Senate Reconciliation Bill Could Add Over $4 Trillion to Debt

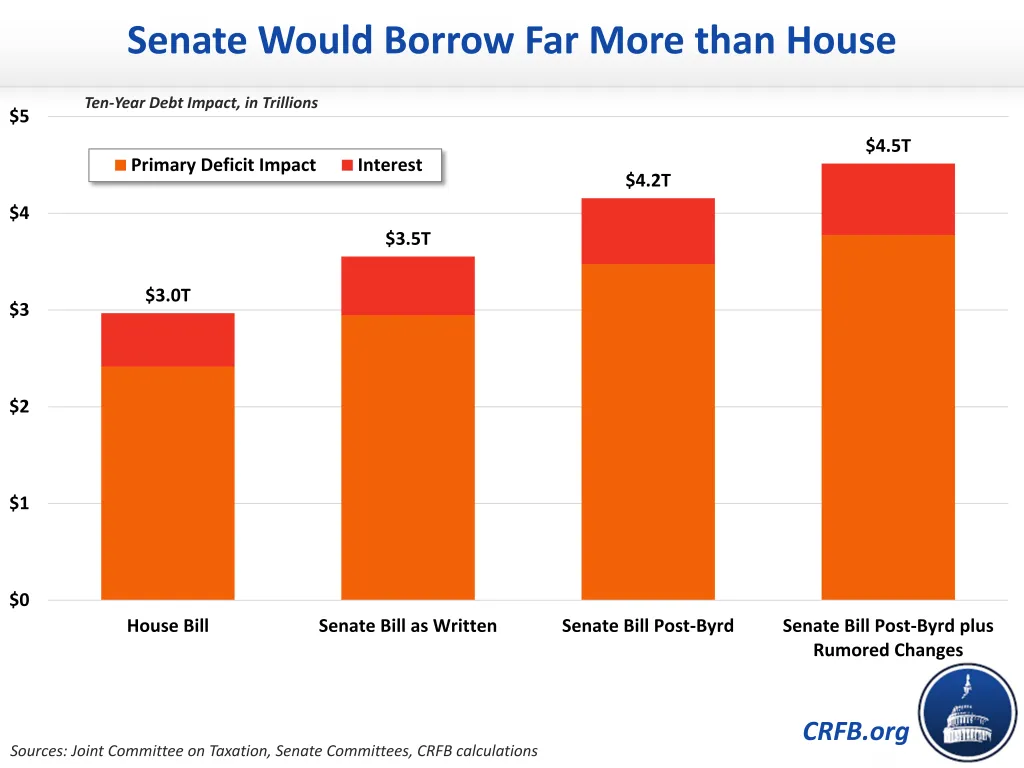

As it currently stands, the Senate reconciliation bill is likely to add $3.5 to $4.2 trillion to the debt through Fiscal Year (FY) 2034, based on our estimates. The debt impact could rise as high as $4.5 trillion if various rumored adjustments are made. That’s $500 billion to $1.5 trillion more in borrowing than under the House-passed bill and will mean the Senate is likely out of compliance with the House reconciliation instructions.

These estimates are preliminary, and lawmakers should wait for an official score from the Congressional Budget Office before voting on the bill.

Although many parts of the Senate bill are in flux, a Joint Committee on Taxation (JCT) score of the tax portion of the bill, the official estimate of the House bill, and reports from committees themselves allow us to construct a preliminary estimate of the bill both as it stands and assuming the removal of provisions that the Senate Parliamentarian advised violate the Byrd rule.

Based on these sources, we estimate the pre-Byrd rule Senate version of the One Big Beautiful Bill Act (OBBBA) would increase primary deficits by $2.9 trillion through FY 2034 and, after accounting for interest, increase total borrowing by $3.5 trillion. Removing provisions that have been flagged for noncompliance with the Senate’s Byrd rule, we estimate the bill would increase primary deficits by $3.5 trillion, boosting total borrowing by $4.2 trillion. With various rumored adjustments – especially to the SALT cap and Section 899 tax – borrowing could rise to $4.5 trillion.

Estimated Fiscal Impact of Major Senate OBBBA Committee Proposals

| Committee Title | Deficit Increase (-) / Decrease (FY2025-FY2034) |

|

|---|---|---|

| Pre-Byrd | Post-Byrd | |

| Finance Committee (tax) | -$4.2 trillion | -$4.3 trillion |

| Finance (Medicaid and Medicare) | $1.0 trillion* | $750 billion* |

| Armed Services | -$157 billion | -$157 billion |

| Homeland Security and Government Affairs | -$105 billion | -$125 billion |

| Health, Education, Labor, and Pensions | $355 billion | $200 billion* |

| Agriculture, Nutrition, and Forestry | $119 billion | $119 billion |

| Commerce, Science, and Technology | $39 billion | $39 billion |

| PRIMARY DEFICIT IMPACT | -$2.9 trillion | -$3.5 trillion |

| Interest | -$600 billion* | -$700 billion* |

| DEBT IMPACT | -$3.5 trillion | -$4.2 trillion |

| Memo: Debt impact with rumored SALT, 899, and hospital changes | -$3.8 trillion | -$4.5 trillion |

Source: CRFB estimates based on Joint Committee on Taxation estimates, press reports, and committee releases.

