The Case for Funding ACA Cost-Sharing Reductions

The House is scheduled to vote today on the Lower Health Care Premiums for All Americans Act. Among other provisions, the legislation requires the government to directly fund Cost-Sharing Reductions, or CSRs, for Affordable Care Act (ACA) insurance plans.

Currently, insurance plans on the ACA exchanges directly provide cost-sharing reductions (CSRs) to lower income beneficiaries and finance those CSRs through higher premiums that are subsidized by the federal government at a significant cost.

Were the government to instead directly fund CSRs – as it did in 2014 through 2017 – it would generate substantial savings and rationalize the system.

In this piece, we explain that directly funding CSRs would:

- Reduce deficits by at least $50 billion over a decade

- Reduce silver plan gross premiums by 10% to 20%

- Rationalize ACA subsidies, restoring subsidy schedules to their intended design

- Remove the perverse incentives that drive many enrollees away from silver plans and stifle state innovation

Funding CSRs should be part of a thoughtful plan to reduce deficits and/or enact fiscally responsible health policy.

What Are Cost-Sharing Reductions (CSRs)?

In establishing subsidized health insurance exchanges for those without employer coverage, the ACA created two major types of subsidies – premium subsides for those with income up to 400% of the federal poverty level (FPL), and cost-sharing reduction (CSR) subsidies for those with income up to 250% of FPL. Under these CSRs, insurance companies covered a large portion of out-of-pocket costs – including co-pays and deductibles – for lower-income beneficiaries.

Within the ACA exchange, a typical “silver plan” has an actuarial value of 70% – meaning the plan is intended to cover about 70% of costs for a typical enrollee, while the other 30% would come from the deductible, copays, and other cost sharing. With CSRs, the plan’s actuarial value rises to 94% for those below 150% of FPL, 87% for those between 150% and 200%, and 73% for those between 200% and 250% – meaning expected cost sharing is at little as 6% of plan costs for the lowest-income enrollees.

CSRs Are Currently Funded Through “Silver Loading”

CSR subsidies are offered by insurers in the form of lower cost sharing, and these insurers were originally reimbursed directly by the federal government. However, due to a drafting error, it is not clear these reimbursements were ever legally appropriated; after legal challenges, in 2017 the Department of Health and Human Services stopped paying insurance companies for their CSRs.

As the law still requires insurers to make CSRs available to enrollees, insurers adopted a practice called “silver loading” in which they incorporate the cost of paying CSRs into premiums for silver-tier plans. Because ACA subsidies are calculated based on silver premiums, increasing the premiums for these plans also increased the subsidies paid by the government for all plans.

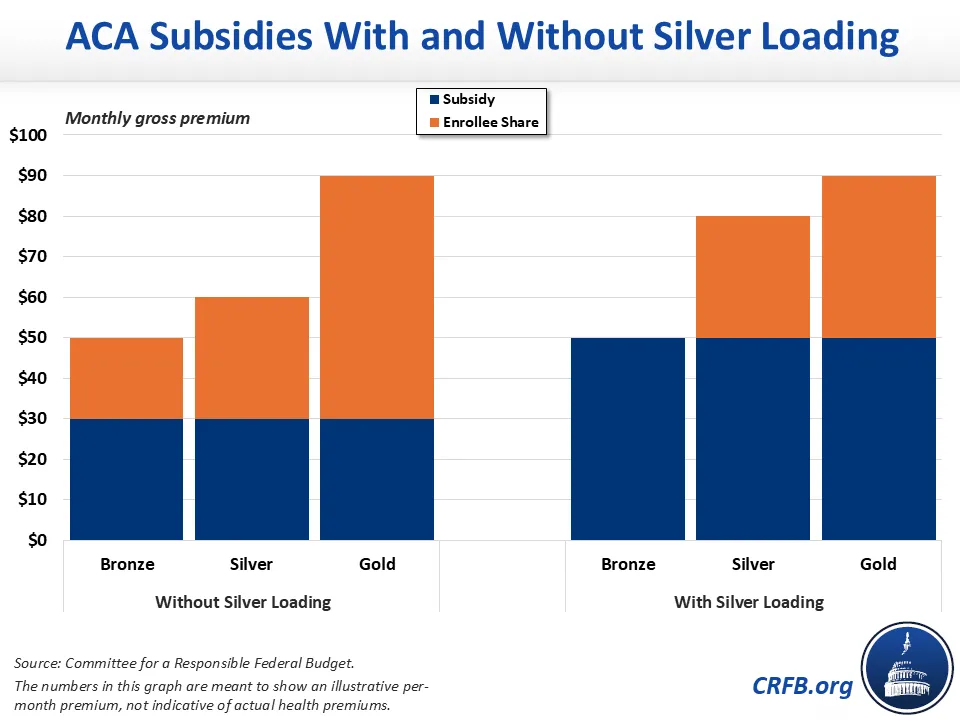

The graph below illustrates how silver loading affects premiums. Importantly, subsidies are set to limit the enrollee premium for the second lowest-cost silver plan to a fixed percentage of their income. Once the subsidy is set, it can be used to purchase any plan – with the beneficiary enjoying all the savings or facing all the costs associated with deviating from the second lowest-cost silver plan.

Before silver loading, in the illustrative example below, the subsidy would cover about half of the cost of a silver plan, three-fifths of the cost of a cheaper bronze-level plan, and one-third the cost of a more expensive gold plan.

“Silver loading” increases the gross cost of silver plans but not bronze or gold plans. And when the cost of the silver plan goes up, so too does the subsidy. As a result, the same subsidy that would have covered most of the cost of a bronze plan would be large enough to cover the full cost, and the same subsidy that covered only a third of a gold plan would instead cover over half of the costs.

