The Cost of the Trump and Biden Campaign Plans

Whoever is inaugurated on January 20, 2021, will face many fiscal challenges over his term. Under current law, trillion-dollar annual budget deficits will become the new normal, even after the current public health emergency subsides. Meanwhile, the national debt is projected to exceed the post-World War II record high over the next four-year term and reach twice the size of the economy within 30 years. Four major trust funds are also headed for insolvency, including the Highway and Medicare Hospital Insurance trust funds, within the next presidential term.

The national debt was growing rapidly before the necessary borrowing to combat the COVID-19 crisis, and this trajectory will continue after the crisis ends. Fiscal irresponsibility prior to the pandemic worsened structural deficits that were already growing due to rising health and retirement costs and insufficient revenue.

The country’s large and growing national debt threatens to slow economic growth, constrain the choices available to future policymakers, and is ultimately unsustainable. Yet neither presidential candidate has a plan to address the growth in debt. In fact, we find both candidates’ plans are likely to increase the debt.

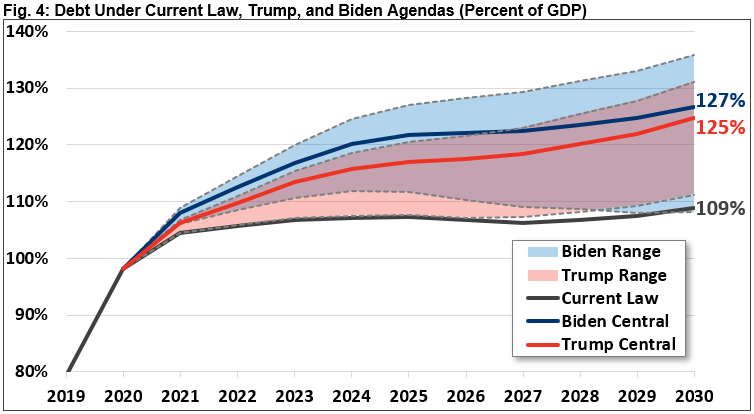

Under our central estimate, we find President Donald Trump’s campaign plan would increase the debt by $4.95 trillion over ten years and former Vice President Biden’s plan would increase the debt by $5.60 trillion. Debt would rise from 98 percent of Gross Domestic Product (GDP) today to 125 percent by 2030 under President Trump and 127 percent under Vice President Biden, compared to 109 percent under current law.

Based on our low-cost and high-cost estimates, Trump’s plan could increase the debt by between $700 billion and $6.85 trillion through 2030, while Biden’s plan could reduce debt by as much as $150 billion or increase it by as much as $8.30 trillion.

These estimates are based on our best understanding of the candidates’ proposals, assume policies are enacted immediately, and exclude any COVID-19 relief proposals.1

This paper is part of US Budget Watch 2020, a project focused on the fiscal and budgetary impact of proposals put forward in the 2020 presidential election. You can read our other analyses, explainers, and fact checks here. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including, but certainly not limited to, their approaches on deficits and debt.

What do the Candidates Propose and How Do the Numbers Add Up?

President Donald Trump has issued a 54 bullet point agenda that calls for lowering taxes, strengthening the military, increasing infrastructure spending, expanding spending on veterans and space travel, lowering drug prices, expanding school and health care choice, ending wars abroad, and reducing spending on immigrants. He also has proposed a “Platinum Plan” for black Americans, which increases spending on education and small businesses.

Meanwhile, Vice President Joe Biden has proposed a detailed agenda to increase spending on child care and education, health care, retirement, disability benefits, infrastructure, research, and climate change, while lowering the costs of prescription drugs, ending wars abroad, and increasing taxes on high-income households and corporations.

Under our central estimate, both plans would add substantially to the debt. Specifically, we find the Trump plan would add $4.95 trillion to the debt over the 2021 to 2030 budget window, while the Biden plan would add $5.60 trillion.

While these costs exclude the effects of spending to address the current pandemic and economic crisis, they include other one-time spending – such as infrastructure investment – that doesn’t add to deficits in future decades. Excluding these temporary policies, the Biden plan would cost $2.35 trillion and the Trump plan $2.45 trillion under our central estimate.

These findings come with a large degree of uncertainty, both because the estimates themselves vary and because the details of the candidates’ proposed policies are often unclear. This is especially true for the Trump campaign, whose agenda contains very little detail. Therefore, we generated low-cost, central, and high-cost estimates for each candidate.2

Under our low-cost estimate, which in many cases relies on campaign-provided figures, we estimate the Trump plan would increase deficits by $700 billion, while the Biden plan would reduce deficits by $150 billion.

Under our high-cost estimate, we find the Trump plan would increase deficits by $6.85 trillion, while Biden’s proposals would increase deficits by $8.30 trillion.

In terms of details, we estimate Biden would spend $2.70 trillion on child care and education, $2.05 trillion on health care, $1.15 trillion on Social Security, Supplemental Security Income (SSI), and retirement, and $4.45 trillion on infrastructure, environment, and other domestic spending under our central estimate. We also estimate that Biden’s defense and immigration policies would save $750 billion, while his tax policies would raise $4.30 trillion and interest costs would increase by $300 billion.

Meanwhile, we estimate Trump would increase spending on education and child care by $150 billion, increase infrastructure and other domestic spending by $2.70 trillion, and security and immigration enforcement spending by $300 billion under our central estimate. He would cut taxes by $1.70 trillion, reduce federal health spending by $150 billion, and leave Social Security and retirement spending unchanged. We estimate $250 billion of interest costs under the Trump agenda.

Because the Trump campaign’s 54 bullet points and platinum plan are relatively vague, we rely on the President’s budget proposals, previous statements, and more detailed proposals from others to interpret these bullets. By contrast, the Biden campaign website features 48 different plans, most of which include dozens of individual policy proposals that overlap in some cases. We identified more than 800 distinct proposals.

In both cases, considerable policy ambiguity exists. Our low-cost and high-cost estimates attempt to capture some degree of this uncertainty.

Under the candidates’ plans, debt will continue to grow over the next decade and beyond. Debt has already grown from 39 percent of the economy in 2008 to 76 percent in 2016, and is estimated to reach 98 percent by the end of FY2020. Under current law, the Congressional Budget Office (CBO) projects debt will continue to rise to 109 percent of GDP by 2030.

Our central estimate of the Trump plan finds debt would rise to 125 percent of the economy by 2030, excluding the effects of further COVID relief. Under our central estimate of the Biden plan, debt would rise to 127 percent of the economy by 2030, again excluding COVID proposals. For context, the standing historical record for debt is 106 percent of GDP, set just after World War II.

The actual debt impact from both campaign agendas could be higher or lower. Under our low-cost scenario, we estimate the Trump and Biden plans would result in debt of 111 percent and 108 percent of the economy in 2030, respectively, with debt declining modestly as a share of the economy after 2025 under the Biden plan. Under our high-cost scenario, debt would rise to 131 percent of the economy under the Trump proposals and 136 percent under the Biden proposals.

These estimates assume policies are implemented immediately, which leads them to overstate the potential debt impact relative to a more likely implementation timeline. On the other hand, these estimates exclude the cost of any further economic or public health spending related to the current crisis. A $3.00 trillion COVID relief package, for example, would increase debt by 10 percent of the economy in 2030. Our estimates also assume lawmakers follow the current law baseline outside of the candidates’ proposals, allowing several policies to expire or otherwise be more favorable in terms of deficit effect than they have been in recent years.

Donald Trump’s Second Term Agenda

President Donald Trump’s 2020 Presidential campaign has not released a formal policy agenda. Instead, it issued a set of bullet point principles and goals as part of a release entitled Trump Campaign Announces President Trump’s 2nd Term Agenda: Fighting For You! and an additional Platinum Plan to support the Black community.

Among the 54 bullet points in the core agenda, we identified 22 with a likely fiscal impact that are unrelated to the COVID crisis (we will be estimating the candidates’ COVID policies separately). We identified several additional policies with fiscal impact in the Platinum plan.

Our analysis exclusively aims to estimate policies outlined in these bullet points, though they provide insufficient detail to score (for example, one policy reads “Cut Taxes to Boost Take-Home Pay and Keep Jobs in America”). We therefore turn to the President’s budget proposals, speeches, and other policy proposals to determine the possible meaning of the bullet points.

