The 30-Year Cost of OBBBA

The recently enacted One Big Beautiful Bill Act (OBBBA) would add an estimated $4.1 trillion to the debt through Fiscal Year (FY) 2034, based on estimates from the Congressional Budget Office (CBO). Over 30 years, we estimate OBBBA will add $19 trillion to the debt as written and $32 trillion if made permanent, before considering dynamic effects. As a result, debt will rise to alarming levels.

We estimate that by FY 2054 the bill will:

- Increase nominal debt by $19 trillion as enacted, or $32 trillion if made permanent.

- Increase real (inflation-adjusted) debt in 2031 dollars by $12 trillion as enacted, or $20 trillion if made permanent.

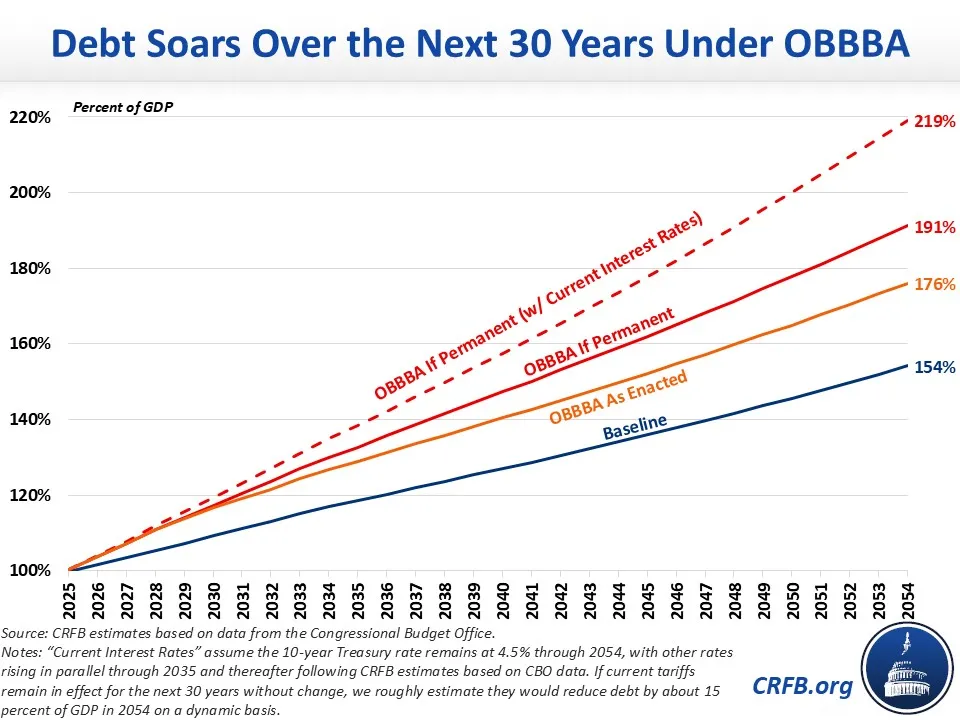

- Boost debt to 176 percent of Gross Domestic Product (GDP) as enacted, or 191 percent of GDP if made permanent, compared to 154 percent under CBO’s January baseline.

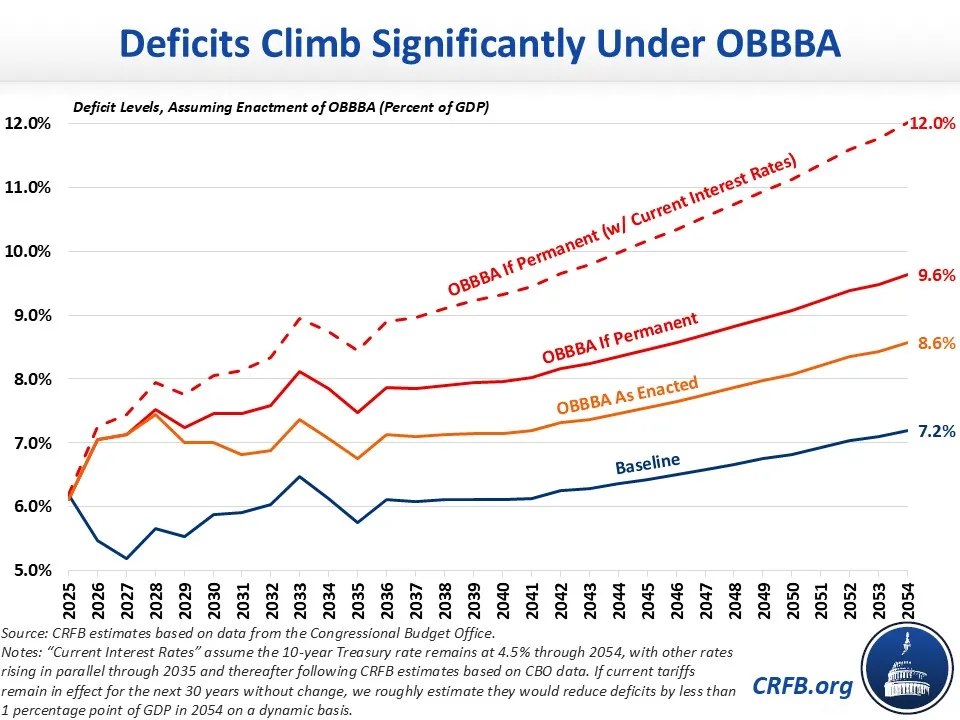

- Increase deficits to 8.6 percent of GDP as enacted, or 9.6 percent of GDP if made permanent, compared to 7.2 percent under CBO’s baseline.

