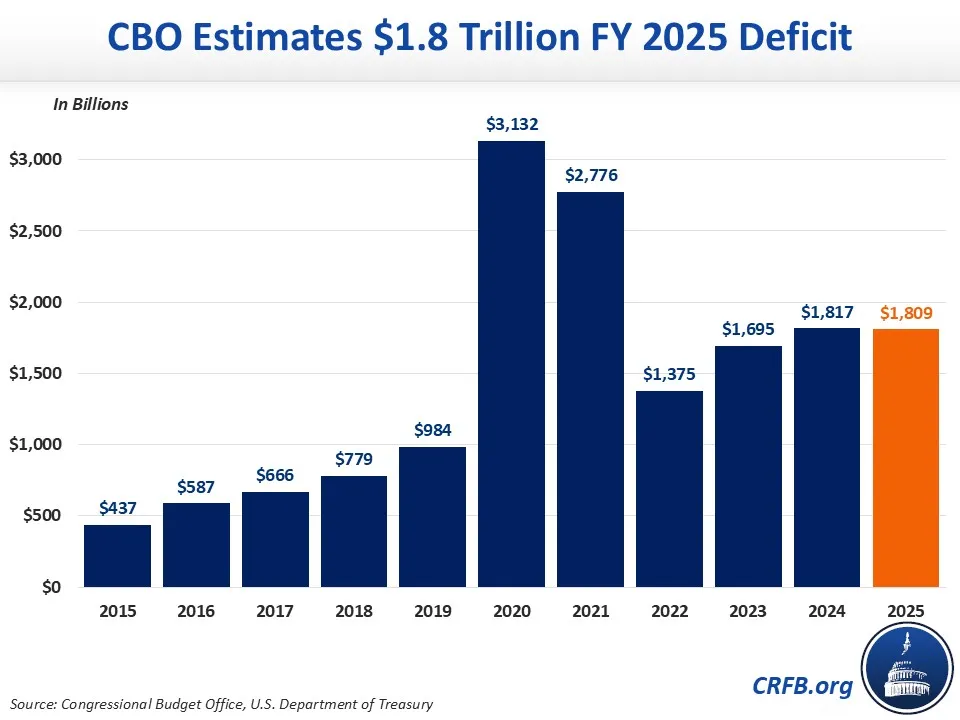

CBO Estimates 2025 Deficit Totaled $1.8 Trillion

The federal budget deficit totaled $1.8 trillion in Fiscal Year (FY) 2025, based on estimates from the Congressional Budget Office (CBO), roughly matching last year’s deficit. Adjusted for timing shifts related to certain days falling on weekends, the deficit declined by $80 billion from last year. But also removing one-time changes to the reported value of the student loan and SBA loan portfolios, the deficit would be roughly $135 billion larger.

We estimate deficits totaled 6.0 percent of Gross Domestic Product (GDP) in 2025, compared to 6.3 percent in 2024.