Silver loading has little net impact on individuals making below 200% of FPL in terms of their premiums or cost sharing, but by increasing benchmark premiums and subsidies, it effectively boosts subsidies for those above 200% of FPL – including subsidized enrollees well over 400% of FPL under the enhanced subsidies. Unsubsidized enrollees – including everyone above 400% of FPL under the original ACA subsidy schedule scheduled to return next year – can also sometimes face higher premiums that effectively subsidize those benefitting from CSRs.

Directly Funding CSRs Saves Federal Money and Reduces Premiums

Directly funding CSRs would end the practice of silver loading, which would in turn reduce silver plan premiums, reducing federal subsidies and thus reducing deficits.

Available estimates suggest that, on average, gross premiums could fall by 10% to 20%. This would lead to significantly lower costs for those in unsubsidized silver plans on the exchange.

With the reduction in silver premiums, the cost of federal subsidies would also decrease, reducing federal spending and deficits. In the Lower Health Care Premiums for All Americans Act, the Congressional Budget Office (CBO) found that funding CSR payments would reduce the deficit by $37 billion, despite not applying to states who continued to provide abortion coverage (which CBO estimated would cover roughly 25% of exchange enrollees). If CSR funding was applied to all states, we estimate that the savings could be over $50 billion.

| CSR Funding Scenario | 2026-2035 Savings |

|---|---|

| Fund CSRs for plans that don't cover abortion | $35 billion |

| Fund CSRs for all plans | $50 billion |

| Fund CSRs for all plans, assuming enhanced subsidies | $60 billion* |

*We estimate that extending enhanced subsidies and funding CSRs together would cost about $290 billion over a decade, compared to $350 billion from extending the enhanced subsidies alone. Figures are rounded to the nearest $5 billion.

Funding CSRs would save even more relative to the enhanced subsidies – perhaps over $60 billion over a decade.1 Savings are higher both because the enhanced subsidies are more costly and because they extend higher up the income ladder. On net, extending the subsidies – even with CSR funding – would still add significantly to the debt.

Funding CSRs Reduces Distortions and Rationalizes the Marketplaces

Silver loading distorts the ACA subsidies writ large. Instead of CSRs only subsidizing lower-income enrollees, as intended, CSRs-turned-silver loading has resulted in ACA subsidies generous enough to significantly reduce enrollees’ costs for all plan tiers. Among other effects, this encourages enrollees above 200% to move into non-silver plans, even if they aren’t the best plans for them.

This movement into non-silver plans reflects a distortion of the marketplaces. Some of this movement consists of people moving into bronze plans who would otherwise want the cost-sharing protection of a 70% actuarial value silver plan. These individuals might be worse off on net with the lower premium bronze plan due to the increased out-of-pocket exposure they now face. Because the higher subsidies from silver loading leads to many “zero-premium” bronze plans that may be easy to enroll in despite their low value, some enrollees might be much worse off.

Other people might only need the coverage of a silver plan but choose a gold plan at its now lower cost. These individuals might pay more in combined premiums and cost sharing than is necessary, and the increase in the purchase of gold plans may even induce higher costs to the health care system from increased utilization.

Overall, silver loading causes the marketplaces to less accurately reflect consumers’ true health and financial needs. Funding CRSs would end silver loading, leading enrollment to better reflect enrollee preferences and restore the subsidy schedule to what Congress originally intended.

In addition to making the marketplaces more efficient, the reduction in premiums from ending silver loading might reduce the pressure to expand the subsidies to reach people with higher incomes. As mentioned above, under the original ACA subsidy schedule, unsubsidized enrollees with higher incomes effectively face higher premiums under silver loading, increasing the premiums they pay. By funding CSRs and ending silver loading, their costs will decrease, making unsubsidized premiums more affordable.

Finally, funding CSRs would restore incentives for experimentation at the state level. Under the ACA, states can pursue certain alternatives to traditional subsidies and be reimbursed at 95% of what the federal government would have otherwise paid. These alternatives can represent win-wins if states can achieve lower costs and the federal government can reduce its reimbursement. However, as Matt Fiedler at Brookings has pointed out, the option for silver loading creates a disincentive for states to pursue options like offering a Basic Health Plan (BHP).

Congress Should Fund CSRs

Funding CSRs is not a partisan issue. Over the years, policymakers from both parties have sought to fund CSRs. The Obama Administration intended for CSRs to be funded from the beginning and fought in court to keep them funded. In 2017, once it became clear that CSRs would not be funded without Congressional action, Senators Lamar Alexander (R-TN) and Patty Murray (D-WA) joined together to introduce legislation to fund CSRs alongside other reforms to the ACA. The House Problem Solvers Caucus, a group of 40 Democratic and Republican representatives, also introduced companion legislation at the time. More recently, Congressional Republicans have proposed multiple ACA reform proposals with CSR funding – and the Trump Administration was also reported to have supported funding CSRs in an ACA reform proposal that did not become public. Outside health experts on the left and right have also supported funding CSRs at various times.

As Americans face rising health care costs and growing deficits, funding CSRs represents a wise first step to address these affordability challenges.

Funding CSRs will allow the individual market to function more efficiently and reduce the price of unsubsidized health insurance premiums. With CSR funding, the exchanges would better reflect enrollee preferences and incentives for state-level innovation would be restored. Most importantly, funding CSRs would reduce budget deficits or generate savings that could serve as much-needed offsets.

Regardless of how Congress decides to address the expiration of the enhanced ACA subsidies, they should directly fund CSRs and end silver loading once and for all.

[1] CRFB calculation based on CBO’s budget and enhanced subsidy projections. Overall, ACA costs would be roughly at least 25% higher than current law, therefore at least 25% additional savings.