Comparing Fiscal Multipliers

The United States is currently facing one of its worst economic and public health crises as a result of COVID-19. Though substantial COVID relief has been enacted, as catalogued at COVIDMoneyTracker.org, more may be needed given high rates of unemployment and low levels of output.

The output gap – the difference between expected economic output under current law and possible economic output if the economy were operating at full potential – is projected to total $1.85 trillion over the next two years according to the Congressional Budget Office (CBO).

Fiscal policy can reduce this output gap over time. How effective a policy will be depends on its “multiplier” – the output produced for each dollar spent. While COVID relief should be designed to achieve a number of different goals – and there is no “right” share or length of the output gap that must necessarily be closed – policymakers should focus on high-multiplier spending and tax cuts where possible.

Importantly, these policies may boost economic activity in the short-term, but they will ultimately add to the debt and thus slow long-term economic growth. Policymakers can balance these risks by focusing on the policies that produce the greatest amount of economic activity for a given cost and can mitigate or reverse them by coupling short-term fiscal support with long-term deficit reduction.

The Size of the Output Gap and Funds Needed to Close It

Congress and the President have enacted a combined $4.7 trillion of COVID relief, which will have a projected net deficit impact of $2.7 trillion. These funds can be tracked at www.COVIDMoneyTracker.org. However, much of this relief is no longer being disbursed and is being depleted by households, businesses, states, and localities.

In designing any further response package, policymakers may have a variety of goals such as reducing COVID cases and deaths, preserving personal income, maintaining business solvency, reducing the rate of unemployment, or restoring economic output.

One key goal will be to maximize the positive effect of the package on Gross Domestic Product (GDP) by shrinking or even eliminating the output gap.

