The Inflation Reduction Act Would Reduce the Tax Gap

Of the $790 billion of savings and offsets in the Inflation Reduction Act (IRA), about $125 billion would come from improving tax compliance. Narrowing the “tax gap” is one of the best ways to raise revenue, as it does so without raising taxes and has a long history of bipartisan support.

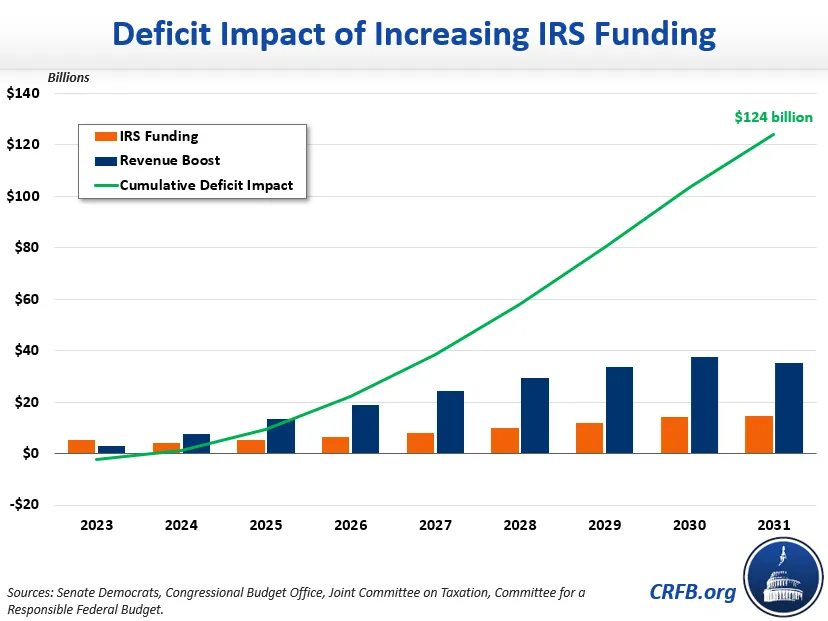

The IRA would narrow the tax gap, or the amount of taxes that are owed but not collected, by increasing funding for the Internal Revenue Service (IRS) by $80 billion over the next ten years. According to the Congressional Budget Office (CBO), the proposal would result in an additional $204 billion in revenue over ten years, for a net savings of $124 billion.

CBO estimates the IRS spending boost will rise from roughly $5 billion in 2023 to $15 billion by 2031. The resulting revenue collection will rise from $3 billion in 2023 to $35 billion by 2031. Although the enhanced funding would end after 2031, the policy would continue to generate additional revenue for several years beyond 2031.

Out of the $80 billion in additional IRS funding, $46 billion would be used for enforcement, $25 billion for operations support, $5 billion for business systems modernization, and $3 billion to improve taxpayer services, with the remaining funding going towards administrative support. This funding would supplement annual IRS appropriations.

Narrowing the tax gap is a commonsense policy to raise revenue. According to the Treasury Department, just under 84 percent of taxes owed in tax-year 2019 were actually paid or collected, resulting in a net tax gap of $554 billion.

Each dollar spent to reduce the tax gap would generate $2.50 of revenue on average over the coming decade, according to CBO’s estimate. This revenue is raised without raising tax rates, cutting tax breaks, or imposing new taxes. It comes from better-ensuring households and businesses pay the taxes they already owe under current law.

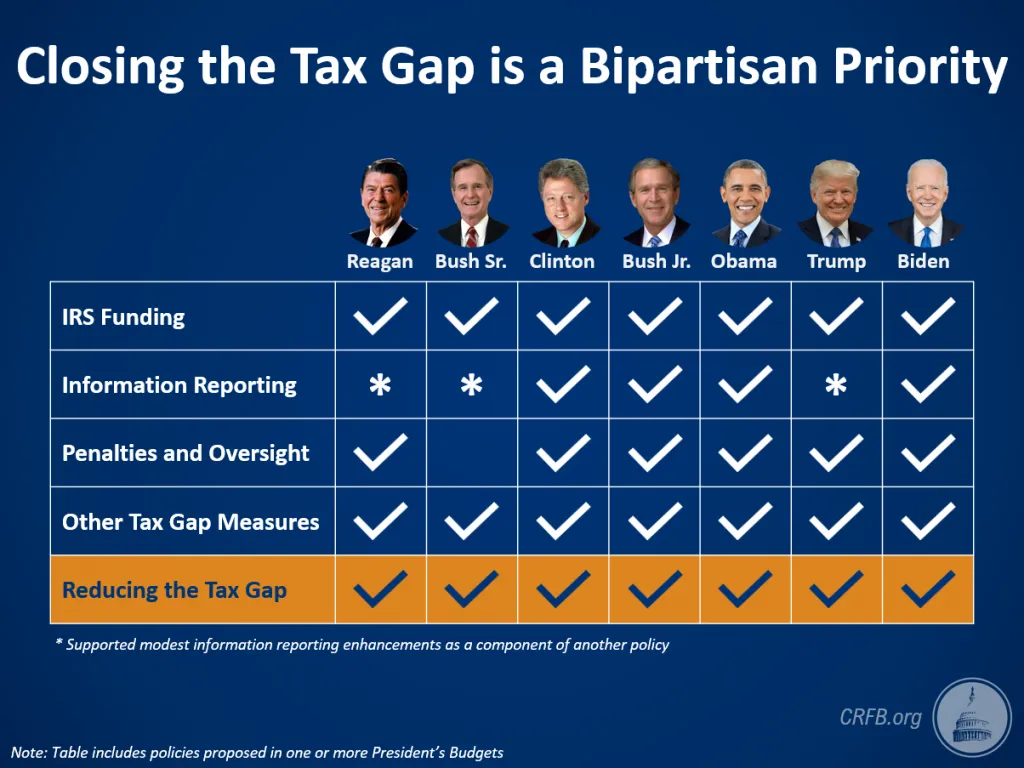

This policy has a long history of bipartisan support. Along with President Biden, every past president from Ronald Reagan to Donald Trump has supported reducing the tax gap with stronger IRS funding.

More recently, a group of 20 tax experts from the left, right, and center, including Committee for a Responsible Federal Budget president Maya MacGuineas, called for better funding for the IRS to support sufficient tax enforcement and address historic backlogs.

With inflation surging at the highest levels in 40 years and debt approaching a record share of the economy, this commonsense initiative is more valuable than ever. Congress will need to make some tough choices to identify the necessary tax increases and spending cuts to put the national debt on a sustainable downward path. Ensuring people pay the taxes they already owe is not one of them – it’s a no-brainer.