Mid-Session Review Offers a Dose of Fiscal Fantasy

The White House Office of Management and Budget (OMB) recently released its Mid-Session Review (MSR) for the President’s Fiscal Year (FY) 2026 budget. Although OMB never released a full President’s budget – which, in addition to the President’s discretionary spending request, is supposed to include proposals for mandatory spending and revenue – the MSR presents the Trump Administration’s latest projections of the fiscal effects of the policies enacted and proposed by the federal government since January.

Based on OMB’s own projections and assumptions, including the full enactment of the President’s proposed discretionary spending levels and other policies, under the MSR:

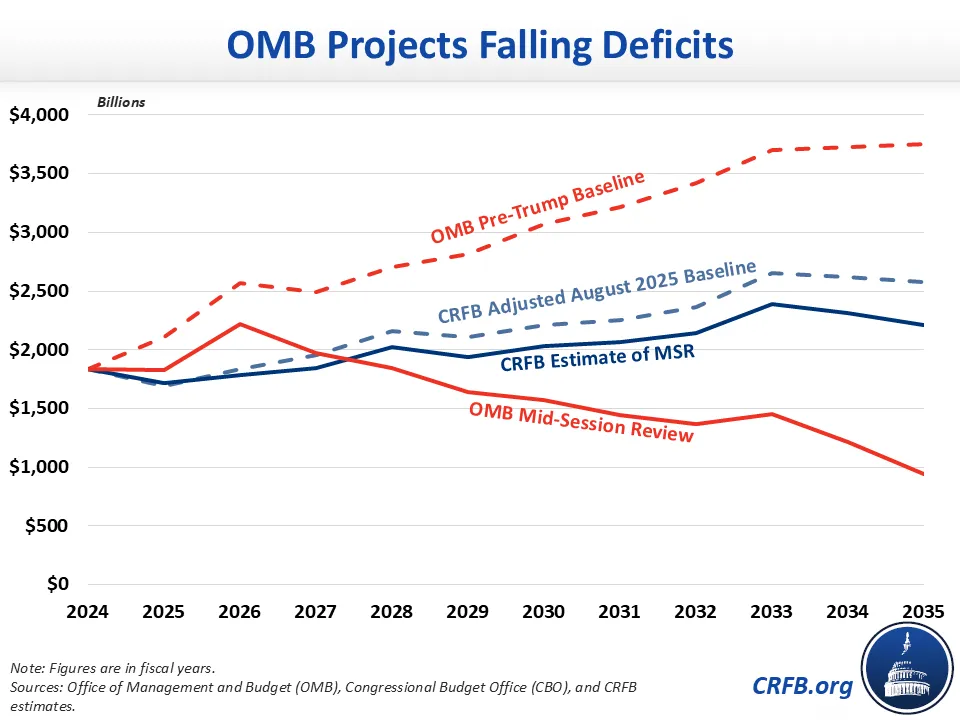

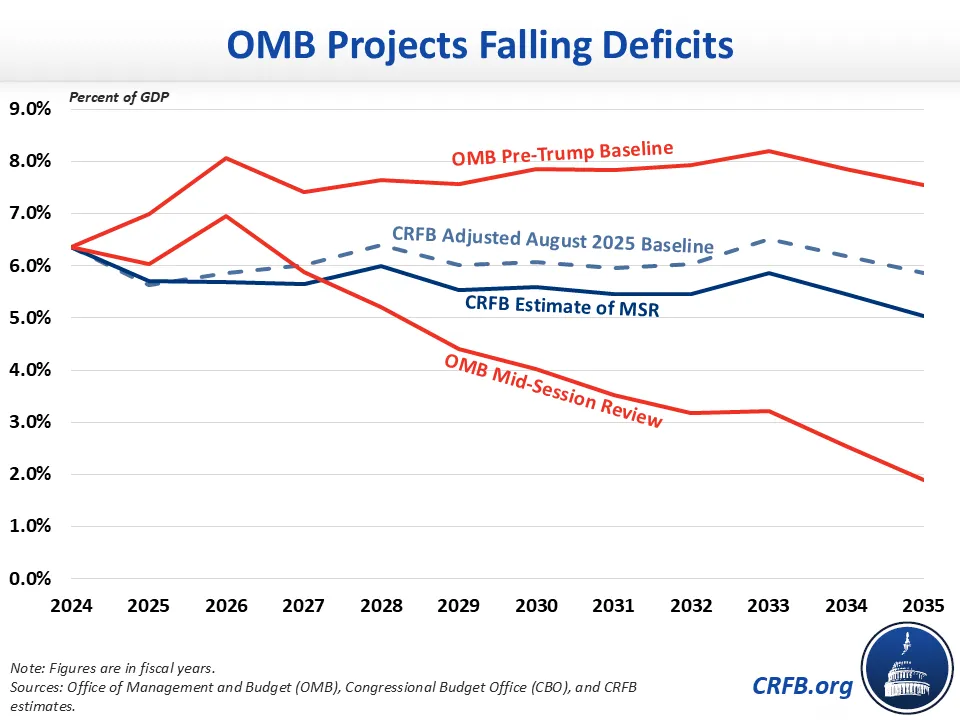

- Deficits would rise from $1.8 trillion (6.0 percent of Gross Domestic Product) in FY 2025 to $2.2 trillion in 2026 (7.0 percent of GDP) and then fall steadily to $944 billion (1.9 percent of GDP) by 2035.

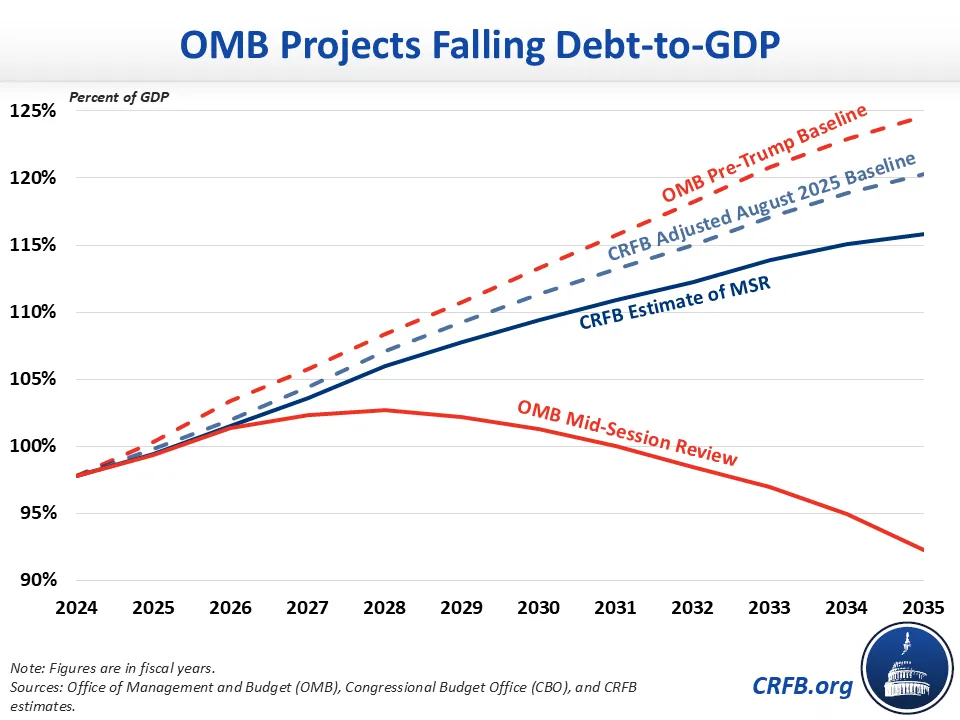

- Debt held by the public would rise from 99 percent of GDP ($30 trillion) in 2025 to 103 percent ($36 trillion) in 2028 before falling gradually to 92 percent ($46 trillion) by 2035.

