Opportunities for Bipartisanship in a Divided Government

In 2021, the United States is likely to operate with divided or near-divided government. Democrats are slated to control the White House and the House of Representatives, while the Senate will either be under Republican control or equally split between Republicans and Democrats.1

Given this makeup, it is unlikely President-elect Joe Biden will be able to enact the entirety of his ambitious agenda of tax and spending increases. However, divided government does not mean legislating should stop. There are many issue areas where Republicans and Democrats have made similar proposals, which could present opportunities for bipartisanship.

From a fiscal and budgetary perspective, policymakers from both parties should be able to find common ground in several areas, including enacting COVID relief, lowering health care costs, improving tax compliance, reforming the budget process, and preparing for the insolvency of major trust funds.

Provide COVID Relief

Neither the COVID pandemic nor its negative effects on the economy are likely to be over by the time President-elect Biden takes office on January 20, 2021. Both Democrats and Republicans have put forward proposals to provide assistance to struggling households and businesses, support an economic recovery, and manage the public health situation. Hopefully, this is an area where policymakers can compromise, either now or in 2021.

The parties appear to have narrowed their differences somewhat from when House Democrats introduced and passed the $3.4 trillion Heroes Act and Senate Republicans put forward the roughly $1 trillion HEALS Act (see our comparison). A bipartisan package would likely include some extension and partial restoration of expanded unemployment insurance benefits, support for small businesses, aid to state and local governments and school districts, financial support for COVID testing, treatment, and vaccination, and other measures.

The Congressional Budget Office (CBO) estimates an output gap of roughly $900 billion in 2021 – though it is likely to be smaller in light of recent economic news. That output gap represents the economic slack policymakers could try to fill with further fiscal support, though some policies are more cost-effective than others.

Lower Health Care Costs

Senate Republicans might not share Biden’s vision for expanding health care coverage, but there is broad bipartisan agreement on the need to lower health care costs. Last year, we showed how recent proposals could save the federal government half a trillion dollars while lowering premiums, out-of-pocket spending, and other costs for households, businesses, and state governments by an additional $400 billion. Many of these proposals, including those that would reduce and reform Medicare provider payments and lower prescription drug costs, currently have broad bipartisan support or have appeared in both President Donald Trump’s and former President Barack Obama’s budget proposals. Recently, there has also been strong bipartisan interest in restricting or ending surprise billing.

Bipartisan Options to Lower Health Care Costs

| Trump/GOP | Obama/Dem | |

|---|---|---|

| Limit surprise billing | $25 to $30 billion* | |

| Reduce Medicare post-acute care payments | $79 billion | $80 billion |

| Pay hospitals and doctors’ offices the same rate for the same services (site-neutral payments) | $146 billion | $15 billion^ |

| Reduce Medicare payments for bad debt | $37 billion | $34 billion |

| Reduce and reform Graduate Medical Education funding | $90 billion | $12 billion |

| Reform Medicare hospice payments | $4 billion | $8 billion |

| Reform Medicare drug benefit design, cap drug price growth at inflation, and promote generic drugs | $95 to $129 billion+ | |

| Reduce physician reimbursement for Medicare Part B drugs | $3 billion** | $7 billion |

Note: estimates represent CBO scores at the time of proposals and are generally over different 10-year budget windows.

* Based on bipartisan Congressional bills

^ Policy was enacted into law in the Bipartisan Budget Act of 2015

+ Based on different versions of the bipartisan Prescription Drug Pricing Reduction Act which passed the Senate Finance Committee. Many similar policies were also put forward in President Trump’s budget and the Elijah E. Cummings Lower Drug Costs Now Act supported by House Democrats.

** Based on President’s budget policies but CBO scores of similar policies in other contexts

In addition to these bipartisan measures, our Budget Offsets Bank includes dozens of proposals to lower health costs, while our Health Savers Initiative – a partnership with West Health Policy Center and Arnold Ventures – is working to develop new, more innovative proposals.

