Repealing the SALT Cap Would be More Regressive than the TCJA

Recently, a number of Members of Congress have called for repealing the current $10,000 cap on the state and local tax (SALT) deduction. Many off these same Members have also complained about the costly, regressive nature of the Tax Cuts and Jobs Act of 2017 (TCJA), which included the SALT deduction cap.

A closer analysis, however, shows that repealing the SALT cap would in fact be more regressive than the TCJA and would provide a larger direct tax cut to the highest income households. Repeal would also cost roughly $85 billion per year of lost revenue over the next five years, which would need to be made up either through higher taxes or additional borrowing, thus supplanting new spending or investments and adding to the debt.

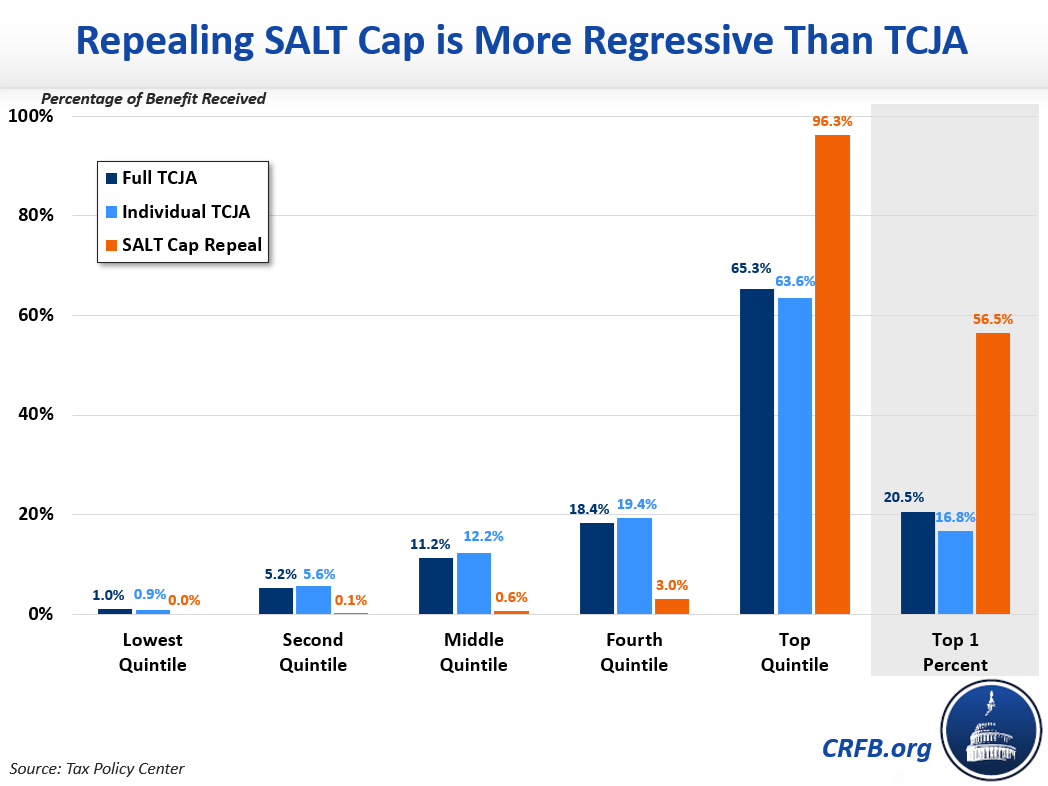

Based on estimates from the Tax Policy Center, more than 96 percent of the benefit of repealing the SALT cap would go to the top quintile of earners, with more than 56 percent going to the top one percent. By comparison, less than two-thirds of the TCJA tax cuts accrue to the top quintile of earners, with only about one-fifth going to the top one percent.

