How Much Would OBBBA Pay For Itself?

The House-passed One Big Beautiful Bill Act (OBBBA) would add about $3 trillion to the debt, including interest, on a conventional basis. However, that score could be higher or lower once accounting for the macrodynamic effects of the bill – as tax and spending policies can influence work, investment, interest rates, and other variables.

Several modelers have produced dynamic estimates of OBBBA. Based on these estimates, we show the bill would:

- Have little impact on the country's projected average annual growth rate, which is 1.8 percent over the next decade according to the Congressional Budget Office (CBO).

- Add to the debt including after dynamic effects, which could reduce the deficit impact by up to $900 billion or increase it by up to $860 billion.

- Increase 2034 output by less than 0.8 percent, or reduce 2034 output by as much as 0.1 percent.

- Increase 2054 output by no more than 0.8 percent, or reduce it by up to 2.9 percent.

- Boost interest rates by 0.3 percentage points in 2034 and 1.2 points in 2054 under one estimate.

- Benefit from the addition of a revenue stabilizer to make its fiscal impact more robust to different economic outcomes.

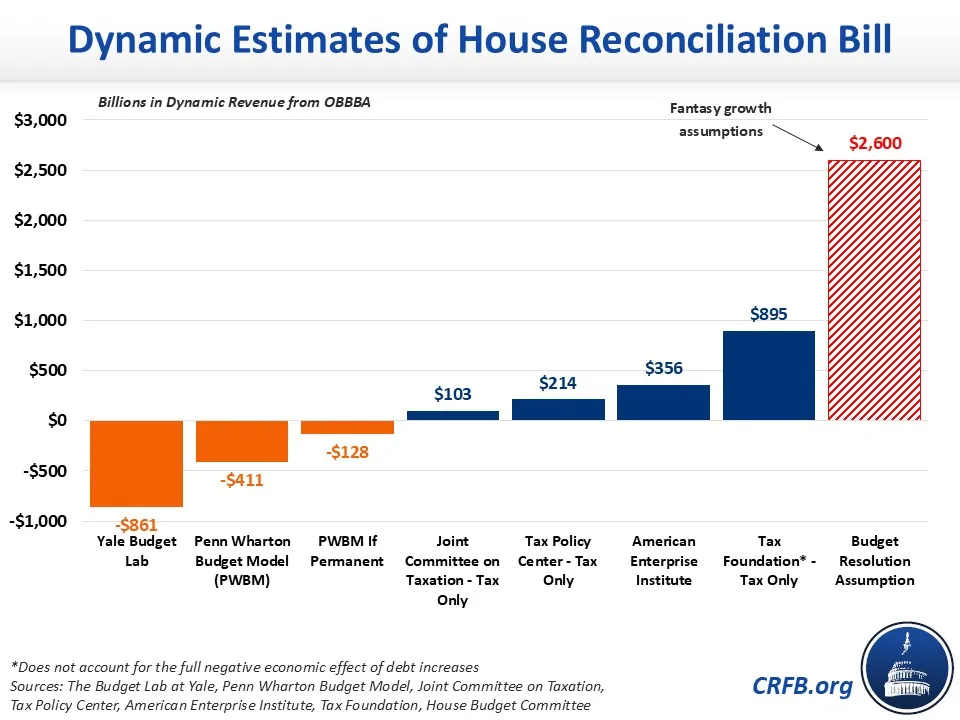

So far, the Joint Committee on Taxation (JCT), the Tax Foundation (TF), the Budget Lab at Yale (YBL), the Penn Wharton Budget Model (PWBM) Kyle Pomerleau of the American Enterprise Institute (AEI) and the Tax Policy Center (TPC) have all produced dynamic analyses of OBBBA. Importantly, these modelers have evaluated different parts of the bill in different ways – for example, JCT and TPC only look at the tax title, TF ignores the negative effects of higher debt, and PWBM evaluates the bill as written and if temporary provisions were made permanent. All reach different conclusions, but all recognize the OBBBA has a combination of pro-growth and anti-growth provisions and would not massively change the annual growth rate or generate enough revenue to "pay for itself." In fact, OBBBA may add more to the debt on a dynamic basis than on a conventional basis, as higher debt pushes up interest rates and costs.

