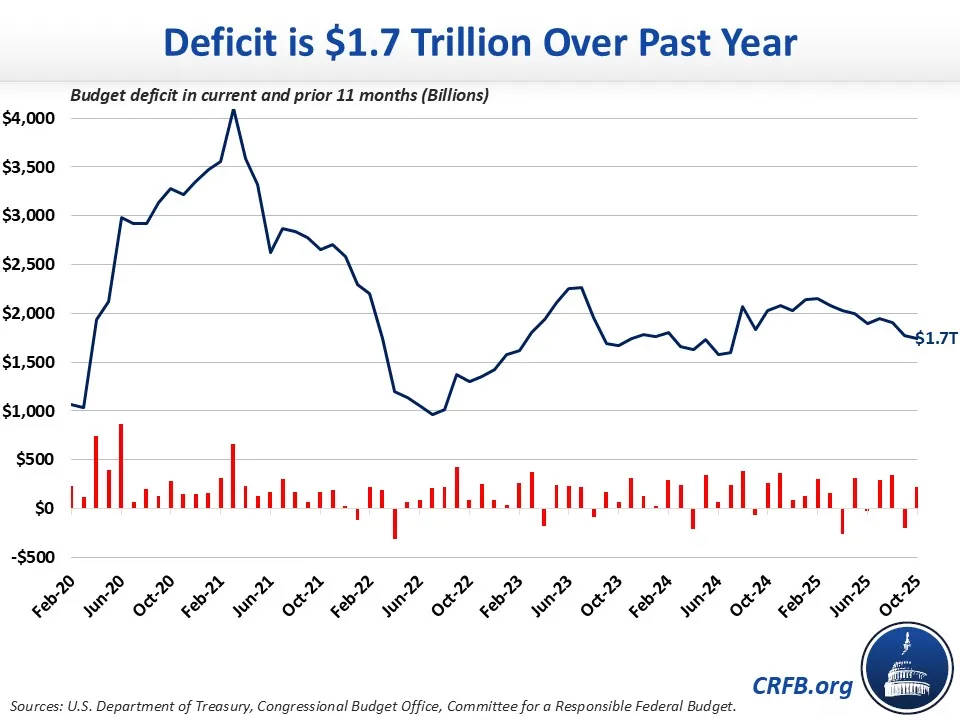

12-Month Deficit Totals $1.7 Trillion, Debt Approaches 100% of GDP

The federal budget deficit totaled $1.74 trillion between November 2024 and October 2025 according to estimates from the Congressional Budget Office (CBO). The rolling deficit is $38 billion lower than the Fiscal Year (FY) 2025 deficit of $1.78 trillion. CBO also estimated that deficits for FY 2025 totaled 5.9% of Gross Domestic Product (GDP) and debt reached 99.8% of GDP.

The deficit in October was $219 billion, according to CBO. Revenues in October totaled $402 billion, while outlays totaled $621 billion. Spending would have been roughly $107 billion lower if not for timing shifts, pushing payments that would have been made on Saturday, November 1 into October.

Over the past 12 months, total nominal spending was $7.0 trillion, compared to $6.8 trillion over the same period in the prior year. Nominal revenue was $5.3 trillion over the past 12 months compared to $4.8 trillion the same period prior.

CBO's report also provided more insight into the $1.8 trillion deficit reported in FY 2025.

Revenue collection increased by $317 billion (6%) from FY 2024 to FY 2025, reaching $5.2 trillion. Of the increase, $230 billion came from individual income taxes, $39 billion from payroll taxes, and $118 billion from tariffs. Corporate tax revenue fell by $78 billion.

Meanwhile, federal spending increased by $275 billion (4%), or $203 billion accounting for timing shifts, in FY 2025 to $7.0 trillion. Accounting for the timing shifts, $121 billion of the increase in FY 2025 came from Social Security, $77 billion from Medicare, $51 billion from Medicaid, and $79 billion from net interest -- each grew by about 8% from FY 2024. Spending on education fell by $233 billion, driven mainly by one-time savings recorded for the federal student loan program due to reforms from the One Big Beautiful Bill Act. The Small Business Administration also decreased spending by $32 billion because it did not log an increase in the cost of outstanding loans as it had in 20924, and the Federal Deposit Insurance Corporation (FDIC) decreased spending by $68 billion since the FDIC spent a net $37 billion to rescue banks in 2024 and recovered a net $26 billion of that in 2025. Other areas of spending grew by $208 billion, with the largest increases at Department of Veterans Affairs ($40 billion, 12%), Department of Defense ($37 billion, 4%), the Department of Homeland Security ($26 billion, 29%), and spending on certain refundable tax credits ($26 billion, 13%).

As a share of the economy, revenue totaled 17.3% of GDP in FY 2025, up from 17.0% in FY 2024 and in line with the 50-year average. Spending totaled 23.1% of GDP, down from 23.3% in FY 2024 but above the 50-year average of 21.2%. As a share of the economy, the FY 2025 deficit totaled 5.9%, which is more than 1.5 times the 50-year historical average and nearly double the 3% deficit target needed to stabilize the national debt.

As the gap between spending and revenue remains far apart, debt also continues to rise. CBO estimates that debt held by the public increased from 97.4% of GDP in FY 2024 to 99.8% of GDP in FY 2025. This is about twice the historic average of roughly 51% over the past 50 years. Debt as a share of GDP has grown 21 percentage points in six years and is projected to grow another 20 percentage points over the next decade.

Lawmakers should commit to reducing annual budget deficits to 3% of GDP and putting debt on a downward path relative to the economy. To achieve this, policymakers should offset any new spending or revenue twice over, pursue trust fund solutions to restore solvency to Social Security, Medicare, and highways, lower health care costs, and enact a combination of additional revenue and spending changes as needed.