IRS Releases Updated Tax Gap Analysis

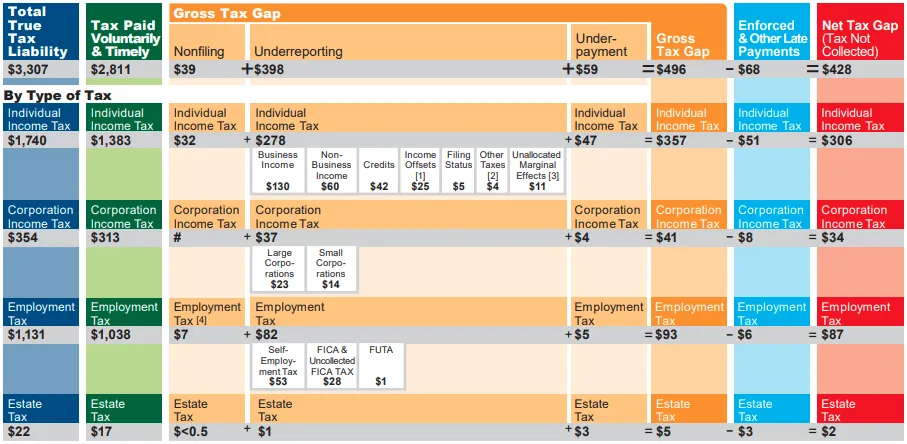

The Internal Revenue Service (IRS) recently released an updated analysis of the “tax gap” – the difference between taxes owed to the federal government each year and the amount actually collected – covering tax years 2014 through 2016. The analysis found that the gross tax gap averaged $496 billion per year and the net tax gap after enforcement and late payments averaged $428 billion per year, meaning 15 percent of taxes were not paid when owed and 13 percent were never paid at all. This represents an improvement in tax compliance relative to earlier years, and recently enacted IRS funding measures should improve compliance even more going forward.

Of the $496 billion gross tax gap, the IRS estimates 80 percent ($398 billion) comes from underreporting of income, with the rest coming from a combination of non-filing and underpayment. 72 percent ($357 billion) of the gross tax gap comes from the individual income tax, compared to 19 percent ($93 billion) from employment taxes and the rest from corporate and estate taxes. At least half of the gross tax gap comes from underreporting of small business income, including $130 billion from underreported pass-through business income and $53 billion from underreported self-employment taxes.

Source: Internal Revenue Service

* Totals include excise tax

# No estimate

[1] Includes adjustments, deductions, and exemptions.

[2] Includes the Alternative Minimum Tax and taxes reported in the “Other Taxes” section of the Form 1040 except for self-employment tax and unreported social security and Medicare tax (which are included in the employment tax gap estimates).

[3] Is the difference between (1) the estimate of the individual income tax underreporting tax gap where underreported tax is calculated based on all misreporting combined and (2) the estimate of the individual income tax underreporting tax gap based on the sum of the tax gaps associated with each line item where the line item tax gap is calculated based on the misreporting of that item only. There may be differences if the marginal tax rates are different in these two situations.

