CBO's Score of the Latest Senate Health Bill

The Congressional Budget Office (CBO) released its updated score of the Better Care Reconciliation Act of 2017 (BCRA). This version includes additional funding for the long-term stability fund and combating the opioid crisis and allows individuals to pay health insurance premiums using Health Savings Accounts (HSAs), among other changes. It pays for these changes by no longer repealing the net investment income tax (NIIT) and Medicare Hospital Insurance (HI) surtax. Retaining these taxes is more than enough to pay for the additional changes, so the bill's deficit reduction increased by $100 billion.

| Provision | 2017-2026 Cost / Savings (-) | |||

|---|---|---|---|---|

| House-Passed AHCA | ORRA | Prior BCRA | Updated BCRA | |

| End Mandate Penalties | $210 billion | $210 billion | $210 billion | $210 billion |

| Reduce Current Law Spending and Tax Subsidies | -$1.57 trillion | -$1.36 trillion | -$1.52 trillion | -$1.49 trillion |

| Enact New Spending and Tax Subsidies | $687 billion | $64 billion | $438 billion | $537 billion |

| Repeal ACA Taxes | $553 billion | $609 billion | $550 billion | $319 billion |

| Total Deficit Impact (Conventional Scoring) | -$119 billion | -$473 billion | -$321 billion | -$420 billion |

AHCA = American Health Care Act; ORRA = Obamacare Repeal Reconciliation Act; BCRA = Better Care Reconciliation Act. The ORRA resembles the 2016 vetoed reconciliation bill that would have repealed the ACA's taxes immediately, repealed its spending on Medicaid and exchange subsidies after two years, and retained its insurance regulations.

Among the key findings of today's report:

- The updated BCRA would reduce deficits by $420 billion through 2026 under conventional scoring. The previous version would have reduced deficits by $319 billion, and the House-passed AHCA would reduce deficits by $119 billion.

- The updated BCRA's $420 billion of savings is the result of a $1.49 trillion reduction in the cost of spending and tax subsidies, with most of the funds used to pay for replacement coverage provisions ($537 billion), repeal of the mandate penalties ($210 billion), and rollback of some of the ACA's tax hikes ($319 billion).

- On net, the updated BCRA would reduce outlays by $903 billion and revenue by $483 billion through 2026. The prior version would have reduced outlays by $1.02 trillion and revenue by $701 billion, while the House-passed AHCA would reduce outlays and revenue by $1.1 trillion and $990 billion, respectively.

- Today's version of the bill contains a few changes from the last version CBO scored. In particular, it adds $70 billion in additional long-term stability funds, adds $43 billion in additional funds to states to combat the opioid crisis, allows individuals to use HSAs to pay premiums, and scraps repeal of the ACA's NIIT and HI surtax (saving $231 billion compared to the last version).