Improve Tax Compliance

During the campaign, President-Elect Biden proposed upwards of $4.3 trillion of tax increases while President Trump supported at least $1.7 trillion of tax cuts. Republicans and Democrats do not need to agree on the appropriate level of taxation to agree that households and businesses should pay any taxes owed.

From 2011 through 2013, the tax gap averaged $441 billion per year, meaning 16 percent of taxes owed were never paid. Closing loopholes and increasing funding for tax enforcement could help close the tax gap. CBO estimates that increasing the budget for Internal Revenue Service (IRS) tax enforcement by $40 billion over the coming decade will yield more than $100 billion of additional revenue. Similar proposals in both President Trump’s and President Obama’s budgets would have yielded anywhere from $39 to $56 billion of net deficit reduction. Additional measures to clarify tax laws, increase withholding and information reporting, and strengthen IRS authority could potentially reduce the tax gap by billions more.

Beyond improving tax collection and enforcement, there has been bipartisan support in the past for closing various loopholes that encourage tax avoidance. Perhaps policymakers could once again unite around proposals to close those old loopholes, as well as new ones that were inadvertently created under the Tax Cuts and Jobs Act (TCJA) of 2017.

Bipartisan Options to Improve Tax Compliance

| Trump/GOP | Obama/Dem | |

|---|---|---|

| Better fund IRS tax enforcement | $56 billion | $39 billion |

| Clarify worker classification rules | $1 billion | $11 billion |

| Enact other tax enforcement measures | <$1 billion | $3 billion |

| Close carried interest loophole | $10 billion^ | $20 billion |

| Require consistent valuation of estates and inheritances | $2 billion* | <$1 billion |

| Strengthen s-corp reasonable compensation rules | $15 billion* | $33 billion |

| Repeal like kind exchange real estate loophole | ~$10 billion* | ~$10 billion |

| Reform treatment of derivatives | $16 billion* | $15 billion |

Note: Estimates represent CBO scores at the time of proposal and are generally over different 10-year budget windows. Like-kind exchange estimated by CRFB to subtract TCJA savings from partial repeal

* Tax Reform Act of 2014

^ Trump 2016 campaign proposal

Reform the Budget Process

Though passing a bipartisan budget resolution is often a challenge under divided government, there is support among members of both parties for fixing our increasingly dysfunctional budget process. One place to start would be the Enzi-Whitehouse Bipartisan Congressional Budget Reform Act (BCoBRA), which passed the Senate Budget Committee with a 15-6 bipartisan vote. The bill would incorporate debt-to-GDP targets into the budget resolution and the budget process, adopt biennial budgeting while keeping annual appropriations, link debt limit increases and discretionary spending caps to passage of a budget resolution, and add transparency requirements such as including interest costs in CBO scores.

To end the risk of government shutdowns, policymakers could consider implementing an Automatic Continuing Resolution (auto-CR), versions of which have been put forward by both Republicans and Democrats. They could also consider changes to the debt limit that would create a better enforcement mechanism to control debt without inherently threatening the risk of default, or pair debt limit reforms with enforceable budget goals. The Unity Task Force recommendations discuss scoring issues and push for a “commission to study shortcomings in the budget process and provide detailed recommendations.” Even if lawmakers have difficulty finding common ground on concrete policies, they should work to improve the functionality of the budget process.

