CBO’s February 2026 Budget and Economic Outlook

The Congressional Budget Office (CBO) released its February 2026 Budget and Economic Outlook today, updating its January 2025 baseline to account for the One Big Beautiful Bill Act (OBBBA), tariffs, changes in immigration, recent trends in the economy, and other factors. CBO’s latest projections show:

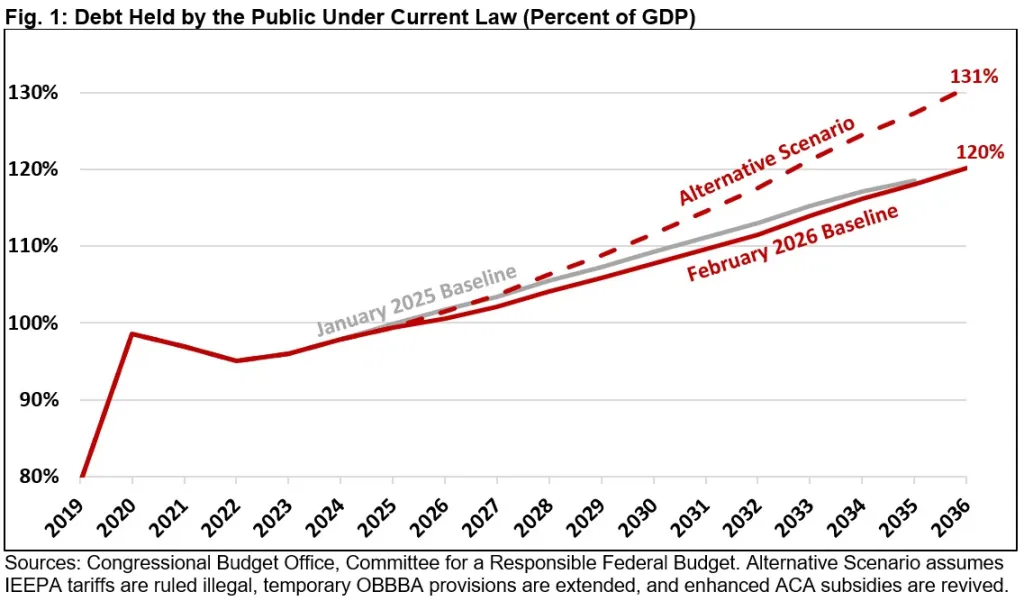

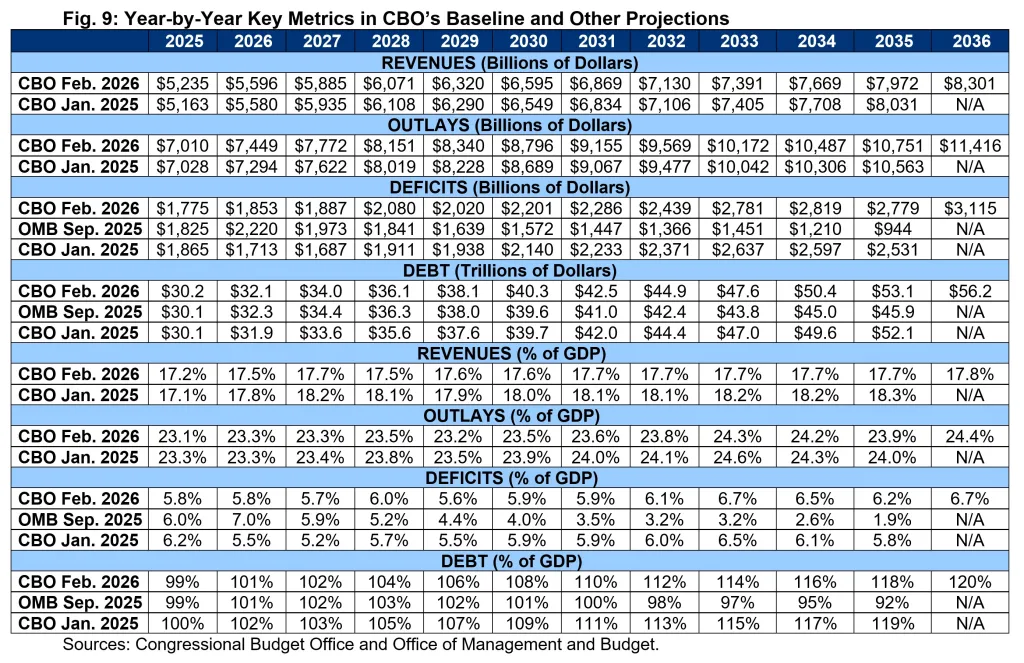

- Debt will reach a record 120% of Gross Domestic Product (GDP) by 2036. CBO projects that debt held by the public will grow by $25 trillion, from nearly $31 trillion today to $56 trillion by 2036. As a share of the economy, debt will grow from 100% of GDP today to a record 108% by 2030 and 120% by 2036.