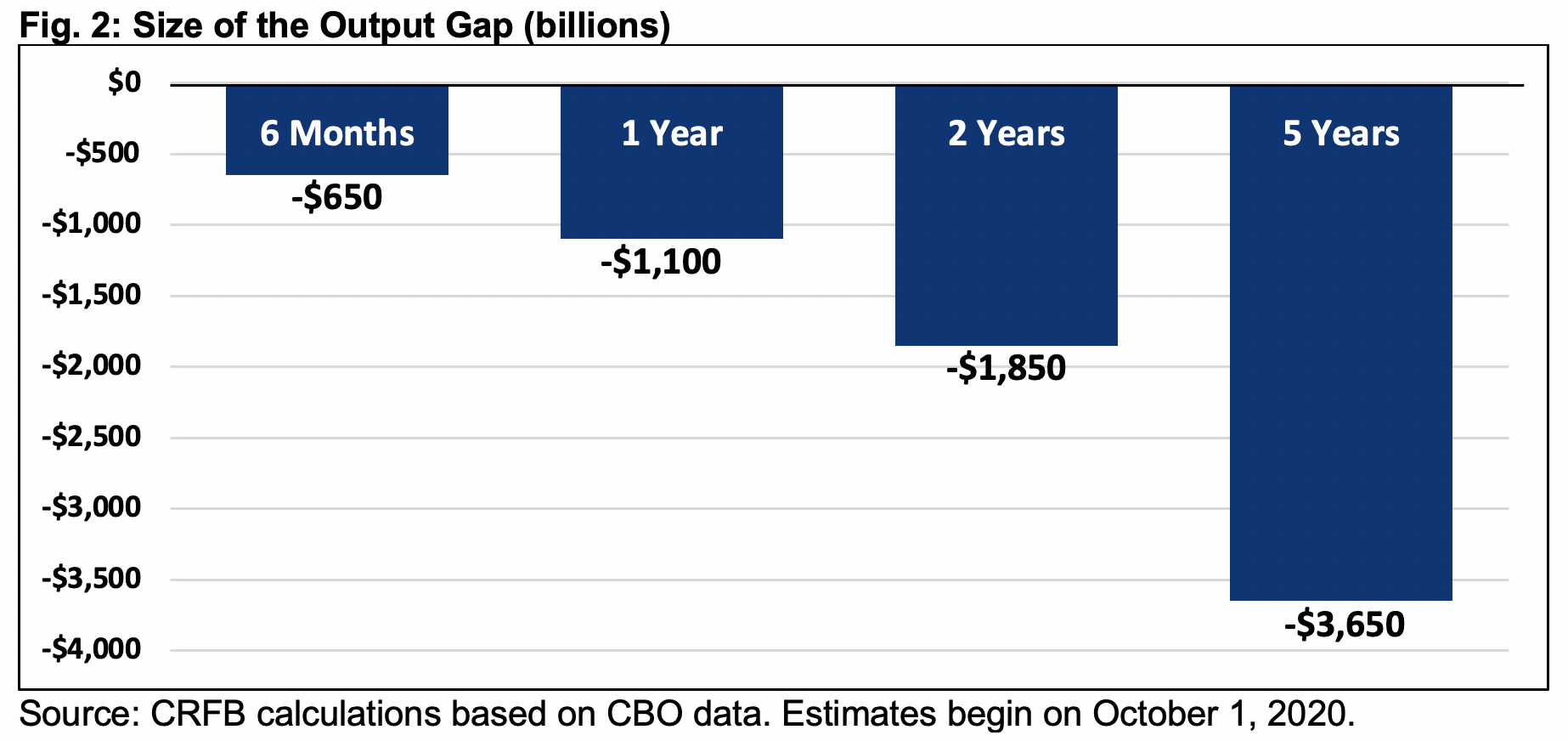

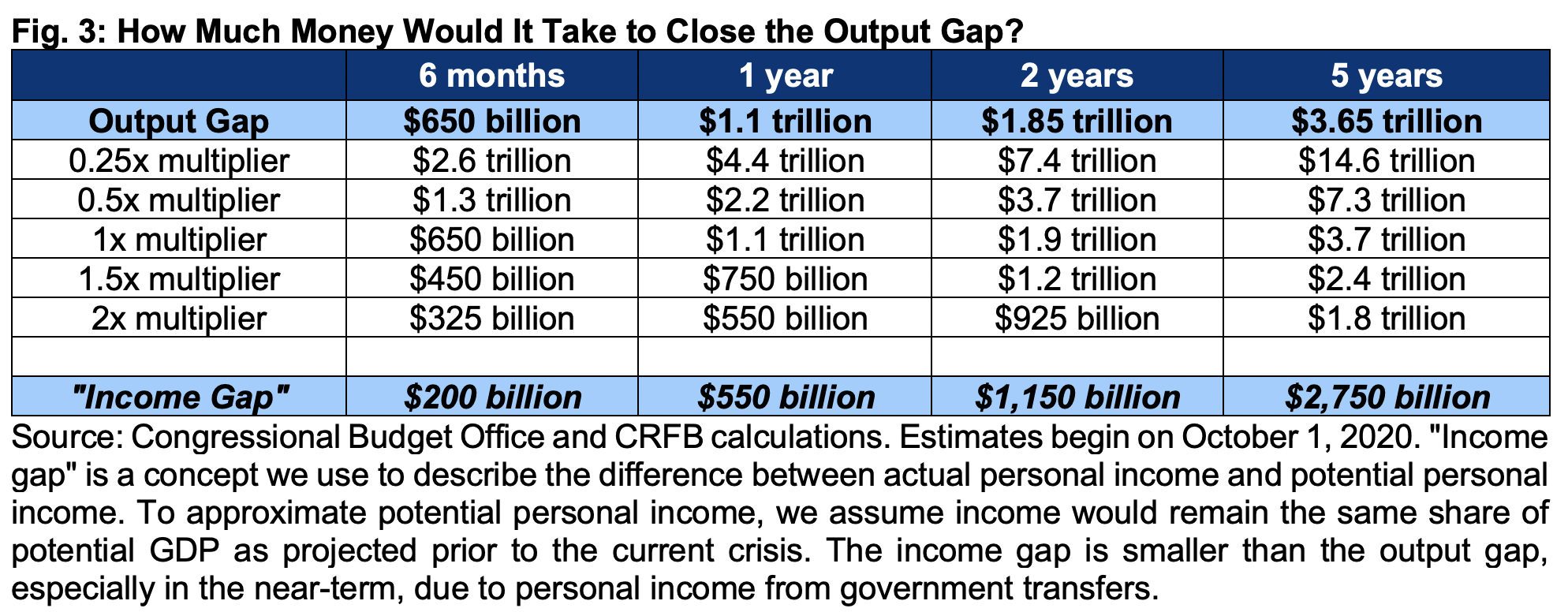

The output gap is the difference between expected economic output as measured by GDP under current law and possible economic output if the economy were operating at full potential. CBO estimates the output gap will total $650 billion over the next six months, $1.1 trillion over the next year, $1.85 trillion over two years, and $3.65 trillion over five years.

How effective a policy will be in reducing the output gap depends on its “multiplier” – the output produced for each dollar spent. For example, a multiplier of 0.5 means that each dollar of spending would produce 50 cents of economic output.

