Senate Tax Bill Could Add $1.8 Trillion to Debt

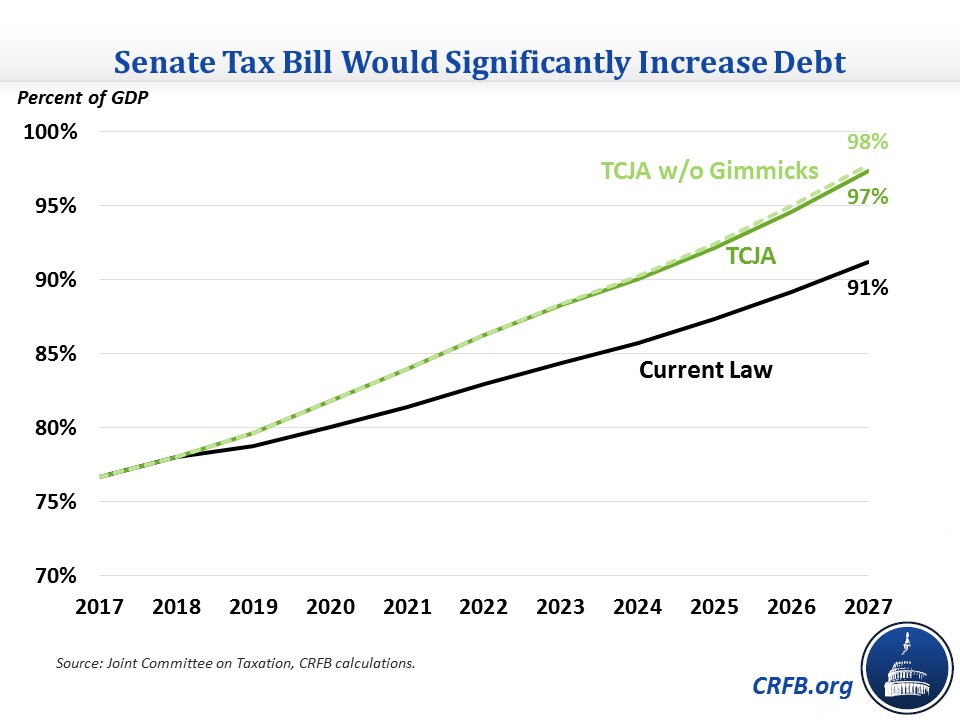

The Senate version of the Tax Cuts and Jobs Act (TCJA) is estimated to increase deficits by $1.5 trillion over ten years. However, even this cost does not reflect the resulting increased spending on interest on the debt and a gimmick included in the bill. After considering these factors, the Senate bill could ultimately cost more than $1.8 trillion over ten years. This would push debt to 98 percent of Gross Domestic Product (GDP) by 2027, compared to 91 percent under current law.

The cost of the Senate bill as estimated by the Joint Committee on Taxation (JCT) is $1.5 trillion over ten years. This increase in the deficit would also cause higher interest spending to service the debt, which would bring the total cost of the bill to $1.73 trillion over ten years.

However, the Senate bill's true cost is even higher than that since it arbitrarily sunsets full business expensing after five years. There is no policy justification for temporary expensing in current economic circumstances, so the sunset is simply to reduce the cost of that policy and the bill as a whole and set up a costly extension in the future. We estimate that factoring in permanent rather than five-year expensing would increase the bill's cost by over $100 billion through 2027. As a result, the true cost would be over $1.8 trillion.

Cost of Senate Version of TCJA

| Ten-Year Cost | |

|---|---|

| Tax Cuts and Jobs Act as scored by JCT | $1.5 trillion |

| Interest cost | $230 billion |

| Total official cost | $1.7 trillion |

| Temporary business expensing made permanent | $100 billion |

| Interest cost | $10 billion |

| Total "real" cost | $1.8 trillion |

Sources: Joint Committee on Taxation, CRFB calculations.

The Senate bill as written would result in debt reaching 97 percent of GDP by 2027 and eclipsing the size of the economy by 2028. Taking out the temporary expensing gimmick and assuming the policy is made permanent, debt would be slightly higher at 98 percent of GDP.

While this gimmick is egregious, the Senate bill overall is much better on gimmicks than the House bill, which contained multiple gimmicks that mask $550 billion of costs through 2027 (including interest). However, using any gimmicks to bring down the cost to the $1.5 trillion limit specified for the reconciliation instructions will ultimately be worse for the budget. Instead, senators should propose real and permanent revenue-raisers to make up the difference.

The headline cost of $1.5 trillion for the Senate's TCJA was already bad enough, but the true cost of the bill when including interest and stripping out the expensing gimmick is even worse at $1.8 trillion. Either number represents a lot of debt being piled on at a time when our fiscal situation is only projected to worsen over the coming decades. Adding $1.8 trillion to the debt would only exacerbate this problem.