Trillion-Dollar Interest Payments Are the New Norm

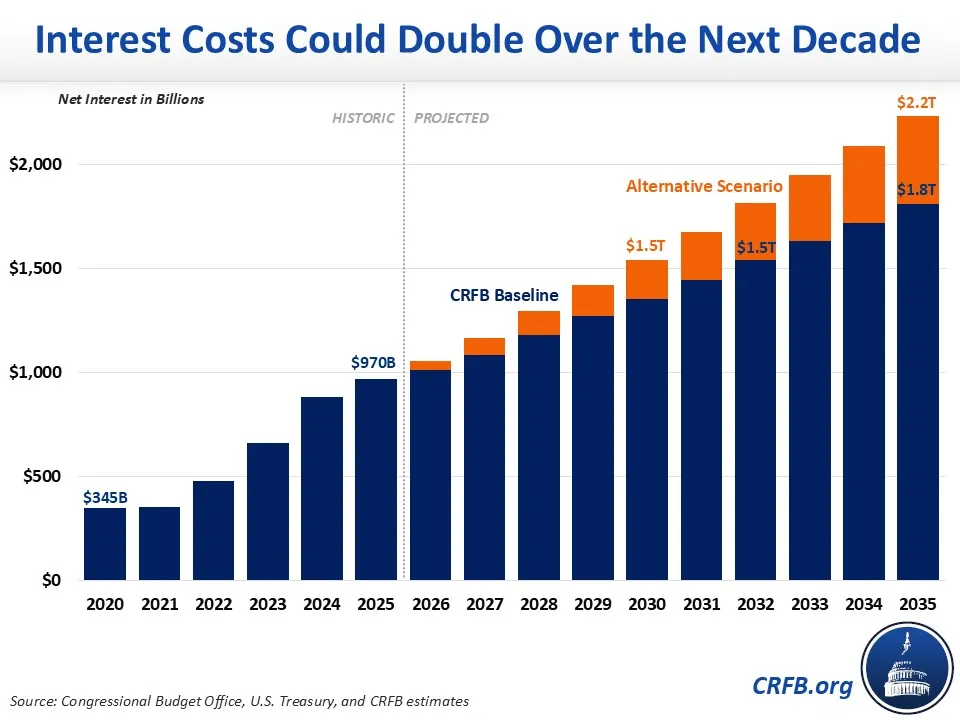

As the national debt continues to climb toward record levels – totaling 100% of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2025 – interest on the national debt has also risen significantly. Just five years ago, in FY 2020, net interest totaled $345 billion; in FY 2025, it totaled $970 billion – nearly three times as large.

While net interest, a specific line in the federal budget that groups together all federal interest payments on publicly-held debt, along with interest payments and receipts for federal credit programs, totaled $970 billion, the Congressional Budget Office (CBO) notes that spending for net interest payments on the public debt surpassed $1 trillion for the first time in FY 2025. Over the coming decade, we project that these figures will only rise, with interest payments surpassing $1.5 trillion in 2032 and $1.8 trillion in 2035.

Under an alternative scenario where the Supreme Court finds many of the Trump Administration’s tariffs illegal, temporary provisions in the One Big Beautiful Bill Act are made permanent without offsets, and yields on Treasury notes and bonds remain higher than CBO’s January 2025 projections, we estimate that interest payments could reach $1.5 trillion in 2030, pass $2.0 trillion in 2034, and ultimately end the decade at $2.2 trillion in 2035.

Our high and rising national debt is largely to blame for these high interest payments. As we continue on course to borrow $2 trillion a year over the next decade, interest payments will rise along with that borrowing. In order to get rising interest costs under control and prevent them from squeezing out other parts of the budget, policymakers should work on a plan to put our national debt on a downward, sustainable path.