Save Vital Trust Funds

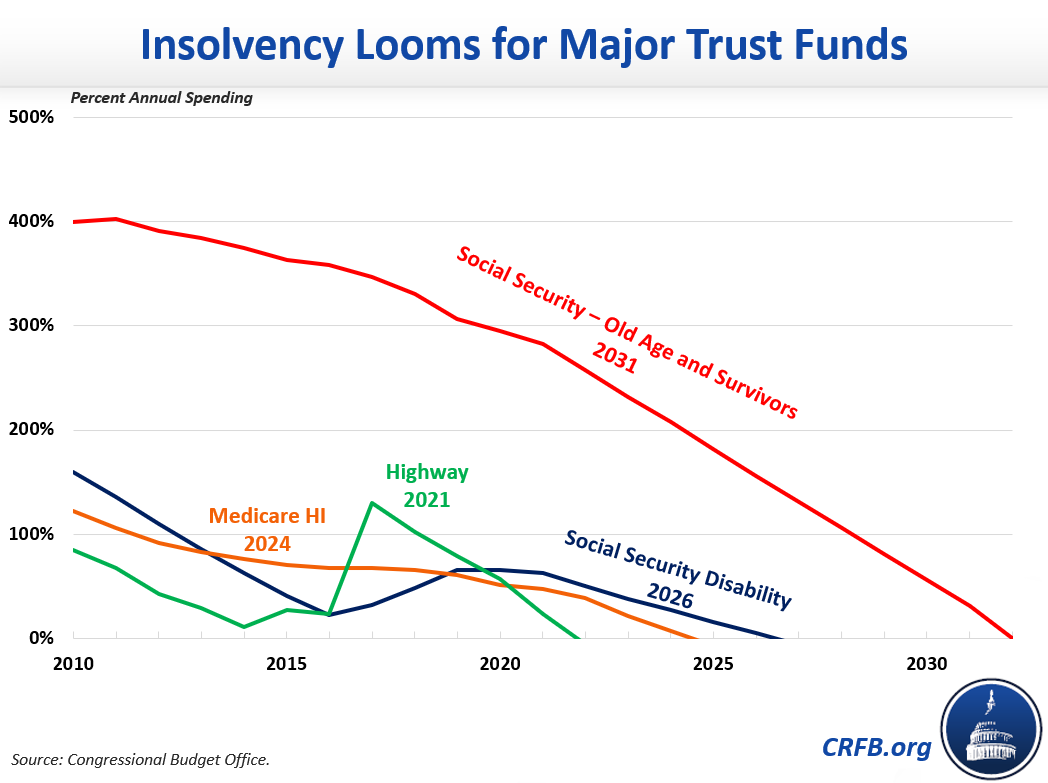

Four major trust funds are projected to become insolvent within the next 11 years, including two within the next Presidential term. According to CBO, the Highway Trust Fund (HTF) will exhaust its reserves in Fiscal Year (FY) 2021 (recent legislation could push that date to 2022), the Medicare Hospital Insurance (HI) trust fund in FY 2024, the Social Security Disability Insurance (SSDI) trust fund in FY 2026, and the Social Security Old Age and Survivors Insurance (OASI) trust fund in calendar year 2031.

Lawmakers will need to work together to save these trust funds sooner rather than later. The longer action is delayed, the more costly and painful the necessary adjustments will be. A possible interim step would be to support something like the bipartisan, bicameral TRUST Act, which currently has 15 Senate cosponsors, 18 House cosponsors, additional support through a mention in a bipartisan House letter with 30 members of each party and the Problem Solvers Caucus, and growing support among budget experts. The TRUST Act would establish bipartisan “Rescue Committees” for each endangered trust fund. The committees would report recommendations to improve solvency if they get majority support and at least two members from each party to ensure bipartisanship. The approved recommendations would then receive expedited consideration in Congress.

* * * * *

Democrats and Republicans are going to have many disagreements in the coming year. But where they do agree, they should work together to support the economy, end the pandemic, reduce health care costs, improve tax compliance, fix the budget process, and take steps toward preventing insolvency of major trust funds. With debt already as large as the economy, inaction should not be an option.

1 Control of the Senate will depend on the result of two run-off elections in Georgia, scheduled for January 5, 2021. Both seats are currently held by Republicans. If Democrats can pick up those two seats, the Senate would be split 50-50 between Republicans and Democrats. Since the Vice President is responsible for casting tie-breaking votes as President of the Senate, this would give Democrats effective control over the Senate as well.