2.8% COLA Highlights Benefits of a COLA Cap

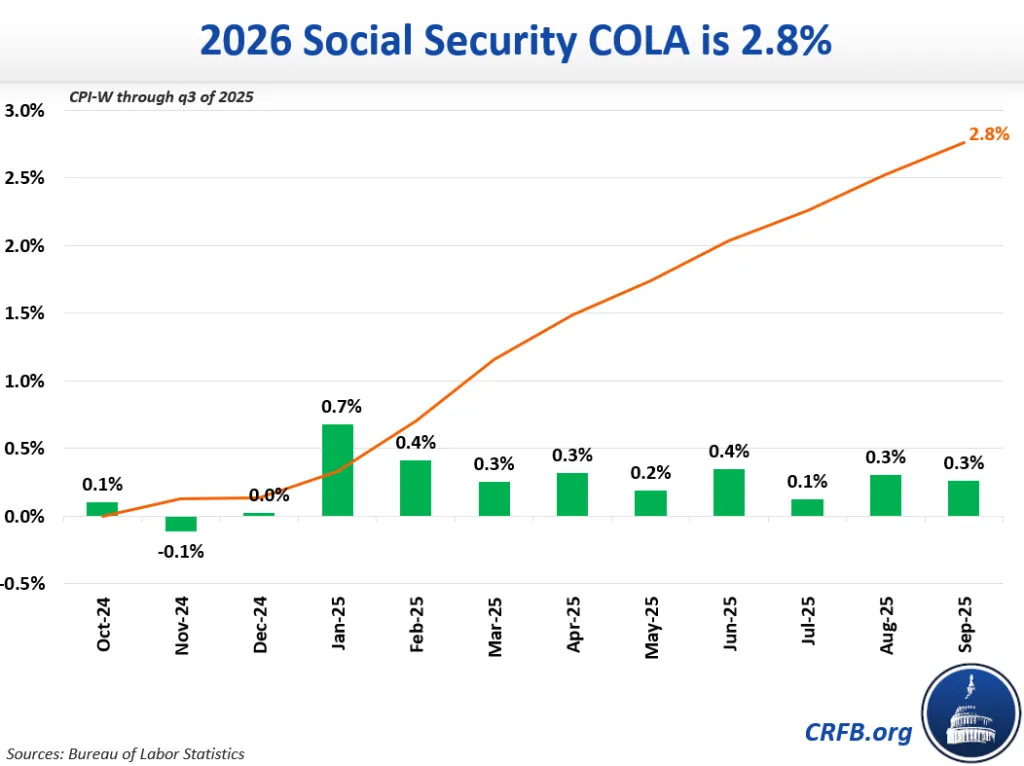

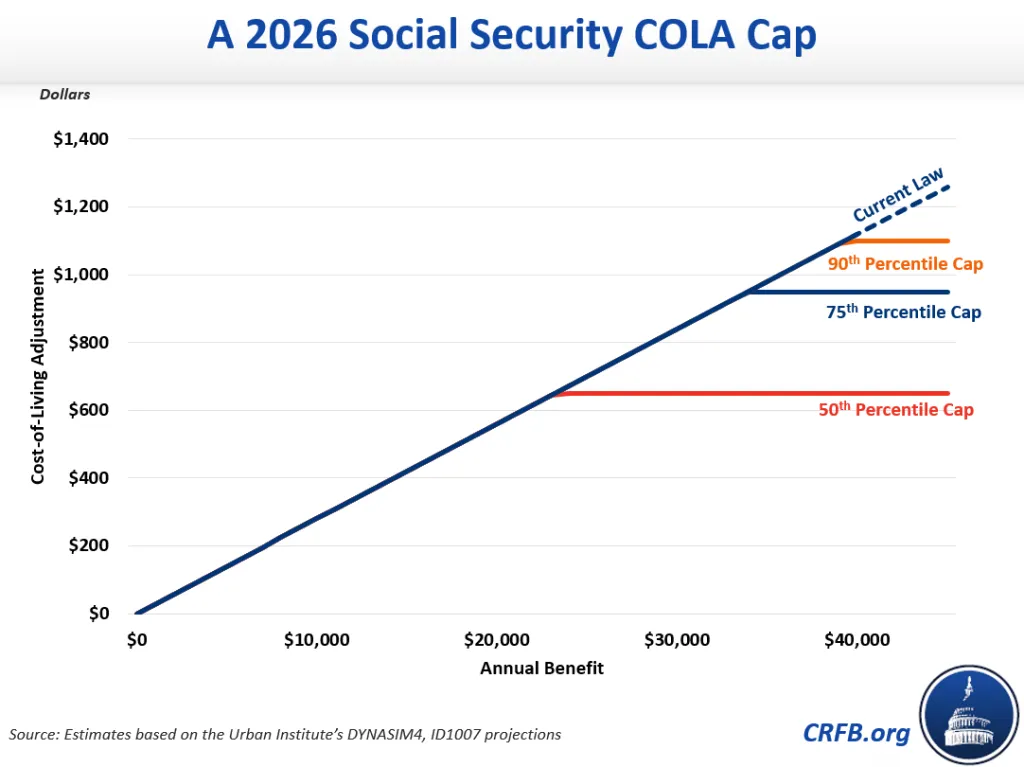

The Social Security Administration announced on October 24 that beneficiaries will receive a 2.8% Cost-of-Living Adjustment (COLA) at the start of 2026. This amounts to about $650 for a typical retiree with a $24,000 benefit, and about $1,400 for the highest income beneficiary with a $49,400 benefit. A COLA cap like the one proposed in our recent Trust Fund Solutions Initiative paper would help improve solvency by retaining but limiting this COLA for the highest earners.

Under Social Security, benefit levels are increased every January through an annual COLA, which is meant to ensure benefits keep track with inflation. All beneficiaries receive COLAs based on the growth in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Historically, growth in the CPI-W outpaced more accurate measures of inflation by an average 0.3 percentage points per year.

With the insolvency of the Social Security retirement trust fund just seven years away, numerous proposals to reform COLAs and slow the growth in benefits have emerged. One novel solution from the Committee for a Responsible Federal Budget’s Trust Fund Solutions Initiative would enact a Social Security COLA cap.

Under the proposal, COLA amounts would be capped at the dollar amount received by a relatively high earner. Based on projections from Karen E. Smith using the Urban Institute’s DYNASIM model, we estimate a 2026 COLA cap with 2.8% CPI-W growth would equal $950 if set at the COLA received by the 75th percentile beneficiary. The cap could be higher or lower depending on how it is set.

Under a COLA cap, most beneficiaries would continue to receive the same COLA as under current law. For example, a typical worker who retired this year at their normal retirement age will receive an $850 COLA in 2026 and would not be affected by the cap. On the other hand, a higher earner with a $1,150 COLA would instead receive one at the $950 cap.

As discussed in our recent paper, a COLA cap has many advantages. A cap would progressively target benefit adjustments on retirees most able to bear them, retain inflation protection for at least an adequate level of benefits, and avoid disincentivizing work among those claiming Social Security benefits. Depending on how the cap is set, it would close between one twentieth to one quarter of Social Security’s solvency gap.

With retirees facing an across-the-board 24% benefit cut in just seven years, policymakers urgently need to begin the work of enacting trust fund solutions. Today’s Social Security COLA announcement is a reminder that capping COLAs can be a thoughtful, progressive step toward achieving sustainable solvency.