Senate ACA Plan Could Add $350-$635 Billion to Debt

Update 12/10/2025: In place of the proposal described below, the Senate is now expected to vote on a clean three-year extension of the enhanced subsidies, which CBO estimates will cost nearly $85 billion. The Senate will also vote on an alternative which we expect to be modestly deficit increasing in the near term and modestly deficit reducing over a decade.

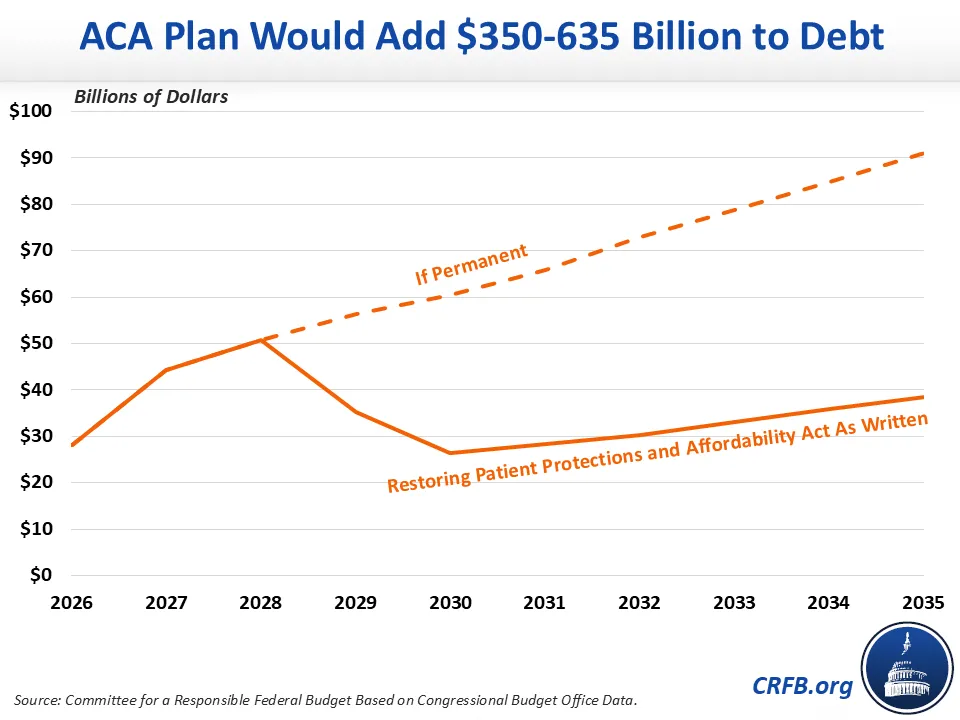

Senators Lisa Blunt Rochester (D-DE) and Ron Wyden (D-OR) introduced the Restoring Patient Protections and Affordability Act last week – legislation to extend the enhanced Affordable Care Act (ACA) subsidies through 2028 and reverse a number of recent measures designed to reduce the cost of the ACA subsidies. We estimate the bill, which is likely to receive a vote in the Senate, would add $350 billion to the national debt over the next decade, including interest. If the subsidies were extended permanently, the debt would grow by $635 billion.

Those who buy insurance on the ACA exchanges were eligible for enhanced subsidies from 2021 through 2025. These subsidies cover the full cost of the second lowest cost “silver plan” for those below 150% of the federal poverty level (FPL) and phase down the subsidy with income so those making over 400% of FPL pay no more than 8.5% of income for a low-cost silver plan. By comparison, the base ACA subsidies limit the cost of those plans to about 4% of income for those at 150% of FPL and almost 10% for those at 400%, with no subsidy above that level.

The Restoring Patient Protections and Affordability Act would extend these enhanced subsidies in full for three years, through 2028. Unlike many other proposals that end the subsidies for very high earners or add new anti-fraud measures, this bill would maintain the full subsidies in their current form. In fact, it would remove existing anti-fraud and program integrity measures by reversing a number of cost-saving measures enacted by the One Big Beautiful Bill Act (OBBBA) and through the Trump Administration’s 2025 Marketplace Integrity and Affordability Rule finalized in June – adding about $200 billion on top of the cost of a “clean” three-year extension.

While there is no official Congressional Budget Office (CBO) cost estimate of the bill yet, we estimate that its provisions – which resemble several that CBO estimated in a September 2025 report to Congress – would add $290 billion to deficits before interest and $350 billion including interest. If the enhanced subsidies were ultimately extended permanently, we estimate this cost would rise to $545 billion through 2035 before interest and $635 billion including interest.

