Analysis of the 2024 Social Security Trustees’ Report

The Social Security and Medicare Trustees released their annual reports today on the financial status of the Social Security and Medicare programs over the next 75 years. The latest Social Security projections show that the program is quickly approaching insolvency and highlight the need for trust fund solutions sooner rather than later to prevent across-the-board benefit cuts or abrupt changes to tax or benefit levels. The Social Security Trustees project:

- Social Security is approaching insolvency. Under current law, Social Security cannot guarantee full benefits to current retirees. The Trustees project the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033, when today’s 58-year-olds reach the full retirement age and today’s youngest retirees turn 71. Upon insolvency, all beneficiaries will face a 21 percent across-the-board benefit cut. Including the Disability Insurance (SSDI) trust fund, the theoretically combined trust funds will be insolvent by 2035 and beneficiaries would face a 17 percent cut.

- Social Security faces large and rising imbalances. According to the Trustees, Social Security will run cash deficits of $3 trillion over the next decade, the equivalent of 2.3 percent of taxable payroll or 0.8 percent of Gross Domestic Product (GDP). Annual deficits will grow to 3.4 percent of payroll (1.2 percent of GDP) by 2050 and 4.6 percent of payroll (1.6 percent of GDP) by 2098. Social Security’s 75-year actuarial imbalance totals 3.5 percent of payroll, which is over 1.2 percent of GDP or nearly $24 trillion in present value terms.

- Social Security’s finances have improved from last year but remain perilous. Social Security’s 75-year solvency gap was reduced from 3.61 to 3.50 percent of payroll as a result of stronger-than-expected economic performance and fewer expected disability applicants, partially offset by lower expected birth rates in future years.

- Time is running out to save Social Security. Policymakers have only a few years left to restore solvency to the program, and the longer they wait, the larger and more costly the necessary adjustments will be. Acting sooner allows more policy options to be considered, allows for more gradual phase in, and gives employees and employers time to plan.

With insolvency rapidly approaching, failing to address Social Security’s imbalances is an implicit endorsement of a 21 percent benefit cut imposed on all beneficiaries regardless of age, income, or need. Policymakers should implement pro-growth trust fund solutions sooner rather than later to ensure long-term solvency and give beneficiaries time to plan and adjust.

Social Security is Approaching Insolvency

Social Security’s retirement program is only nine years from insolvency, and action must be taken soon to prevent an across-the-board benefit cut for many current and future beneficiaries.

The Trustees project the Social Security Old-Age and Survivors’ Insurance (OASI) trust fund will deplete its reserves by 2033; the SSDI trust fund is in much stronger shape and will remain solvent over the next 75 years. On a theoretically combined basis – assuming revenue is reallocated between the trust funds – Social Security will become insolvent by 2035.

Upon insolvency of the OASI fund, all retirees – regardless of age, income, or need – will face a 21 percent across-the-board benefit cut, which will grow to 31 percent by the end of the 75-year projection window. We previously estimated that a typical couple retiring in the year of insolvency would face a $17,400 cut in their annual benefits. On a combined basis, insolvency would lead to a 17 percent initial cut, growing to 27 percent by the end of the window.

The year 2033 is only nine years away. That means the OASI trust fund is on course to run out of reserves when today’s 58-year-olds reach the normal retirement age and when today’s youngest retirees turn 71. Meanwhile, the Medicare Hospital Insurance (HI) trust fund will exhaust its reserves in 2036, when today’s 53-year-olds become eligible.

The Trustees’ findings are similar to recent estimates from the Congressional Budget Office (CBO), which estimated the OASI trust fund would be exhausted by Fiscal Year (FY) 2033, the HI trust fund by FY 2035, and the theoretically combined Social Security trust funds by FY 2034.

Social Security Faces a Large and Growing Shortfall

The Trustees project that Social Security will run chronic deficits. They estimate the combined program will run a cash-flow deficit of $169 billion this year – which is 1.7 percent of taxable payroll or 0.6 percent of GDP. Social Security will run $3.0 trillion of deficits over the next decade.