- Enacted and proposed policies would reduce deficits by $16.1 trillion from 2025 to 2035 relative to OMB’s ‘current policy’ baseline, including $5.6 trillion from faster assumed economic growth.

Importantly, OMB’s assumptions are extremely rosy relative to more credible projections. Specifically:

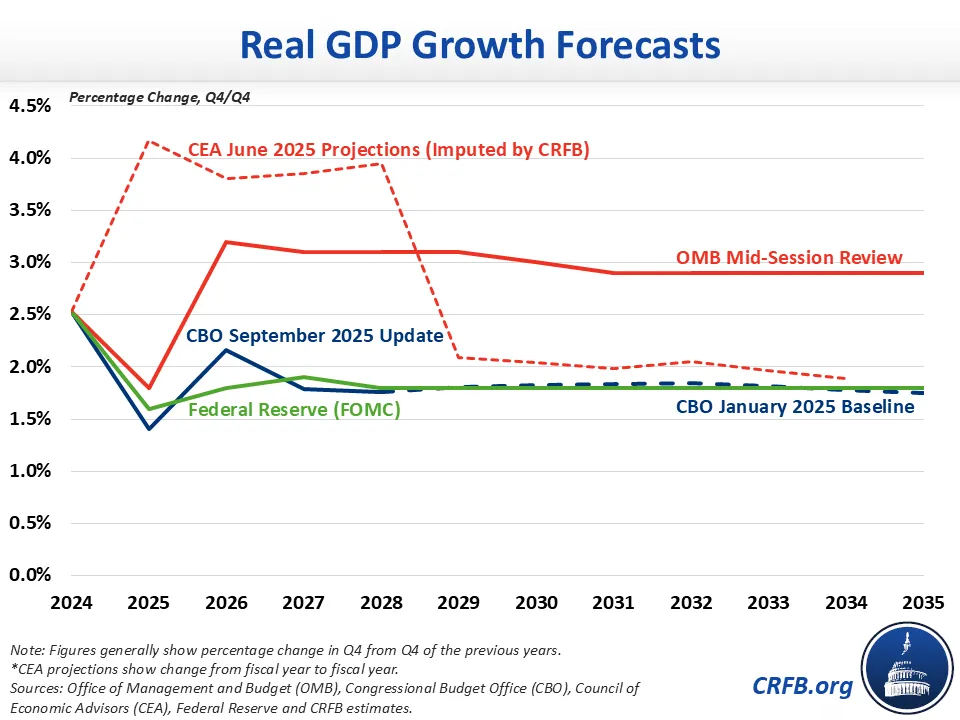

- OMB projects real economic growth will average 2.9 percent a year from 2025 to 2035, whereas CBO and the Federal Reserve both project 1.8 percent real annual growth.

- OMB projects that new tariffs will raise $4.1 trillion through 2035, whereas CBO projects they will raise $3.3 trillion on a conventional basis, assuming they are ultimately ruled to be legal.

- OMB estimates the One Big Beautiful Bill Act (OBBBA) will reduce deficits by $1.4 trillion relative to their current policy baseline, whereas CBO’s estimates imply approximately $600 billion of savings relative to a current policy baseline and $3.7 trillion of costs relative to prior law.

- OMB estimates their discretionary proposals would save $4.2 trillion from 2025 to 2035, whereas we estimate savings would be closer to $2 trillion based on our best understanding of the policies.

OMB Estimates Large Deficit Reduction

OMB estimates that deficits before President Trump took office would have totaled $33.6 trillion from 2025 to 2035, assuming “an extension of the Tax Cuts and Jobs Act.” Importantly, this baseline is $10 trillion higher than the Congressional Budget Office’s (CBO) January 2025 baseline and $5 trillion higher than CBO’s baseline assuming Tax Cuts and Jobs Act (TCJA) extension. Although OMB doesn’t explain the remaining difference, much of it appears to come from much higher mandatory spending projections, especially on Medicare and veterans benefits.

