Limiting the Cost of Medicare Expansion

As Congress negotiates proposals for Medicare benefit expansions, it should consider ways to limit their costs by either dropping the expansions entirely or making sensible adjustments to the reforms that align them with the rest of the Medicare program. One of the more promising ways to do so would be to ensure the expansion does not further increase payments to Medicare Advantage (MA) private plans, which we've shown are already receiving overpayments.

The House Ways and Means Committee’s portion of the reconciliation package would expand Medicare to include vision, hearing, and dental benefits beginning in 2022, 2023, and 2028, respectively.

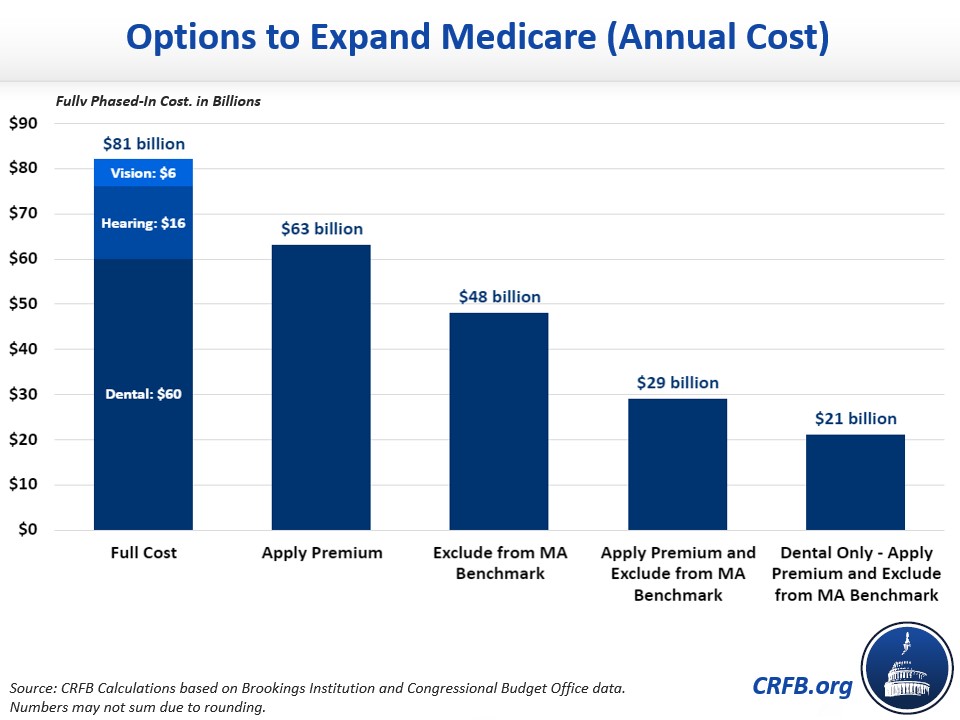

Though many seniors already have access to these types of benefits through Medicaid or Medicare Advantage plans, the Congressional Budget Office (CBO) has estimated that expanding the benefits to everyone with no premium would cost over $80 billion per year when fully phased in – more than the combined average annual cost of President Biden’s proposals to extend Affordable Care Act (ACA) premium subsidy enhancements from the American Rescue Plan, provide for universal pre-K, fund tuition-free community college, and support affordable child care.

Since the Medicare program is already growing rapidly and the Medicare Hospital Insurance (HI), or Part A, trust fund is just five years from insolvency, policymakers should avoid expanding benefits before securing the underlying finances of the program. They could also consider a more targeted expansion based on need.

To reduce the costs of providing comprehensive benefits, Matt Fiedler of the USC-Brookings Schaeffer Initiative for Health Policy has suggested incorporating the benefits when calculating Part B premiums while excluding them from the MA benchmark. Together, these changes could reduce annual costs from over $80 billion to below $30 billion.

Medicare Parts B and D both already include a premium that generally covers one-quarter of costs, with smaller premiums for low-income seniors and higher premiums for high-income seniors. Fiedler estimates that applying this same premium to new benefits would reduce expansion costs by 22 percent, or roughly $18 billion per year when fully phased in.

Since nearly all Medicare Advantage plans offer vision, dental, and hearing benefits, costs could be further reduced by excluding them from the benchmarks used to help determine payments to insurers for MA plans. Fiedler estimates excluding these benefits from the benchmarks would reduce the cost of the benefit expansion by 41 percent without affecting the ability of MA plans to offer these benefits. That policy alone could save roughly $33 billion per year when fully phased in.

Instead of, or in addition to benchmarking adjustments, policymakers could consider more direct MA changes to pay for new spending or control overall Medicare cost growth. Excess payments already made to MA plans are well documented. Through our Health Savers Initiative, we examined how the federal government spends more to cover enrollees in Medicare Advantage relative to traditional fee-for-service Medicare in part due to “up-coding". As the share of MA beneficiaries continues to grow, this disparity is likely to become an even larger burden on the federal budget.

Our proposed solution would address the up-coding issue directly, but a number of other MA options could also generate savings, such as improvements to quality benchmark adjustments and competitive bidding reforms. Moreover, every dollar of direct MA savings generates roughly 50 cents for the Part A trust fund.

Given the numerous proposals for expanding health care benefits in the current reconciliation package, it is critical that policymakers find ways to limit costs and pay for new spending in order to ensure the package is fiscally responsible. Attempts to address the excesses of Medicare Advantage should be part of that discussion, especially considering nearly half of all Medicare beneficiaries will be enrolled in MA plans over the next decade.

Read more options and analyses on our Reconciliation Resources page.