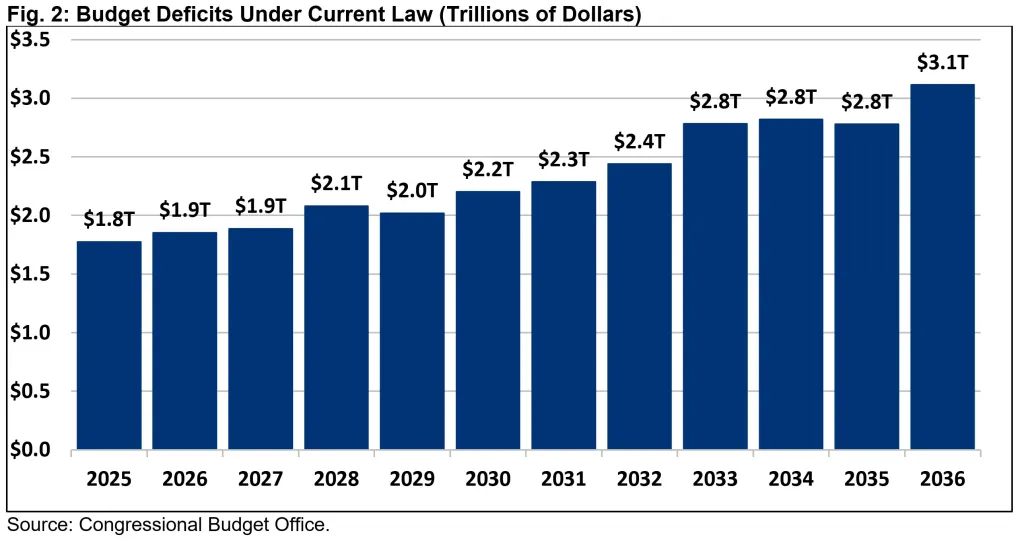

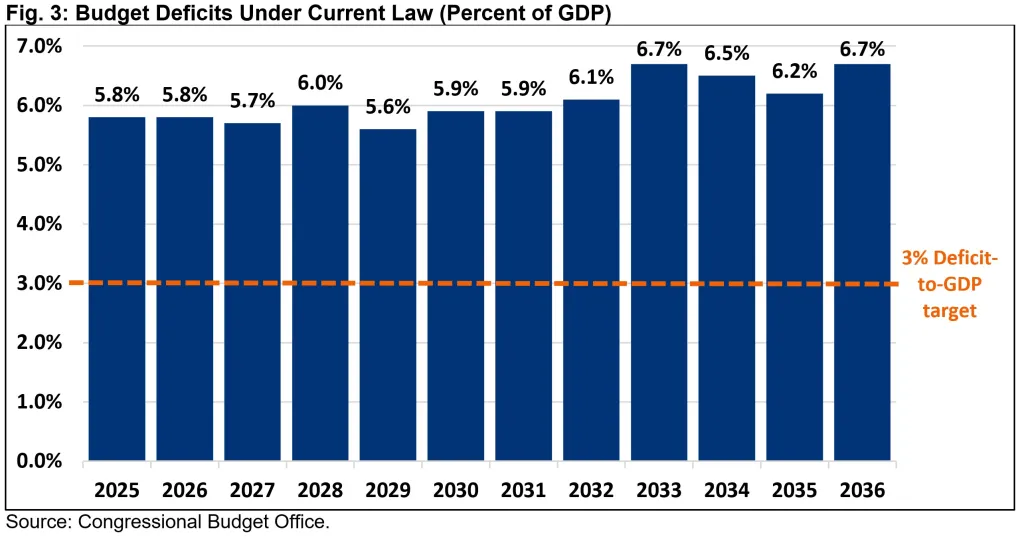

- Deficits will exceed $3 trillion by 2036. Deficits will total $24.4 trillion (6.1% of GDP) over the next decade, rising from $1.8 trillion (5.8% of GDP) in 2025 to $3.1 trillion (6.7% of GDP) by 2036.

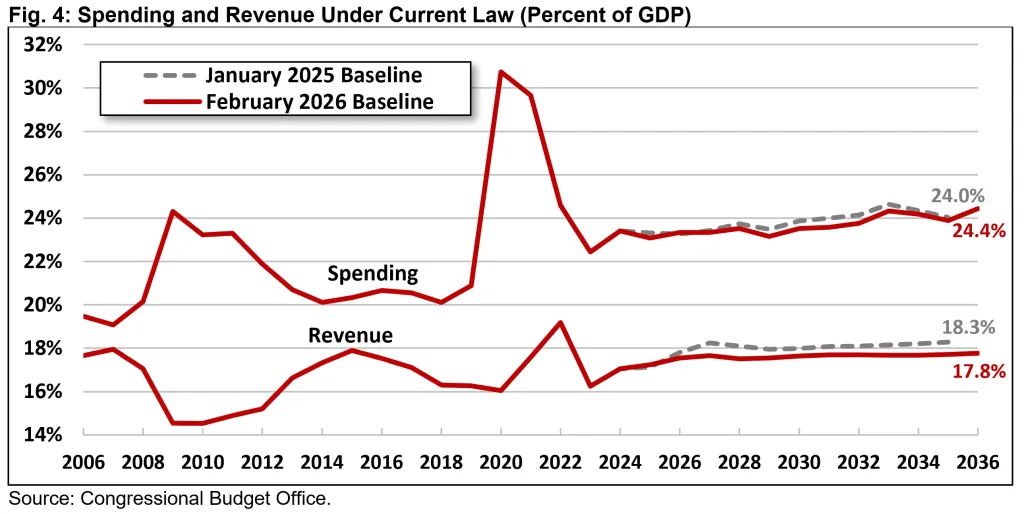

- Spending is larger and growing faster than revenue. Spending will rise from 23.1% of GDP ($7.0 trillion) in 2025 to 24.4% ($11.4 trillion) by 2036. Revenue will rise from 17.2% of GDP ($5.2 trillion) to 17.8% ($8.3 trillion) in 2036.

- Interest costs will explode. Nominal interest costs will more than double from $970 billion in 2025 to $2.1 trillion by 2036. As a share of the economy, interest costs will rise from a record 3.2% of GDP in 2025 to 4.6% by 2036.