To close the two-year output gap with policies that have a 0.5x multiplier, policymakers would need to allocate roughly $3.7 trillion. With a 1.5x multiplier, they would only need to allocate $1.2 trillion. The table below shows the amount of fiscal support that would be necessary to achieve a variety of goals. (For more discussion, see How Big Should the Next COVID Package Be?)

Some of the economic boost from these policies might take place beyond the period of the output gap they are focused on addressing. It is unlikely any amount of fiscal stimulus could fully close the output gap in real time so long as the pandemic continues to require social distancing.

What Policies Have the Highest Multipliers?

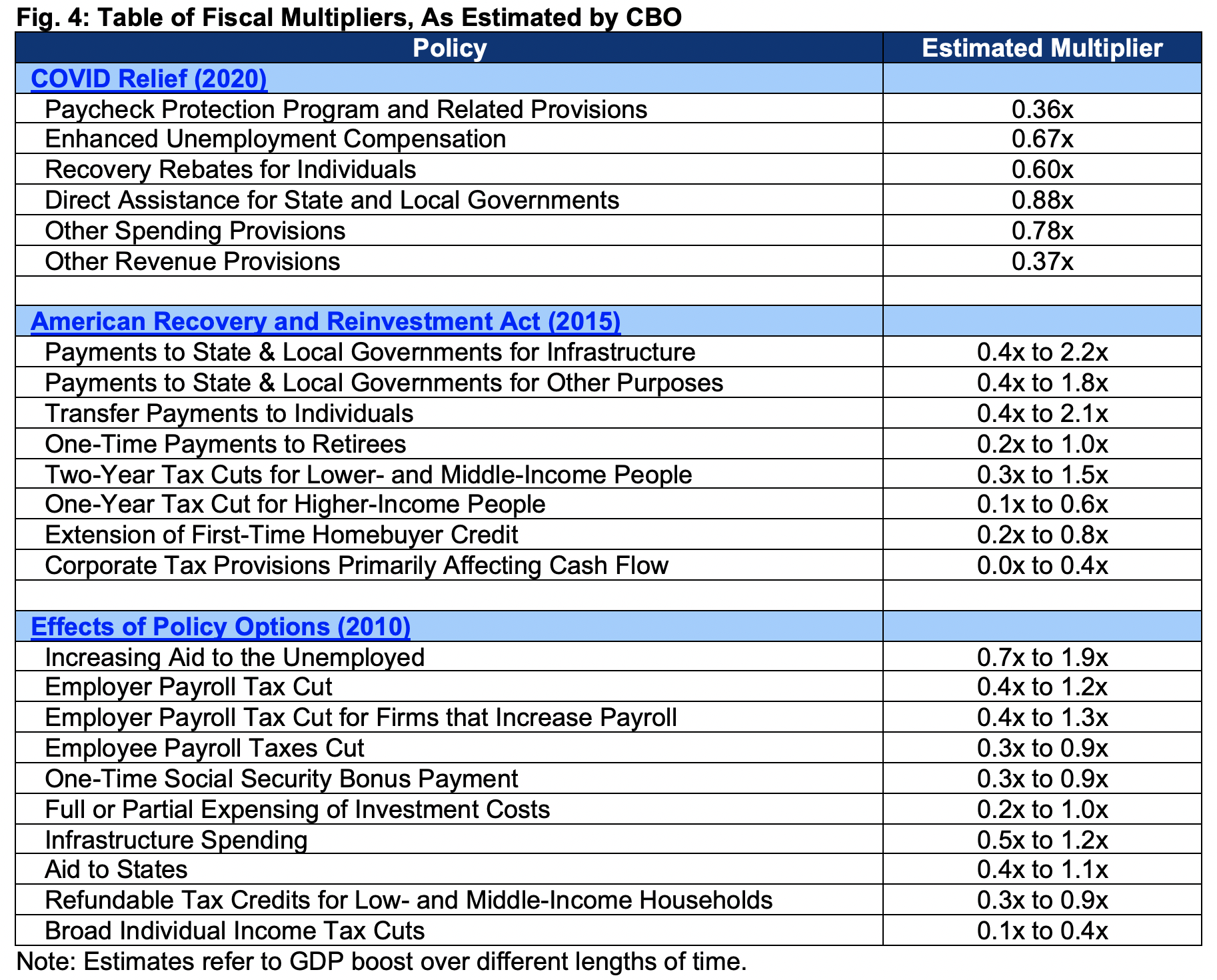

CBO recently analyzed $2.6 trillion of net spending and tax breaks enacted so far to address the current recession. Though the agency’s estimates came with substantial uncertainty, CBO found the relief will ultimately boost economic activity by $1.5 trillion and that it lifted GDP by about 8 percent over the past three months. This equates to an average multiplier of almost 0.6 – a figure partially tempered by social distancing.