Based on our assumptions of the campaign proposals, in our central estimate we find the Trump plan includes $5.45 trillion of spending increases and tax cuts, partially offset by $750 billion of savings. In our low-cost estimate, $2.50 trillion of spending increases and tax cuts are coupled with $1.85 trillion of savings. In our high-cost estimate, $7.15 trillion of spending increases and tax cuts are partially offset by $650 billion of savings.

Incorporating the cost of debt service, we estimate President Trump’s agenda would add between $700 billion and $6.85 trillion to the debt from 2021 through 2030, assuming immediate enactment. Under our central estimate, the agenda would add $4.95 trillion to the debt.

Importantly, this is not an analysis of the President’s budget, which President Trump has put forward every year as mandated by law. The latest budget was proposed in February and scored by CBO to reduce deficits by just over $2.00 trillion over a decade. However, most of the policies in the budget are not mentioned or alluded to on the Trump campaign website, nor on the campaign trail. Some are not even specified within the budget itself. Furthermore, our analysis does not include policies discussed by President Trump but not mentioned or referenced on the campaign website.

Child Care and Education

Overall, we estimate President Trump’s child care and education agenda would cost $50 to $200 billion over a decade, including $150 billion under our central estimates.

| Provide Universal School Choice | -$50 billion | -$50 billion | -$50 billion |

The Trump campaign has proposed providing school choice to every child in America, which presumably means allowing parents to use federal public education dollars to help cover private school tuition. While these funds could come from existing federal dollars, we assume this policy would include a proposal from the President’s FY 2021 budget proposal to offer an Education Freedom Scholarships tax credit. This credit would go to individuals and businesses who donate to organizations that provide scholarships for private K-12 education. Since the credit is capped at $5 billion per year, it would cost about $50 billion over ten years.

| Increase Child Care Credits and Access to Preschool | $0 | -$100 billion | -$150 billion |

As part of the Platinum Plan for Black Americans, the Trump campaign proposes to “increase childcare tax credits and provide greater access to quality preschool.” While the campaign does not provide any further detail, President Obama proposed expanding child care tax breaks and offering universal Pre-K at an ultimate combined cost of $15 billion per year once phased in. We use this to generate our high-cost estimate of $150 billion. On the other hand, President Trump’s latest budget proposal includes only a few billion of spending on child care – which rounds to $0 under our low-cost estimate. Our central estimate of $100 billion assumes child care tax breaks similar in magnitude to those proposed by President Obama and an expansion of preschool funding about half as large.

| Subtotal, Child Care and Education | -$0.05 trillion | -$0.15 trillion | -$0.20 trillion |

Health Care

Overall, we estimate President Trump’s health care policies would save between $150 billion and $1.00 trillion over ten years, with a central estimate of $150 billion.

| Cut Prescription Drug Prices, End Surprise Billing | $150 billion | $150 billion | $150 billion |

The Trump campaign has proposed to cut prescription drug prices and to end surprise billing, a practice where patients are charged for out-of-network health services at in-network facilities. Absent more information from the campaign, we assume drug savings match those in the President’s FY 2021 budget proposal – based on a Senate Finance Committee package that would reform the Medicare Part D formula and cap drug price growth in excess of inflation. Based on numerous bills, we assume ending surprise billing would generate additional savings by reducing private health premiums, and thus the cost of health-related tax preferences.3 Additionally, the President recently announced he would allow the importation of safe drugs from Canada.4 Taken together, we estimate roughly $150 billion of savings from these policies.5

| Reform the Health Care System | $850 billion | $0 | $0 |

The Trump campaign has said it would reform the health care system to put patients and doctors “back in charge,” lower health care insurance premiums, and cover all pre-existing conditions. Since the campaign does not mention specific policies to achieve these goals, we assume the intent is to enact the President’s proposed “vision for health reform” from his FY 2021 budget proposal. The President’s budget assumes this proposal would save about $850 billion by reducing spending on Medicaid and the Affordable Care Act.6 However, the budget lacks any concrete details on how those savings would be achieved, and so CBO scored it with no savings or costs.7 We assume $850 billion of savings under our low-cost scenario and no savings or costs under our central and high-cost scenarios.

| Subtotal, Health Care | $1.00 trillion | $0.15 trillion | $0.15 trillion |

Infrastructure, Environment, and Other Domestic Spending

Overall, we estimate President Trump’s infrastructure and remaining domestic policy proposals would cost between $750 billion and $2.95 trillion. Under our central estimate, we find it would cost $2.70 trillion over ten years.

| Increase Infrastructure Spending | -$300 billion | -$2.00 trillion | -$2.00 trillion |

The Trump campaign has proposed to “build the world’s greatest infrastructure system,” “win the race to 5G,” and “continue to lead the world in access to the cleanest drinking water and cleanest air.” He has also proposed in his Platinum Plan to invest almost $20 billion in broadband and internet access. Though the campaign has not otherwise provided specifics, President Trump has said in speeches and on Twitter that he would like a “big and bold” $2.00 trillion infrastructure plan, which we assume in our central and high-cost scenarios.8 Our low-cost estimate of $300 billion is based mainly on the proposals in the President’s budget, which would allocate $9 billion to a capital revolving fund, $75 billion toward expanding surface transportation spending, and $190 billion to “support major infrastructure investment.”9 Some additional costs would come from expanding 5G, water, and clean air funding.

| Expand U.S. Presence in Outer Space | -$400 billion | -$650 billion | -$900 billion |

The Trump campaign has called for building up the newly created Space Force, establishing a permanent presence on the moon, and sending a manned mission to Mars. We believe Space Force – a new branch of the military to provide space capability – would cost about $150 billion based on the President’s FY 2021 budget proposal. The cost of the lunar and Mars missions are much more uncertain, but we believe they would cost somewhere between $250 billion and $750 billion over a decade.10 Overall, the President’s space policies would cost about $650 billion under our central estimate, $400 billion under our low-cost estimate, and $900 billion under our high-cost estimate.

| Support Black-Owned Businesses and Job Training | -$50 billion | -$50 billion | -$50 billion |

As part of the Platinum Plan, Trump has proposed supporting Black-owned businesses in a number of ways. Most significantly from a financial perspective, he would spend up to $40 billion to help increase the number of Black-owned contracting businesses, financial services entities, and private equity investment funds. Trump would also expand Pell Grants and apprenticeship and job training programs to help support training and retraining of black workers. In total, we estimate these proposals would cost $50 billion over a decade.11

| Subtotal, Infrastructure, Environment, Other Domestic Spending | -$0.75 trillion | -$2.70 trillion | -$2.95 trillion |

National Security and Immigration

Overall, we estimate the Trump campaign’s national security and immigration policies could save as much as $550 billion or cost as much as $550 billion. Under our central estimate, we find they would cost $300 billion.

| Support a Strong “America First” National Defense | -$200 billion | -$500 billion | -$650 billion |

The Trump campaign has proposed to “maintain and expand America’s military strength,” and “wipe out global terrorists who threaten to harm Americans.” The campaign also proposes to “get our allies to pay their fair share” and “build a great cybersecurity defense system and missile defense system.” These principles are consistent with those put forward in the President’s FY 2021 budget proposal.12 For our central estimate, we assume the President intends to increase the defense budget by $50 billion to $60 billion per year, as proposed in the first four years of his budget after the current spending caps expire, at a cost of $500 billion over a decade. In our high-cost estimate, we assume the President would fully implement the Pentagon’s Future Years Defense Program, which would cost roughly $650 billion, based on CBO's estimates.13 In our low-cost estimate we assume the full budget proposal, which freezes the defense budget after 2025 and allows the size of the military to shrink in real terms to below current law levels, at a cost of $200 billion.

| Stop Endless Wars and Bring Our Troops Home | $750 billion | $550 billion | $500 billion |

The Trump campaign has proposed to “stop endless wars and bring our troops home.” We assume this means ending or at least limiting the U.S. presence in Afghanistan and the Middle East, thereby reducing the $80 billion per year currently spent on Overseas Contingency Operations (OCO). In our central estimate, we assume this means a drawdown of OCO spending in line with the President’s FY 2021 budget proposal – $69 billion of spending in 2021, $20 billion in each of the next two years, and $10 billion per year after that – saving about $550 billion over ten years.14 In our high-cost estimate, we assume spending would remain at $20 billion per year, indexed for inflation – saving $500 billion. In our low-cost estimate, we assume OCO funding would be fully repealed – saving $750 billion.