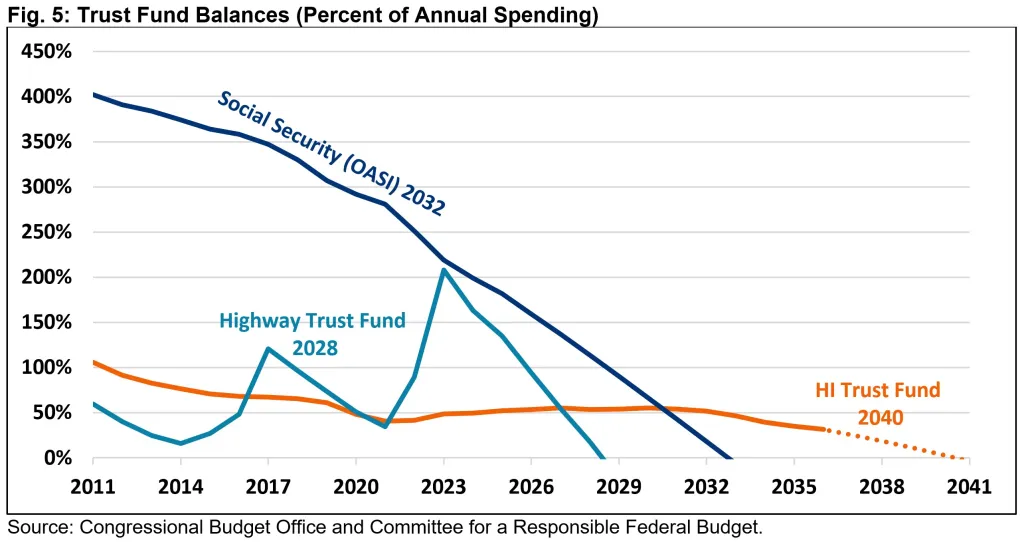

- Major trust funds are approaching insolvency. The Highway Trust Fund will deplete its reserves by 2028, the Social Security retirement trust fund in 2032, and the Medicare Hospital Insurance trust fund around 2040.

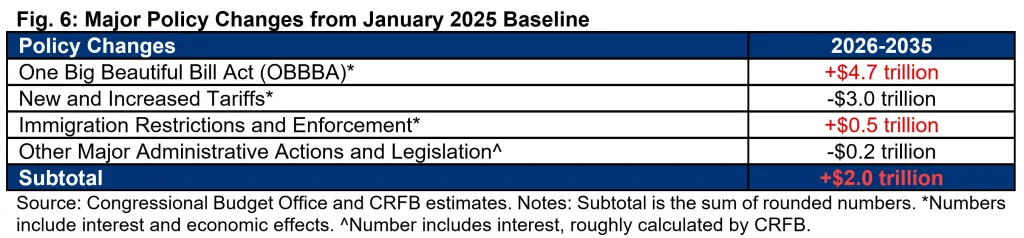

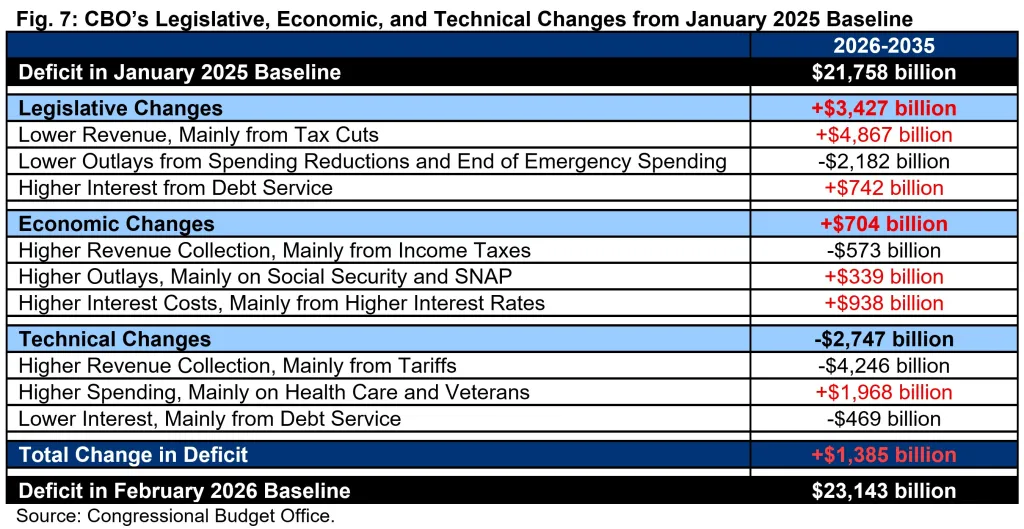

- Deficit projections are higher than last year. CBO now projects $1.4 trillion more borrowing between 2026 and 2035 than it did last January, with $2 trillion of additional net borrowing from policy changes. The reconciliation law alone will add $4.7 trillion to the debt, while tariffs will subtract $3 trillion.

