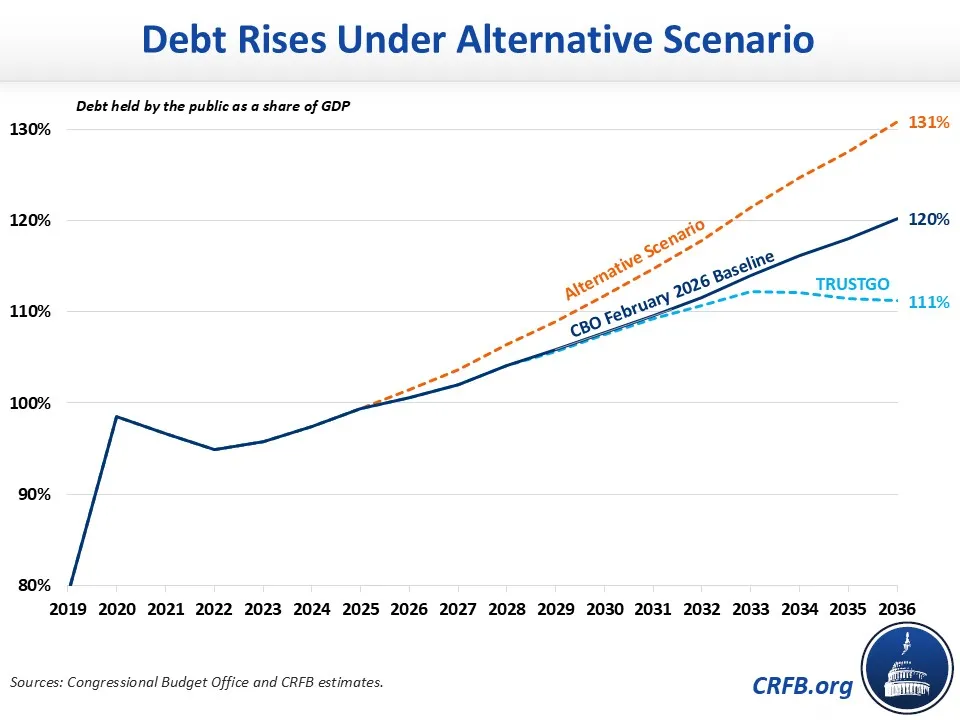

Debt Could Reach 131% of GDP Under an Alternative Scenario

Under the Congressional Budget Office's (CBO) new February 2026 baseline, deficits will total $26 trillion – about 6.1% of Gross Domestic Product (GDP) – over the Fiscal Year (FY) 2026 to 2036 period, reaching $3.1 trillion or 6.7% of GDP by FY 2036. Under their baseline, debt will reach 120% of GDP by 2036. The actual fiscal outlook could be far worse.

Under an alternative scenario where the temporary provisions of the One Big Beautiful Bill Act (OBBBA) are made permanent, enhanced Affordable Care Act (ACA) health insurance subsidies are revived, and the Supreme Court upholds lower court rulings that many of the Trump Administration tariffs are illegal, deficits would exceed $31 trillion through FY 2036 (7.3% of GDP) and reach $3.8 trillion (8.1% of GDP) in 2036, while debt would climb to 131% of GDP.

On the other hand, if temporary provisions are allowed to expire or are extended with offsets, tariffs remain or are replaced, and Social Security and highway spending is limited to revenue after trust fund insolvency, deficits and debt would be lower than CBO projects. Under this “TRUSTGO” scenario, we estimate deficits would decline as a share of the economy to $2.2 trillion (4.6% of GDP) by FY 2036 and debt as a share of the economy would begin declining toward the end of window, standing at 111% of GDP in 2036.

An “Alternative Scenario” Would Worsen Deficits and Debt

Though CBO’s baseline projects high deficits and rising debt, the severity of the nation’s unsustainable fiscal outlook is mitigated by the scheduled expiration of various tax and spending provisions and by significant revenue from tariffs unilaterally imposed by the Trump Administration. These savings may not ultimately materialize.

Many of OBBBA’s provisions were enacted as temporary. For example, reduced taxes on tips, overtime, and senior income expire after 2028; the higher State and Local Tax (SALT) Deduction cap expires after 2029; 100% bonus depreciation for factories only applies to facilities constructed before 2029 and placed in service before 2031; and boosted appropriations for defense and immigration can no longer be obligated after the end of FY 2029. If these and other temporary OBBBA provisions are instead made permanent, it would add $1.9 trillion (0.4% of GDP) to primary deficits, including about $290 billion (0.6% of GDP) in FY 2036 alone. If the enhanced ACA subsidies that expired at the end of 2025 are also revived, it could increase primary deficits by an additional $400 billion (0.1% of GDP), including about $50 billion (0.1% of GDP) in 2036.

Meanwhile, reduced revenue from tariffs could increase deficits even further. Most of the tariffs imposed by the current Administration were authorized under the International Emergency Economic Powers Act (IEEPA), which the U.S. Court of International Trade and the U.S. Court of Appeals for the Federal Circuit have ruled illegal. The Supreme Court is currently considering an appeal of these rulings and will make the final determination as to their legality.

We estimate that revenue would fall by $1.9 trillion (0.5% of GDP) through 2036 if IEEPA tariffs are ruled illegal and not replaced with other tariffs or offsets. (The Administration could potentially use alternative authorities to replicate much of the IEEPA tariffs – such as Sections 122, 201, or 301 of the Trade Act of 1974; Section 232 of the Trade Expansion Act of 1962; or Section 338 of the Tariff Act of 1930).

