Senate Proposes $4.2 Trillion of Tax Cuts

Note: the Joint Committee on Taxation (JCT) has put together a current law score of the Senate Finance Committee tax proposals, which roughly match our numbers in this analysis. You can view JCT's tables here.

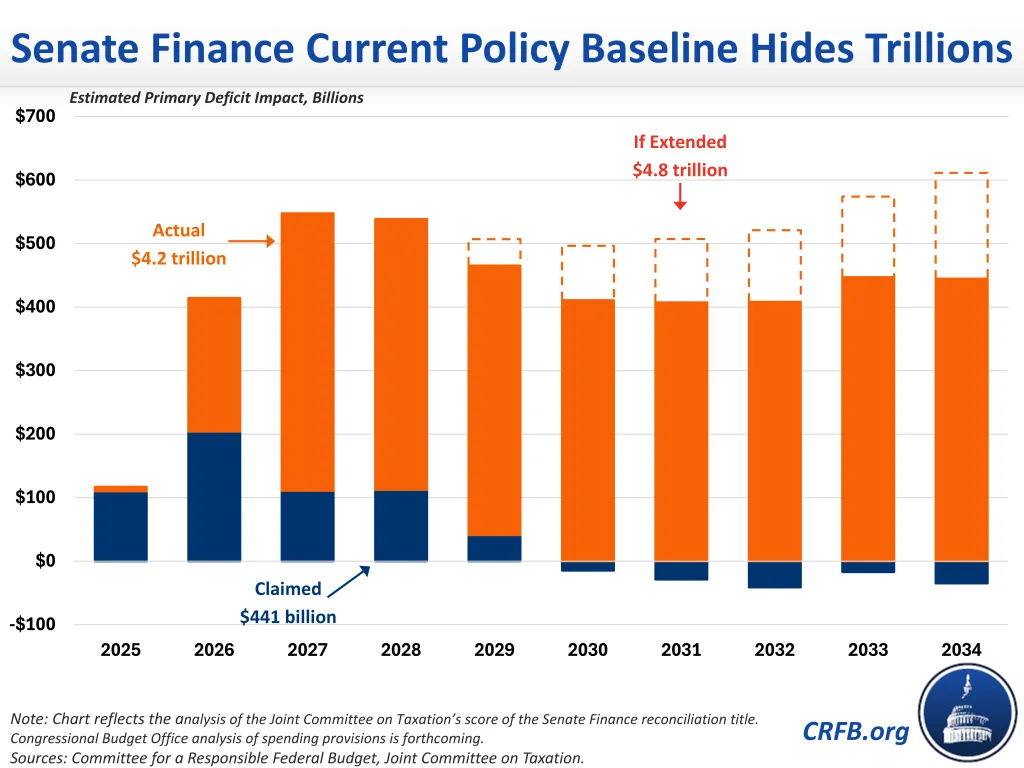

Last week, the Senate Finance Committee released its proposals for the One Big Beautiful Bill Act (OBBBA) reconciliation package. The committee claims its tax proposals would add $441 billion to the deficit through 2034. However, this estimate is reached by relying on an egregious budget gimmick they describe as “current policy,” whereby lawmakers tell the scorekeeper to assume existing tax policies are already extended (but that new policies will not be extended). On a current law basis, we estimate the Senate-proposed tax cuts would increase deficits by $4.2 trillion – nearly $500 billion above the House’s equivalent proposals. That figure would rise to $4.8 trillion if temporary tax cuts in the bill were ultimately made permanent.

The core of the Senate bill is an extension and expansion of the individual portions of the 2017 Tax Cuts and Jobs Act (TCJA), most of which expire at the end of this year. Although the Senate Finance Committee claims these changes would reduce revenue by $308 billion through 2034, they would actually increase deficits by $3.6 trillion – and that figure could go up after negotiations over SALT relief. The Senate’s extension of TCJA’s individual provisions is somewhat less expensive than the House’s $3.9 trillion – and there is an even bigger difference on a permanent basis ($3.6 versus $4.1 trillion), since the Senate includes permanent expansions of the Child Tax Credit and standard deduction and the House includes only temporary expansions.

Reviving business tax parameters in effect in 2021 – including 100 percent bonus depreciation for equipment and expensing for research – would reduce revenue by nearly $800 billion. This is roughly twice as much as claimed, and three times as much as in the House. However, the Senate provisions are mostly permanent while the House provisions are largely temporary; they have a similar cost on a permanent basis.

Senate vs. House Reconciliation Tax Provisions (in billions)

| Provision | Deficit Increase (-) / Decrease (FY2025-FY2034) |

|

|---|---|---|

| Senate | House Equivalent | |

| Extend & Expand Rate Cuts | -$2,203 | -$2,177 |

| Extend AMT Repeal for Most Taxpayers | -$1,369 | -$1,304 |

| Extend & Expand Standard Deduction Hike | -$1,385 | -$1,308* |

| Repeal Personal and Dependent Exemption | $1,900 | $1,870 |

| Extend & Expand Child Tax Credit Increase | -$817 | -$797* |

| Extend & Expand 199A Pass-Through Deduction | -$737 | -$820 |

| Extend TCJA Deduction Changes (modifications below) | $1,086 | $1,086+ |

| Limit SALT Workaround and Other Deduction Changes (higher SALT cap in House) | $33 | -$279+ |