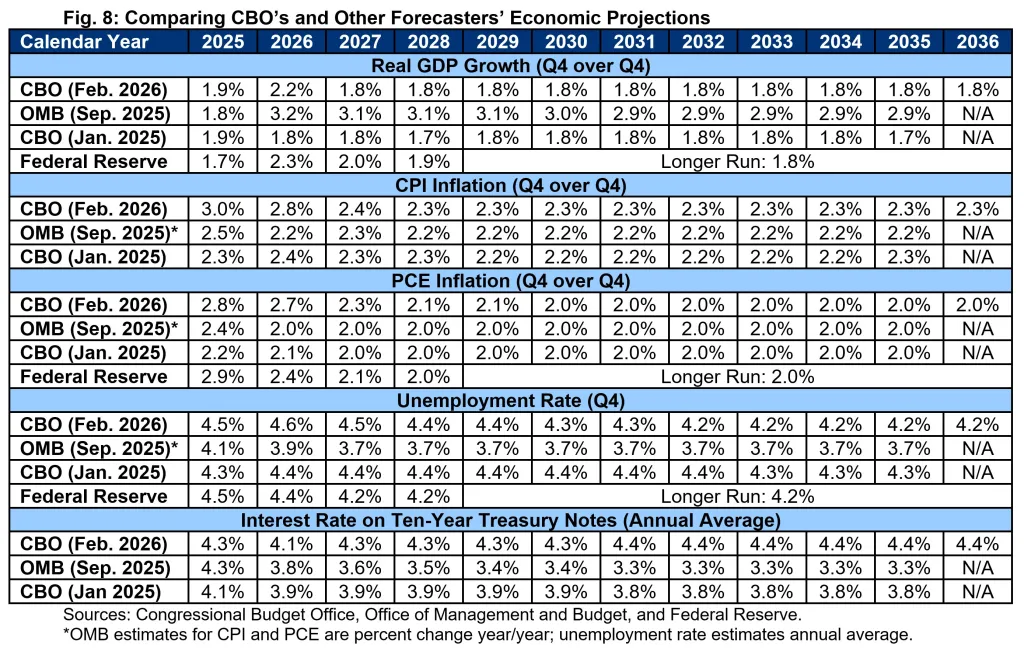

- The economy will surge then normalize, while interest rates will rise. CBO projects real GDP will grow by 2.2% in 2026, due in part to economic stimulus from OBBBA, but slow to 1.8% per year thereafter. They project PCE inflation of 2.7% in 2026, returning to its 2.0% target by 2030. CBO projects short-term interest rates will decline but remain above 3%, while ten-year Treasury yields will grow from 4.1% in 2026 to 4.4% in 2031 and beyond.

With debt approaching record levels, interest costs exploding, trust funds approaching insolvency, and deficits expected to remain more than twice as large as the oft-discussed 3% of GDP target, lawmakers should come together to enact significant deficit reduction.

Debt Is Approaching Record Levels and Rising Rapidly

Debt held by the public is currently around 100% of GDP, roughly double the 50-year historical average. Under CBO’s baseline, debt will surpass the 106% of GDP record set after World War II by FY 2030 – just four years from now – and will continue to grow to 120% of GDP by 2036.

In dollar terms, debt held by the public is currently almost $31 trillion and will rise to above $36 trillion in 2028, $47 trillion in 2033, and over $56 trillion in 2036.

Over the long run, CBO projects debt will continue to grow as a share of the economy, reaching 144% of GDP after 20 years and 175% of GDP by 2056.

Actual debt could grow even faster than CBO’s baseline projections. For example, we estimate debt would rise to 131% of GDP by 2036, as opposed to 120%, if the Supreme Court rules that many of the recently-imposed tariffs are illegal, lawmakers make permanent the temporary provisions in OBBBA, and enhanced Affordable Care Act health insurance subsidies are revived on a permanent basis.