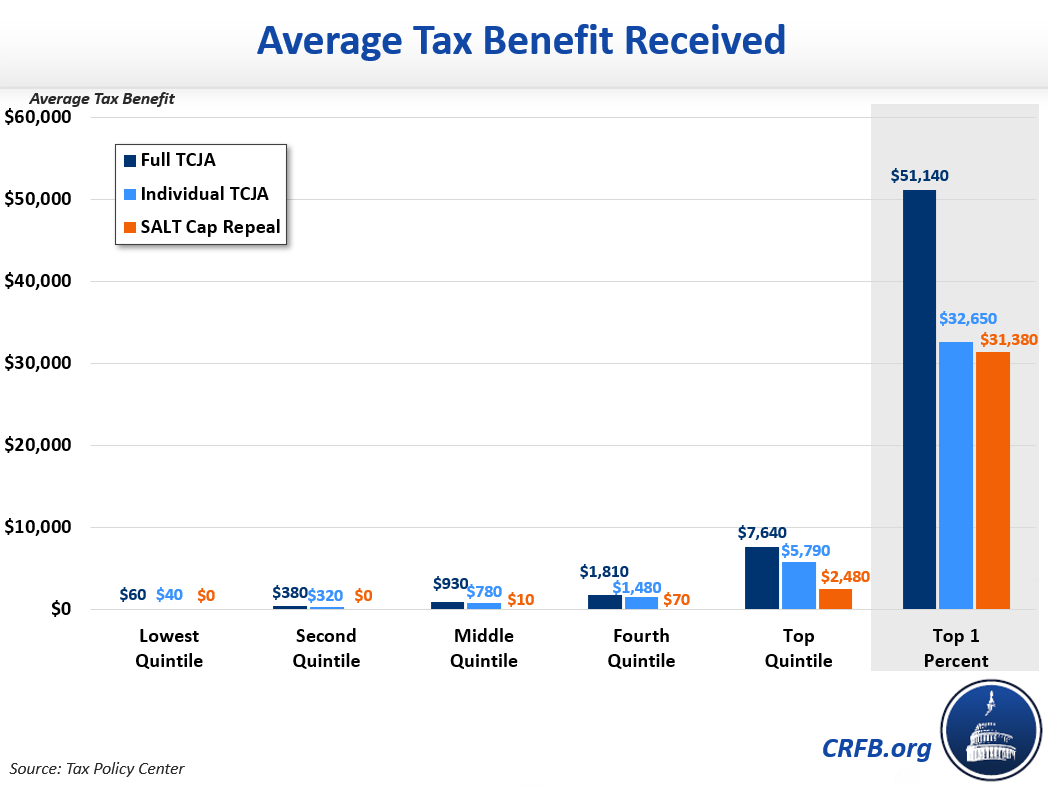

Repealing the SALT cap would mean an average annual tax cut of approximately $31,000 for those in the top one percent of earners, which is about the same size as the benefit they receive each year from individual income tax cuts in the TCJA. Meanwhile, repealing the SALT cap would deliver an average annual tax cut of only $10 for those in the middle-income quintile – a tiny fraction of the $780 they receive each year from individual provisions in the TCJA.1

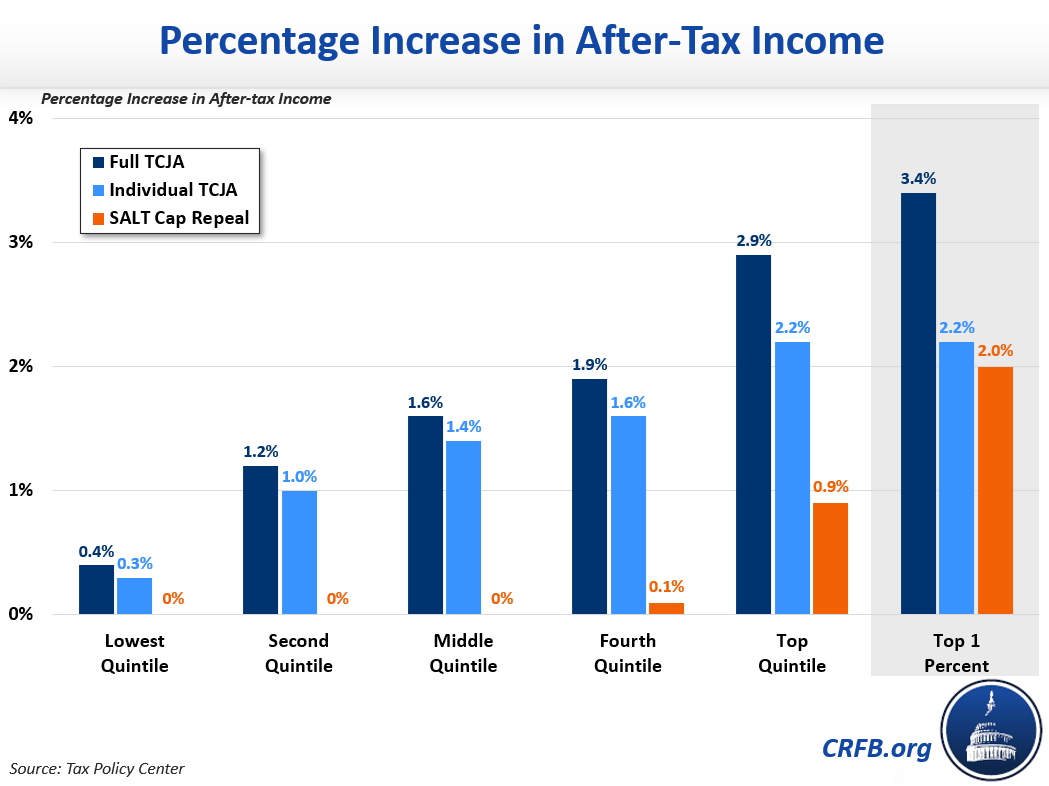

Measured by change in after-tax income, the repealing the SALT cap would mean a 2.0 percentage point increase for those in the top quintile and virtually no increase for those in the middle-income quintile. While the individual income tax cuts in the TCJA deliver a similar-sized benefit to those at the top, they also increase after-tax income for those in the middle by 1.4 percentage points.2

By any measure, repealing the SALT cap would be far more regressive than the TCJA. This is especially true if SALT cap repeal comes on top of the TCJA, which already reduced individual tax rates, repealed most of the Alternative Minimum Tax (which would have otherwise limited the SALT deduction), and expanded the standard deduction so that few middle-class families would need to take the SALT deduction in the first place.

Of course, the regressive effects of repealing the SALT cap could be offset by progressive tax increases – for example, raising the top income tax rate. But that would mean using scarce revenue-raising options to finance tax cuts for higher earners rather than paying for new initiatives or addressing the mounting debt. Furthermore, repealing the SALT deduction cap would result in a narrower tax base, which would reduce the economic and revenue-raising efficiency of any rate increases.

Smart tax reform should broaden the tax base, not narrow it. Given massive deficits and large proposed spending plans, lawmakers should be looking to close tax breaks and increase revenue, not create new revenue-losing tax breaks for the highest earners. As experts on the left, right, and center have demonstrated, there is little case for repealing the SALT deduction cap.

Read more options and analyses on our SALT Deduction Resources page.

1 After distributing benefits from corporate tax cuts in the TCJA to individuals, the average annual tax benefit rises to approximately $51,000 for the top one percent of earners and $930 for those in the middle-income quintile.

2 After distributing benefits from corporate tax cuts in the TCJA to individuals, the average annual increase in after-tax income rises to 3.4 percentage points for the top one percent of earners and 1.6 percentage points for those in the middle-income quintile.