Better Budget Process Initiative: Automatic CRs Can Improve the Appropriations Process

A government shutdown could occur at the end of this month. This year’s appropriations process is at a standstill, and disagreement over further economic relief and other issues may derail even a “clean” continuing resolution (CR) extending current funding.

Unfortunately this end-of-fiscal-year impasse is not unusual. Congress has only passed all appropriations bills on time 3 of the last 44 fiscal years. And in several instances – most recently between December 22, 2018, and January 25, 2019 – failure to reach agreement has resulted in a full or partial government shutdown.

Fortunately, we can avoid such disruptions. In the wake of the U.S. government’s most recent shutdown, bipartisan support surged for legislation to provide for automatic continuing resolutions (auto-CRs). Under current law, if Congress fails to pass new appropriations bills or a CR before the prior funding expires, parts of the government cease operations. Auto-CRs ensure that funding for programs will continue, thereby preventing such government shutdowns.

Shutdowns impose unnecessary costs on the public, on federal workers, and on Congress. They are also unnecessary. Many state governments have auto-CRs. States continue to enact appropriations nonetheless, and they reap the benefits of a more coherent process. Auto-CRs have the potential to improve Congress as an institution while producing tangible policy benefits.

Despite some concerns, the benefits are likely to outweigh the risks. Auto-CRs would probably have minimal influence on total spending levels and are highly unlikely to continue at length. Moreover, policymakers have tools to mitigate potential disincentives to do regular appropriations. Adopting auto-CRs is one of several important improvements to the budget process that Congress should consider.

The Cost of Government Shutdowns

Government shutdowns are a relatively new phenomenon. For most of American history, agencies and administrations continued their normal operations during funding lapses, under the assumption that funds would soon come.

That changed in 1980, when Attorney General Benjamin Civiletti produced an opinion interpreting the Anti-Deficiency Act of 1870 as barring agencies from obligating funds once appropriations expired. This opinion became the legal basis for modern shutdowns. Under this interpretation, affected agencies must cease most unobligated spending and furlough most employees when appropriations bills expire. Workers deemed essential keep working – but neither they nor furloughed employees are paid unless and until Congress chose to compensate them after the fact (which it always did).

Since then, the federal government has partially or fully shut down 20 times, including 4 true shutdowns and another 16 shutdowns over weekends. The longest shutdown began at the beginning of the day of December 22, 2018, and lasted 35 days until January 25, 2019. It was the first time that a shutdown began during one Congress and ended in another.

Shutdowns are highly disruptive. Tax dollars pay federal workers to stay home and agencies to plan for and execute shutdowns rather than pursuing core missions. They reduce economic output. They increase hardship and uncertainty for furloughed federal workers. They increase backlogs and reduce government services like permit approvals, and they contribute to the perception and reality of government dysfunction.

Even the partial shutdown in 2018 and 2019 – which furloughed 300,000 out of 2.1 million civilian workers – came with a significant cost. According to estimates from the Congressional Budget Office (CBO), the shutdown delayed compensation for 800,000 workers, reduced GDP through March 2019 by $11 billion, and reduced total GDP by $3 billion, even after delayed payments were processed. CBO estimated that it increased deficits slightly by reducing collected fees and limiting the government’s opportunity to undertake audits and reduce fraud.