Over the long term, the Trustees project Social Security’s cash shortfall (assuming full benefits are paid) will grow to 2.6 percent of taxable payroll (0.9 percent of GDP) by 2035, to 3.4 percent of payroll (1.2 percent of GDP) by 2050, and to a high of 5.1 percent of payroll (1.7 percent of GDP) by 2079. Costs will then decline to 4.6 percent of payroll (1.6 percent of GDP) by 2098.

Social Security’s growing long-term shortfall is the result of rising costs, mostly due to the aging of the population. Total Social Security costs have already risen from 11.0 percent of taxable payroll in 2003 to 14.5 percent of payroll in 2023 and are projected to rise further to 16.8 percent by 2050 and 18.1 percent of payroll by 2098. Revenue will fail to keep up with growing costs, rising only modestly from 13.0 percent of payroll today to 13.5 percent by 2098.

On a 75-years basis, the Social Security trust funds face an actuarial shortfall of 3.5 percent of taxable payroll, which is 1.2 percent of GDP or $23.8 trillion in present-value terms. A plan to restore sustainable solvency over the next 75 years would require the equivalent of increasing payroll taxes immediately by 27 percent or reducing spending by 21 percent for all current and future beneficiaries, or some combination. Actual reforms could be better targeted, rather than across the board, and phased in gradually.

Social Security’s Finances Have Improved Modestly But Time Has Run Short

Social Security’s long-term outlook has improved relative to last year’s projection, mainly on the disability side, but its financial challenges remain large. The 2023 Social Security Trustees’ Report estimated a 75-year actuarial imbalance of 3.61 percent of taxable payroll, which has declined to 3.50 percent in this year’s report. The insolvency date for the theoretically combined trust funds has been pushed back one year from 2034 to 2035 but is still only 11 years away.

The most significant improvements from last year’s report are driven by changes in economic and disability assumptions. On the economic side, stronger near-term output, updated educational attainment, and greater covered employment led to a 0.13 percent of payroll improvement. Meanwhile, a significant reduction in expected disability applications – driven by recent experience – led to an additional 0.12 percent of payroll improvement.

Methodological and programmatic data changes improved the 75-year outlook by 0.08 percentage points of payroll mostly due to updates to the sample of newly eligible retired worker and disabled-worker beneficiaries used to project average benefit levels as well as updated post-entitlement benefit adjustment factors.

Partially offsetting these improvements, new demographic assumptions increased Social Security’s 75-year shortfall by 0.16 percentage points of payroll. Most significantly, the Trustees now expect lower fertility – at 1.9 children per woman instead of 2.0 percent. They also incorporated lower-than-projected actual fertility in 2023, higher mortality rates, and other updates to population, immigration, and marriage assumptions.

Legislative and regulatory changes had a negligible effect on Social Security’s 75-year shortfall. Since the 2023 report, there have been ongoing judicial developments related to immigration policy, including a ruling on the Deferred Action for Childhood Arrivals (DACA) program that deferred full implementation of the program. While the 2023 report assumed the DACA program would be fully implemented by mid-2023, the Trustees now assume the program will not be fully implemented until mid-2024.

The remaining changes to the outlook come from the new projection window. Including the year 2098 in the Trustees’ 75-year solvency projections worsened Social Security’s 75-year actuarial imbalance by 0.06 percentage points of payroll.

Although the 75-year imbalance shrunk this year, it has generally been growing over the past 15 years. This year’s 3.50 percent of payroll imbalance is more than 80 percent larger than the 1.92 percent of payroll imbalance estimated in 2010.

Importantly, while Social Security’s finances have generally worsened overall, Social Security Disability Insurance’s finances have continued to improve. As recently as 2015, the SSDI program faced a 0.31 percent of payroll (17 percent of revenue) shortfall and was only one year from insolvency. A temporary reallocation of payroll taxes from the old-age program reduced that shortfall to 0.26 percent of payroll the next year.