* Rough estimates.

Importantly, the legislation is very much in a state of flux. The current analysis reflects the state of the bill as of 6:00 a.m. on June 27. Finance Committee tax numbers come from JCT, while Finance Committee health numbers combine the CBO score of similar provisions in the House bill with our own estimates of expanded restrictions on state financing schemes.1 Estimates from the committees on Homeland Security; Commerce, Science, and Technology; and Armed Services come directly from their committee websites. The Agriculture, Nutrition, and Forestry estimates are based on media reports. The estimates for the Health, Education, Labor, and Pensions Committee changes are our own.2 The post-Byrd estimates are based on information from the Senate Budget Committee and other sources. Our analysis excludes costs or savings from several other committees (Judiciary; Energy and Natural Resources; Environment and Public Works; and Banking, Housing, and Urban Affairs) that we estimate – on net – will have a negligible impact on the final score.

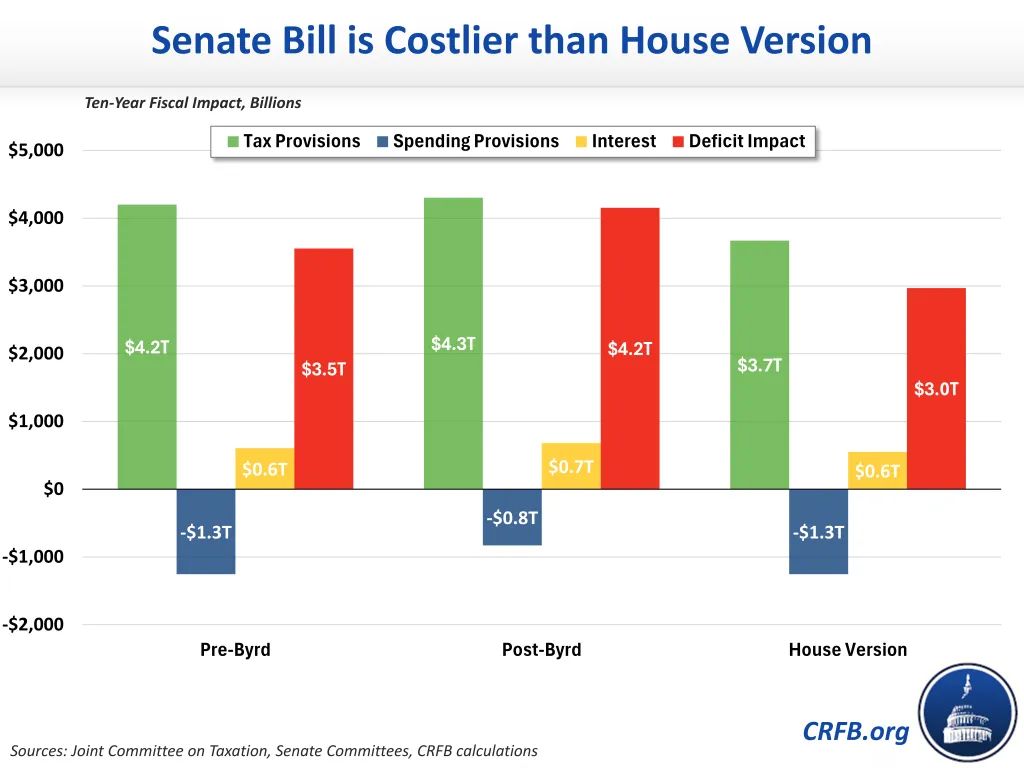

As it stands, the Senate bill includes more tax cuts and fewer offsets than the House bill. The $4.2 trillion of net tax cuts in the Finance section (which include Affordable Care Act and Inflation Reduction Act savings) are about $500 billion higher than the equivalent changes from the House version. Remaining net savings from provisions outside of the tax title are similar to the House bill – at $1.3 trillion – as written. But tax changes could be $100 billion larger, and spending reductions $500 billion smaller, if all the Byrd-noncompliant policies are removed.

On net and including interest, the Senate bill as it stands would increase borrowing by $500 billion to $1.2 trillion more than the House bill – by $3.5 to $4.2 trillion over ten years, as opposed to $3.0 trillion. Possible changes could further increase the debt impact to $4.5 trillion – $1.5 trillion above the House.

The primary spending and revenue changes mean the Senate bill would not be compliant with the House reconciliation instructions, which allow $4.0 trillion of tax cuts to accompany at least $1.2 trillion of net ($1.5 trillion of gross) spending cuts, $4.5 trillion of tax cuts to accompany at least $1.7 trillion of net ($2.0 trillion of gross) spending cuts, or a sliding scale combination of tax and spending cuts sufficient to keep net primary borrowing below $2.8 trillion.

