OBBBA’s 30-Year Price Tag

The House-passed One Big Beautiful Bill Act (OBBBA) would add $3 trillion to the debt through Fiscal Year (FY) 2034 as written and $5 trillion if made permanent. Over the long run, it would add far more to the debt.

We estimate that by FY 2054 the bill would:

- Increase debt by $15 trillion as written, or $31 trillion if made permanent.

- Increase debt to 172 percent of Gross Domestic Product (GDP) as written, or 190 percent of GDP if made permanent.

- Increase deficits to 8.4 percent of GDP as written, or 9.6 percent of GDP if made permanent.

- Increase interest costs to 6.0 percent of GDP as written, or 6.6 percent of GDP if made permanent.

These estimates likely understate the fiscal impact of OBBBA, as they assume interest rates that are significantly lower than today’s levels and don’t account for OBBBA’s effects on growth and interest rates. Most modelers have found that after boosting near-term output, OBBBA would reduce long-term output and increase interest rates as a result of additional borrowing.

OBBBA Will Increase Long-Term Borrowing

According to the Congressional Budget Office (CBO), the House-passed OBBBA would add roughly $3 trillion to the debt through 2034, including interest, boosting total deficits by 0.8 percent of GDP. Over 30 years, we estimate OBBBA would increase debt by over $15 trillion, boosting deficits by 1.0 percent of GDP.

Although new spending and tax cuts are smaller over the long run than in the early years, a number of offsets expire after 2034, while interest costs continue to accrue as a result of rising debt. We find the primary deficit impact of OBBBA would decline from a peak of 1.6 percent of GDP in 2027 to a low of 0.2 percent of GDP by 2031 before rising to 0.5 to 0.6 percent of GDP between 2035 and 2054. Interest costs will rise gradually to 0.6 percent of GDP by 2054. As a result, OBBBA as written would add about 1.2 percent of GDP to the deficit in 2054.

Fiscal Impact of OBBBA

| 10-Year | 20-Year | 30-Year | |

|---|---|---|---|

| OBBBA As Written | |||

| Nominal Dollars | +$3.0 trillion | +$7.6 trillion | +$15.4 trillion |

| Real (2031) Dollars | +$2.8 trillion | +$5.8 trillion | +$9.7 trillion |

| Deficits as a Share of GDP | +0.8% | +0.9% | +1.0% |

| Change in Debt as a Share of GDP | +7% | +12% | +18% |

| OBBBA If Permanent | |||

| Nominal Dollars | +$5.0 trillion | +$14.5 trillion | +$31.0 trillion |

| Real (2031) Dollars | +$4.7 trillion | +$11.2 trillion | +$19.6 trillion |

| Deficits as a Share of GDP | +1.4% | +1.7% | +1.9% |

| Change in Debt as a Share of GDP | +12% | +24% | +36% |

Sources: CRFB estimates based on data from the Congressional Budget Office.

Note: CBO's March 2025 projections of the GDP Price Index are used for calculating "Real Dollars" figures.

If temporary provisions in OBBBA are made permanent, we estimate the deficit impact would total $31 trillion through 2054, or 1.9 percent of GDP.

Most significantly, OBBBA sets numerous tax provisions to expire arbitrarily in 2028 or 2029, including temporary enhancements to the standard deduction and Child Tax Credit, tax exemption for tips and overtime, and various business tax breaks. OBBBA also includes significant one-time appropriations for defense, border security, and immigration enforcement, and it includes a number of offsets – mainly related to the delay of Biden Administration rules – that end after the budget window.

With all these provisions made permanent, the primary deficit impact of the bill would remain relatively stable at 1.2 to 1.3 percent of GDP per year over the long run. Meanwhile, interest costs will rise gradually to 1.2 percent of GDP by 2054. As a result, OBBBA with extensions would increase the deficit by 2.4 percent of GDP in 2054.

These estimates, if anything, likely understate the deficit impact of OBBBA. Long-term dynamic estimates from Penn Wharton Budget Model, Yale Budget Lab, and the Joint Committee on Taxation find that OBBBA would slow long-term economic growth and boost interest rates as a result of the higher debt. Assuming interest rates remain around their recent levels – either due to OBBBA or for other reasons – debt would be $55 trillion higher in 2054 under a permanent OBBBA, with more than $34 trillion of that increase due to OBBBA itself.