| Increase Spending on Veterans | -$100 billion | -$400 billion | -$400 billion |

The Trump campaign has proposed to “provide world-class health care and services” to veterans. Since 2014, policymakers have aimed to improve care available to veterans by allowing some veterans to see health care providers outside of the VA health system. These programs – VA CHOICE and Community Care – have not been fully funded. In our central and high-cost estimates, we assume President Trump would allow most veterans to see private health providers, at a cost of roughly $400 billion over ten years.15 For our low-cost estimate, we assume more modest veterans funding based on the $100 billion increase proposed in the President’s FY 2021 budget.16

| Address Illegal Immigration | $100 billion | $50 billion | $0 |

The Trump campaign has proposed several policies related to illegal immigration, including ending certain funding for sanctuary cities – local jurisdictions that limit their cooperation with federal immigration authorities – and blocking undocumented immigrants from receiving certain government benefits. For these estimates, we assume modest savings from defunding sanctuary cities based on prior estimates of the same policy during the 2016 campaign and count these savings in our central and low-cost estimates. We identify additional savings from the President’s FY 2021 budget proposal, where he proposes to require a valid Social Security Number to receive most tax credits and require immigrant status documentation before receiving Medicaid benefits. Our central estimate of $50 billion of savings is based on CBO’s estimate of these policies,17 while our low-cost estimate of $100 billion is based on the Office of Management and Budget’s (OMB) score.18 In our high-cost estimate, we assume any savings would be more than offset by a reduction in the number of tax-paying immigrants, leading to a negligible net fiscal impact.

| Subtotal, National Security and Immigration | $0.55 trillion | -$0.30 trillion | -$0.55 trillion |

Tax Policy

We estimate President Trump’s proposed tax policies would lose between $1.40 and $2.95 trillion of revenue – though due to lack of detail, the actual cost could be even higher than our high-cost estimate suggests. Under our central estimate, these policies would cost about $1.70 trillion over ten years.

| Reduce Individual Taxes | -$1.25 trillion | -$1.25 trillion | -$2.45 trillion |

The Trump campaign has promised to “cut taxes to boost take-home pay and keep jobs in America.” Absent more information, it is impossible to know what this involves. At a minimum, we assume the President would support extending the provisions of the Tax Cuts and Jobs Act (TCJA) of 2017 beyond their 2025 expiration, as proposed in his FY 2021 budget. These extensions include a continuation of lower individual income tax rates, a larger standard deduction and Child Tax Credit (CTC), and a smaller Alternative Minimum Tax (AMT) and estate tax. They also include a repeal of personal exemptions, and limits to the mortgage interest deduction and the state and local tax deduction. Permanently extending TCJA provisions would cost about $1.25 trillion over ten years.

President Trump and his campaign have also floated additional tax cuts, including repealing the worker side of the payroll tax,19 cutting middle class taxes by 10 percent,20 indexing capital gains taxes to inflation,21 reducing the capital gains rate to 15 percent,22 and lowering the 22 percent individual marginal income tax rate to 15 percent.23 Depending on the details, these proposals could result in substantial revenue losses. Our high-cost estimate assumes as a proxy that the bottom three rates are cut by 10 percent each and capital gains are indexed to inflation – actual tax cuts could be larger or smaller. In combination with extending the TCJA, this would cost $2.45 trillion over a decade. Since no policies beyond TCJA extension have been proposed on the campaign’s website, in the President’s budget proposals, or elsewhere, we do not count them in our central and low-cost estimates.

| Enact Made in America, China Insourcing Tax Breaks | $0 | -$50 billion | -$100 billion |

The Trump campaign has promised “Made in America” tax credits and tax benefits for companies that bring jobs back from China. Without details on these policies or a basis for estimating them, we assume a $50 billion cost in our central estimate, using the cost of extending the foreign-derived intangible income (FDII) deduction at its current rate after 2025 as a proxy. For our low-cost estimate, we assume the cost would be negligible and for our high-cost estimate, we assume it would cost twice as much – $100 billion.

| Expand Opportunity Zones | -$50 billion | -$50 billion | -$50 billion |

The Trump campaign has proposed expanding Opportunity Zones, though it has not said how it would do so. Opportunity Zones allow investors to defer or eliminate taxes on gains related to investments in economically distressed areas. They were expanded substantially under the TCJA, and taxes on deferred gains from these newer zones must be repaid by the end of 2026. We assume President Trump would extend the deadline for repaying deferred capital gains taxes from 2026 to 2030 and enact additional expansions for a total cost of $50 billion over ten years.

| Allow 100% Expensing for Essential Industries | -$100 billion | -$350 billion | -$350 billion |

The Trump campaign has proposed to “allow 100% expensing deductions for essential industries like pharmaceuticals and robotics who bring back their manufacturing to the United States.” Historically, most business expenses have been deductible over time based on a depreciation schedule that reflects their useful life. Allowing businesses to deduct the cost all at once – a provision known as full expensing – provides an incentive for businesses to increase investment. While the campaign has put forward little detail on this policy, we assume it would involve extending current expensing policy. This includes the full expensing of equipment allowed under the TCJA, which is scheduled to phase out between 2023 and 2026, as well as the full expensing of research and experimentation, which companies can amortize over five years beginning in 2022. Under our central and high-cost estimates, this would cost $350 billion through 2030. Our low-cost estimate assumes a more targeted policy at a cost of $100 billion. Importantly, these policies would cost somewhat less in the steady state, as they partially represent a shift in the timing of taxes paid.

| Subtotal, Tax Policy | -$1.40 trillion | -$1.70 trillion | -$2.95 trillion |

Net Interest

Assuming immediate enactment and excluding COVID-specific policies, President Trump’s agenda would increase deficits under all three of our scenarios. Higher debt would result in higher interest payments. Overall, we estimate interest payments would rise by somewhere between $50 billion and $350 billion through 2030 under our low- and high-cost estimates. Under our central estimate, interest payments would rise by $250 billion.

| Subtotal, Net Interest | -$0.05 trillion | -$0.25 trillion | -$0.35 trillion |

| Grand Total | -$0.70 trillion | -$4.95 trillion | -$6.85 trillion |

Deficit and Debt Impact

Under current law, CBO projects deficits will total $13 trillion (5.0 percent of GDP) over the next ten years. Debt is projected to jump from over 79 percent of GDP in 2019 to 104 percent by 2021, reach an all-time record of 107 percent by 2023, and climb to 109 percent by 2030.

President Trump’s policies would increase deficits by $700 billion under our low-cost scenario, by $6.85 trillion under our high-cost scenario, and by $4.95 trillion under our central estimate.

As a result, debt would rise to 111 percent of GDP by 2030 under our low-cost scenario, 131 percent under our high-cost scenario, and 125 percent under our central estimate.

Under our central estimate of the Trump plan, ten-year deficits would total $17.95 trillion (7.0 percent of GDP); they would total $13.70 trillion (5.3 percent of GDP) under our low-cost estimate and $19.85 trillion (7.7 percent of GDP) under our high-cost estimate.

Excluding temporary policies – which will add to the debt over the next decade but have little impact on structural deficits – we estimate deficits would total between $13.20 trillion (5.1 percent of GDP) and $17.10 trillion (6.6 percent of GDP) over a decade, with a central estimate of $15.45 trillion (6.0 percent of GDP).

Joe Biden's Vision

Former Vice President Joe Biden proposes a sweeping policy agenda that would dramatically increase spending and raise taxes. Details are outlined on his campaign website through a number of initiatives under the header Bold Ideas.24

Specifically, Biden has put forward detailed proposals to increase spending on child care and education, expand and build upon the Affordable Care Act (ACA) (detailed in our paper, Understanding Joe Biden's 2020 Health Care Plan), expand Social Security and Supplemental Security Income (SSI) benefits, combat climate change, protect the environment, invest in infrastructure, support American jobs, manufacturing, and innovation, expand access to affordable housing, provide paid family and medical leave, and address other issues.

To help offset the cost of his policy agenda, Vice President Biden has proposed numerous tax increases (mostly detailed in our paper, Understanding Joe Biden’s 2020 Tax Plan) targeted at high-earners and corporations, military and health spending savings, and pro-growth immigration reform.

