Extending TCJA is as Big as Doubling Social Security’s Shortfall

Policymakers are considering an extension of expiring parts of the Tax Cuts and Jobs Act (TCJA) as part of a reconciliation bill, which could reduce revenue by nearly $4 trillion through Fiscal Year (FY) 2034. We estimate that this is as large as the entire Social Security shortfall, not only over the next decade but over the long term. In other words, extending the TCJA would be the fiscal equivalent of doubling Social Security’s projected cash shortfall.

Based on the most recent Congressional Budget Office (CBO) Long-Term Outlook, the Social Security program will cost about $3.3 trillion more than it raises in revenue through 2034, whereas the Joint Committee on Taxation (JCT) estimates extending most parts of the TCJA would reduce revenue by $3.9 trillion. Through 2055, the Social Security shortfall and revenue loss from TCJA extension will both approach $20 trillion, before interest.

A final reconciliation bill could add more or less to deficits than a full extension of TCJA. The House reconciliation instructions allow $2.8 trillion of borrowing through 2034, which represents more than four-fifths of Social Security’s shortfall. The Senate instructions, on the other hand, allow $5.8 trillion of borrowing. CBO recently estimated that a package roughly consistent with the Senate instructions, if made permanent, would increase primary deficits by more than $28 trillion through 2055 on a dynamic basis – about one-and-a-half times the size of the Social Security shortfall.

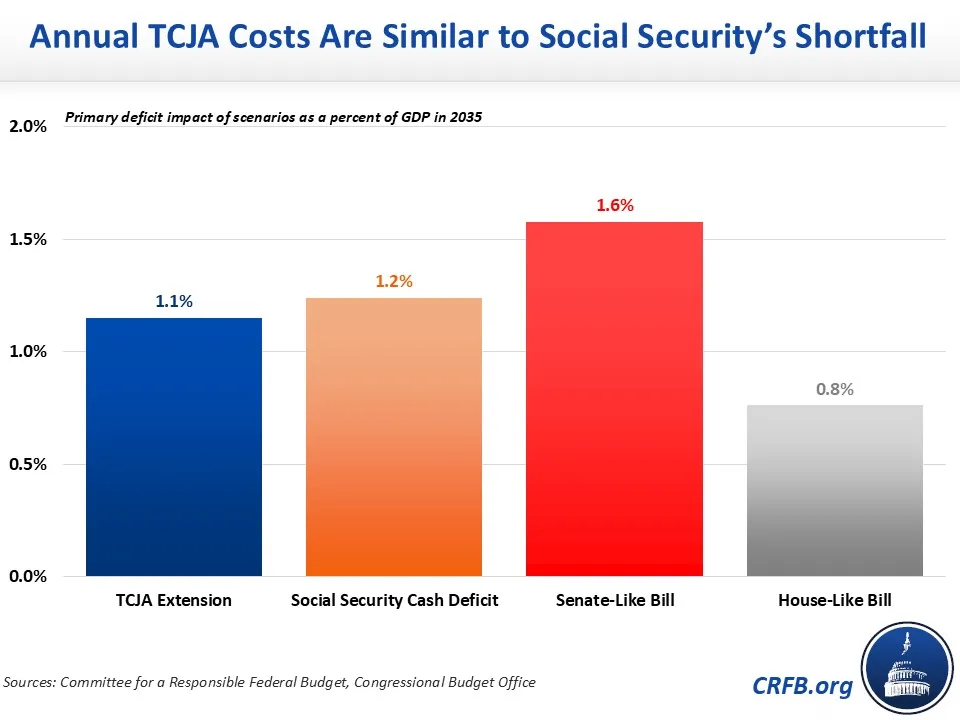

These findings are roughly true on an annual basis, not just a cumulative one. By 2035, for example, Social Security faces a 1.2 percent of Gross Domestic Product (GDP) cash shortfall. That’s similar in size to the 1.1 percent of GDP estimated impact of TCJA extension and smaller than the 1.6 percent of GDP dynamic estimate impact of a bill based on the Senate plan.

As we’ve explained many times, it is incredibly important for lawmakers to address Social Security’s large imbalances before the trust fund's reserves are exhausted. Doing so would not only prevent a deep across-the-board cut in benefits but would also improve the nation’s fiscal outlook and – if designed well – could strengthen retirement security and accelerate economic growth.

Fixing Social Security will require making tough choices on both the revenue and benefit side of the program. Extending the TCJA without offsets would further deepen the nation's fiscal problems.

TCJA extension is as large as the entire Social Security shortfall, and extending the TCJA without offsets would be the fiscal equivalent of effectively doubling the Social Security shortfall.