$3 Trillion of Dynamic Feedback is Fantasy Math

According to a recent press report, the House may try to claim $3 trillion of deficit reduction as a result of “assumed economic growth from tax cuts” as part of a multi-trillion-dollar tax cut and spending package. Although tax cuts are likely to boost economic output and generate some revenue as a result, this $3 trillion feedback assumption is an order of magnitude larger than any semi-credible estimates and would require fantastical levels of sustained economic growth. In this piece, we show that:

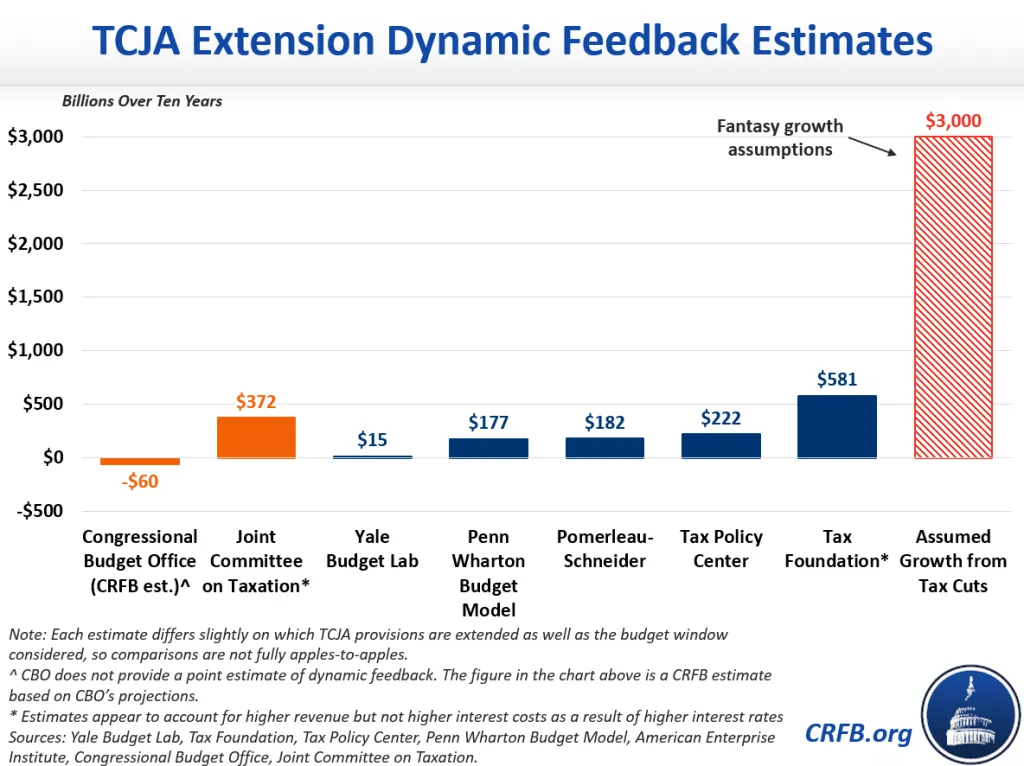

- Credible dynamic estimates find extending the Tax Cuts and Jobs Act (TCJA) would produce between $60 billion of negative dynamic feedback and $581 billion of positive dynamic feedback.

- The $3 trillion of claimed dynamic feedback is 14 times as large as the average estimate of $213 billion.

- Producing $3 trillion of dynamic feedback would require a 75 percent sustained increase in real economic growth, from a projected 1.8 to 3.2 percent per year.

