Closing the Stepped-Up Basis Loophole

Reconciliation should not add a penny to the national debt. As lawmakers work to craft a package with $3.5 trillion of new spending and tax breaks through reconciliation, they should not take reasonable pay-fors off the table. That includes President Biden’s proposal to close the stepped-up basis loophole for capital gains. Addressing stepped-up basis has broad support, and would improve fairness and efficiency in the tax code while generating substantial new revenue.

Under current law, investors are generally taxed on their capital gains – the increased value of their stocks and other assets – at the time of sale. If a person buys a stock for $10 and sells it for $30, they will pay a tax on the $20 capital gain. Capital gains are generally taxed at a lower rate than ordinary income, with a top tax rate of 20 percent instead of 37 percent.

When a person dies and passes an asset onto an heir, the “basis” (assumed purchase price) of the asset is “stepped-up” to reflect its current value. When the heir sells the asset, they only pay taxes on the gains accrued while the asset was in their possession. This creates a substantial loophole where stepped-up basis rules allow some capital gains to escape taxation altogether. For example, if a person buys a stock for $10, passes it on at $29, and then it is sold for $30, capital gains taxes only apply to $1 of gains; $19 of gains escape taxation altogether.

There are two main ways to close the stepped-up basis loophole: tax capital gains at death, or replace stepped-up basis with a carryover basis. The former would impose capital gains taxes before the basis of an asset is stepped-up, while the latter would require the inheritor to pay capital gains taxes based on the original basis of the asset at the time of sale. Either approach can include exemptions and adjustments for farms and businesses, homes, or smaller amounts of inherited assets. Both would improve the fairness and efficiency in taxing capitals gains while generating additional revenue.

Reforming Stepped-Up Basis Would Improve Fairness

Addressing step-up basis would improve fairness between taxpayers in similar situations (“horizontal equity”) while also improving progressivity of the tax code (“vertical equity”).

Imagine three individuals, all with investments that have appreciated by $100,000 over the years. The first person sells those investments right before their death, the second passes them to their child right before death, and the third holds the assets until death and bequeaths them to their child. The tax code treats those three individuals differently – taxing the full $100,000 of gains immediately for the person who sells before death, taxing them upon sale for the person who gifts the assets before death, and never taxing those gains for the person who inherits the assets after their parent’s death. Reforms to stepped-up basis can reduce these inequities.

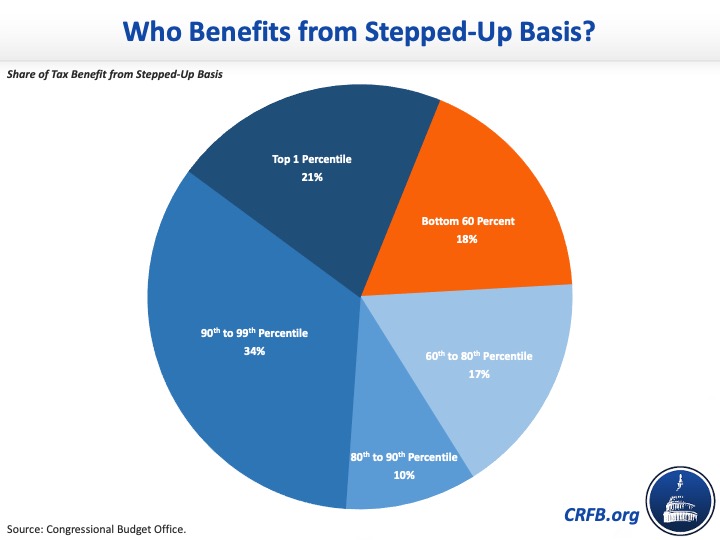

Addressing stepped-up basis would also improve the progressivity of the tax code. Since higher earners hold most of the assets in the United States, they benefit the most from capital gains tax breaks. In 2013, the Congressional Budget Office (CBO) estimated that nearly two-thirds of the value of stepped-up basis was enjoyed by those in the top quintile, with over a fifth of the benefit going to those in the top one percent.

Improving Step-Up Basis Would Improve Efficiency

In addition to making the code less fair and progressive, stepped-up basis rules harm economic and revenue-raising efficiency. They do so mainly by creating a lock-in effect where individuals hold their assets too long in order to avoid the capital gains tax.