Since that time, a combination of administrative reforms, strong labor markets, and other factors has eliminated that shortfall, turning it into a 0.14 percent of payroll surplus. Despite this improvement, policymakers should continue to support improvements to the disability program, which can improve fairness and administration of benefits while supporting individuals with disabilities who want to remain in or return to the workforce. Such reforms can also help grow the economy and improve the Social Security program’s combined finances.

Delaying Fixes to Social Security is Costly

The Trustees recommend that “lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them.” Quick action would also give policymakers choices in making targeted adjustments, enhancing benefits for vulnerable populations, and achieving pro-growth reforms.

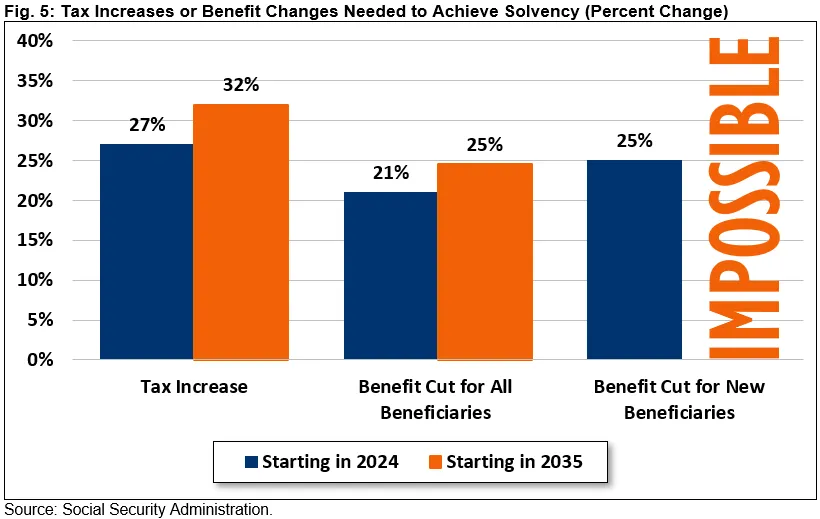

According to the Trustees, lawmakers could restore 75-year solvency with the equivalent of a 27 percent (3.3 percentage point) payroll tax increase, a 21 percent reduction in all benefits, or a 25 percent reduction in benefits for new beneficiaries if they act today.

Delaying action until 2035 would increase the size of necessary adjustments by about one-fifth. In that year, taxes would need to be raised by 32 percent (4.0 percentage points) or benefits cut for all beneficiaries by 25 percent. It would be impossible to restore solvency from new beneficiaries alone – even eliminating all benefits would be insufficient.

Thoughtful trust fund solutions would not only prevent deep across-the-board benefit cuts, but could also support economic growth, reduce inflationary pressures, and improve the nation’s fiscal outlook. We have published ten options to improve Social Security solvency – including a number of benefit and revenue changes. Other proposals can be designed with our Social Security Reformer tool. The closer we get to insolvency, the fewer of these options remain available.

Conclusion

The Social Security Trustees continue to warn that the Social Security retirement program is significantly out of balance and just nine years from insolvency. Absent reforms, Social Security will be unable to pay full benefits to many current beneficiaries, let alone today’s workers and future generations. Taking no action to fix Social Security will be an implicit endorsement of a 21 percent across-the-board cut to all beneficiaries, regardless of age or need.

As policymakers delay necessary action, the program’s finances continue to deteriorate. The longer policymakers wait, the larger and more abrupt any adjustments will need to be. All options should be on the table including changes to revenue, spending and the retirement age.

Fortunately, many well-known options to fix Social Security’s finances exist and could be enacted and implemented with political will and bipartisanship. A number of comprehensive plans already exist to restore solvency, and our Social Security Reformer Tool allows anyone to design their own. Policymakers should also consider pursuing new, innovative solutions to promote economic growth and improve retirement security in concert with addressing the program’s finances.

Policymakers cannot wait much longer to enact thoughtful Social Security reforms.

Tags

What's Next

-

Image

-

Image

-

Image