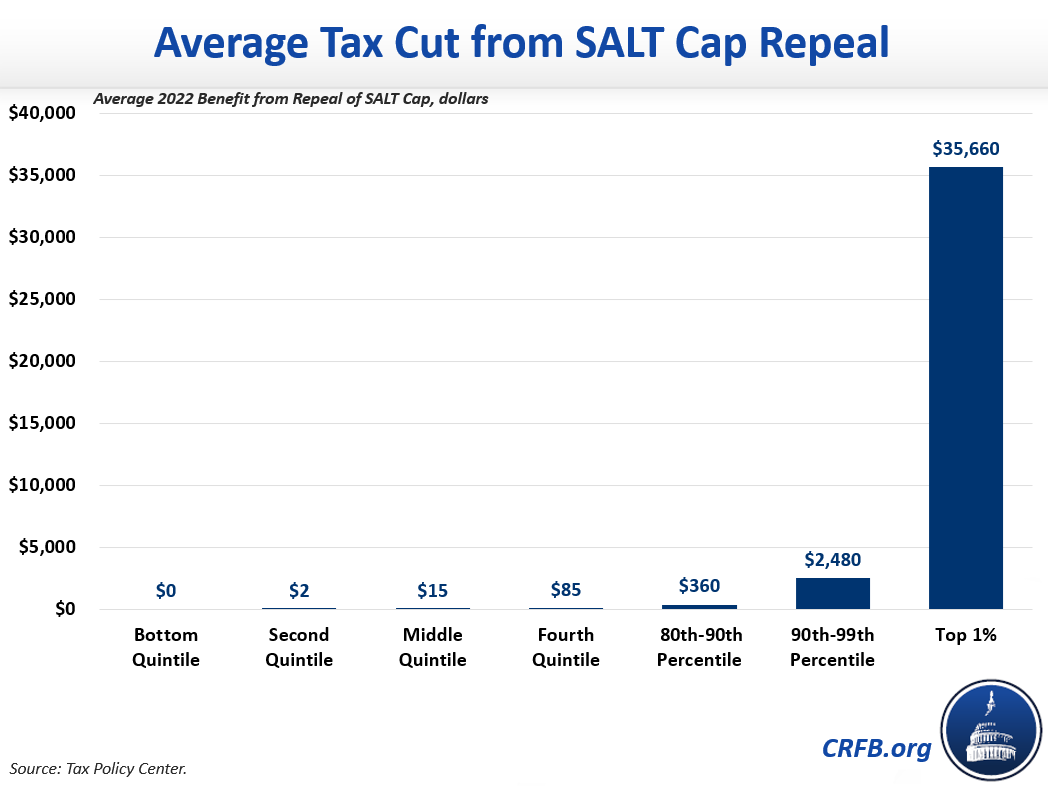

Perhaps the least justifiable policy Congress is considering is repeal of the $10,000 cap on the SALT deduction, which would cost over $85 billion per year and deliver 90 percent of the benefit to the top 10 percent of taxpayers. Repealing the SALT deduction cap would consume all revenue raised from the proposed tax rate increases and cost as much as universal pre-K, tuition-free community college, paid family and medical leave, affordable child care, and an Earned Income Tax Credit (EITC) expansion combined. Full SALT cap repeal would amount to an average tax cut of nearly $36,000 for taxpayers in the top 1 percent and only $15 for middle-income taxpayers, and there is no real way to make SALT cap relief progressive.

#2: Scale Back New Spending on Seniors

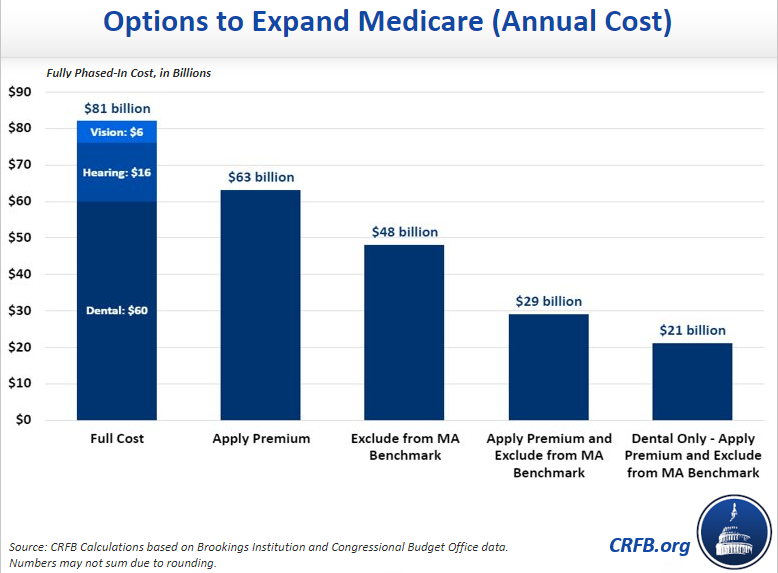

The current reconciliation package includes large new spending proposals for seniors. Specifically, the package expands the generosity of Medicare's drug benefit, includes long-term care funding, and expands Medicare to include dental, hearing, and vision benefits with no premium. These policies are likely to cost well over $100 billion per year when fully phased in and come on top of reforms to Medicare Part D that reduce seniors' prescription drug costs and premiums.