By mitigating this lock-in effect, addressing stepped-up basis reduces distortions in portfolio choice and liquidity, and may lead to better economic investments. Addressing stepped-up basis also improves the revenue-raising efficiency of the capital gains tax.

With stepped-up basis in effect, higher capital gains rates lead to significant reductions in ‘realization’ and therefore have limited revenue potential. Many economists and estimators have found that raising the capital gains rate above 30 percent or so would actually lose revenue. Addressing stepped-up basis would increase the revenue-maximizing capital gains rate, and allow current capital gains taxes to raise revenue more efficiently.

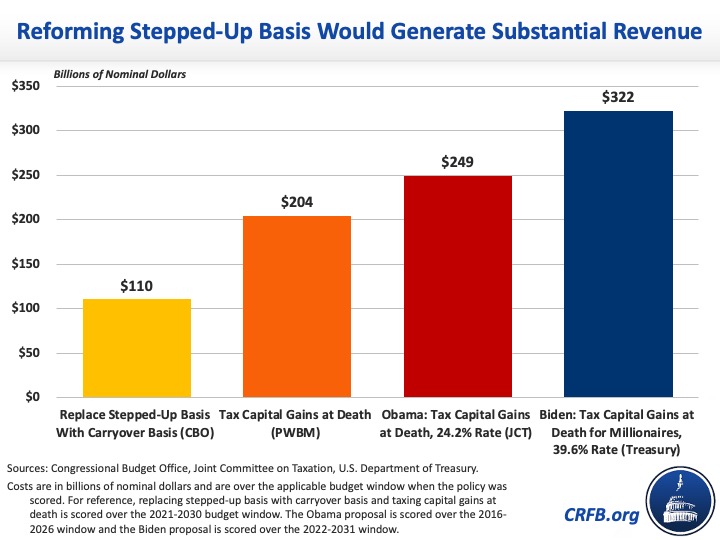

Addressing Stepped-Up Basis Would Generate More Revenue

Reforming stepped-up basis, whether by replacing it with carryover basis or a tax on capital gains at death, would generate substantial revenue. According to CBO, replacing the stepped-up basis with a carryover basis would generate $110 billion of revenue over a decade. Meanwhile, the Penn Wharton Budget Model (PWMB) finds taxing capital gains at death would raise $204 billion of revenue over ten years. By 2030, these policies would raise $18 billion and $30 billion per year, respectively.

Addressing stepped-up basis in combination with other revenue increases can raise even more revenue. For example, President Obama’s proposal to tax most capital gains at death and increase capital gains rates by 4.2 percent was scored to raise $249 billion between 2016 and 2026. President Biden’s proposal, which would tax capital gains at death for millionaires and tax capital gains at his proposed top ordinary tax rate of 39.6 percent for taxpayers earning over $1 million, would raise $322 billion according to the Treasury.

Addressing Stepped-Up Basis Has Broad Support

In his Fiscal Year (FY) 2022 budget proposal, President Biden proposed eliminating stepped-up basis and taxing capital gains at death with an exemption of $1 million per person and special rules for real estate, farms, and other illiquid assets. But President Biden is not the first to put forward ideas to repeal or reform stepped-up basis.

In 2010, the Simpson-Bowles National Commission on Fiscal Responsibility and Reform, which had bipartisan support from 11 of its 18 commissioners, proposed taxing capital gains before investments were passed on to heirs as part of a comprehensive tax reform to lower rates and eliminate most tax preferences. The Bipartisan Policy Center’s Debt Reduction Task Force led by the late Alice Rivlin and Senator Pete Domenici included a similar proposal.

A few years later, President Obama proposed taxing capital gains at death and at a 28 percent total rate, with an exemption of $100,000 per person and additional rules for real estate and other illiquid assets. More recently, Senators Mitt Romney (R-UT) and Michael Bennett (D-CO) proposed replacing stepped-up basis with a carryover basis – with a $1.6 million exemption – to finance their proposed expansion of the Child Tax Credit.

Reforming stepped-up basis has support from those on both sides of the aisle and from many tax experts. Doing so would improve fairness, efficiency, and revenue collection, and it should be part of the discussion of paying for reconciliation.

There is no excuse for further borrowing.

Read more options and analyses on our Reconciliation Resources page.