The analysis also demonstrated that some spending increases and tax cuts have higher multipliers than others, meaning that some policies can boost the size of the economy more for a given dollar spent.

In general, the following criteria result in higher multipliers:

- Funding for direct government purchases;

- Transfers or tax cuts for those likely to spend the money rather than save it;

- Funding that can be spent quickly;

- Policies that are credibly temporary;

- Policies that encourage rather than discourage work and capital investment; and

- Policies that target structural damage in the economy.

In some cases, these criteria are in conflict. For example, infrastructure spending is a direct government purchase but is rarely spent quickly. As another example, unemployment benefits go to those most likely to spend – lower-income households who experienced a significant drop in income – but may also discourage work.

Some policies may have low multipliers but achieve other important goals such as improving public health, securing household or business balance sheets, maintaining income, reducing poverty, or saving small businesses.

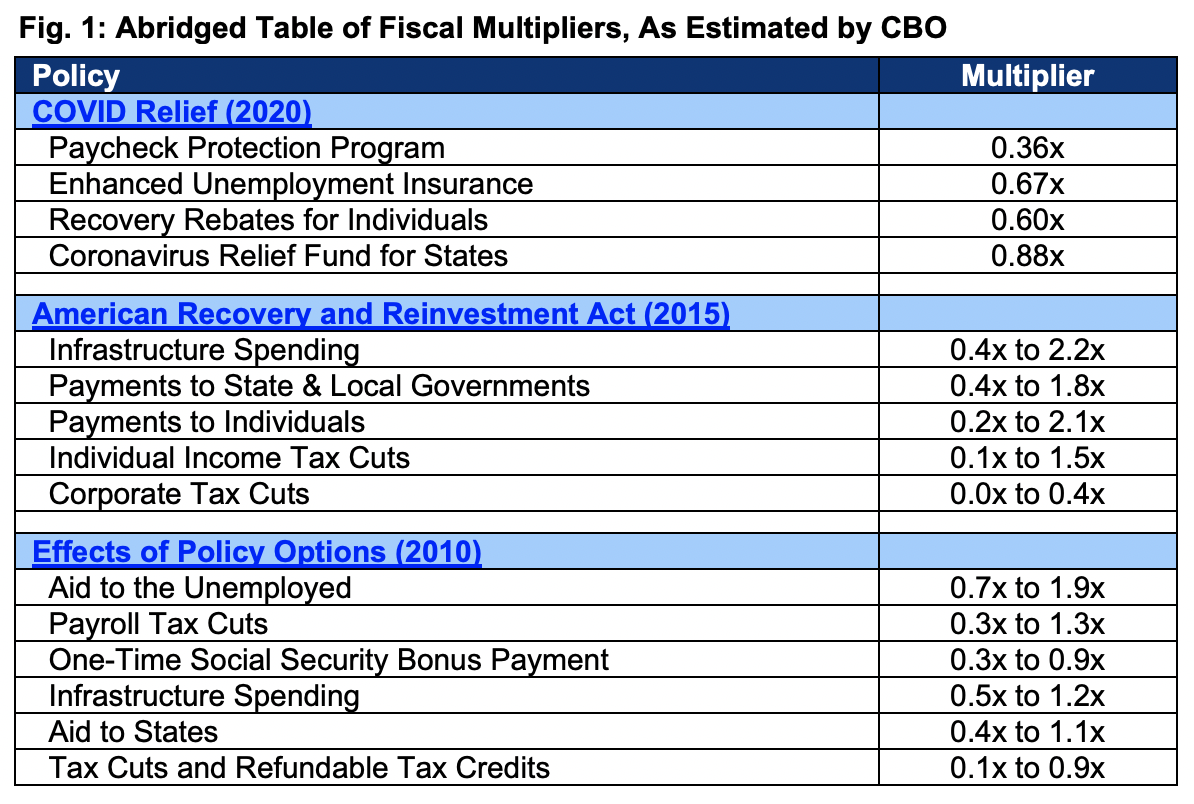

The Congressional Budget Office has produced numerous estimates over the years for specific and broad policy multipliers. The table below compiles many of these policies. CBO’s multipliers for recent COVID relief are lower than normal because social distancing reduces the macroeconomic effectiveness of fiscal policy. Future COVID relief is likely to have a larger economic impact than a similar policy enacted earlier this year when lockdowns were more stringent, but still less impact than in previous recessions.