In total we have identified over 800 proposals on Biden’s website, a majority of which we were able to estimate. To avoid double counting, we did our best to identify overlap between various proposals on his campaign website, but in some cases a lack of clarity forced us to make assumptions.

Based on these assumptions, we estimate Biden’s initiatives would cost $11.10 trillion over ten years, partially offset by $5.80 trillion of revenue and savings, under our central estimate. Under our low-cost scenario, Biden’s $8.95 trillion of proposals are more than offset by $9.15 trillion of revenue and savings. Under our high-cost estimate, $12.90 trillion of new spending is partially offset by $5.00 trillion of revenue and savings.

Incorporating the cost of debt service, we estimate Vice President Biden’s agenda would reduce the debt by $150 billion or increase it by as much as $8.30 trillion between 2021 and 2030, assuming immediate enactment. Under our central estimate, Biden's agenda would add $5.60 trillion to the debt.

Child Care and Education

Altogether, we estimate Vice President Biden’s child care and education agenda would cost as little as $2.40 trillion or as much as $3.05 trillion to implement, with a central estimate of $2.70 trillion over ten years.

| Support Child Care and Universal Pre-K | -$300 billion | -$500 billion | -$750 billion |

As part of his “Build Back Better” plan, Biden has put forward a comprehensive set of proposals to make child care more widely available and affordable. He would provide access to free pre-kindergarten for all three- and four-year-olds by working with states to provide a mixed delivery system involving public schools, child care centers, family caregivers, and the Head Start program. He would make the existing Child and Dependent Care Tax Credit fully refundable and expand it to cover half of all child care expenses up to $8,000 for one child or $16,000 for multiple children. Finally, borrowing from Representative Bobby Scott’s (D-VA) Child Care for Working Families Act, Biden would implement a sliding-scale subsidy system designed to prevent any family earning under 1.5 times the area median income from spending more than 7 percent of its income on child care. The Biden campaign estimates these provisions would cost $325 billion, which is the basis of our low-cost estimate of $300 billion over a decade. We believe the proposal is more likely to cost between $500 billion and $750 billion, depending mostly on the cost of the sliding-scale subsidy.25

| Increase K-12 Education Funding | -$600 billion | -$600 billion | -$600 billion |

Biden’s plan would increase funding for K-12 public schools though several different avenues. First, he would triple the annual appropriation for Title I, which provides federal funding to local school boards and public schools that serve a disproportionately high percentage of students from low-income families. He would also fully fund the Individuals with Disabilities Education Act (IDEA), which provides additional funding to public schools to provide resources for students with disabilities. Finally, the plan includes several smaller proposals, such as allowing high school students to use Pell Grants to take college-level courses, establishing partnerships between high schools, community colleges, and employers, and doubling the number of psychologists, guidance counselors, nurses, social workers, and other health professionals in schools. We estimate these proposals would cost $600 billion over ten years. For more information, see our previously published analysis of Biden’s K-12 Education Plan.26

| Increase Higher Education Spending | -$1.50 trillion | -$1.60 trillion | -$1.70 trillion |

Biden would expand access to and reduce the out-of-pocket cost of education beyond high school in a variety of ways. First, he would make public colleges and universities tuition-free for all families with incomes below $125,000, as proposed in Senator Bernie Sanders’s (I-VT) College for All Act of 2017.27 Biden would also provide up to two years of community college or high-quality training at no cost to students.28 Furthermore, he would invest $75 billion in Historically Black Colleges and Universities (HBCUs), Tribal Colleges and Universities (TCUs), and Minority-Serving Institutions (MSIs), $50 billion to develop better workforce training programs, and $8 billion to help community colleges improve the health and safety of their facilities. Biden would double the maximum value of a Pell Grant – expanding both the size of Pell Grants and eligibility for them.29

Biden would also offer substantial relief to those with student debt. He would forgive all tuition-related student debt accrued at two- and four-year public colleges and universities, as well as private HBCUs, TCUs, and MSIs.30 Biden would automatically enroll remaining borrowers in a reformed income-based repayment program that would limit repayments to five percent of income above $25,000 and would forgive the remaining balance after 20 years. He would also expand loan forgiveness for those in public or community service and exempt forgiven loans from taxation.31

We estimate these provisions would likely cost between $1.50 and $1.70 trillion over a decade,32 with a central estimate of $1.60 trillion.33

| Subtotal, Child Care and Education | -$2.40 trillion | -$2.70 trillion | -$3.05 trillion |

Health Care and Long-Term Care

Overall, we estimate Vice President Biden’s health and long-term care agenda could cost as little as $1.00 trillion or as much as $2.40 trillion to implement, with a central estimate of $2.05 trillion over a ten-year period. This includes gross costs of $2.60 trillion to $3.05 trillion – $2.80 trillion in our central estimate – and savings of $1.60 trillion to $650 billion – $750 billion in our central estimate. These plans are outlined and analyzed in significant detail in our recent paper, Understanding Joe Biden’s 2020 Health Care Plan.

| Expand Health Insurance Coverage | -$1.70 trillion | -$1.90 trillion | -$2.10 trillion |

Biden’s plan would build on the Affordable Care Act by expanding current subsides, establishing a new public insurance option, automatically enrolling low-income individuals in premium-free coverage, and lowering the Medicare Age from 65 to 60.34 Though not all details of Biden’s plan have been made public, the crux of his plan appears to be very similar to Variation #2 of the Healthy America Program proposed by Blumberg, Holahan, Buettgens, and Zuckerman of the Urban Institute – which is cited on Biden’s campaign website.35 The most significant difference is that Biden would maintain the existing Medicaid program in roughly its current form and individuals over age 60 would be allowed to enroll in Medicare. Accounting for these and other differences, we estimate the proposal would cost about $1.90 trillion over a decade under our central estimate.36 Given uncertainty about both the estimates and plan details, we assume a cost of $1.70 trillion and $2.10 trillion under our low- and high-cost estimates, respectively.37

| Support Elder Care and Long-Term Care | -$600 billion | -$600 billion | -$650 billion |

As part of his “Build Back Better” plan, Biden has put forward a number of proposals to improve access to, and quality of, long-term health care for seniors. On the spending side, Biden would eliminate the current waitlist for home and community care under Medicaid, create a Long-Term Services and Supports Innovation Fund, increase the number of, and training for, long-term care professionals (including at VA facilities), and create a new Public Health Jobs Corps. On the tax side, Biden would establish a $5,000 tax credit for informal or family caregivers to cover out-of-pocket expenses based on Senator Joni Ernst’s (R-IA) Credit for Caring Act.38 He would also increase the generosity of current tax benefits for purchasing long-term care insurance (including insurance paid for with retirement savings). We estimate these policies would cost $600 billion to $650 billion in total – $600 billion under our central estimate – based on figures put forward by the campaign,39 estimates from the Tax Policy Center,40 and our own calculations.41

| Fund Rural Health, Mental Health, & Opioid Crisis | -$300 billion | -$300 billion | -$300 billion |

Biden proposes to increase rural health care and mental health care funding, as well as address the costs of opioid addiction. On the rural side, Biden has proposed to double federal funding for Community Health Centers and increase payments to rural facilities in numerous ways – several of which are proposed in Senator Lamar Alexander’s (R-TN) Save Rural Hospitals Act – to support rural hospitals and expand care in those communities.42 Biden would improve enforcement of mental health parity laws and expand funding for mental health services. In addition, he has proposed to spend $125 billion to address the opioid crisis, including $75 billion in flexible grants to states.43

| Reduce Health Costs | $1.30 trillion | $450 billion | $350 billion |

Biden has proposed a number of changes to reduce prescription drug prices and other spending for both individuals and the federal government. Most significantly, Biden would repeal the law that bans Medicare from negotiating drug prices directly.44 For new drugs and biologics sold without competition, he would establish an independent board to set “reasonable” prices based on the average price in other countries (when available). This price would be used in Medicare and the public option and would also be available for private plans on the individual market.45 Furthermore, Biden would limit price increases for name-brand and biotech drugs, end “abusively priced” generic drugs by limiting their price increases to the rate of inflation, allow the purchase of safe prescription drugs from other countries, and encourage the accelerated development and introduction of generic drugs to increase competition.

Outside of the drug space, Biden would end the practice of “surprise medical billing,”46 reduce market concentration among health care providers, and partner with the health care workforce to deploy innovations designed to improve outcomes and lower costs.