In an alternative scenario where all the temporary provisions were extended without offsets and IEEPA tariffs are ruled illegal with no replacement, primary deficits would be $4.2 trillion higher through FY 2036 and interest would grow by an additional $820 billion.

Under that scenario, deficits would total 7.3% of GDP over the FY 2026 to 2036 period – including 8.1% of GDP in 2036 – and debt would rise to 131% of GDP by 2036. The alternative scenario does not account for dynamic effects on interest rates and the economy, which could worsen the fiscal outlook by pushing the economy further into a debt spiral.

Deficits Under an Alternative Scenario

| Assumptions in Alternative Scenario | 2026-2036 Cost (Nominal) |

2036 Cost (Nominal) |

2026-2036 Cost (% of GDP) |

2036 Cost (% of GDP) |

|---|---|---|---|---|

| Current Law Deficits | $26.3 trillion | $3.1 trillion | 6.1% | 6.7% |

| Temporary OBBBA Provisions Made Permanent | $1.9 trillion | $0.3 trillion | 0.4% | 0.6% |

| Permanent Revival of ACA Health Subsidies | $0.4 trillion | <$0.1 trillion | 0.1% | 0.1% |

| IEEPA Tariffs Ruled Illegal | $1.9 trillion | $0.2 trillion | 0.5% | 0.4% |

| Interest | $0.8 trillion | $0.2 trillion | 0.2% | 0.4% |

| Increase in Deficits Under Alternative Scenario | $5.0 trillion | $0.7 trillion | 1.2% | 1.5% |

| Deficits Under Alternative Scenario | $31.3 trillion | $3.8 trillion | 7.3% | 8.1% |

Sources: Congressional Budget Office and CRFB estimates. Note: Numbers may not sum due to rounding.

The “TRUSTGO Scenario” Would Improve the Budget Outlook

While extended temporary provisions and ending tariffs would worsen the fiscal outlook, securing the trust funds would improve it.

Under our TRUSTGO scenario, we assume lawmakers offset or allow temporary policies to expire, preserve or replace tariff revenues, and enforce trust fund solvency by limiting Social Security and highway spending to available revenue once reserves run out.

In its latest baseline, CBO projects the Highway Trust Fund will run out of reserves in FY 2028 and the Social Security retirement trust fund in 2032. Under the law, this insolvency would result in an immediate 40% cut to highway spending and an average 28% cut to Social Security retirement and survivor benefits, as spending cannot exceed revenue. However, by law and convention the CBO baseline assumes the programs will continue to spend, resulting in an additional $3 trillion of borrowing (before interest).

Compared to CBO’s baseline, limiting Social Security benefits to dedicated revenue would reduce primary deficits by $2.7 trillion (0.6% of GDP) through 2036, including $690 billion (1.5% of GDP) in 2036 alone. Limiting Highway Trust Fund spending to dedicated revenue would reduce primary deficits by $290 billion (0.1% of GDP) through 2036, including nearly $40 billion (0.1% of GDP) in 2036.

CBO also finds that limiting Social Security benefits to revenue would reduce interest rates and boost medium-term output (after an initial reduction) by reducing debt and increasing the incentive to work, save, and invest.

After incorporating economic effects, we estimate the TRUSTGO scenario would reduce total deficits to 5.3% of GDP over a decade, including 4.6% in 2036, and debt would stabilize at around 111% of GDP by 2036.

Deficits Under TRUSTGO Scenario

| Assumptions in TRUSTGO Scenario | 2026-2036 Savings (Nominal) |

2036 Savings (Nominal) |

2026-2036 Savings (% of GDP) |

2036 Savings (% of GDP) |

|---|---|---|---|---|

| Current Law Deficits | $26.3 trillion | $3.1 trillion | 6.1% | 6.7% |

| Social Security | $2.7 trillion | $0.7 trillion | 0.6% | 1.5% |

| Highway Trust Fund | $0.3 trillion | <$0.1 trillion | 0.1% | 0.1% |

| Interest | $0.3 trillion | $0.1 trillion | 0.1% | 0.2% |

| Dynamic Effects* | $0.5 trillion | $0.1 trillion | 0.1% | 0.3% |

| Deficit Impact Under TRUSTGO Scenario | -$3.7 trillion | -$1.0 trillion | -0.9% | -2.0% |

| Deficits Under TRUSTGO Scenario | $22.6 trillion | $2.2 trillion | 5.3% | 4.6% |

Sources: Congressional Budget Office and CRFB estimates. Notes: Numbers may not sum due to rounding. Dynamic impacts on GDP are accounted for. *Savings from Dynamic Effects include effects on interest rates.

Thoughtful trust fund solutions could do even more to improve the fiscal and economic outlook – including by retaining a positive (rather than zero) balance to the Highway and Social Security trust funds, by enacting reforms to secure the Medicare Hospital Insurance trust fund in advance of its 2040 projected insolvency date, and by incorporating explicitly pro-growth reforms to promote work, savings, and investment.

* * *

The federal budget is on an unstainable trajectory as is, and it would be in far worse shape if tariff revenue disappears and temporary provisions are revived or extended.

Rather than continuing to add further to the debt, lawmakers should work to replace any lost tariff revenue and should either allow temporary deficit-increasing policies to expire going forward or else offset their costs twice over. Policymakers should also implement solutions to stabilize weakening trust funds, achieving as much or more savings as the scheduled automatic reductions triggered by insolvency, but in a far more thoughtful way.

This combination of reforms and offsets could put the debt on a more sustainable long-term path, reducing the likelihood of a debt spiral and the risk of a fiscal crisis.