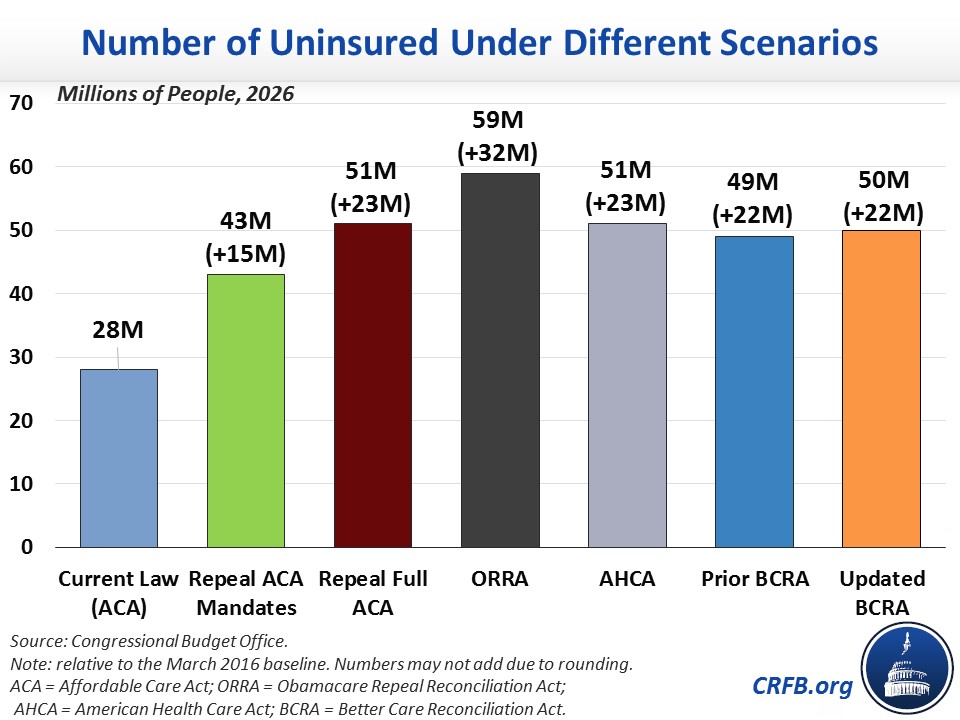

- In terms of coverage, CBO projects the updated BCRA would reduce the number of Americans with health insurance by 15 million in 2018 and by 22 million in 2026. That is almost identical to the previous version of the bill and similar to the 14 million and 23 million reductions in the insured, respectively, in the case of the AHCA.

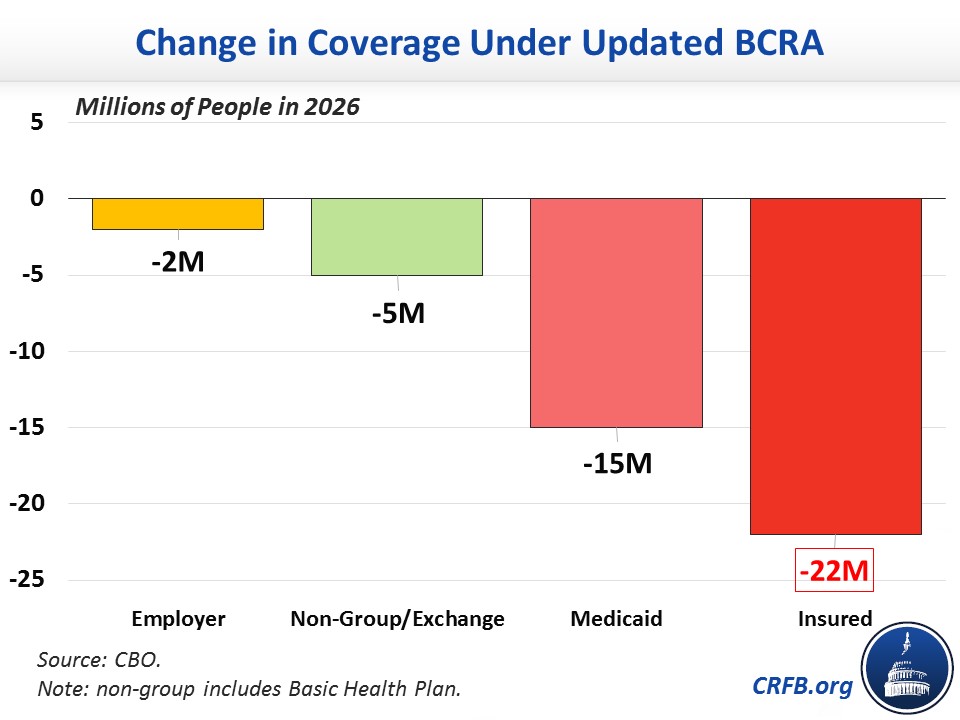

- The 22 million reduction in 2026 is the result of 15 million fewer Medicaid beneficiaries, 5 million fewer with private non-group insurance (including insurance obtained on the exchanges), and 2 million fewer with employer-sponsored insurance. The previous version had 7 million fewer with private non-group insurance and a negligible change in employer-sponsored insurance coverage.

- CBO has not completed an estimate of the macroeconomic effects of the updated BCRA. In our assessment, the legislation would likely improve growth slightly under CBO's model (as the prior version likely would have) but less so than the modest growth we expected from the House-passed AHCA.