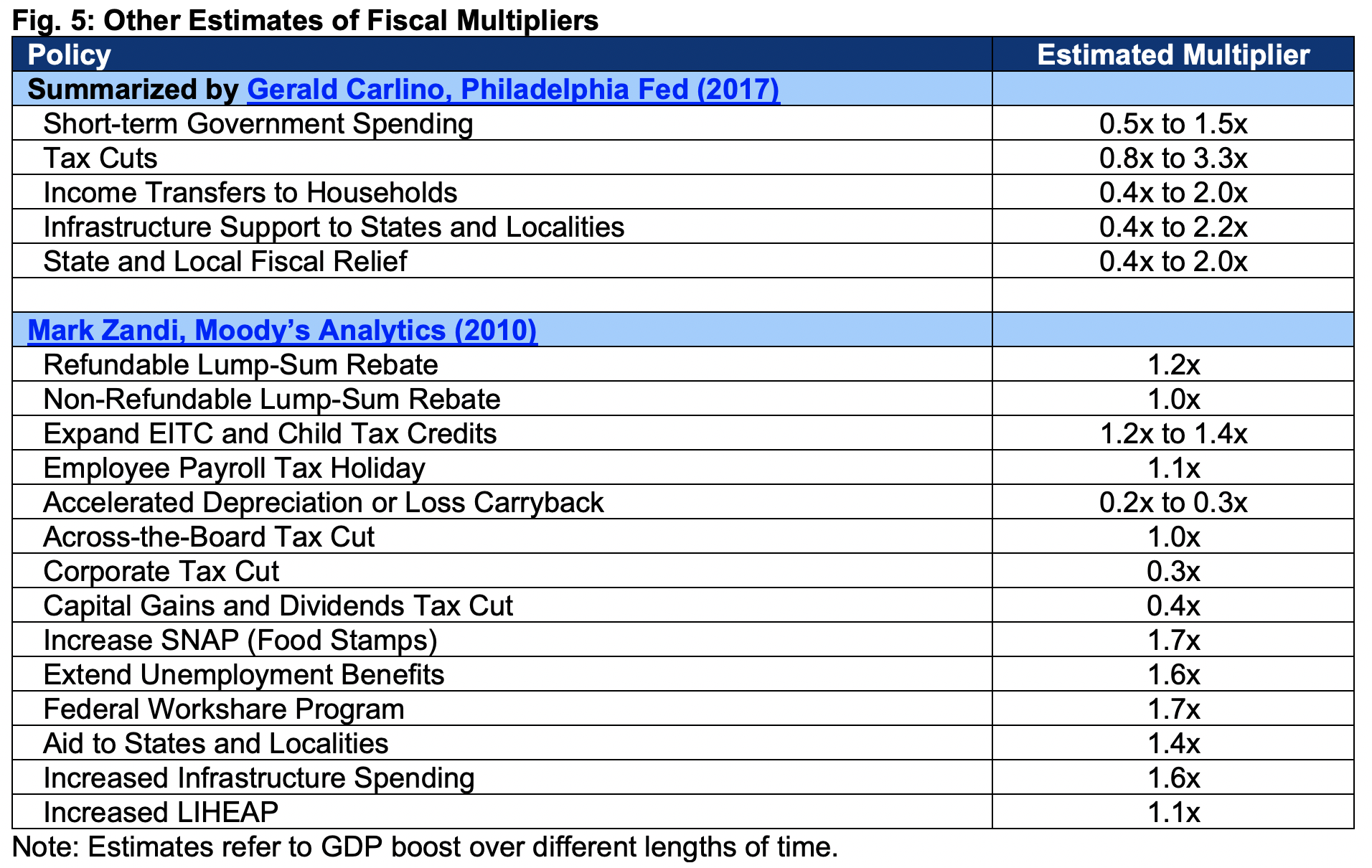

Other estimators have reached different conclusions. Gerald Carlino, an economist at the Federal Reserve, summarized many across the academic literature. Mark Zandi of Moody’s Analytics estimated the measures considered in 2010. These multipliers are not strictly comparable to CBO’s, but show the relative effect of policies within each set of estimates.

Importantly, there is no free lunch. Deficit-financed stimulus can boost the economy in the near-term but will likely reduce long-term output. For example, CBO projects the $2.6 trillion COVID relief will shrink economic output by 0.4 percent in 2030.

Because the negative impact of borrowing depends only on the size of a package and the positive impact depends heavily on the composition, policymakers should aim to maximize the “bang for the buck” with high-multiplier spending when possible.

Perhaps more importantly, policymakers could counter any negative long-term economic effects by coupling short-term fiscal support with policies that offset the costs over the medium term and reduce them over the long term. A well-designed package of near-term stimulus and long-term consolidation could increase economic output both in the near term and the long term.