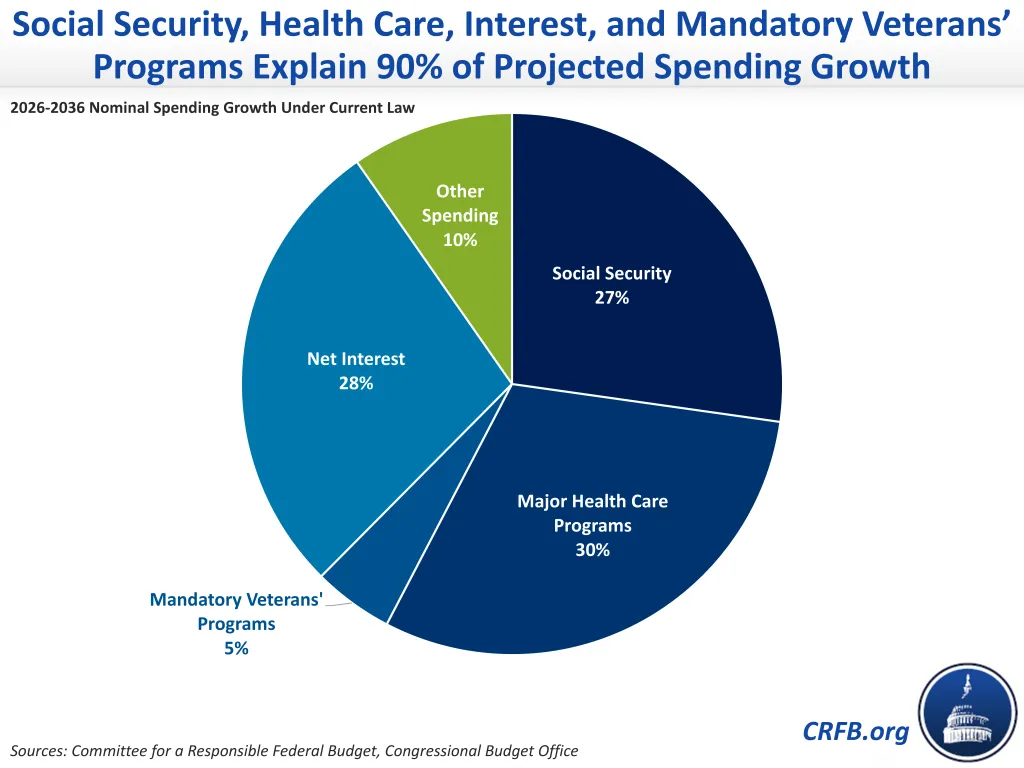

90% of Spending Growth Will Come From Health, Retirement, Veterans, & Interest

Over the coming decade, the vast majority of growth in federal government spending will come from just four parts of the federal budget: Social Security, health care, mandatory veterans’ programs, and interest on the national debt.

According to the Congressional Budget Office’s latest Budget and Economic Outlook, total nominal spending will grow by $4 trillion or 53% over the coming decade, from $7.4 trillion in Fiscal Year (FY) 2026 to $11.4 trillion in FY 2036. Over 85% of that overall spending growth will be driven by Social Security, major health care programs, and net interest – up from 83% in last year’s baseline. Adding mandatory veterans’ programs increases that share to 90%. All other areas of government spending – including all discretionary spending and other mandatory spending – will account for only 10% of overall nominal spending growth.

Social Security – the largest line item in the federal budget – is projected to grow by $1 trillion (65%) from FY 2026 to 2036, accounting for 27% of nominal spending growth. Major health care programs – which include Medicare, Medicaid, Affordable Care Act subsidies, and the Children’s Health Insurance Program – will grow by $1.2 trillion (63%), accounting for 30% of nominal spending growth. That growth would have been even more significant were it not for the $1 trillion of ten-year savings (and well over $200 billion of 2036 savings) from the One Big Beautiful Bill Act (OBBBA).

Interest on the national debt – the fastest growing part of the federal budget – will more-than-double in size, growing by $1.1 trillion (106%) and accounting for 28% of nominal spending growth. And mandatory veterans’ programs – which include all federal programs benefitting veterans except for health care, which is largely funded through discretionary appropriations – will grow by nearly $200 billion (63%), accounting for another 5% of nominal spending growth.

All other federal government spending – which includes both defense and non-defense discretionary programs (including much of veterans’ health care), as well as other mandatory spending such as income security programs, federal civilian and military retirement, higher education spending, agriculture programs, some funding for administration of justice and defense (due to mandatory funding for those areas included in OBBBA), and other programs – will account for only 10% of overall nominal spending growth over the coming decade.

Relative to the economy, spending on Social Security, health care, interest, and mandatory veterans’ programs will grow by 2.8% of Gross Domestic Product (GDP) – accounting for 255% of overall spending growth as a percentage of GDP. Other programs will shrink by 1.7% of GDP.

According to CBO, the growth in Social Security and major health care programs – which alone account for more than half of overall nominal spending growth – will be primarily driven by an increase in the population over age 65 and growth in federal health care costs. Growth in mandatory veterans’ programs will be driven primarily by an increase in disability compensation payments, which account for more than three-fourths of total mandatory outlays for veterans’ programs.

Net interest payments – which are already at an all-time high as a share of the economy at 3.2% of GDP – are projected to grow by an average of 7.5% per year and more-than-double in nominal terms over the coming decade. This growth, as we have explained previously, is due to the combination of more debt and higher interest rates on that debt, which in turn can be at least partly attributed to the overall growth in debt.

These projections make clear that our increasingly poor fiscal outlook comes down to the out-of-control growth in just a handful of programs. Policymakers must therefore focus on controlling the growth of these programs in order to improve our overall fiscal outlook.