In total, we estimate these proposals would save about $450 billion over a decade under our central estimate and $350 billion under our high-cost estimate.47 Most of these savings are the result of lower drug costs. For our low-cost scenario, we assumed a much larger savings of $1.30 trillion based on estimates from the Penn Wharton Budget Model.48 In our view, that figure assumes much more aggressive drug price negotiations than outlined on the Biden campaign website.

| Revenue Feedback from Health Plan | $300 billion | $300 billion | $300 billion |

By expanding coverage in the exchanges and creating a public option, Biden would reduce the number of Americans who receive health insurance benefits through their employer, reduce the per-person cost of employer-provided health insurance, and lower out-of-pocket costs for many Americans. As a result, wages would be higher, and existing income and payroll tax breaks related to health care – especially the tax exclusion for employer-provided health insurance – less valuable. We estimate this would generate roughly $300 billion of additional income and payroll tax revenue over a decade.49

| Subtotal, Health Care and Long-Term Care | -$1.00 trillion | -$2.05 trillion | -$2.40 trillion |

Social Security, SSI, and Retirement

We estimate Vice President Biden’s proposals to expand Social Security, the Supplemental Security Income (SSI) program, and tax credits for retirees and older workers could cost as little as $950 billion or as much as $1.30 trillion, with a central estimate of $1.15 trillion over ten years.

| Expand Social Security | -$400 billion | -$400 billion | -$400 billion |

Biden would expand Social Security by establishing a minimum benefit at 125 percent of the Federal Poverty Level (FPL), providing a 5 percent increase for those who have received Social Security benefits for at least 20 years,50 and increasing benefits for surviving spouses.51 Biden also says he will “get rid of the benefit cuts for workers and surviving beneficiaries who happen to be covered by both Social Security and another pension,” which we interpret to mean eliminating the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).52

With regards to Social Security Disability Insurance (SSDI), Biden would eliminate the current five-month waiting period to collect benefits and two-year waiting period to collect Medicare. In addition, Biden would increase the earnings limit for SSDI – which currently stands at $1,170 per month – and gradually phase-out this benefit to eliminate the SSDI “benefit cliff.”

In total, we estimate these provisions would cost $400 billion over ten years.53 By themselves, they would also worsen Social Security’s 75-year solvency by about 30 percent. To offset these costs and improve Social Security solvency, Biden would subject wages above $400,000 per year to the payroll tax, which we discuss in the tax section below.

| Expand Supplemental Security Income | -$550 billion | -$700 billion | -$800 billion |

Biden would dramatically expand the Supplemental Security Income program, which provides income support to low-income seniors and Americans with disabilities. Most significantly, he would increase SSI benefit levels to a minimum of 100 percent of the Federal Poverty Level (FPL). Under current law, the maximum individual benefit is only three-quarters of the FPL. Biden would also eliminate SSI marriage penalties and raise the current asset limits of $2,000 for individuals and $3,000 for couples (not counting a primary home and vehicle).

The Biden campaign has not elaborated on exactly how the benefit formula would be revised, but it is worth noting that the average benefit – almost $600 per month – would have to be increased by at least 80 percent to assure a universal benefit of 100 percent of the FPL; presumably it would be increased more if this is only the minimum benefit. We therefore assume total SSI spending is increased by 80 percent in our low-cost scenario,54 100 percent in our central scenario, and increased by 120 percent in our high-cost scenario. We estimate these provisions would cost $700 billion over ten years, with a low-cost estimate of $550 billion and a high-cost estimate of $800 billion.

| Expand Tax Breaks for Older Americans | $0 | -$50 billion | -$100 billion |

In addition to expanding Social Security and SSI, Biden would modify the tax code with the goal of improving retirement income. His plan would provide nearly all workers without a pension or 401(k)-type plan access to an “automatic 401(k)” and offer tax credits to small businesses to incentivize creating retirement savings plans for their employees. Biden would also equalize the tax benefits of defined contribution plans by converting the current deductibility of traditional retirement contributions into matching 26 percent refundable tax credits for 401(k)s, Individual Retirement Accounts (IRAs), and other traditional retirement plans. In addition, the plan would extend the Earned Income Tax Credit (EITC) to childless workers above age 65. We estimate these changes would cost $50 billion over ten years under our central estimate55 and $100 billion under our high-cost estimate.56 In our low-cost scenario, savings from the proposal to equalize tax benefits of defined contribution plans would roughly offset the cost of the other proposals, leading to a negligible net cost.57

| Subtotal, Social Security, SSI, and Retirement | -$0.95 trillion | -$1.15 trillion | -$1.30 trillion |

Infrastructure, Environment, and Other Domestic Spending

Vice President Biden has a number of plans that increase spending on research, infrastructure, procurement, and combatting climate change. However, the extent to which they overlap, and whether or not more recent plans supplement or replace earlier ones, is unclear. Depending on the amount of this overlap, we estimate Biden’s proposed increases to domestic spending in this category could cost anywhere from $3.00 trillion under our low-cost scenario to $5.50 trillion under our high-cost scenario. Under our central estimate, we assume $4.45 trillion over ten years. $3.00 trillion of this is primarily one-time spending and would not have direct, long-term costs.

| Invest in Green Infrastructure, American Innovation | -$2.00 trillion | -$3.00 trillion | -$4.00 trillion |

Over the course of his campaign, Biden has released several plans to address climate change, protect the environment, promote sustainable infrastructure, and foster research and development of new, green technologies. One plan, named “the Biden Plan for a Clean Energy Revolution and Environmental Justice,” calls for an investment of $1.70 trillion over ten years in order to put America on a path towards a 100 percent clean energy economy and net-zero emissions by no later than 2050, repair and modernize water, transportation, and energy infrastructure systems, reduce pollution and protect the environment, and incentivize the adoption and rapid deployment of clean energy technologies across the country. Another plan, “the Biden Plan to Invest in Middle Class Competitiveness,” calls for infrastructure investment of $1.30 trillion over ten years, including $300 billion for housing construction and $100 billion for education-related construction.

Biden’s more recent “Build Back Better” agenda includes a new, and seemingly more ambitious, plan called “The Biden Plan to Build a Modern, Sustainable Infrastructure and an Equitable Clean Energy Future” that calls for 100 percent clean energy by 2035, along with significant new investments. The plan would spend $2.00 trillion over four years. Meanwhile, “The Biden Plan to Ensure the Future is ‘Made in All of America’ by All of America’s Workers" proposes investing $300 billion over four years to promote research and development of breakthrough technologies – like electric vehicle technology, artificial intelligence systems and next-generation communication networks – as well as $400 billion over four years on federal procurement of products made in the United States by domestic workers.

Unfortunately, neither the Biden campaign’s website nor its staff have given any indication as to how much of these $5.70 trillion of proposals describe the same funds versus distinct allocations. In our low-cost estimate, we assume all of these initiatives overlap and they are all subparts of Biden’s newer $2.00 trillion sustainable infrastructure and clean energy proposal. In our high-cost estimate, we assume only the old $1.70 trillion clean energy plan has been replaced with the new $2.00 trillion clean energy plan, and the remaining $2.00 trillion represents distinct proposals, resulting in a total estimate of $4.00 trillion. Our central estimate of $3.00 trillion over ten years represents the midpoint between our low- and high-cost scenarios, due to the lack of clarity from the campaign.58

| Expand Affordable Housing | -$350 billion | -$750 billion | -$750 billion |

Biden’s plan for housing includes several proposals to expand access to quality, affordable housing and provide needed services and support to individuals experiencing homelessness. Most significantly, he would dramatically expand Section 8 public housing vouchers, which ensure qualifying households spend no more than 30 percent of their income on rent. Under current law, only one-quarter of all households that qualify for Section 8 vouchers receive them. Biden would increase funding so all eligible households could receive vouchers. He would also reinstate and expand a tax credit for first-time homebuyers that would provide up to $15,000 toward the purchase of a home as well as establish a new renter’s credit, which would allocate $5 billion per year to defray the cost of housing for low-income individuals. He has proposed a number of smaller measures as well.