Dynamic Estimates of OBBBA (FY 2025-2034, billions)

| Conventional Estimate | Dynamic Estimate | Dynamic Feedback | % Dynamic Feedback | GDP Impact (2034) | |

|---|---|---|---|---|---|

| Joint Committee on Taxation – Tax Only | -$3,819 | -$3,716 | +$103 | 3% | +0.2%* |

| Yale Budget Lab' | -$2,677 | -$3,538 | -$861 | -32% | -0.1% |

| Penn Wharton Budget Model | -$2,787 | -$3,198 | -$411 | -15% | +0.4% |

| Penn Wharton Budget Model – If Permanent | -$4,425 | -$4,553 | -$128 | -3% | +0.2% |

| Tax Foundation - Tax Only | -$4,007 | -$3,112 | +$895 | 22% | +0.8%* |

| American Enterprise Institute | -$2,416 | -$2,060 | +$356 | 15% | +0.4%* |

| Tax Policy Center - Tax Only | -$3,798 | -$3,584 | +$214 | 6% | +0.4% |

Sources: JCT, The Budget Lab at Yale, Penn Wharton Budget Model, Tax Foundation, the American Enterprise Institute, and the Tax Policy Center. Estimates are of primary deficit, unless specified otherwise. *JCT's GDP impact is over 2030-2034, Tax Foundation's GDP impact is "long-run., and AEI GDP impact is in 2035 'estimates include interest costs

Modelers differ significantly on how much, if at all, OBBBA will "pay for itself" through higher revenue and other economic feedback – though none find it will pay for itself in full or come anywhere close to achieving the fantastical growth assumptions in the budget resolution. On the high end, TF estimates the bill's dynamic revenue effects will cover almost $900 billion of its costs – which is 22 percent of the gross tax cuts and 34 percent of the net deficit increase. However, this estimate does not account for the effects of debt on growth or interest rates. AEI, which does incorporate the impact of debt, finds roughly $350 billion of dynamic feedback, covering 9 percent of the tax cut and 15 percent of the bill's deficit impact. TPC, meanwhile, finds the tax title of the bill would pay for about $210 billion (6 percent) of itself and JCT finds it will pay for about $100 billion (3 percent) of itself.

On the other hand, PWBM and YBL estimate OBBBA will add more to the debt on a dynamic basis than under conventional scoring. PWBM estimates $130 to $410 billion of additional costs. YBL estimates over $860 billion of additional costs, including debt service, as a result of dynamic feedback.