[4] Self-employment tax only

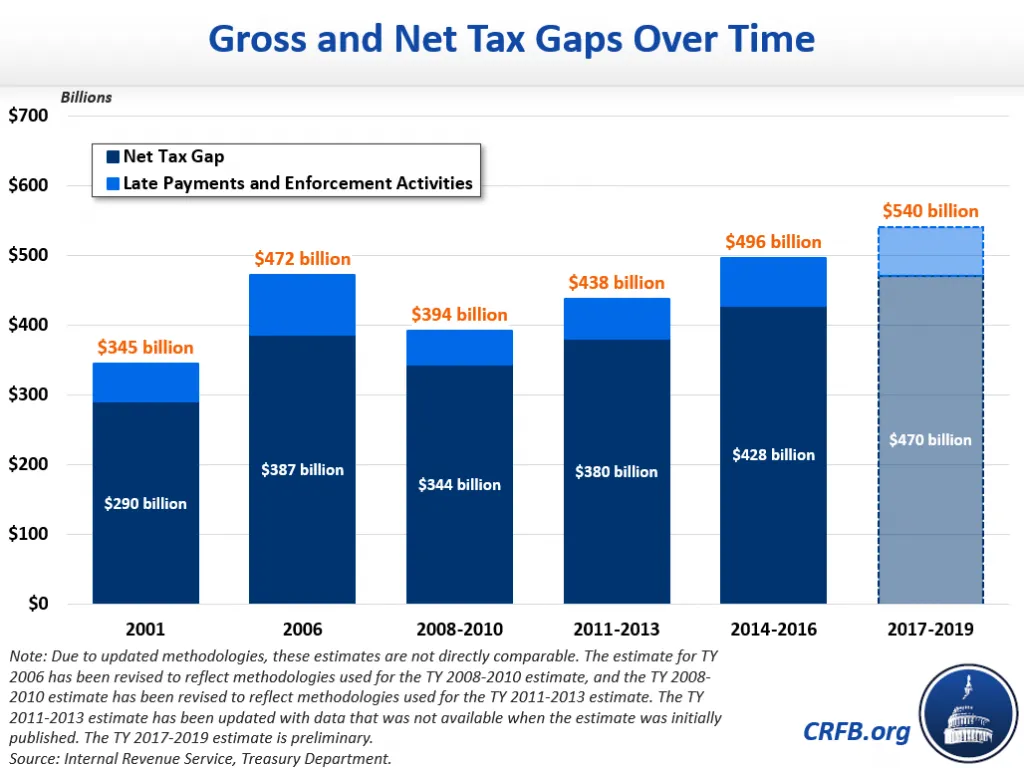

After updating tax gap estimates from the 2011-2013 period and producing preliminary estimates for the 2017-2019 period (inclusive of changes from the Tax Cuts & Jobs Act), the IRS report shows the tax gap is growing over time – but shrinking as a share of taxes owed. The IRS estimates the average annual gross tax gap grew from $438 billion over the 2011-2013 period to $496 billion over the 2014-2016 period, then to $540 billion over the 2017-2019 period. They estimate the annual net tax gap grew from an average of $380 billion in 2011-2013 to $428 billion in 2014-2016, and to $470 billion in 2017-2019.

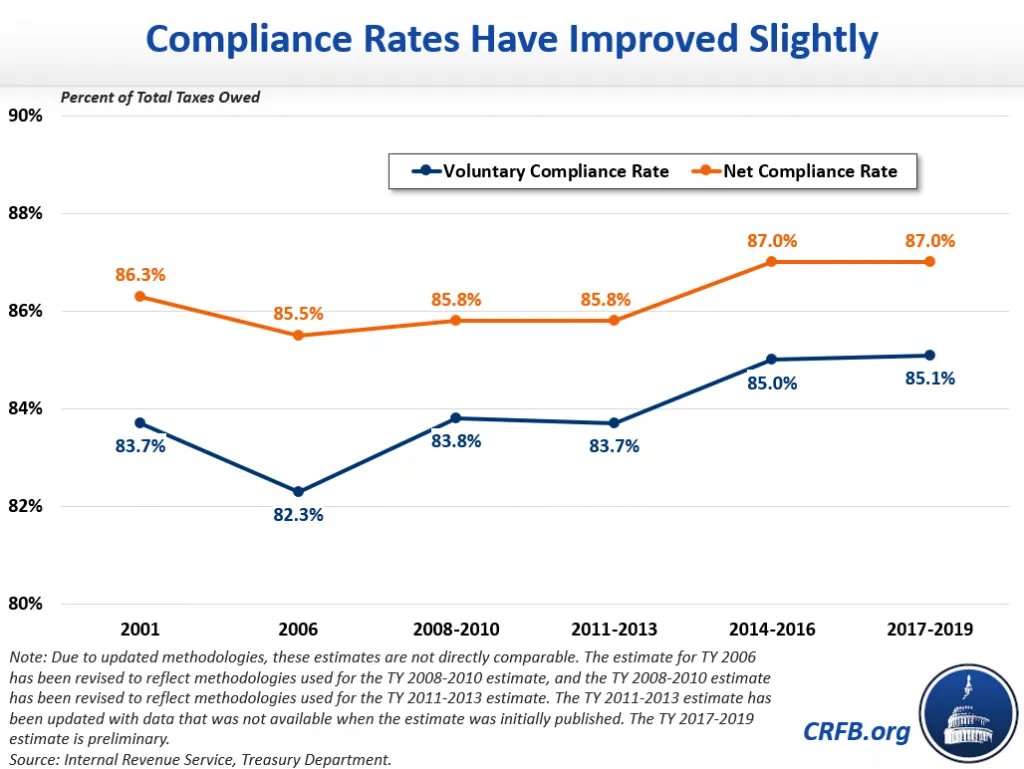

The increase between the 2011-2013 and 2014-2016 periods can be more than fully explained by income growth and changes to the tax code, which increased total true tax liability by 26 percent. Relative to taxes owed, the tax gap actually shrank – with the voluntary gross compliance rate jumping from 83.7 percent to 85 percent and the net compliance rate rising from 85.8 percent to 87 percent.1

Consistent with previous tax gap analyses, the updated data clearly show a direct correlation between the “visibility” of certain types of income and the typical amount of misreporting.2 Income subject to substantial information reporting and withholding, such as wages and salaries, had a net misreporting percentage (NMP) of only 1 percent, whereas income subject to little or no information reporting, such as small business income and income from rents and royalties, had an NMP of 55 percent.3

Given the substantial increase in IRS funding enacted through the Inflation Reduction Act, the agency will hopefully be able to make progress on bringing these figures down and increasing overall tax compliance. Shrinking the tax gap is one of the most efficient ways of raising revenue, and it does so without raising anyone’s taxes. It also has a long history of bipartisan support, including from every president since Ronald Reagan.

Policymakers would be wise to enact additional measures to help reduce the tax gap and close tax loopholes that make it easy for taxpayers to avoid paying what they owe. The CRFB Fiscal Blueprint for Reducing Debt and Inflation proposes to do exactly that.

1 The voluntary compliance rate refers to the percentage of total taxes owed that are paid on time and voluntarily, while the net compliance rate refers to the percentage of total taxes owed that are ultimately paid after including late payments and taxes collected through enforcement measures.

2 “Visibility” refers to the degree to which income is subject to tax withholding or reported to the IRS by a third party.

3 The net misreporting percentage (NMP) is the ratio of the total amount of misreported income in a given category to the sum of the amount that should have been reported, expressed as a percentage.