Tariff Dividends Could Cost $600 Billion Per Year

President Trump proposed paying a dividend of “at least $2,000 a person” with new tariff revenue in a post on Truth Social this weekend. The post noted that “high income people” would be excluded from the dividend and also discussed paying down the national debt.

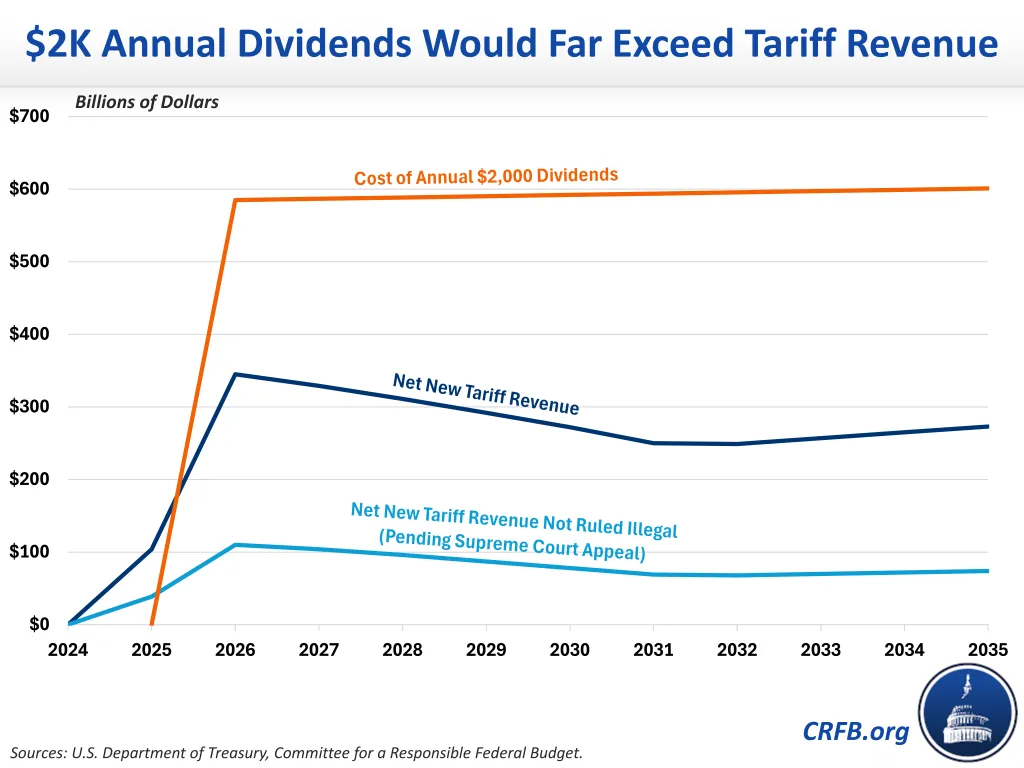

Assuming these dividends are designed like the COVID-era Economic Impact Payments, which went to both adults and children, we estimate each round of payments would cost about $600 billion.1 In comparison, President Trump’s new tariffs currently in effect have raised approximately $100 billion thus far and – including those tariffs that have been ruled illegal pending a Supreme Court appeal – are projected to raise about $300 billion per year.

While the President did not specify the frequency with which dividends would be paid, nor the precise amount (he said “at least $2,000 a person”), we estimate that $2,000 dividends would increase deficits by $6 trillion over ten years, assuming dividends are paid annually. This is roughly twice as much as President Trump’s tariffs are estimated to raise over the same time period.

Our analysis also shows:

- On a revenue neutral basis, current tariffs could be used to pay a $2,000 dividend every other year, starting in early 2027.

- If the Supreme Court upholds lower court rulings – in which case most of President Trump’s tariffs would be illegal – income from President Trump’s remaining tariffs would be sufficient to pay $2,000 dividends after seven years.

- Using income from tariffs to pay dividends would mean that income could not be used to reduce deficits or offset borrowing from the One Big Beautiful Bill Act (OBBBA).

- Using all the tariff revenue for rebates would push debt to 127% of Gross Domestic Product (GDP) by 2035 instead of 120% under current law; if $2,000 dividends are paid annually, debt would reach 134% of GDP.

With our national debt quickly approaching an all-time high and annual budget deficits approaching $2 trillion per year, it is imperative that policymakers focus on actually reducing deficits and putting debt on a downward path. Additional tariff revenue should be used to reduce deficits – as several administration figures have stated is the intention – instead of passing that revenue onto taxpayers in the form of cash dividends.

1 The first round of COVID-era Economic Impact Payments (EIPs), which was included in the CARES Act, amounted to $1,200 per qualifying adult and $500 per qualifying child under the age of 17. The second round of EIPs, included in the Consolidated Appropriations Act of 2020, amounted to $600 per qualifying adult and $600 per qualifying child. In both cases, payments began phasing out for individuals earning $75,000 per year or more ($150,000 for joint filers), at a rate of 5% for every $100 one’s Adjusted Gross Income was above the threshold. The third round of EIPs, included in the American Rescue Plan, amounted to $1,400 per eligible person including all dependents, regardless of age. This round also began phasing out at $75,000 of income for individuals ($150,000 for joint filers) but at a much steeper rate than previous rounds.