High and rising debt levels present significant risks and threats to the economy and the nation as a whole. This includes slower economic growth, higher interest rates, increased inflationary pressure, heightened national security risks, reduced fiscal space, growing debt service payments, and greater risk of a fiscal crisis.

High Deficits Will Continue to Grow

CBO projects annual budget deficits will grow from less than $2 trillion in 2025 to over $3 trillion by 2036, totaling $24.4 trillion over the next decade.

As a share of the economy, CBO projects deficits will average 6.1% of GDP over the next decade – twice the 3% of GDP deficit target needed to put the debt on a sustainable path. Annual deficits will rise from 5.8% of GDP in 2025 to 6.0% in 2028, dip in 2029, then grow to 6.7% of GDP by 2036.

Spending Will Continue to Grow Faster Than Revenue

As a share of the economy, spending and revenue – which are already far apart – will both grow over the next decade under CBO’s baseline; however, spending will grow somewhat faster.

Spending will average 23.8% of GDP over the decade – compared to the 50-year historical average of 21.2% – growing from 23.1% of GDP ($7.0 trillion) in 2025 to 24.4% ($11.4 trillion) by 2036. Revenue will grow from 17.2% of GDP ($5.2 trillion) in 2025 to 17.7% ($5.9 trillion) in 2027, dip to 17.5% ($6.1 trillion) in 2028, then commence growing to 17.8% of GDP ($8.3 trillion) by 2036.

Spending growth will be largely driven by the rising cost of Social Security, health care programs, veterans spending, and interest on the debt, partially offset by declining discretionary and other mandatory spending, relative to GDP.

Spending on Social Security and health care will grow from a combined 11.2% of GDP ($3.4 trillion) in 2025 to 12.5% of GDP ($5.9 trillion) by 2036. Mandatory spending on veterans’ programs will grow from 0.8% of GDP ($251 billion) in 2025 to 1.1% ($491 billion) in 2036, nearly doubling in nominal terms. And net interest costs will more than double nominally, growing from a record 3.2% of GDP in 2025 ($970 billion) to 4.6% of GDP ($2.1 trillion) by 2036.

CBO projects revenue will rise in 2026 and 2027, despite new tax cuts enacted under OBBBA, in large part due to new tariff revenue – with tariffs collecting $421 billion in 2027, up from $77 billion in 2024. Beyond that, revenue will remain relatively stable as a share of the economy, with tariff revenue projected to decline as a share of the economy, offset by the return of Federal Reserve remittances and an increase in income tax revenue due to the expiration of various temporary tax cuts (for example, “no tax on tips”) as well as “real bracket creep.”

Major Trust Funds Are Approaching Insolvency

Several important federal programs are internally financed through trust fund accounting, where spending is covered by dedicated revenue plus reserves. CBO projects that two of those trust funds will run out of money in the next six years, with a third likely to run out by 2040.

Specifically, CBO estimates the Highway Trust Fund will run out of reserves in FY 2028 and the Social Security retirement trust fund will be insolvent by FY 2032. CBO also projects the Medicare Hospital Insurance trust fund will be shrinking by the end of the budget window; we estimate the fund would be exhausted around 2040 under CBO’s baseline.

Upon insolvency, the law calls for spending to be cut to match revenue. The result would be a 40% immediate cut to highway spending and an average 28% cut to Social Security retirement and survivor benefits in the years after insolvency. For Social Security, we previously estimated a typical couple aged 60 today retiring at insolvency would face an $18,400 cut.

Importantly, CBO’s baseline assumes the trust funds will continue to spend at scheduled levels beyond insolvency. Under their baseline, the trust funds will run a combined $5.6 trillion (1.4% of GDP) in cash deficits over the next decade, including $3.0 trillion (0.7% of GDP) after they become insolvent and $780 billion (1.7% of GDP) in 2036 alone.