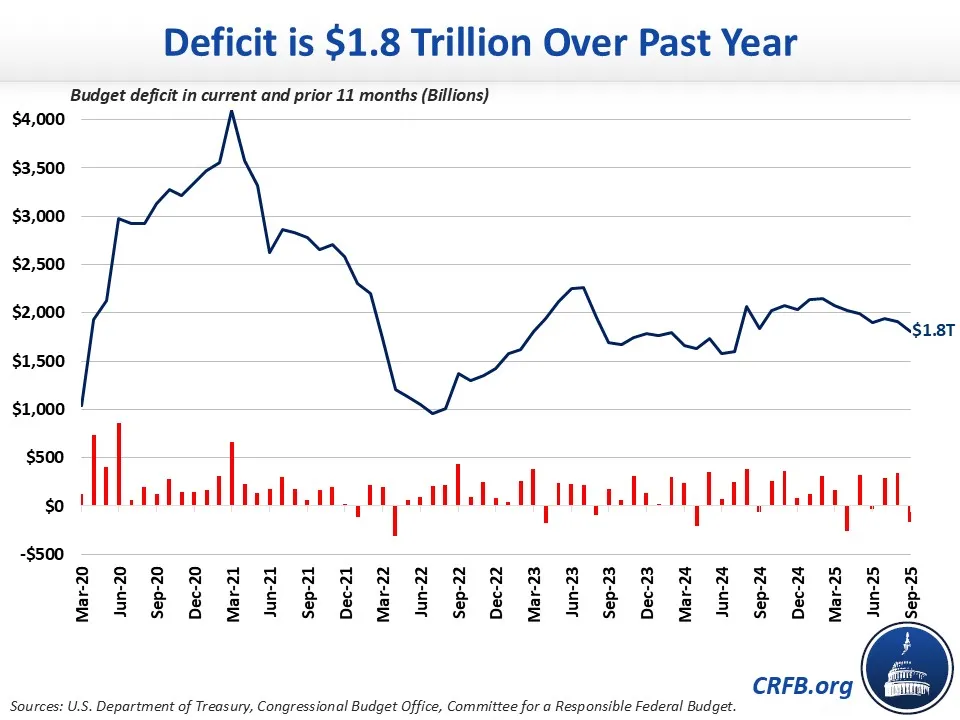

In recent months, the rolling 12-month deficit has been falling some, from a peak of $2.2 trillion in February to $1.9 trillion through the end of August and $1.8 trillion by the end of the fiscal year. This drop can be explained by revaluations of the present value of government loan portfolios, both due to policy changes and re-estimated.

CBO estimates revenues totaled $5.2 trillion in FY 2025, an increase of 6 percent from FY 2024. Outlays totaled $7.0 trillion, or 4 percent more than last year.

The bulk of the increase in revenues from 2024 to 2025 came from individual income and payroll taxes, which rose $260 billion (6 percent). This includes $185 billion from withheld taxes and $95 billion from April and quarterly tax payments, partially offset by a $26 billion boost in refunds.

Customs duties also rose substantially – by $118 billion or 153 percent – due to the tariffs imposed by the Trump Administration over the last nine months. Meanwhile, corporate income tax receipts fell by $77 billion (15 percent) from last year due to a combination of the tax cuts enacted by the One Big Beautiful Bill Act (OBBBA) in July, as well as timing shifts.

On the spending side, Social Security, Medicare, Medicaid, and interest each grew by 8 percent. Specifically, Social Security costs grew by $121 billion, Medicare by $117 billion ($72 billion after timing shifts), Medicaid by $52 billion, and interest by $80 billion. Other significant spending increases came from the Departments of Veterans Affairs ($41 billion), Defense ($38 billion), and Agriculture ($28 billion).

Growth in the health and retirement programs was driven both by rising per capita costs and the growing number of beneficiaries. In the case of Social Security, retroactive payments from the repeal of WEP/GPO also boosted costs. Growth in interest spending was due to the combination of higher interest rates and higher debt – and in 2025 interest costs surpassed $1 trillion for the first time.

Several areas of spending also fell in 2025, though this reduction is almost entirely due to accounting quirks and one-time policies rather than structural spending reductions. For example, Education spending fell by $234 billion from 2024 to 2025, driven by a $180 billion reduction in the present value cost of the government’s student loan portfolio – with $131 billion due to reforms from OBBBA – along with $42 billion due to the expiration of the COVID-era Education Stabilization Fund. Similarly, the present value cost of Small Business Administration loans was boosted by $33 billion in 2024, resulting in lower spending for 2025. And finally, the Federal Deposit Insurance Corporation (FDIC) spending dropped by $63 billion since the FDIC spent a net $37 billion to rescue banks in 2024 and recovered a net $26 billion in 2025.

As a share of the economy, we estimate spending totaled 23.3 percent of GDP, same as FY 2024. We estimate revenue totaled 17.3 percent of GDP, compared to 17.0 percent last year. Deficits totaled about 6.0 percent of GDP, compared to 6.3 percent in FY 2024. Absent some of the one-time accounting issues mentioned above, deficits would have been relatively stable.

Although tariffs are continuing to bring in more revenue, deficits remained high in 2025 and are likely to continue to grow in the coming decade. We recently estimated that deficits will grow to $2.2 trillion by 2028 and $2.6 trillion by 2035 under current law. Policymakers should work to reduce this borrowing and put the national debt on a more sustainable trajectory.