Deficits and Debt Will Surge under OBBBA

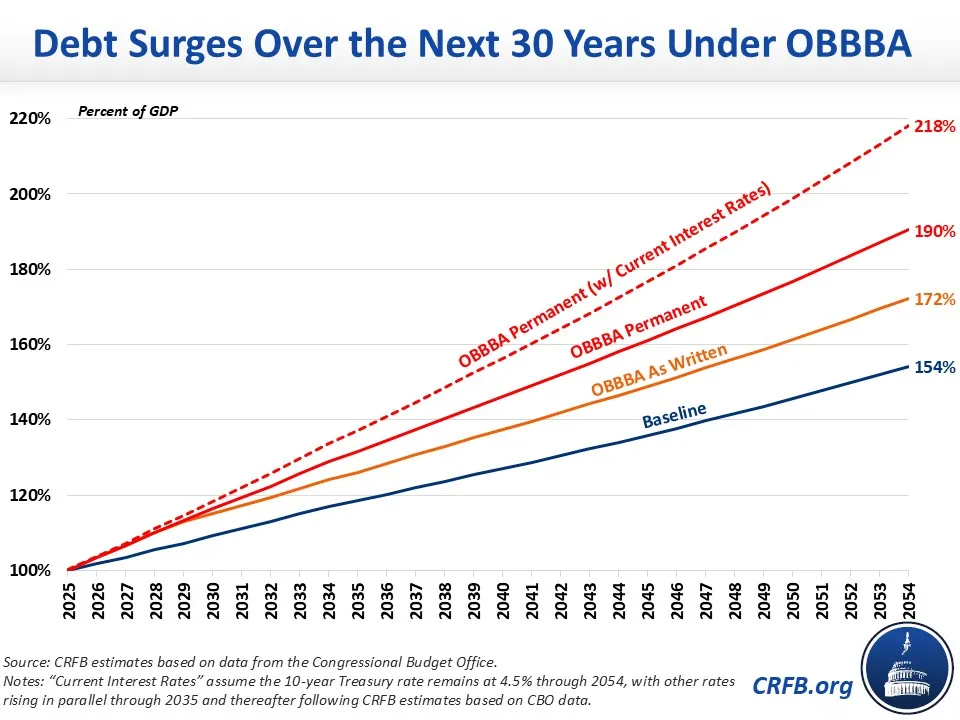

As a result of the additional $15 to $31 trillion of 30-year borrowing under OBBBA, debt levels will surge. CBO already projects debt to rise from 100 percent of GDP today to 154 percent by 2054 under current law. We estimate debt would further rise to 172 percent of GDP under OBBBA as written and 190 percent of GDP if OBBBA were made permanent.

Debt could rise even higher with heightened interest rates. If interest rates remain around their current levels while output grows as projected, debt would reach 218 percent of GDP assuming permanent OBBBA.

Deficits would also rise under these scenarios. Even under current law, annual deficits are projected to rise from 6.2 percent of GDP in 2025 to 7.2 percent by 2054. Under OBBBA deficits would rise to 8.4 percent of GDP, under a permanent OBBBA they would rise to 9.6 percent, and under a permanent OBBBA with current interest rates they would reach 12.0 percent of GDP.

Interest costs alone are projected to grow from 3.2 percent of GDP in 2025 to 5.4 percent by 2054 under current law. Interest costs would climb further to 6.0 percent of GDP by 2054 under OBBBA as written, 6.6 percent under a permanent OBBBA, and 8.9 percent under a permanent OBBBA and current interest rates. Assuming permanent OBBBA and today’s interest rates, interest would consume half of all revenue by 2054.

* * * * *

The U.S. government’s long-term fiscal outlook is unsustainable under current law, as the rising cost of health and retirement programs are projected to outflank growth in revenue (including from the expiration of large parts of the 2017 tax cuts).

Under the House-passed One Big Beautiful Bill Act debt would rise even more rapidly, creating serious challenges for the nation’s fiscal and economic health. The Senate should work to improve the House bill – for example by replacing temporary provisions with permanent ones, reducing the cost of Medicare and Medicaid, further limiting various tax deductions (including the SALT deduction), and bringing overall spending and revenue changes in line.

A more fiscally responsible and pro-growth bill could improve, rather than worsen, the nation’s fiscal and economic outlook.