Fiscal Impact of Restoring Patient Protections and Affordability Act, FY 2026-2035

| Policy | Ten-Year Cost | |

|---|---|---|

| As Written | If Permanent | |

| Extend Enhanced ACA Subsidies for 2026-2028 | $95 billion | $350 billion |

| Repeal Disallowance of Subsidy for Income-Related Special Enrollment Period | $80 billion | $80 billion |

| Repeal Requirement to Affirmatively Verify Eligibility & Reconcile Taxes | $55 billion | $55 billion |

| Nullify Portions of the 2025 Marketplace Integrity and Affordability Rule | $35 billion | $35 billion |

| Restore and Expand Limits to Recapture of Overpayments and Other Changes | $25 billion | $25 billion |

| Subtotal, Primary Deficit Impact | $290 billion | $545 billion |

| Interest | $60 billion | $90 billion |

| Total Deficit Impact | $350 billion | $635 billion |

Source: CRFB estimates based on Congressional Budget Office projections. Figures are rounded to the nearest $5 billion.

Over the first four years, we estimate the bill would add over $150 billion to the debt – including roughly $50 billion in 2028. Annual costs would decline if the enhanced subsidies are allowed to expire but still reach roughly $40 billion by 2035, with interest. If the subsidies are extended in future legislation, the cost could exceed $90 billion by 2035.

Although some have described this as a “clean” extension of the enhanced ACA subsidies, it is anything but. While much of the early costs are the result of the three-year extension, other changes make up the bulk of costs over time.

The bill would repeal several recently-enacted program integrity measures from OBBBA aimed at combatting waste, fraud, and abuse in the ACA exchanges. Most significantly, it would reverse an OBBBA provision that disallows subsidies for enrollees who enroll during an income-related special enrollment period (SEP) – repealing this provision would cost about $80 billion through 2035, based on CBO estimates.

The bill would also repeal OBBBA’s requirement that enrollees affirmatively verify their eligibility for subsidies – rather than allowing insurance brokers to automatically reenroll them annually – and the requirement that enrollees reconcile their tax credits on their tax returns annually rather than every two years. This would increase deficits by about $55 billion, based on CBO estimates.

The bill would also eliminate several changes finalized by the Trump Administration’s Marketplace Integrity and Affordability Rule. The rule makes several changes to ACA exchanges, some of which apply only to 2026, including repealing the income-based SEP for 2026, and others that apply permanently. Most significantly, it loosens insurers’ de minimis actuarial value (AV) requirement, allowing insurers to offer plans that are up to 4 percentage points lower in AV than each current tier requires instead of prior law’s 2 percentage points. It also changes the way that premium subsidies are calculated, reverting to the pre-pandemic methodology established in 2020. This bill would reverse both of those components of the rule, most significantly, and restore the income-based SEP for 2026, at a cost that we estimate is roughly equal to $35 billion based on CBO’s estimates.

Finally, the bill would make other smaller changes, including restoring and expanding limits on how much the government can recapture in subsidy overpayments, extending the open enrollment period for 2026 through May 1, restoring $90 million of ACA navigator funding, creating a new SEP for enrollees awaiting pre-enrollment verification, and requiring insurers to issue notices to 2026 enrollees about these changes. We estimate these changes will cost about $25 billion, though with some uncertainty.

Unfortunately, the legislation does not include any offsets, nor any modifications to reduce the costs of the subsidies.

Taken together, we estimate the changes in the bill would reduce the number of uninsured individuals by 5 to 6 million when fully phased in and 1 to 2 million once the expanded subsidies expire. Because much of the costs come from reversing program integrity measures, a meaningful share of this coverage may go to those for whom benefits are not intended under the law. It is unclear whether gross premiums would go up or down.

A recent Government Accountability Office (GAO) preliminary report on investigating fraud risks in the ACA exchanges indicate that the program may be vulnerable to fraudulent enrollment. Given this finding and given the significant cost of any enhanced subsidy extension, lawmakers should be pursuing options to improve rather than worsen program integrity and to lower rather than expand the cost of enhanced ACA subsidies. Lawmakers should ensure that any extension of the ACA subsidies is not only fully paid for, but also reduces deficits (ideally offset two-for-one under Super PAYGO) and lowers health care costs.

Several policymakers have proposed plans that at least take small steps to pare back the costs of the subsidies and reduce fraud; and numerous bipartisan, sensible offsets are available to help lawmakers offset any new costs.