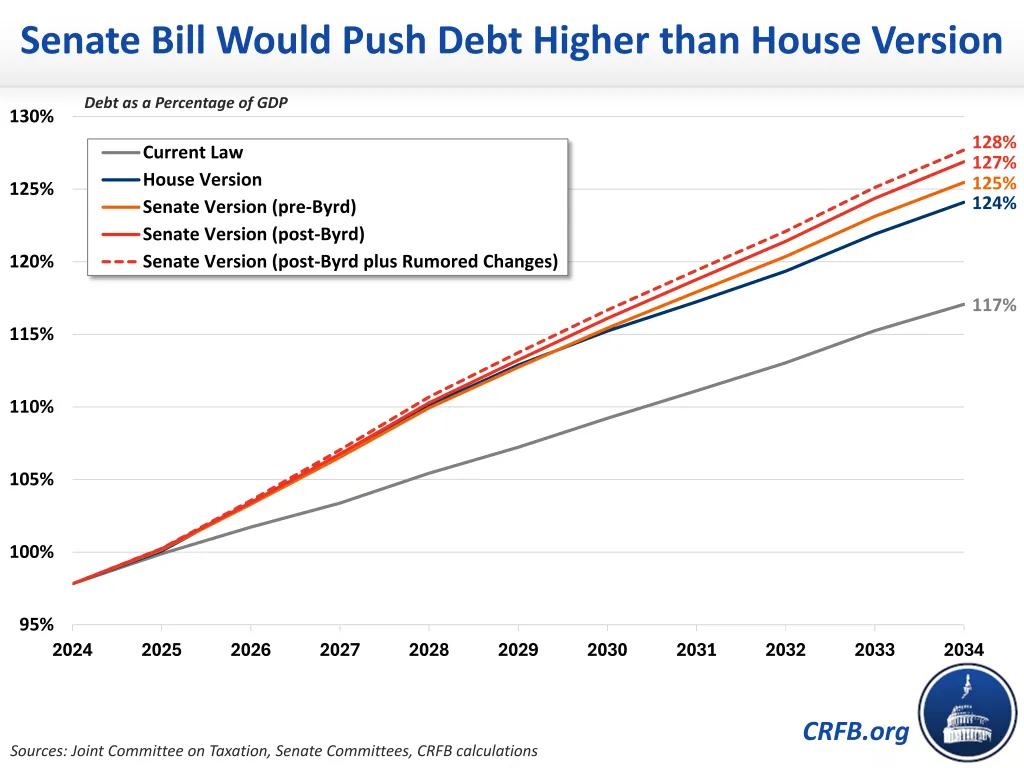

The Senate bill would also significantly boost debt as a percentage of the economy, from about 100 percent of output today to between 125 and 128 percent of GDP by FY 2034. This is far above the 117 percent of GDP projected under current law and also higher than the 124 percent under the House bill.

The actual deficit impact could be far higher than under the bill as currently written. Senate Finance Committee Chairman Mike Crapo (R-ID) has already said he is dropping a $52 billion tax provision known as "Section 899", which would have allowed the United States to apply "retaliatory taxes" when foreign countries tax American companies. Press reports suggest that senators are also currently negotiating a plan to increase the SALT cap and establish a new rural hospital fund, which could add $250 billion or more to the total cost. Costs could rise by hundreds of billions more on a dynamic basis, as higher debt pushes up interest rates.

Finally, the Senate bill includes a number of temporary provisions, including a massive temporary expansion of the Radiation Exposure Compensation Act (RECA), along with numerous temporary tax cuts and spending increases. Making these provisions permanent could add up to $1 trillion to the total cost of the Senate bill.

Rather than adding trillions of dollars to the debt, the Senate should revise this bill to at least fully offset any costs and, ideally, go further to reduce deficits and debt.

1 The part of the bill with the greatest fiscal impact – the tax provisions in the Senate Finance Committee section – has already been estimated by JCT to increase deficits by approximately $4.2 trillion over the coming decade. While JCT did not score the various changes to Medicaid and Medicare in the Finance section, based on scores of similar provisions in the House version, we roughly estimate they will save $1 trillion over the same period. However, several health-related cost-saving provisions in the Finance section have been ruled by the Senate Parliamentarian as noncompliant with the Senate’s Byrd rule. Sources have reported that, if those provisions are ultimately struck from the bill, it would reduce the net savings in the section by roughly $250 billion and increase the revenue loss from the tax provisions by $100 billion.

2 We have previously published our estimate of $355 billion in savings for the Senate Health, Education, Labor, and Pensions Committee section, which is based on our own understanding of the provisions. Like the Finance section, the Senate Parliamentarian has identified several cost-saving provisions as noncompliant with the Byrd rule. We estimate that removing those provisions reduces the net savings by more than $150 billion.