- Increase interest costs to 6.1 percent of GDP as enacted, or 6.6 percent of GDP if made permanent, compared to 5.3 percent under CBO’s baseline.

These estimates do not include dynamic effects of the legislation, which are likely to boost near-term economic output and also increase interest rates. CBO’s dynamic score of the House bill, along with other comprehensive dynamic estimates, suggests these effects would worsen the debt impact of the bill – particularly over the long term.

Projections also do not incorporate the impact of changes to tariff policy. While tariffs can generate significant amounts of revenue, there has been uncertainty as to the final size and permanency of recent tariffs.

This piece is in part an update to an analysis released in June.

Fiscal Impact of OBBBA

| 10-Year | 20-Year | 30-Year | |

|---|---|---|---|

| OBBBA As Enacted | |||

| Nominal Dollars | +$4.1 trillion | +$9.5 trillion | +$18.7 trillion |

| Real (2031) Dollars | +$3.8 trillion | +$7.3 trillion | +$11.8 trillion |

| Deficits as a Share of GDP | +1.1% | +1.1% | +1.2% |

| Change in Debt as a Share of GDP | +10% | +16% | +22% |

| OBBBA If Permanent | |||

| Nominal Dollars | +$5.5 trillion | +$15.1 trillion | +$31.7 trillion |

| Real (2031) Dollars | +$5.2 trillion | +$11.7 trillion | +$20.0 trillion |

| Deficits as a Share of GDP | +1.5% | +1.7% | +2.0% |

| Change in Debt as a Share of GDP | +13% | +25% | +37% |

Sources: CRFB estimates based on data from the Congressional Budget Office.

Note: CBO's March 2025 projections of the GDP Price Index are used for calculating "Real Dollars" figures.

The Fiscal Outlook Worsens Substantially Under OBBBA

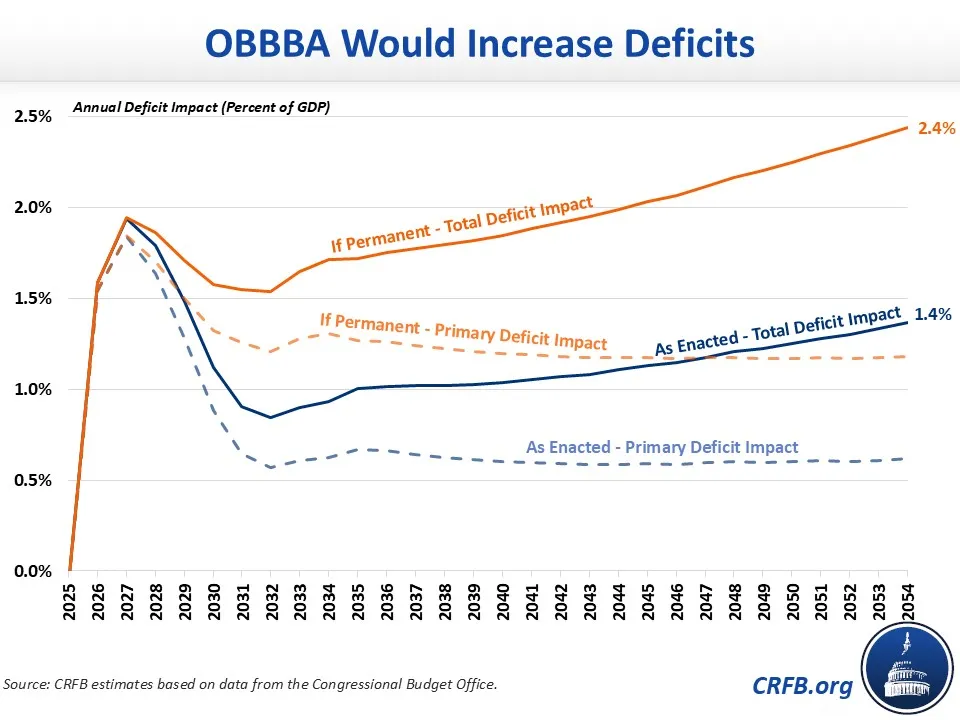

Based on data from the Congressional Budget Office (CBO), we estimate that through FY 2034 OBBBA will increase the debt by $4.1 trillion and boost total deficits by 1.1 percent of GDP, with much of that increase front-loaded in the initial years due to the arbitrary expiration of major policies. Over 30 years, we estimate the legislation will increase debt by $19 trillion and boost total deficits by 1.2 percent of GDP.