Proposals to End Shutdowns

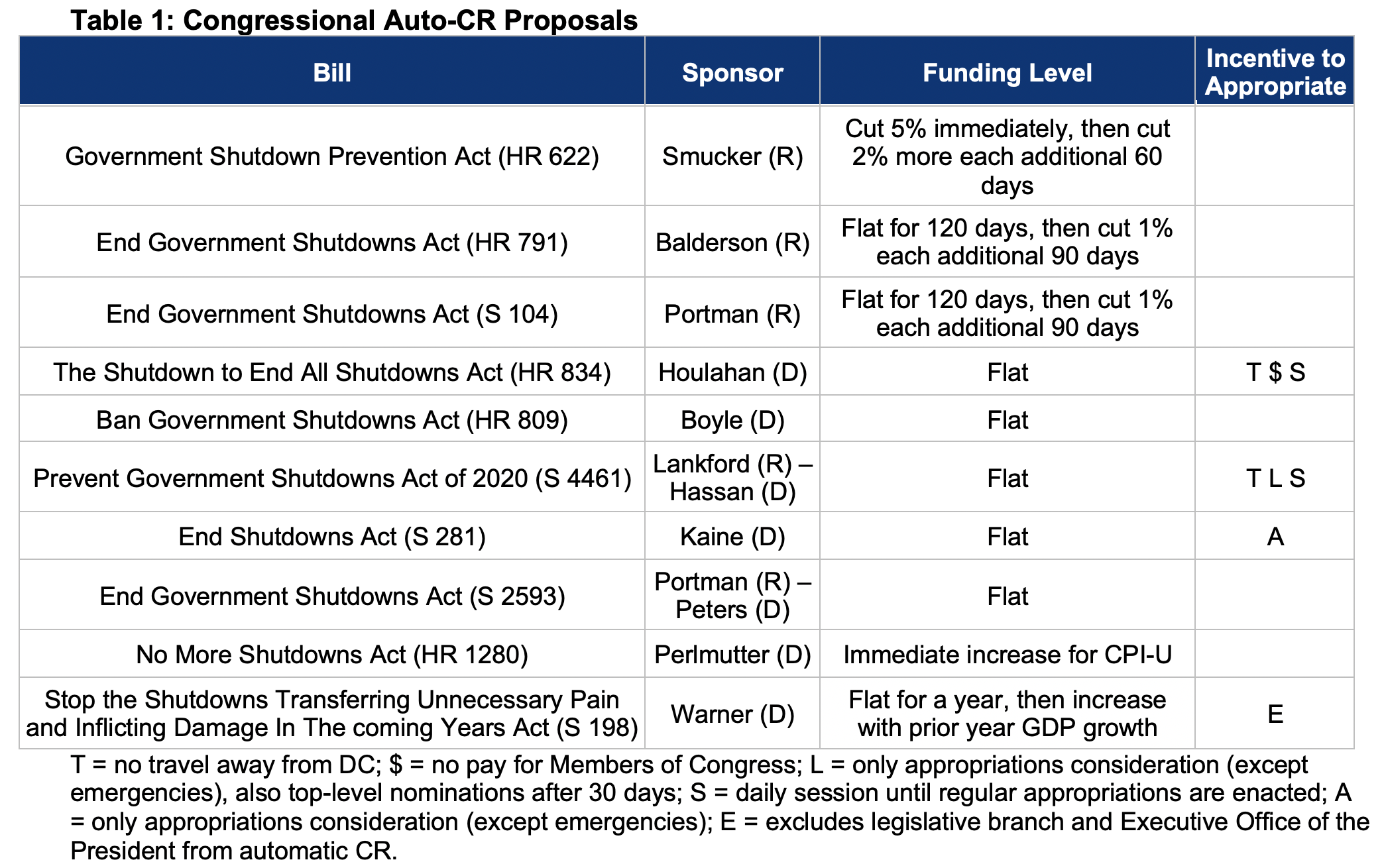

Auto-CR legislation has attracted broad bipartisan support across numerous proposals. All would continue to fund programs at levels close to those provided in prior appropriations acts. Some would reduce or increase spending rates when previous spending expires or after a specified amount of time, and others would simply extend the same nominal spending rates.

Some proposals would only extend spending, while others include additional incentives for Congress to pursue appropriations. They include restricting member travel, requiring daily votes, putting member pay in escrow, and restricting legislative business to regular appropriations legislation, among other options.

Last year, the Senate Committee on Homeland Security and Governmental Affairs reported the Lankford-Hassan Prevent Government Shutdowns Act (S. 1877, the precursor to S. 4461) by a vote of 10-2. The two members voting “no” each have their own auto-CR legislation.

Learning from Other Approaches

Shutdowns in other countries are exceedingly rare. In many, the elected governments would fall and face elections if they failed to pass budgets. For better or worse, the political stakes of budgeting are not as high in the United States, so another approach is needed.

U.S. state political institutions are more similar to the federal government’s structure. No state has a parliamentary system, each has an independently elected governor, and every state except Nebraska has a bicameral legislature.

Twenty states avoid shutdowns entirely or in part because of auto-CRs. Of those, 13 have relatively comprehensive auto-CRs to preserve spending programs while policymakers finalize regular budget and appropriations legislation. The National Association of State Budget Officers provides more details here on pages 71 through 74.

States with auto-CRs continue to appropriate. Final spending packages are sometimes delayed, but the delay rates are similar between auto-CR and shutdown states. In 2018, for example, 13 states needed extra time to pass budgets and appropriations, but they all ultimately did. Of the tardy states, five of the 20 with auto-CRs (25 percent) took extra time while eight of 30 that risk shutdowns (27 percent) did. Auto-CR states, however, avoid the lost productivity, brinkmanship, and other disruptions from preparing for or experiencing a shutdown.

The federal government, on the other hand, has operated under CRs an average of five months per year since 1997, sometimes covering an entire fiscal year.

Auto-CRs Improve Policy Outcomes and Governance

Auto-CRs have clear policy benefits. They avoid the resource waste involved in planning for shutdowns and furloughs, maintain government services, and reduce backlogs.

Auto-CRs could improve spending efficiency. Federal agencies often must delay signing contracts until spending is finalized in a December appropriations package, but then they are rushed to spend in less than a full fiscal year. Short-term CRs inhibit efficient contracting due to the Anti-Deficiency Act, but an auto-CR lets agencies move forward at the start of the fiscal year.

Auto-CRs could facilitate “new starts” as well—purchases not funded in the prior period—if appropriations language made such an allowance. The new starts challenge is most pronounced in defense policy due to the need for timely deployment of updated systems.