Relative to its own baseline, OMB estimates its recent and proposed actions would save $16.1 trillion from 2025 to 2035. This includes $5.6 trillion from economic feedback, $4.2 trillion from discretionary spending cuts, $4.1 trillion from new tariffs, and $1.4 trillion from the enactment of OBBBA (relative to full TCJA extension).

OMB’s Estimated Deficit Impacts vs CBO-Based Estimates, FY 2025-2035

| Category | OMB | CBO/CRFB |

|---|---|---|

| Baseline Deficits | -$33.6 trillion | -$23.6 trillion |

| Extend Expiring TCJA Tax Cuts | In Baseline | -$4.3 trillion |

| Additional OBBBA Tax Cuts | -$0.4 trillion | -$0.9 trillion |

| OBBBA Spending Reductions | $1.7 trillion | $1.4 trillion |

| Impose New Tariffs | $4.1 trillion | $3.3 trillion |

| Reduce Discretionary Spending (proposed) | $4.2 trillion | $2.0 trillion |

| Dynamic Feedback from Economic Changes | $5.6 trillion | -$0.5 trillion* |

| Technical Adjustments | -$0.9 trillion | N/A |

| Change in net interest^ | $1.8 trillion | $0.1 trillion |

| Total Change in Deficits | $16.1 trillion | $1.2 trillion |

| Mid-Session Review Deficits | -$17.5 trillion | -$22.5 trillion |

Sources: Office of Management and Budget (OMB), Congressional Budget Office (CBO), and CRFB Estimates.

*Estimate based on CBO’s dynamic score of the initial tariffs and House version of OBBBA. Final dynamic scores may differ.

^Debt Service impacts of TCJA extension are included in CBO/CRFB estimate, but included in OMB baseline deficits.

Using more realistic assumptions and a more appropriate baseline, we estimate policies outlined in the budget would reduce deficits by closer to $1.2 trillion – less than 8 percent of what OMB claims. Some of this difference – $4.3 trillion of the change in primary deficits – can be explained by OMB inappropriately assuming expiring tax provisions are extended in their baseline while also failing to assume new temporary tax and spending changes are permanent. Relative to CBO estimates, OMB also appears to overstate the net savings from OBBBA’s new tax and spending changes by $800 billion and overstate tariff revenue by another $750 billion. If the recent court ruling finding many of the tariffs illegal is upheld, the revenue will be over $2 trillion lower in total. Based on our understanding of the Administration’s discretionary proposals, we also find they would save about $2 trillion less than OMB estimates.

Most significantly, OMB assumes an enormous $5.6 trillion of dynamic effects from their policies (presumably excluding the effects of extending the TCJA, which should be in their baseline). Based on CBO’s rules of thumb, this would require more than doubling the economic growth rate, boosting annual economic growth by over 2 percentage points – many times higher than any reasonable estimate of the effects of their policies. Even with no change in interest rates, it would require an approximately 80 percent (1.5 percentage point) increase in the annual real GDP growth rate. By contrast, CBO estimated the Administration’s initial $3 trillion of tariffs would result in roughly $300 billion of dynamic costs due to the negative effect on the economy. And CBO estimated the House version of OBBBA would have over $400 billion of dynamic costs, mainly from higher interest rates, which makes the Administration’s economic estimates even more unlikely to be accurate.

OMB Projects Declining Deficits

OMB projects deficits will rise from $1.8 trillion in FY 2025 to $2.2 trillion in FY 2026 and then fall steadily to $944 billion by 2035. While OMB only reports dollars, their data implies deficits will peak at 7.0 percent of GDP in 2026 before falling to 4.0 percent of GDP in 2030, 2.6 percent in 2034, and 1.9 percent in 2035. By comparison, deficits under their baseline would total $3.8 trillion (7.5 percent of GDP) in 2035 assuming their economic assumptions.

Removing OMB’s overly rosy estimates and using CBO’s baseline as a starting point, we estimate deficits under the MSR would fall to $1.8 trillion in FY 2026 but rise to $2.0 trillion by 2028 and $2.4 trillion in 2033 before falling to $2.2 trillion by 2035. As a share of GDP, deficits would remain between 5.5 and 6.0 percent of GDP through most of the budget window before falling to 5.0 percent of GDP in 2035.

OMB Projects Declining Debt-to-GDP

As a result of lower deficits and rising GDP, OMB’s projections suggest debt would grow more slowly than current law and debt-to-GDP would decline.

Although OMB does not provide debt numbers directly, their deficit numbers imply debt held by the public would rise from $30 trillion at the end of this year to $46 trillion by the end of 2035, compared to $62 trillion implied under their baseline.

As a share of GDP, debt held by the public under the MSR would rise from about 99 percent of GDP in 2025 to 103 percent by 2028 before declining to 98 percent of GDP by 2032 and 92 percent by 2035. By comparison, debt would total 125 percent of GDP in 2035 under their baseline while maintaining their economic assumptions.

Using our estimates, we project that debt would continue to rise through 2035 to $51 trillion or 116 percent of GDP.

MSR Relies on Rosy Economic Assumptions

Much of the fiscal improvement under OMB’s MSR is driven by extremely rosy economic assumptions that are relatively far out of the mainstream.

OMB assumes that, with the Administration’s enacted and proposed policies, real GDP growth would average almost 3 percent over the budget window. As OMB states: “Compared to the economic forecast of the previous administration … GDP growth is about 1 percentage point faster every year starting in 2025.” Specifically, they project that Q4-to-Q4 real GDP growth will rise to 3.2 percent in 2026, 3.1 percent in 2027, and 2.9 percent per year by 2035.

These estimates are far outside of the mainstream. CBO recently projected GDP growth of 1.4 percent this year (Q4-to-Q4), 2.2 percent in 2026, and about 1.8 percent by 2028. And the latest estimates from members of the Federal Reserve’s Federal Open Market Committee (FOMC) projected long-run real GDP growth of about 1.8 percent per year. The most optimistic member of the FOMC predicted roughly 2.5 percent annual growth in the long run. And other private forecasters generally agree that growth is likely to average around 2 percent – though there may be a near-term sugar high.

Although OMB’s economic projections are far above mainstream forecasts, they are significantly below those of the White House Council of Economic Advisors (CEA) in the short-run, which appears to forecast 4 percent annual growth in the next few years and 2 percent thereafter.

Although nearly all forecasters agree that OBBBA will boost near-term economic growth, the effects are generally expected to be modest, to at least partially fade over time, and to be partially or fully offset by the effects of tariffs and reductions in net immigration.

OMB’s unemployment, inflation, and interest rate assumptions also appear to be optimistic (though much less so than their GDP growth assumptions). OMB projects that unemployment will fall from 4.0 percent in 2024 to 3.7 percent by 2027 and stabilize there through 2035, while CBO projects unemployment will rise to 4.4 percent and FOMC members project it will reach 4.2 percent and stabilize there. OMB projects that consumer price index (CPI) inflation, calendar year over calendar year, will rise from 3.0 percent in 2024 to 2.5 percent in 2025 before declining to 2.2 percent by 2028 and stabilizing there through 2035. CBO projects inflation will only reach 2.8 percent in 2025, but will not fall below 2.2 percent by 2028. The FOMC members’ inflation projections are more consistent with CBO’s.

And OMB estimates that interest rates will drop quickly over the next the budget window, with 10-year Treasury yields dropping from 4.3 percent in 2025 to 3.5 percent by 2028 and stabilizing at 3.3 percent in 2031 and beyond. These figures are substantially lower than those projected by CBO, which recently estimated 10-year Treasury yields would remain above 3.9 percent through 2028.

While lower projected deficits and debt should reduce yields on Treasuries, faster economic growth should push in the opposite direction, making OMB’s projections somewhat internally inconsistent, in additional to being rosy overall.

***

While the MSR correctly states that the fiscal situation was unsustainable in January, enacted and proposed policy changes will not fix it as claimed. Bad accounting and wishful thinking cannot get the country out of debt. Instead, policymakers will need to meaningfully increase revenues and/or reduce spending in order to put the nation’s finances on a sustainable path.