The Biden campaign estimates its housing plan would cost $640 billion over a decade, including $300 billion of housing-related infrastructure spending counted in our infrastructure category, which we used to generate our lost-cost estimate of $350 billion. However, we estimate expanding Section 8 housing vouchers alone would cost at least $450 billion,59 and the two tax credits would cost a combined $300 billion.60 Our central and high-cost estimate of $750 billion reflects these costs.

| Provide Universal Paid Leave | -$550 billion | -$550 billion | -$550 billion |

Biden has proposed creating a universal paid family and medical leave program. While his campaign website does not specify details, we assume this proposal is the same as included in Congresswoman Rosa DeLauro’s (D-CT) Family and Medical Insurance Leave (FAMILY) Act, which would provide all workers up to 12 weeks of paid leave if they have a serious health condition, are caring for an immediate family member with a serious health condition, experience the birth or adoption of a child, or face a “qualifying emergency” arising from the foreign deployment of a family member in the armed forces. Benefits would be equal to approximately two-thirds of a recipient’s highest earnings over the preceding three years, with a minimum of $580 per month and a maximum of $4,000 per month. It should be noted that the FAMILY Act includes a 0.4 percent increase in the payroll tax as a partial offset, which Biden has not proposed. Based on CBO estimates, this proposal would cost $550 billion.61

| Other Domestic Spending | -$100 billion | -$150 billion | -$200 billion |

While we have detailed Biden’s major proposals above, there are several with minor but significant costs. For instance, Biden has a plan to support labor unions and empower workers, which we estimate would cost roughly $50 billion over ten years to implement. His plan for criminal justice reform would cost $30 billion over ten years, and his plan for rural America another $20 billion. In total, we estimate Biden’s smaller spending proposals would cost $150 billion over ten years. Since this is a very rough estimate, we assume a fairly wide potential cost range, with a low-cost estimate of $100 billion and a high-cost estimate of $200 billion.

| Subtotal, Infrastructure, Environment, and Other Domestic Spending | -$3.00 trillion | -$4.45 trillion | -$5.50 trillion |

National Security and Immigration

In total, we estimate Vice President Biden’s defense and immigration policies would save anywhere from $700 billion to $950 billion over ten years, with a central estimate of $750 billion.

| End Wars in Afghanistan and Middle East | $750 billion | $550 billion | $500 billion |

As a major part of his foreign policy platform, Biden has proposed to significantly scale-back America’s engagement in military conflicts around the world, including ending “forever wars” in Afghanistan and the Middle East. Specifically, Biden proposes to narrow the focus of the U.S. military’s mission to combat Al-Qaeda and the Islamic State. While the Biden campaign has not provided details on the specific nature of the drawdown, we assume he intends to reduce the $80 billion per year currently spent on Overseas Contingency Operations. In our central estimate, we assume this means a drawdown of OCO spending in line with President Trump’s FY 2021 budget proposal (and similar to those in President Obama’s budget proposals) – $69 billion of spending in 2021, $20 billion in each of the next two years, and $10 billion per year after that – saving about $550 billion over ten years. In our high-cost estimate, we assume spending would remain at $20 billion per year, indexed to inflation, saving $500 billion. In our low-cost estimate, we assume OCO funding would be fully ended, saving $750 billion.62

| Pass Immigration Reform | $200 billion | $200 billion | $200 billion |

Biden would significantly expand immigration. He would undo virtually all of the changes to immigration policy that have occurred under the Trump Administration – including the national emergency declaration used to fund construction of the border wall, travel and refugee bans from certain primarily Muslim countries, the proposed “public charge” rule, and the end of the Deferred Action for Childhood Arrivals (DACA) program. He would then work with Congress to develop and pass comprehensive immigration reform legislation, which would increase the volume of legal immigration, create a pathway to citizenship for undocumented immigrants currently living in the United States, expand visas for high-skilled workers and agricultural workers, eliminate country quotas, and significantly increase the annual limit on refugees, among other policy goals. We assume such a bill would likely resemble the 2013 comprehensive immigration package, the Border Security, Economic Opportunity, and Immigration Modernization Act, which Biden helped develop as Vice President. If so, it would save about $200 billion on net, as an increased number of legal immigrants will cause tax revenue to rise more than spending on government benefits.63

| Subtotal, National Security and Immigration | $0.95 trillion | $0.75 trillion | $0.70 trillion |

Tax Policy

Separate from the targeted tax breaks allocated in different spending plans, we estimate Vice President Biden’s tax increases would raise as much as $6.60 trillion or as little as $3.65 trillion, with a central estimate of $4.30 trillion over ten years. Many of these estimates were generated based on modeling from the Tax Policy Center,64 Tax Foundation,65 American Enterprise Institute,66 and Penn Wharton Budget Model,67 as described in our recent paper, Understanding Joe Biden’s 2020 Tax Plan. Low-cost figures generally come from the Biden campaign.

| Increase Corporate Taxes | $1.95 trillion | $1.80 trillion | $1.50 trillion |

Biden would increase corporate taxes in a number of ways. Most significantly, he would raise the corporate income tax rate from 21 percent to 28 percent – halfway to the pre-Tax Cuts and Jobs Act (TCJA) rate of 35 percent (though with a broader base that would lift total corporate taxes to above pre-TCJA levels).68 He would also establish a 15 percent minimum tax on “book” profits – or reported annual income net of annual expenses – for large corporations,69 establish a 21 percent minimum tax (up from 10.5 percent today) for intangible income earned abroad, apply that tax on a country-by-country rather than worldwide basis, and eliminate the deduction for Qualified Business Asset Investments (QBAI).70 Biden has also proposed additional tax provisions designed to discourage offshoring and corporate inversions, including a 10 percent surtax on the sales of goods and services to American consumers by American firms that route their transactions through a foreign subsidiary. In total, we estimate these tax increases would raise $1.50 trillion to $1.95 trillion of revenue, with a central estimate of $1.80 trillion over ten years.

| Increase Individual and Pass-Through Taxes | $2.30 trillion | $1.40 trillion | $1.20 trillion |

Biden would increase a number of taxes on households making $400,000 per year or more. First, he would increase the top income tax rate from 37 percent to 39.6 percent – its rate prior to enactment of the TCJA. He would also repeal the TCJA’s 20 percent deduction for pass-through income for high earners and restore the “Pease Limitation,” which indirectly reduces the value of itemized deductions.

He would also tax long-term capital gains and dividends as ordinary income at a rate of 39.6 percent – as opposed to the current-law preferential rate of 20 percent – for individuals and couples earning more than $1 million, eliminate the stepped-up basis for capital gains at death for higher earners, and repeal “like kind exchange” rules that allow real estate investors to avoid paying capital gains taxes by swapping properties.71 Finally, Biden would institute an overall cap of 28 percent on the rate against which one could take itemized deductions.

Together, we estimate these provisions would raise $1.40 trillion of revenue based on an average of modeled estimates outlined in our paper, Understanding Joe Biden’s 2020 Tax Plan. Our low-cost estimate assumes it would raise $2.30 trillion, based on a combination of outside estimates and figures provided by the Biden campaign. Our high-cost estimate finds $1.20 trillion of new revenue.72

| Increase Social Security Payroll Tax Maximum | $1.00 trillion | $900 billion | $800 billion |

Under current law, the Social Security program is funded through a 12.4 percent payroll tax – half of which is paid by employers and half paid by employees – on income up to a certain taxable maximum. That taxable maximum – $137,700 in 2020 – increases each year at the rate of wage growth. Biden would increase revenues into the Social Security program by subjecting wages above $400,000 to this same 12.4 percent payroll tax. In doing so, he would create a “donut hole” in Social Security payroll taxes between the current maximum and $400,000. Over time, that donut hole would close as the current taxable maximum continues to increase with wages, while the $400,000 threshold remains static. This proposal would raise $800 billion to $1.00 trillion of revenue over a decade - $900 billion in our central estimate.73 Notably, it would raise revenue equivalent to 1.9 percent of taxable payroll over 75 years, about 60 percent of Social Security’s solvency gap as measured by the program’s Trustees. We estimate roughly half of this revenue would go to improve solvency and the other half to finance new benefit enhancements.74

| Establish a Financial Risk Fee on Large Banks | $350 billion | $100 billion | $100 billion |