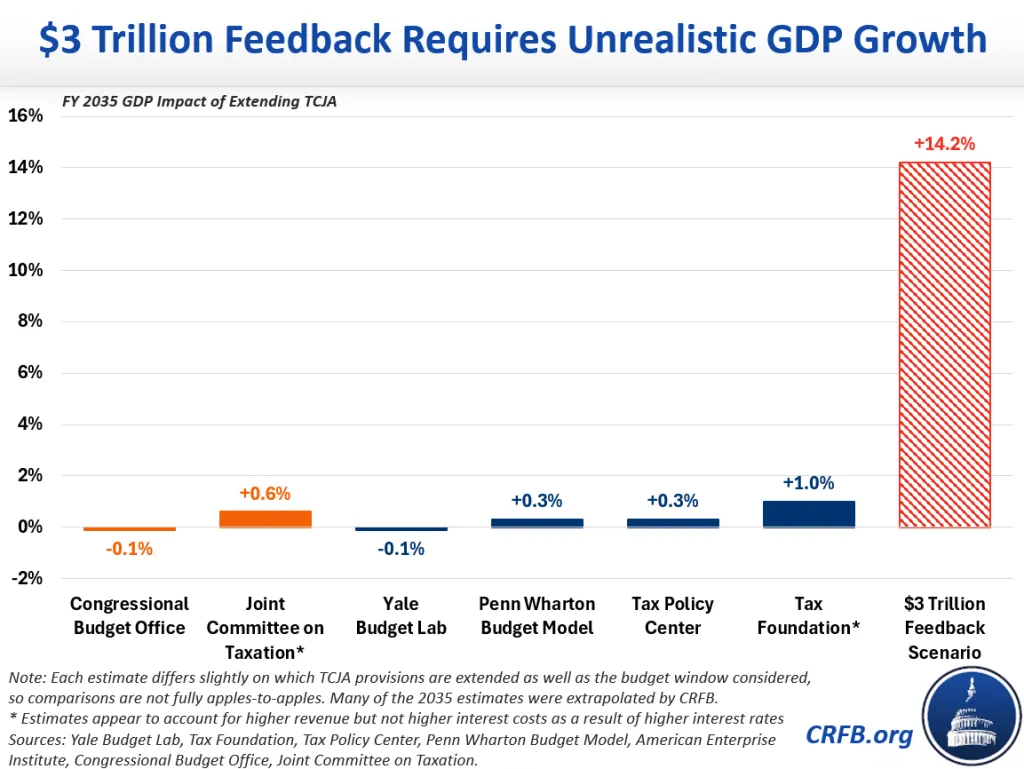

- To produce $3 trillion of dynamic feedback, real Gross Domestic Product (GDP) would need to be 14 percent larger by 2035, more than 42 times the average estimated GDP impact of extending the tax cuts.

To be sure, additional policies beyond tax cuts could further boost economic growth. But as we’ve shown before, even a very aggressive combination of tax, spending, energy, and regulatory reforms would be insufficient to generate such high GDP growth. Nor should the feedback effects of hypothetical future actions be counted against the real cost of additional borrowing today.

Claims of $3 trillion in dynamic feedback are not credible and are designed to mask massive new borrowing that could hamper long-term economic growth. Were Congress to pass a $5.5 trillion reconciliation bill, we’ve shown that it would nearly double the growth of debt-to-GDP, boost interest costs by $1.3 trillion, and risk setting off a debt spiral.

There Is No Credible Path to $3 Trillion of Revenue Feedback

The assumption of $3 trillion in dynamic feedback from tax extensions is 14 times higher than the average independent estimate of TCJA extension. At least seven modelers – including the Congressional Budget Office (CBO), the Joint Committee on Taxation (JCT), and several groups from the left, right, and center – have estimated the dynamic feedback from extending the TCJA. At the low end, CBO estimates imply a slight deficit increase, with higher interest costs appearing to outweigh higher revenue collection. On the high end, the Tax Foundation estimates $581 billion of revenue feedback – but importantly this does not incorporate the negative economic impact of higher debt nor the impact an extension would have on higher interest rates and therefore interest costs. No credible estimate is even the same order of magnitude as the $3 trillion assumption.

Importantly, these existing dynamic estimates mostly assume $3 to $4 trillion in tax cuts, rather than the $5.5 trillion apparently under consideration. But 55 percent claimed feedback is still an order of magnitude larger than the -2 percent to +14 percent feedback estimated by various modelers.