Perhaps more important than the direct benefits, auto-CRs can improve overall governance and strengthen Congress as an institution. Few members of Congress truly want to shut down broad areas of the government. Even so, some have attempted to use an imminent funding deadline to gain leverage for an ideologically-charged policy that lacks broad support.

The more frequent outcome is that leadership and top appropriators produce a package behind closed doors and force members on short notice into a binary choice: leadership’s deal or shutdown.

An auto-CR reduces the stakes. It alters the choice to one of status quo spending or the leadership deal (or, ideally, regular appropriations). This should encourage more consensus-based packages that solid majorities of Congress can support, which implies a more inclusive process with real floor deliberation and amendments. Auto-CRs could benefit leaders by alleviating resentment from other members over having to swallow negotiated deals at the last minute.

Shutdowns contribute to polarization. They foster unrealistic notions of procedural leverage and allow factions to derail appropriations. Many members feeling excluded from the process can erode trust. Knowing that leadership will produce the final package also encourages poison-pill amendments, to which leaders have reacted by further limiting amendments, which can antagonize members further.

Of course, other polarization-enhancing factors exist that an auto-CR would not address. Ideally, making the process for discretionary spending less contentious would give members of Congress more ability to focus on those other challenges.

Addressing Common Objections to Auto-CRs

Auto-CRs are by no means a silver bullet. But many concerns and criticisms of auto-CRs don’t stand up to scrutiny or can be addressed with smart design choices.

Claim: Congress won’t pass appropriations if funding continues automatically.

Reality: Even without the threat of a shutdown, members of Congress would have strong incentives to enact full appropriations bills. Otherwise they have little ability to designate new funding, support new initiatives, provide for changing national security needs, or shift funds from lower to higher priorities. At the state level, auto-CRs have little effect: states with auto-CRs pass budgets with comparable timing to shutdown states. Relieving Congress of the need to negotiate and enact short-term CRs may even make it easier for full appropriations to pass. Even so, many auto-CR bills (see Table 1) would create further rewards (and lift penalties) for enacting full appropriations bills to prevent or replace an auto-CR.

Claim: Auto-CRs would undermine the congressional power of the purse.

Reality: Auto-CRs do not prevent Congress from budgeting and appropriation. Rather, they reduce the high-stakes brinkmanship around discretionary spending. Concern about Congress’s lack of fiscal adjustment would be better targeted at the 70 percent of the budget (and an even larger share of tax expenditures) that is currently on auto-pilot. Auto-CRs could create space to focus on budgeting holistically, including reforming our broken budget process, as well as reauthorizing and reforming programs. In addition, the President’s role as the commander-in-chief of the armed forces gives the administration strong reasons to ensure that funding for defense priorities adjusts to changing security realities. Timely, regular appropriations are vital for maintaining a modern and well-resourced military capacity.

Claim: CBO scored an auto-CR as costing $12.6 trillion.

Reality: An auto-CR could change the classification of spending but would not significantly change the level of spending. As we have explained, CBO’s scoring rules require it to treat appropriations under an auto-CR as mandatory, and thus they estimate a $12.6 trillion increase in mandatory spending. However, this increase in mandatory spending would be accompanied by a similarly-sized reduction in discretionary spending. Depending on the level of the auto-CR, it could temporarily result in a slight increase or decrease in spending – in the billions, not trillions – but even that change would quickly be overtaken by congressional decision-making.

Claim: Auto-CRs would eliminate the only source of leverage members have.

Reality: Attempts to force ideologically-charged provisions through appropriations often backfire. When leaders or a block of members attempt to jam something through, other members tend to dig in their heels and fight back. Sometimes perceptions of procedural abuse polarize an issue far beyond actual policy differences. The existing appropriations process may be insufficiently inclusive, but other approaches to improving deliberation are possible.

Claim: The Constitution prohibits appropriating funds “to raise and support Armies ... for a longer term than two years.”

Reality: Auto-CR legislation is not intended or designed to provide for long-term spending; it is meant to reduce posturing and acrimony as policymakers finalize full appropriations. Even so, this constitutional issue could be addressed with a two-year limit on extensions of Army funding.

Conclusion

Automatic continuing resolutions would improve congressional procedures as well as public policy. They can help reduce brinkmanship and posturing around appropriations deadlines, reduce polarization both between and within parties, and allow more focus on institutional and structural policy challenges. Auto-CRs would reduce the waste from planning and implementing shutdowns, bring more predictability to federal contracting, and enable new starts to proceed on a rational timeline.

Crafting an auto-CR includes many design choices. Beyond the rate of growth – flat, negative, or positive – Congress would need to decide which additional incentives are appropriate to promote timely and responsible appropriations action.

It is well past time for Congress to end the turmoil from shutdown brinkmanship. The benefits of an automatic continuing resolution are substantial, and legitimate concerns are able to be addressed. Congress can and should end shutdowns for good.