Were Social Security benefits limited to revenue, CBO projects debt in 2036 would be $3.4 trillion (8.1% of GDP) lower. CBO also estimates that, after near-term economic turmoil resulting from the abruptness of the benefit cut, economic output would be 1% higher by 2036 as a result of the lower debt and increased incentive to work, save, and invest.

The Fiscal Outlook Has Further Deteriorated

Between FY 2026 and 2035, CBO projects deficits will be $1.4 trillion higher than in its January 2025 baseline, with major policy changes adding about $2 trillion to deficits. CBO estimates OBBBA, alone, will add $4.7 trillion to deficits through 2035 including interest and macrodynamic effects, while changes in immigration policy will add an additional $0.5 trillion. Partially offsetting these costs, new tariffs will reduce deficits by about $3 trillion, and other legislative and administrative actions will on net save roughly $0.2 trillion.

Broken down by the traditional legislative, economic, and technical categories, CBO finds that legislative changes (excluding dynamic effects but including certain baseline quirks) will increase deficits by $3.4 trillion, technical changes (including the direct but not behavioral effects of tariffs) will reduce deficits by $2.7 trillion, and economic changes will increase deficits by $0.7 trillion.

While nominal deficits are higher than in the January 2025 baseline, debt as a percentage of GDP is similar in 2035 due to higher GDP as a result of stronger growth and inflation. However, higher interest rates mean debt will rise more rapidly beyond 2035 under CBO’s current baseline.

The Economy Will Surge then Normalize, While Interest Rates Will Rise

CBO projects strong real GDP growth of 2.2% in 2026, followed by sustained 1.8% growth after the “sugar high” boost from recently enacted policies dissipates.

Inflation will follow a similar pattern, with the personal consumption expenditure (PCE) price index growing by 2.7% in 2026 and PCE inflation gradually falling to the Federal Reserve’s target rate of 2.0% by 2030. CBO expects the unemployment rate to rise to 4.6% in 2026 and then gradually decline to 4.2% in 2032 and onward.

Finally, CBO expects long-term interest rates to remain high and rise throughout the decade. Although CBO projects the three-month Treasury yield will fall from 3.7% today to an average of 3.2% over the decade as the Fed cuts rates, they project ten-year Treasury yield will rise from an average of 4.1% in 2026 to 4.4% by 2031 through 2035 – driven in large part by rising debt.

CBO’s economic projections incorporate the estimated effects of recent policy changes. CBO estimates OBBBA will boost the level of output by 0.7% in 2034, while tariffs and immigration changes will reduce output. CBO expects these three changes will boost overall price levels and that OBBBA will increase interest rates by 10 to 20 basis points in most years.

Conclusion

CBO’s latest baseline shows an unsustainable fiscal outlook, with debt approaching record levels, deficits remaining elevated at more than twice a reasonable target, and interest costs exploding. Later in the decade, under CBO’s baseline, the average interest rate on all federal debt will exceed nominal economic growth (R>G), which could represent the start of a debt spiral.

Meanwhile, the Highway, Social Security retirement, and Medicare hospital trust funds are all on course to run out of reserves – the first two funds within the next seven years – resulting in automatic, across-the-board cuts without changes to the law.

The actual fiscal outlook could be far worse. If the Supreme Court rules with lower courts that a large share of the President’s tariffs are illegal and policymakers extend various expiring or expired provisions, deficits could reach $3.8 trillion in 2036 as opposed to $3.1 trillion, and debt could grow to 131% of GDP by 2036 as opposed to 120%. In this case, a debt spiral would be far more likely and the risk of a fiscal crisis would grow.

Rather than continue to add to the debt – as policymakers have over the past year – Congress and the President should work to reduce deficits toward 3% of GDP, stabilize the debt as a share of the economy, and restore solvency to beleaguered trust funds. The necessary spending and revenue adjustments could be made through regular order or a bipartisan fiscal commission.

Appendix: Key Metrics in CBO’s Budget & Economic Outlook

What's Next

-

Image

-

Image

-

Image