Biden would institute a “financial risk fee” on banks, bank holding companies, and non-bank financial institutions with over $50 billion in assets. While the Biden campaign has not provided additional details on the nature of the fee, a policy option from CBO would generate about $100 billion of revenue – which we assume in our central and high-cost estimate.75 Former President Barack Obama’s budget proposals contained a similar size fee. In our low-cost estimate we assume the tax will be designed to raise $350 billion, since the Biden campaign intends to use it to finance $340 billion of its housing plan.76

| Improve Tax Compliance | $1.00 trillion | $100 billion | $50 billion |

Each year, hundreds of billions of dollars in owed taxes go uncollected, due to either underreporting of income, underpayment of owed taxes, or non-filing. This gap between taxes owed and taxes collected – known as the “tax gap” – averaged $441 billion per year from tax years 2011 through 2013, equivalent to about 16 percent of the total tax liability, according to the latest available Internal Revenue Service (IRS) data. IRS enforcement activities were only able to recover an average of $60 billion per year. Biden has proposed to narrow the tax gap by improving tax compliance. While the Biden campaign has not elaborated on the details of its proposal, we assume it would involve both increasing funding for IRS reporting and enforcement (which CBO estimates would result in net deficit reduction) and changing various rules and laws to reduce tax evasion. Our high-cost estimate of $50 billion assumes similar tax gap savings to what was proposed under the Obama Administration’s FY 2017 budget proposal.77 Our low-cost estimate assumes $1.00 trillion of new revenue (while we find this revenue figure implausibly high, it is based on an estimate of an aggressive tax gap reduction plan published by professors Natasha Sarin and Lawrence Summers). Under our central estimate, we assume $100 billion of net revenue based on CBO and Joint Committee on Taxation (JCT) estimates of various provisions.78

| Subtotal, Tax Policy | $6.60 trillion | $4.30 trillion | $3.65 trillion |

Net Interest

Assuming immediate enactment and excluding COVID-specific policies, Biden’s agenda would increase deficits over the next five years under all three of our scenarios and increase deficits over ten years under our central and high-cost scenarios. Higher debt would result in higher interest payments. Overall, we estimate interest payments would rise somewhere between $50 billion and $400 billion through 2030 under his agenda. In our central estimate, interest payments would rise by $300 billion.

| Subtotal, Net Interest | -$0.05 trillion | -$0.30 trillion | -$0.40 trillion |

| Grand Total | $0.15 trillion | -$5.60 trillion | -$8.30 trillion |

Deficit and Debt Impact

Under current law, CBO projects deficits will total $13 trillion (5.0 percent of GDP) over the next ten years. Debt is projected to jump from over 79 percent of GDP in 2019 to 104 percent by 2021, reach an all-time record of 107 percent by 2023, and climb to 109 percent by 2030.

Vice President Biden’s agenda would reduce deficits by $150 billion under our low-cost scenario and increase them by $8.30 trillion and $5.60 trillion under our high-cost and central estimates, respectively.

As a result, debt would rise to 108 percent of GDP by 2030 under our low-cost scenario, 136 percent under our high-cost scenario, and 127 percent under our central estimate.

Under our central estimate of the Biden plan, ten-year deficits would total $18.60 trillion (7.2 percent of GDP); they would total $12.85 trillion (5.0 percent of GDP) under our low-cost estimate and $21.30 trillion (8.3 percent of GDP) under our high-cost estimate.

Excluding temporary policies – which will add to the debt over the next decade but have little impact on structural deficits – we estimate deficits would total between $10.60 trillion (4.1 percent of GDP) and $17.05 trillion (6.6 percent of GDP) over a decade, with a central estimate of $15.35 trillion (6.0 percent of GDP).

Conclusion

Even before the onset of the COVID-19 pandemic and subsequent global economic crisis, the federal government was on an unsustainable fiscal path. Trillion-dollar deficits had become the norm and were projected to push our debt-to-GDP level to an all-time record by early next decade.

Now, the COVID-19 pandemic and economic crisis has accelerated that timeline. The national debt is projected to exceed the size of the economy this fiscal year and grow to twice the size of the economy within 30 years. Furthermore, four major trust funds are headed toward insolvency, including the Highway and Medicare trust funds, within the next presidential term.

Under our central estimate, neither major candidate for President of the United States in 2020 has put forward a plan that would address our unsustainable fiscal path. Instead, both President Donald Trump and former Vice President Joe Biden have promoted policy agendas that would likely significantly add to annual deficits and increase debt-to-GDP over the next decade.

Specifically, we estimate President Trump’s agenda would cost $4.95 trillion and increase the debt to 125 percent of GDP by 2030. We estimate Vice President Biden’s proposals would cost $5.60 trillion and increase debt to 127 percent of GDP by 2030.

Both of these estimates come with a significant degree of uncertainty. Under our low-cost estimate, the Trump plan would only cost $700 billion over a decade, and the Biden plan would actually reduce deficits by $150 billion. Under these scenarios, debt would still rise from 98 percent of GDP today to 111 percent of GDP by 2030 under Trump and to 108 percent under Biden.

Under our high-cost estimates, debt would increase by $6.85 trillion under Trump, resulting in 2030 debt of 131 percent of GDP, and $8.30 trillion under Biden, resulting in 2030 debt of 136 percent.

While some of the candidates’ policies are temporary and thus would not add to structural deficits, debt is likely to grow further over the long term under either candidate’s plan. This high and rising debt could have significant economic, generational, fiscal and distributional consequences.

Basis of Estimates

To develop our estimates of President Trump’s and Vice President Biden’s proposals, we first identified the policies to consider and then estimated the revenue and spending implications of those policies over a ten-year period. Policy areas were identified from the candidates’ official campaign websites – donaldjtrump.com and joebiden.com – as of October 1, 2020. Biden’s policies all come from 48 policy areas in the Bold Ideas section of his website, whereas Trump’s come from the 54 bullet points included as part of his Trump Campaign Announces President Trump’s 2nd Term Agenda: Fighting For You! and The Platinum Plan: President Trump’s Pillars releases. We first took an inventory of all policy proposals, then narrowed our focus to only proposals that could have a significant fiscal impact. Where appropriate, we filled in missing details regarding proposals from the candidates’ websites, using information from speeches, debates, news articles, other analyses of candidate proposals, the President’s budget proposals, similarly described proposals, and ongoing discussions with the campaigns. We grouped individual policy changes into sets of proposals, rounded each to the nearest $50 billion, then excluded proposals that totaled substantially less than $50 billion.

For each set of proposals, we generated a low-cost, central, and high-cost estimate. Differences between these estimates are based both on differing available scores of the same policy and on different interpretations of the policy itself. In many cases, costs ended up being the same in multiple or all three estimates.

Our estimates are generated in part based on a variety of respected sources, all of which are cited in endnotes accompanying each policy.

In general, whenever the campaigns provided their own estimates, we automatically incorporated them under our low-cost estimates and evaluated the validity and credibility of those estimates to determine whether they should also be incorporated into our central or high-cost estimates. Whenever the campaigns provided single-year costs or savings, we assumed the ten-year effects would be ten times as large.

When the campaigns did not provide an estimate or their estimates did not appear to match the policy, we first turned to credible estimators who have specifically evaluated either the Trump or Biden plans. If such estimates were not available, we turned to credible estimates of the same or similar plans in other contexts. Where significant differences existed, we adjusted estimates to better match the proposals put forward by the campaigns. Finally, if no credible outside estimate could be found, we generated our own using our own models or open source models. All estimates are based on conventional scoring and exclude the effects of changes to economic output on the deficit. The direction of these effects is uncertain, but is likely to be small relative to the totals.

Our sources are mentioned throughout this document, but we especially relied on estimates from the Congressional Budget Office, Office of Management and Budget, Tax Policy Center, Tax Foundation, Penn Wharton Budget Model, American Enterprise Institute, and Urban Institute. Many of our estimates have already been detailed in recent US Budget Watch and Committee for a Responsible Federal Budget papers, including Understanding Joe Biden’s 2020 Tax Plan, Understanding Joe Biden’s 2020 Health Care Plan, and Analysis of the President’s FY 2021 Budget.

In order to provide an apples-to-apples comparison, our estimates assume policies are fully implemented at the beginning of calendar year 2021. Realistically, most policies would start later, and some would take years to implement or to fully phase in. Our estimates also exclude policies related to the current pandemic and economic crisis, which we will evaluate separately.

Our estimates should be considered very rough and could change depending on further details provided by the campaigns.

This report should be not construed as an endorsement of any candidate for office. It is purely for informational purposes.