| Limit Value of Itemized Deductions to 35% Rate | $34 | $41 |

| Limit Deductibility of Business Losses | $26 | $26 |

| Extend & Expand Estate Tax Cut | -$212 | -$212 |

| Subtotal, Extend & Expand TCJA Individual Provisions | -$3,644 | -$3,874 |

| Revive 100% Bonus Depreciation for equipment (through 2029 in House) | -$363 | -$37* |

| Revive Domestic R&E Expensing (through 2029 in House) | -$141 | -$23* |

| Revive Looser Interest Limit (through 2029 in House) | -$61 | -$40* |

| Extend and Modify International Tax Rates and Rules | -$216 | -$165 |

| Extend & Expand Opportunity Zones through 2033 | -$7* | -$5* |

| Subtotal, Revive TCJA Business Provisions | -$788 | -$270 |

| Cut Taxes on Tips through 2028 | -$31* | -$40* |

| Cut Taxes on Overtime through 2028 | -$89* | -$124* |

| Increase Senior Standard Deduction through 2028 | -$91* | -$66* |

| Establish Deduction for Car Loan Interest through 2028 | -$31* | -$58* |

| Establish "Trump Accounts" and Contribute through 2028 | -$17* | -$17* |

| Offer Non-Itemizer Charitable Deduction (through 2028 in House) | -$74 | -$7* |

| Create Scholarship Tax Credit | -$26 | -$20 |

| Other Individual Tax Cuts | -$51 | -$64 |

| Subtotal, New Individual Tax Cuts | -$410 | -$396 |

| Allow Expensing of Factories through 2028 | -$141* | -$148* |

| Extend and Reform Clean Fuel Tax Credit | -$57* | -$45* |

| Other Business and Related Tax Cuts | -$78 | -$74 |

| Subtotal, New Business Tax Cuts | -$276 | -$267 |

| Repeal EV Tax Credits | $194 | $191 |

| Phase Out Energy Investment, Production, and Manufacturing Credits | $251 | $249 |

| Repeal or Reform other IRA Credits | $92 | $131 |

| Subtotal, Repeal and Reform IRA Credits | $537 | $571 |

| Affordable Care Act (ACA) Reforms | $187 | $245 |

| Impose Floor on Charitable Deduction | $81 | $17 |

| Foreign Corporate Retaliation Tax | $52 | $116 |

| Expand Executive Compensation Deduction Limit | $20 | $20 |

| EITC Reforms | $15 | $15 |

| Increase College Endowment Tax | $4 | $23 |

| Impose Remittance Excise Tax | $1 | $26 |

| Other Revenue Provisions | $17 | $74 |

| Subtotal, Other Revenue Increases and Tax Credit Reductions | $377 | $536 |

| TOTAL | -$4,202 | -$3,700 |

| Memo: Total if Made Permanent | -$4.8 trillion | -$5.2 trillion |

Sources: CRFB estimates based on data from the Joint Committee on Taxation and the Congressional Budget Office.

Note: individual provisions are calculated by adding a current policy adjustment to the current policy score, and thus include some interactions with provisions stacked before and after. Figures may not sum due to rounding.

* Enacted on a temporary basis in part or in full.

+ CRFB estimate based on JCT numbers.

Other tax cuts in the Senate bill – including tax cuts for tipped income, overtime, auto loan interest, and factory investment – would add nearly $700 billion to the debt. That’s only marginally higher than the Senate claims or than the House proposals. Compared to the House, the Senate generally has more limitations on most of these tax breaks, though it increases the senior standard deduction by $6,000 per person instead of by $4,000.

On the revenue generating side, repealing and reforming credits from the Inflation Reduction Act (IRA) would result in $537 billion of revenue, compared to the House’s $571 billion. Affordable Care Act (ACA) changes in the Senate bill would save $187 billion compared with $245 billion in the House bill. Restrictions to the charitable deduction are tougher in the Senate bill than the House bill, raising $81 billion (compared to $17 billion) by applying a floor to individual itemizers as well as businesses. But other major revenue raisers, including the excise tax on remittance payments, the increase in the tax on college endowments, and the foreign corporate retaliation tax all raise less in the Senate bill than in the House bill ($57 billion compared to $165 billion). The remaining revenue increasing provisions would raise $52 billion, compared to $109 billion in the House bill.

While the Senate enacts more of its policies on a permanent basis than the House, it still relies on a number of arbitrary expirations to reduce its official cost. If made permanent, the Senate’s tax section would cost over $4.8 trillion instead of $4.2 trillion as written. By comparison, the House tax policies would cost $5.2 trillion if made permanent, compared with $3.7 trillion as written.

Though the Joint Committee on Taxation's (JCT) score of the Senate Finance Committee’s section is revealing, it is not a complete picture of the Senate bill. JCT did not estimate the budget effect of Medicaid savings under the Finance title, for example, nor does it include spending cuts and increases from other Senate committees. Knowing how those provisions affect the deficit impact of the bill will be critical to understanding the overall deficit impact, as will full Congressional Budget Office (CBO) scores for other committee sections.

The Senate should not vote on any legislation until they have a full CBO score, and they should ensure the final bill reduces rather than adds to the national debt.