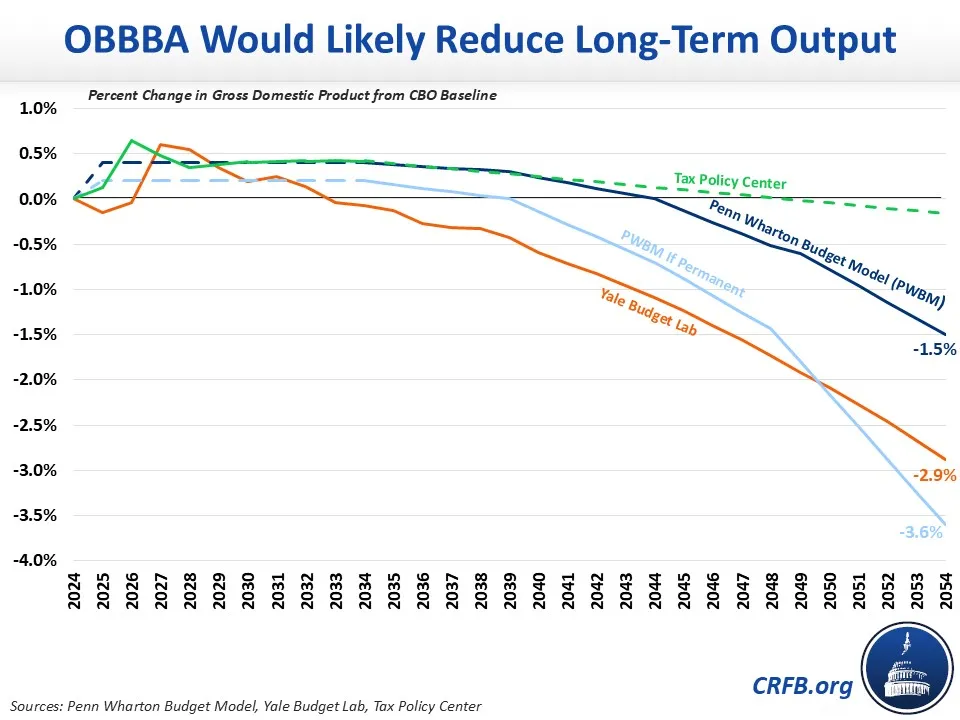

Despite these significant differences, none of the models find OBBBA will change the average annual growth rate by more than a few basis points over the next decade. While all six modelers find the House bill would boost output in the early years – due to stimulative effects and/or increased incentives to work and invest - those models that account for the impact of debt find the bill will ultimately reduce output.

PWBM estimates OBBBA would boost output by 0.4 percent in 2034 but shrink it by 1.5 percent by 2054. If the bill were made permanent, they find it would reduce output by 3.6 percent by 2054. Similarly, YBL estimates the bill would boost output by 0.6 percent in 2027 but shrink output by 2.9 percent after 30 years. TPC estimates GDP would increase by about 0.4 percent in 2034 but gradually shrink the economy before 25 years. And although JCT does not provide annual estimates, it finds the tax portion of OBBBA would boost output by about 0.2 percent between 2030 and 2034 and begin to shrink output by the end of the second decade. AEI finds output would increase by 0.8 percent in the first five years and 0.4 percent by 2035; AEI's 0.3 percent long-run estimate does not incorporate debt effects.

Although lower output will ultimately reduce revenue collection, negative dynamic feedback is driven primarily by higher interest costs – as higher debt pushes up interest rates. YBL estimates yields on the 10-year Treasury note will increase 30 basis points from current law projections by 2034, 60 basis points by 2044, and 117 basis points by 2054. This increase on top of CBO's baseline would mean the 10-year Treasury yield could reach 4.9 percent by 2054, from 4.2 percent in 2025.

The wide differences in expected economic impact by modeler help to highlight why policymakers should not rely on economic growth to cover the deficit impact of legislation – particularly at fantastical growth rates. Ideally, legislation should be at least deficit neutral (if not deficit reducing) on both a conventional and dynamic basis, and any gains from growth should be dedicated to deficit reduction.

If lawmakers do choose to rely on dynamic feedback effects, they should be based on official scorekeeper estimates. And regardless of whose estimates, a revenue stabilizer could be added to the bill to ensure the revenue materializes regardless of the growth rate.

As an example, inflation-indexed parameters in the tax code could instead be indexed annually to nominal GDP growth minus the expected real GDP growth rate. If real GDP grows as expected, this is equivalent to inflation indexing. But if growth is slower, brackets will index more slowly and generate a similar amount of 'real bracket creep' as predicted under the higher growth scenario. This stabilizer would prevent revenue as a share of GDP from falling well below expectations (though it would not make up for all the lower nominal revenue). Conversely, if growth is faster than expected, this stabilizer would prevent excessive real bracket creep relative to expectations.

As policymakers consider improvements to the House-passed bill, they should consider more ways to offset revenue loss, as tax cuts typically do not pay for themselves. Lawmakers should also ensure the bill is fiscally responsible and pro-growth, rather than adding another $3 trillion or more to our rising debt.

Note: Updated 6/13 to incorporate AEI and TPC dynamic estimates.