New Senate Tax Bill Cuts Less Than $3.7 Trillion of Tax Breaks

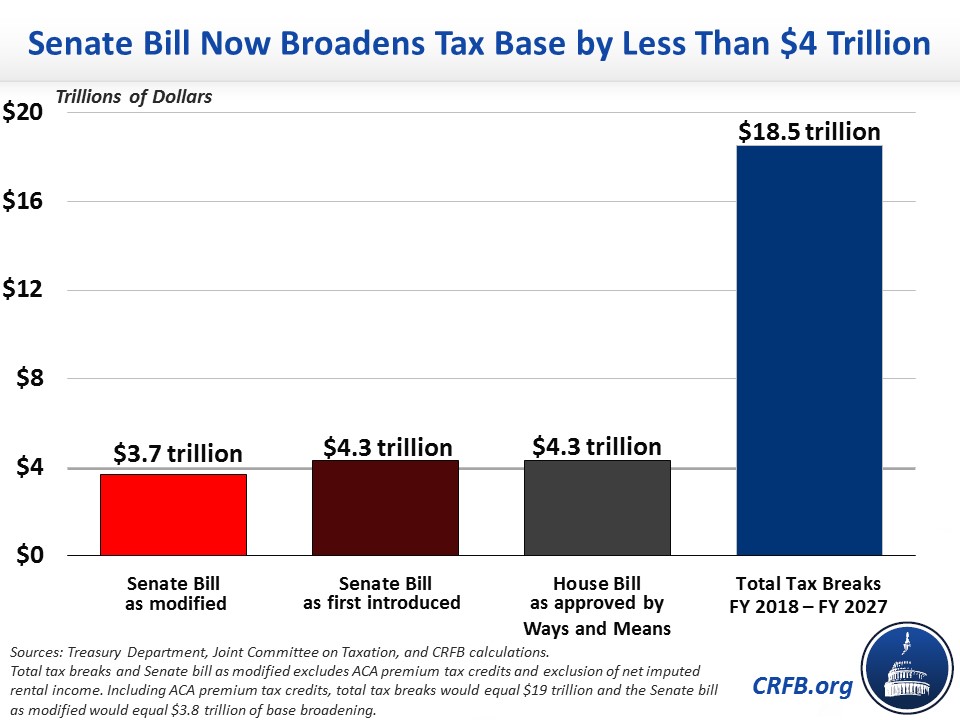

One of the main goals for tax reform has been to follow the mantra of "broaden the base, lower rates." Yet despite over $18 trillion of tax expenditures under current law over the next decade, we estimate the latest Senate bill cuts only $3.7 trillion of tax breaks. This is significantly less than the $4.3 trillion of tax breaks cut by the House bill and the original Senate version of the Tax Cuts and Jobs Act (TCJA). All of the versions of the TCJA contain several base-broadeners to help offset their rate cuts, but the current Senate bill has substantially fewer than it started with.

While even eliminating all tax expenditures wouldn't raise the full $18 trillion (the Tax Policy Center estimates it would raise about $10.5 trillion against lower individual and corporate rates), the Senate clearly leaves significant revenue on the table and leaves most tax breaks in place. In fact, most of the largest tax expenditures – including the employer health exclusion, mortgage deduction, charitable deduction, retirement account benefits, tax-free bonds, the research and experimentation credit, and special rules for capital gains – are virtually untouched by the bill.

Our estimate of the number of tax breaks cut by the Senate bill is, if anything, a generous one. In estimating the number of tax breaks cut by the new Senate bill, we relied on a broad definition that included not only changes that reduced the costs of tax expenditures but also reductions to non-tax expenditure base provisions (NTEBPs) and provisions that indirectly offset the effects of tax breaks through new rules or surtaxes. We also didn't include the cost associated with expanding tax breaks in the bill (for example, the bill increases the cost of the child tax credit by $584 billion). We did not include revenue or spending cuts resulting from provisions unrelated to tax breaks – for example, we did not count revenue from repealing the individual mandate or from indexing the tax code to the more accurate chained Consumer Price Index (chained CPI).*

We don't expect tax reform to repeal all tax breaks (though that would be a good place to start the discussion). But base broadening in the current Senate bill is too small to cover the reported or true cost of the legislation. Lawmakers should work to find additional base-broadening measures to offset their desired rate cuts.

*Note that we count the Affordable Care Act (ACA or "Obamacare") premium credits as a spending program rather than a tax expenditure – both in our estimate of the effect of the bill and the total cost of tax breaks. Were we to count these premium tax credits as a tax expenditures, total base broadening in the bill would rise between $3.8 trillion and $3.9 trillion.