*Update 10/14/2020: This paper has been updated after publication to correct a minor spreadsheet error. We previously stated that Vice President Biden’s plan would result in debt of 128 percent of GDP in 2030 under our central estimate and 138 percent under our high-cost estimate. We now find Biden’s plan would result in debt of 127 percent of GDP in 2030 – 1 percentage point lower – under our central estimate and 136 percent – 2 percentage points lower – under our high-cost estimate.

1 We have analyzed the major proposals from the candidates as of October 1, 2020. Using credible outside sources, as well as our own estimates for each policy, we generated a low-cost, central, and high-cost estimate of the fiscal implications of Trump’s and Biden’s proposals. Our estimates are rough, rounded, and based on our understanding of the candidates’ policy proposals and details. We have sought clarification from the campaigns where policies were unclear, but the estimates are our own. Importantly, both candidates have additional proposals to combat the current health and economic crisis. COVID-related proposals are excluded from this analysis but will be estimated in a separate piece.

2 Reflecting uncertainty about the costs of individual proposals (especially with President Trump), as well as the details of what is being proposed, we generated low-cost, central, and high-cost estimates for each candidate. These estimates are detailed in later pages, with our methodology discussed mainly in the endnotes. Each scenario relies on different policy and estimating assumptions to present estimates that are rough, rounded, and reflect our best understanding and estimates of the candidates’ policies, given the information currently available and shared with us by the campaigns. The low- and high-cost estimates are not absolute bounds, as actual net costs could be below or above them. To allow for comparison across proposals, our estimates generally assume the candidates’ plans are fully phased in by the beginning of FY 2021 and show the net fiscal impact between FY 2021 and FY 2030.

3 See, for example, Congressional Budget Office. “S. 1895, Lower Health Care Costs Act,” July 2019.

4 Thomas, Katie. “Trump Administration Takes First Step to Allow Drug Imports From Canada.” New York Times, 19 Dec. 2019, https://www.nytimes.com/2019/12/18/health/drug-prices-imports-canada.html.

5 Through executive order, the President is also ostensibly reducing Medicare Part B drug prices by requiring that Medicare pays at “most favored nation status” levels. The President has also announced that he is issuing drug discount cards to seniors. These policies are pre-election and would roughly cancel each other out, thus we do not include them in our analysis.

6 Office of Management and Budget. “A Budget for America’s Future,” February 2020. https://www.govinfo.gov/content/pkg/BUDGET-2021-BUD/pdf/BUDGET-2021-BUD.pdf

7 Congressional Budget Office. “An Analysis of the President's 2021 Budget” March 2020. https://www.cbo.gov/publication/56278

8 See, for example, “Remarks by President Trump on the Infrastructure Initiative.” https://www.whitehouse.gov/briefings-statements/remarks-president-trump-infrastructure-initiative/ and https://twitter.com/realDonaldTrump/status/1245000074167541761?s=20

9 We use OMB’s estimate of the President's FY 2021 budget proposal for three policies. These include $75 billion for increasing surface transportation spending through a highway bill reauthorization, $190 billion for other infrastructure investments such as bridges and freight, and $9 billion for a capital fund for infrastructure investments.

10 We estimate it would cost roughly $200 billion to return to the moon and establish a permanent lunar presence, based on estimates from a 2009 CBO report and 2009 CSIS study. Actual costs could be higher or lower depending on how fast the base is established and how much cost overrun there is – our low and high scenario assume $150 billion and $250 billion, respectively. When it comes to Mars, existing estimates range from $100 billion to $500 billion per mission. We assume these as our low- and high-cost estimates, and take the mid-point of $300 billion as our central estimate.

11 Most of this cost comes from the $40 billion to support Black contractors and investors. Additional proposals are similar to those put forward in the President’s budget proposal and would cost no more than a few billion dollars over a decade. See Office of Management and Budget. “A Budget for America’s Future,” February 2020. https://www.govinfo.gov/content/pkg/BUDGET-2021-BUD/pdf/BUDGET-2021-BUD.pdf

12 Office of Management and Budget. “A Budget for America’s Future,” February 2020. https://www.govinfo.gov/content/pkg/BUDGET-2021-BUD/pdf/BUDGET-2021-BUD.pdf

13 CBO estimates the strategy would require $77 billion more budget authority over five years and $376 billion more over fifteen years, in 2021 dollars, than what the Pentagon has outlined. By our estimates, this totals about $200 billion in budget authority over ten years in nominal dollars, which equates to about $150 billion of additional outlays. See Congressional Budget Office. “Long-Term Implications of the 2021 Future Years Defense Program,” September 2020. https://www.cbo.gov/publication/56526

14 Office of Management and Budget. “A Budget for America’s Future,” February 2020. https://www.govinfo.gov/content/pkg/BUDGET-2021-BUD/pdf/BUDGET-2021-BUD.pdf

15 CBO estimated in 2014 that a program that allowed VA enrollees to see any doctor would cost $50 billion per year when fully phased in. We take this estimate and subtract the amount currently spent on community care based on CBO’s estimate of the VA Mission Act.

16 Department of Veterans Affairs. “FY 2021 Budget Submission,” February 2020. https://www.va.gov/budget/docs/summary/fy2021VAbudgetInBrief.pdf

17 Congressional Budget Office. “An Analysis of the President's 2021 Budget” March 2020. https://www.cbo.gov/publication/56278

18 Office of Management and Budget. “A Budget for America’s Future,” February 2020. https://www.govinfo.gov/content/pkg/BUDGET-2021-BUD/pdf/BUDGET-2021-BUD.pdf

19 See, for example, Tony Romm. “Trump promises permanent payroll tax cut if re-elected,” Washington Post, August 8, 2020. https://www.washingtonpost.com/us-policy/2020/08/08/trump-payroll-tax-cut/

20 Brian Faler. “Trump weighing 10 percent middle-class tax cut plan,” Politico, February 14, 2020. https://www.politico.com/news/2020/02/14/trump-middle-class-tax-cut-115262

21 See, for example, Caitlyn Oprysko and Arren Kimbel-Sannit. “Trump again flirts with easing capital gains taxes,” Politico, August 30, 2019. https://www.politico.com/story/2019/08/30/trump-capital-gains-taxes-1478882

22 See, for example, Zachary Evans, “Trump Floats Capping Capital Gains Tax at 15 Percent if Reelected,” National Review, August 13, 2020. https://www.nationalreview.com/news/trump-floats-capping-capital-gains-tax-at-15-percent-if-reelected/

23 Jeff Stein, “Trump advisers exploring tax proposal that would lower ‘middle class’ rate to 15 percent,” Washington Post, November 12, 2019. https://www.washingtonpost.com/business/2019/11/12/trump-advisers-exploring-tax-proposal-that-would-lower-middle-class-rate-percent/

24 “Joe’s Vision.” Joe Biden for President: Official Campaign Website, 18 Sept. 2020, joebiden.com/joes-vision.

25 Our central and high-cost estimates assume that universal pre-kindergarten will cost $150 billion over ten years (as estimated in our analysis of Biden’s K-12 Education Plan) and the enhanced Child and Dependent Care Tax Credit, $100 billion (as estimated in our analysis of Biden’s Tax Plan). The Child Care for Working Families Act appropriates $20 billion, $30 billion, and $40 billion for the first three years of the program and then allows such sums as are necessary beyond that. Our central estimate assumes the program would continue to cost $40 billion per year for the remaining seven years. Our high-cost estimate assumes costs will average $60 billion per year, which we sourced from a Vox.com article attributed to Ajay Chaudry, an independent researcher and New York University fellow who is familiar with the legislation. We also assume there would be considerable interaction between this program and the proposals for universal pre-K and the expanded Child and Dependent Care Tax Credit.

26 Our earlier analysis of Biden’s preschool and K-12 education plan provided an estimated cost of $850 billion over ten years. That included $150 billion for universal pre-K, which we include in the child care section of this analysis, as well as $100 billion for school construction, which we include in the infrastructure section of this analysis.

27 For this proposal, we assumed a cost of $48 billion per year, or $480 billion over ten years, provided by the Sen. Sanders campaign. See https://berniesanders.com/issues/free-college-cancel-debt/

28 This estimate is based on a CBO score of a provision in President Obama’s FY 2017 budget proposal. See https://www.cbo.gov/system/files/2020-03/56216-2016-03-29-education.pdf