It is possible the $3 trillion number is also assuming feedback from pro-growth policies not associated with the tax cuts. Although revenue could end up significantly higher or lower than current projections, it’s highly unlikely any mix of policies under consideration could achieve $3 trillion of feedback. Even if they could, it would be inappropriate to count them as part of the bill as opposed to counting them when enacted.

$3 Trillion of Dynamic Feedback Would Require 75% Faster Growth

In order to generate $3 trillion of dynamic feedback over a decade, we estimate real economic growth would need to accelerate by 75 percent each year for the next decade. Instead of growing by roughly 1.8 percent per year – as projected by the Congressional Budget Office and Federal Reserve – real GDP would have to grow by 3.2 percent per year. While it is certainly possible to achieve this growth rate for several quarters or even years, ten years of sustained 3.2 percent growth is highly unlikely.

In our 2017 paper “How Fast Can America Grow?,” we showed that even lifting productivity growth, capital growth, and prime-age labor force participation to the levels of the booming 1990s would be insufficient to achieve this level of sustained growth. The Congressional Budget Office recently estimated that there is only about a 5 percent chance growth would average 3.2 percent or more through 2030 under current law, and a much smaller chance that growth would continue over a full decade.

Extending and reforming the tax cuts could certainly boost output, but the effects are likely to be small. To achieve $3 trillion of dynamic feedback, output would need to be more than 14 percent higher than projected. That’s 42 times as much as the average estimate that tax cut extensions will boost output by 0.3 percent and 14 times higher than the Tax Foundation’s estimate that tax cut extensions would boost 2035 output by 1.0 percent.

Additional policies besides tax cut extensions – including additional tax reforms, deregulation, energy development and distribution, spending reforms, and deficit reduction – could boost economic growth beyond the modest effects of TCJA extension. But no set of policies would come anywhere close to expanding the economy by 14 percent above baseline estimates over a decade. And some parts of the Administration’s agenda, including tariffs and immigration restrictions, would actually slow economic growth and shrink overall output1

Reconciliation Needs Real Offsets and Reforms

There is no plausible way to generate $3 trillion of dynamic deficit reduction by extending tax cuts and adding $5.5 trillion to the debt. While lower taxes do generally boost economic activity, the effects are often much smaller than advocates claim – especially as it relates to expiring parts of the TCJA – and may be largely if not fully offset by the negative economic effects of higher debt. $3 trillion of dynamic feedback is 14 times the average independent estimate and would require a 75 percent increase in the projected growth rate. This is simply not credible.

Rather than relying on fantastical numbers, lawmakers should make the hard choices to ensure reconciliation is fiscally responsible, deficit reducing, and as pro-growth as possible. Instead of simply extending the TCJA, they should identify the bill’s most important parts and should work to reform or improve other elements in order to minimize revenue loss and maximize incentives to work, save, and invest. They should also identify pro-growth tax and spending offsets to ensure the overall package reduces rather than adds to the debt. Our Budget Offset Bank includes tens of trillions of dollars in potential options.

No reconciliation package will generate $3 trillion of feedback from economic growth. However, policymakers should work to accelerate economic growth, which would not only lift incomes but generate additional savings for deficit reduction. Perhaps the best way to ensure sustained economic growth is to put the debt on a sustainable long-term path.

Note: This blog has been updated from the original publication to reflect the Tax Foundation's newer methodology in estimating the path of output growth.

1 Immigration restrictions could theoretically reduce or increase output per person but will unambiguously reduce overall output by shrinking the number of workers. According to the Congressional Budget Office, the recent immigration surge will boost real GDP by 2.9 percent in 2034; reversing it would have roughly the inverse effect. CBO has also estimated that the Administration’s plan for a uniform 10 percent tariff and/or 60 percent tariff on Chinese goods would reduce output between 0.3 to 0.6 percent by 2034. Other modelers have reached similar conclusions, or else found even more significant negative growth effects. Other modelers have reached similar conclusions, or else found even more significant negative growth effects.