Spending on programs for seniors – Social Security and Medicare in particular – represents the fastest growing part of the budget. At the same time, the Medicare Hospital Insurance (HI), or Part A, trust fund is only five years from insolvency, and faces a $578 billion net funding gap over the next decade. Given that seniors are already financially better off than other cohorts, it makes little sense to dedicate substantial new resources to older Americans at this time – certainly not before shoring up the programs that already exist. Certainly, there is no argument for sending seniors $1,000 vouchers, as some have proposed.

New funding for long-term care could be better targeted or based on a contributory system of benefits, while limits to out-of-pocket drug costs could be enacted in the context of a deficit-reducing Medicare Part D re-design, such as the bipartisan reforms put forward by Senators Ron Wyden (D-OR) and Chuck Grassley (R-IA) and advanced by the Senate Finance Committee.

Rather than expanding Medicare benefits for dental, hearing, and vision (which are already available through many Medicare Advantage (MA) plans), policymakers could drop the provisions entirely, or consider a much more targeted and cost-effective approach. At minimum, premiums should be instituted to cover about 25 percent of the benefits' costs as with Medicare Parts B and D, and Medicare Advantage "benchmarks" should not increase total new spending given that many MA plans already cover dental, vision, and hearing benefits. Holding benchmarks constant and including a 25 percent premium would reduce the cost of the proposed expansion by about two-thirds. Costs could be further reduced by making dental, hearing, and vision a separate supplemental benefit with an income-related premium that required well off seniors to pay most or all of the costs.

#3: Resize Tax Breaks

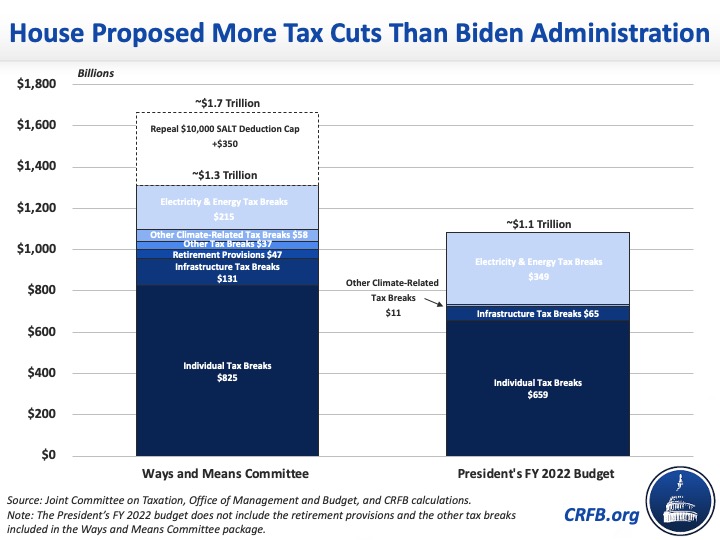

The House Ways and Means Committee approved over $1.3 trillion of tax breaks and tax cuts in its portion of the reconciliation package, which is about $230 billion more than what the Biden Administration proposed in its budget. Excluding the renewable energy and electricity tax breaks, the Ways and Means Committee’s tax breaks and tax cuts are nearly $320 billion larger than the Administration’s. If the House adds a repeal of the $10,000 cap on the State and Local Tax deduction, as many have committed to, the package’s tax breaks would be $600 to $700 billion larger than the White House’s. Scaling back these tax breaks could substantially reduce the size of the package.

Many of the tax breaks and tax cuts in the House Ways and Means package are unnecessary, poorly targeted, or too costly. For example, the package’s electric vehicle tax credits are 2.5 times more than the Administration’s while it’s infrastructure financing subsidies are 3.5 times as much as the White House’s. Most of the difference would feed to wealthy bond holders, luxury vehicle owners, and corporations.

The Ways and Means package also restores a number of special interest tax breaks rightly scaled back by the Tax Cuts and Jobs Act (TCJA) of 2017, such as the Rehabilitation Tax Credit, and it offers arguably unnecessary tax breaks for university endowments and medical students and residents. The Ways and Means Committee’s expansion of the Child Tax Credit is also roughly 20 percent (over $25 billion per year) larger than the Administration’s in large part because it removes a requirement that taxpayers verify their identity with a valid Social Security Number (SSN). To add insult to injury, the House is likely to add SALT cap relief or repeal, which could cost nearly as much as the Child Tax Credit expansion and deliver nearly all the benefit to high income earners.

Rather than undermine the base broadening from the TCJA and including new, poorly-targeted tax breaks on top of it, it would be better if policymakers limited their legislating through the tax code. The Administration’s proposals should be considered a ceiling, not a floor, for how much taxes are cut through reconciliation.

#4: Boost Health Savings

The House Ways and Means Committee approved roughly $700 billion of savings from prescription drug pricing reforms. This includes annual negotiation with drug manufacturers for the most expensive and commonly used prescription drugs, a requirement that drug manufacturers who increase their prices faster than inflation pay back the excess amount to the federal government, and a $2,000 cap on out-of-pocket costs for Medicare Part D beneficiaries. The package also cancels a Trump Administration drug rebate rule set to take effect in 2022 (though it is already delayed until 2026 in the bipartisan infrastructure bill). Policymakers should not water down the savings from prescription drug or other health care reforms as some have suggested. In fact, additional options should be included to generate more health savings.

One option is to reduce excessive payments to Medicare Advantage plans, which are paid more than traditional Medicare in part because of fraudulent "up-coding.” A number of reform options are available. Policymakers could also look to reduce excessive provide payments – for example, by paying hospitals and doctors’ offices at the same rate for providing the same services (site-neutral payments), reducing excessive post-acute care payments, or ending unnecessary reimbursements for "bad debts." Many of these ideas have bipartisan support and have been proposed by both former Presidents Obama and Trump.

Congress could also identify savings within the Affordable Care Act (ACA) to help fund proposed ACA expansions. For example, restoring direct federal reimbursements for cost-sharing reductions would save $100 billion or more (though the savings may not be "scoreable") while also improving and rationalizing the insurance exchanges. Introducing a public option could save a similar amount of money, perhaps more.

A table of health savings options is below, and more options are available at our Budget Offsets Bank and through our Health Savers Initiative.

Illustrative Options to Offset New Health Spending

| Policy | Ten-Year Savings |

|---|---|

| Reduce excessive Medicare Advantage payments | $50 to $350 billion |

| Equalize Medicare payments regardless of site-of-care | $50 to $250 billion |

| Reduce and reform Medicare post-acute care payments | $50 to $100 billion |

| Reduce or repeal Medicare payments for bad debts | $25 to $80 billion |

| Freeze thresholds and increase Medicare premiums for high earners | $50 to $100 billion |

| Reform Medicare cost-sharing and Medigap rules | $50 to $100 billion |

| Limit use of Provider Taxes to Inflate Medicaid Match | $25 to $450 billion |

| Establish a public option for the health exchanges | ~$150 billion |

| Restore Cost-Sharing Reduction subsidies | ~$100 billion |

Sources: Congressional Budget Office, Senate Finance Committee, and Committee for a Responsible Federal Budget calculations.

#5: Raise More Revenue

The House Ways and Means Committee approved roughly $2.25 trillion of revenue increases in its portion of the reconciliation package to help finance an expected $3.5 trillion total of tax breaks and spending under reconciliation. This includes $1 trillion of tax increases on high-income households, roughly $950 billion from corporate changes, and over $300 billion from increasing excise taxes, closing the tax gap, and other changes. While these tax increases are substantial, they are roughly $1.3 trillion smaller than President Biden's proposals, and much more could be done.

Most importantly, policymakers could do more to reduce the tax gap and improve tax compliance. Ensuring people pay the taxes they owe is not a tax increase and has a long history of bipartisan support. The Administration's proposals to require better information reporting from financial institutions could raise substantial funds. Additional revenue could come from closing the stepped-up basis loophole for assets transferred at death, which would make the tax code more progressive, efficient, and pro-growth. Other sources of new revenue include taxes on carbon or oil, which could help stem the dangers of climate change beyond what could be accomplished with new spending alone. Policymakers could also consider financing new initiatives like paid family leave with a payroll tax (an employer-side payroll tax could avoid direct taxes on individuals making less than $400,000 per year), and looking to a variety of tax expenditure reforms and limits for additional funding.

A table of revenue options is below, and more options are available at our Budget Offsets Bank.

Illustrative Options to Generate Additional Revenue

| Policy | Ten-Year Savings |

|---|---|

| Close the tax gap by increasing information reporting | $200 billion ($473 billion according to OMB) |

| Close the stepped-up basis loophole by taxing capital gains at death | ~$200 billion |

| Close the stepped-up basis loophole by replacing with carryover basis | ~$100 billion |

| Extend the $10,000 SALT deduction cap to businesses and corporations | $250 billion |

| Impose a $25 per metric ton carbon tax | $1.1 trillion |

| Impose a $10 per barrel oil tax | $350 billion |

| Enact a 0.3 percent employer-side payroll tax for paid family leave | $225 billion |

| Limit tax deductions and exclusions to 28 percent bracket | $400 billion |

Sources: Congressional Budget Office, Office of Management and Budget, Penn Wharton Budget Model, and Committee for a Responsible Federal Budget calculations.

*****

As policymakers continue to work on their reconciliation package, they should aim to find more offsets and scale back or better target provisions as necessary to avoid adding to an already high national debt. While our suggested improvements are only illustrative, they show a clear path to improving the reconciliation package.

Read more options and analyses on our Reconciliation Resources page .