The annual primary deficit increase of OBBBA will be as high as 1.8 percent of GDP in 2027, fall to 0.6 percent of GDP by 2031, and remain relatively stable thereafter. However, interest costs on OBBBA’s cumulative debt impact grow continuously over the period, reaching 0.7 percent of GDP by 2054. As a result, annual deficits will increase 1.4 percent of GDP by 2054.

OBBBA sets the stage for additional borrowing beyond what is enacted under the law since it relies on numerous arbitrary expirations of both tax breaks and new spending. For example, an expanded radiation exposure compensation fund expires after 2028, as do reduced taxes on tips, overtime, and senior income; the higher SALT deduction cap expires for taxable year 2030; and a $10 billion a year rural hospital fund expires after 2032.

This is a common gimmick used by lawmakers to mask the intended deficit impact of legislation. If the arbitrarily expiring parts of OBBBA are ultimately made permanent, we estimate the policies would increase the debt by $32 billion by 2054. Under this scenario, deficits would increase by 2.0 percent of GDP over thirty years, including by over 2.4 percent in 2054 – with primary deficits up 1.2 percent of GDP and interest costs up 1.3 percent of GDP.

Even these estimates likely understate the fiscal impact of OBBBA. Dynamic estimates from third-party and nonpartisan government modelers find that the legislation will boost interest rates due to the higher debt load and likely slow long-term economic growth after boosting near-term output.

As an illustration: If interest rates remain around recent levels and expiring OBBBA provisions are made permanent then debt would be $56 trillion higher in 2054 relative to CBO’s baseline, with more than $35 trillion being directly from OBBBA and the rest from increased interest costs on baseline debt. Deficits in that scenario would total 3.4 percent of GDP above CBO’s March long-term baseline through 2054, including 4.8 percent of GDP in 2054.

Debt Levels Will Reach Dangerous Levels Under OBBBA

Under CBO’s pre-OBBBA baseline, in which large parts of the 2017 tax cuts were scheduled to expire (and new tariffs were not yet in effect), debt was expected to rise from about 100 percent of GDP today to 154 percent of GDP by 2054. This projection is quite worrisome by itself, and OBBBA will exacerbate the fiscal situation by increasing debt to an estimated 176 percent of GDP by 2054 as enacted or 191 percent of GDP if expiring provisions are made permanent.

Importantly, these projections assume interest rate projections that don’t incorporate the larger debt under OBBBA. If interest rates remain around their current levels while output continues to grow as projected, we estimate debt would reach roughly 220 percent of GDP under a permanent OBBBA scenario.

It is worth noting that none of these estimates incorporate recent tariff revenue – nor do they incorporate potential lost revenue from the significant reductions in net immigration.

If tariffs in effect today were made permanent and continued over the next 30 years – including an additional 10 percent tariff on most imports and an additional tariff of 30 percent on Chinese imports – we estimate they would reduce debt-to-GDP by about 15 percent in 2054 on a dynamic basis, based on a letter by CBO. For example, debt would rise to above 175 percent of GDP under a baseline that incorporated permanent OBBBA and permanent tariffs. On the other hand, it is important to note that roughly two-thirds of the tariffs currently in effect were ruled illegal by the U.S. trade court, pending appeal. If only the remaining tariffs are made permanent, they will reduce debt by less than 5 percent of GDP in 2054.

Deficits Will Rise Under OBBBA

Under CBO’s most recent baseline, deficits were projected to rise from 6.2 percent of GDP in 2025 to 7.2 percent of GDP by 2054. Deficits will instead rise to 8.6 percent of GDP in 2054 under OBBBA as enacted, 9.6 percent of GDP under a permanent OBBBA, and 12.0 percent of GDP under a permanent OBBBA and current interest rates. Under a permanent OBBBA with current tariffs, deficits would approach 9 percent of GDP.

Prior to OBBBA, interest costs were expected to grow from 3.2 percent of GDP in 2025 to 5.3 percent by 2054. Interest will instead increase to 6.1 percent of GDP under OBBBA as enacted, 6.6 percent of GDP if expiring provisions are made permanent, and 9.0 percent of GDP if interest rates remain around current levels alongside permanent OBBBA provisions. Assuming permanent OBBBA and today’s interest rates, interest would consume more than half of all revenue by 2054.

The passage of OBBBA will put tremendous strain on the long-term fiscal and economic health of the nation. Added to the already unsustainable fiscal outlook, the new law puts the nation at significant risk of higher interest costs, slower growth, more chaotic market movements, and reduced fiscal space to respond to future crises or invest in national priorities. With OBBBA now in law, lawmakers should pursue legislation that reins in deficits, secures trust funds, and ensures all temporary parts of OBBBA are allowed to expire or, if extended, are more than fully offset with additional budgetary savings.