- CBO has not completed a second-decade estimate of the updated BCRA, but it does estimate that the legislation would reduce future deficits. We estimated that the prior version would likely save $1.7 trillion in the second decade, totaling $2.1 trillion over 20 years. It is likely that this version would save somewhat more since it saves more in the first decade and its new savings are permanent while its new costs are generally temporary.

The table below breaks down the major elements of the CBO score.

| Provision | 2017-2026 Cost / Savings(-) | |

|---|---|---|

| Prior BCRA | Updated BCRA | |

| Reduce Individual Mandate Penalty to $0 | $171 billion | $171 billion |

| Reduce Employer Mandate Penalty to $0 | $38 billion | $38 billion |

| Subtotal, End Mandate Penalties | $210 billion | $210 billion |

| Repeal ACA Premium and Cost-Sharing Subsidies in 2020 | -$657 billion | -$657 billion |

| Reduce ACA Medicaid Match to Base Medicaid Rate for “Expansion” Beneficiaries, Establish Per-Capita Caps, & Institute Optional Work Requirements | -$772 billion | -$756 billion |

| Other Reductions | -$69 billion | -$65 billion |

| Coverage Interactions | -$21 billion | -$8 billion |

| Subtotal, Reduce Spending and Tax Subsidies | -$1.52 trillion | -$1.49 trillion |

| Establish New Premium Tax Credits in 2020 | $233 billion | $230 billion |

| Create State Stability and Innovation Funds | $107 billion | $158 billion |

| Repeal Disproportionate Share Hospital (DSH) Payment Cuts (Medicare & Medicaid) | $61 billion | $70 billion |

| Combat the Opioid Epidemic | $2 billion | $41 billion |

| Expand Health Savings Accounts (HSAs) | $19 billion | $19 billion |

| Allow HSAs to be used to Pay Premiums | n/a | * |

| Other Costs | $16 billion | $19 billion |

| Subtotal, Increase Spending and Tax Subsidies | $438 billion | $537 billion |

| Repeal ACA 3.8% Net Investment Income Tax (NIIT) | $172 billion | $0 |

| Repeal ACA Health Insurer Tax | $145 billion | $145 billion |

| Repeal ACA Medicare Hospital Insurance 0.9% Surtax Starting in 2023 | $59 billion | $0 |

| Delay ACA “Cadillac Tax” Start Date to 2026 | $66 billion | $66 billion |

| Repeal Most Other ACA Tax Increases | $109 billion | $108 billion |

| Subtotal, Repeal ACA Taxes | $550 billion | $319 billion |

| Total Deficit Impact | -$321 billion | -$420 billion |

Source: Congressional Budget Office and Joint Committee on Taxation. Note: numbers may not add due to rounding. *CBO did not separately score this poicy from the coverage provisions, but it is shown separately in the table to show the contrast between versions.

The biggest changes in the cost estimate of this updated bill versus the prior BCRA come from keeping the NIIT and the HI surtax, totaling $231 billion in additional savings. This savings is partially offset by the increase in long-term stability funds, the increase in funding to combat the opioid crisis, and smaller Medicaid changes that increase the cost of repealing the Disproportionate Share Hospital allotment cuts.

CBO estimates the updated bill would increase the uninsured by 22 million in 2026. This is a result of 15 million fewer on Medicaid, 5 million fewer in the individual market, and 2 million fewer in the employer market. The chart below shows how much coverage would change in 2026 compared to current law under the ACA.

Below is a chart showing the various proposals and their effects on the number of uninsured.

Importantly, CBO’s estimates do not incorporate future changes that could be made to insurance market rules, either by regulation or through further legislation. Such changes have the potential to increase total insurance coverage, but increasing coverage would also likely reduce the net savings. Additionally, lawmakers have signaled that they intend to modify this legislation with an amendment offered by Senator Ted Cruz (R-TX) that could have profound effects on the insurance market; the impacts of that amendment are not included in this analysis.

Continue to visit CRFB's health care page for further ongoing analysis of Affordable Care Act replacement legislation and developments.

Further Readings: