What's In the One Big Beautiful Bill Act?

Note: This blog was updated on 8/4/25 to reflect CBO's newly-released estimates of the permanent cost of certain expiring tax provisions in OBBBA.

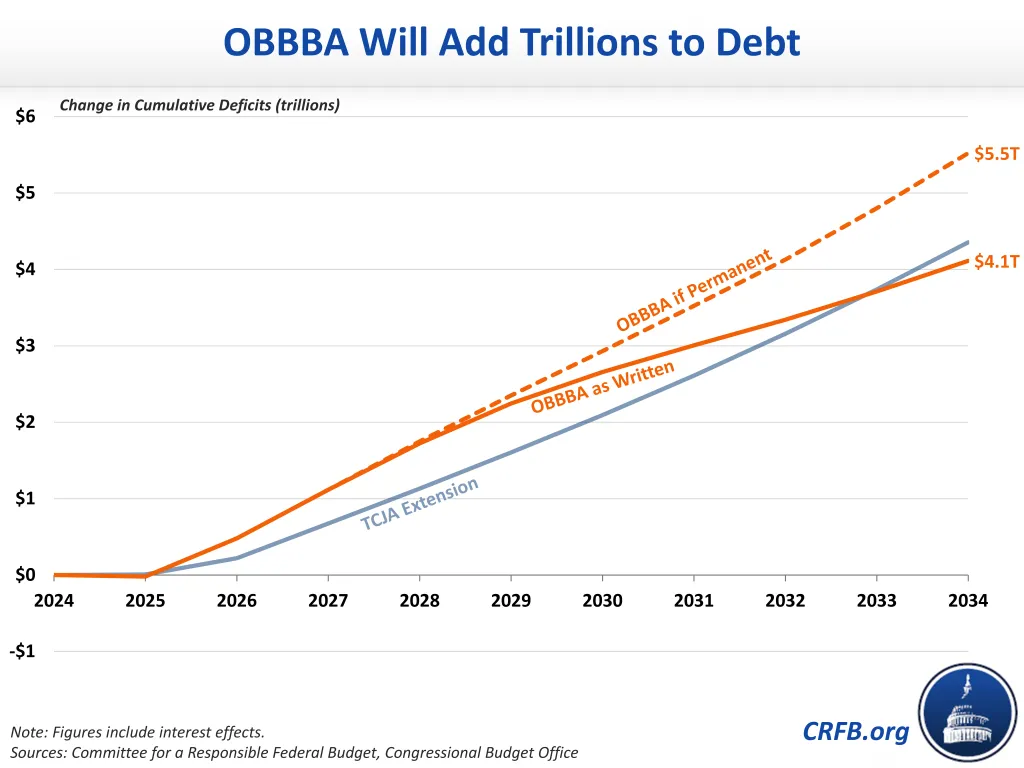

The recently-enacted One Big Beautiful Bill Act (OBBBA) will increase borrowing by $4.1 trillion through 2034 on a conventional basis, according to new estimates from the Congressional Budget Office (CBO). This includes $5.9 trillion of tax cuts and spending increases, $2.5 trillion of offsets, and over $700 billion of interest costs. On a permanent basis, we estimate the law will add more than $5.5 trillion to the debt through 2034.

Fiscal Effects of the One Big Beautiful Bill Act (FY 2025-34)

| Provision (click on subcategories to expand/collapse the table) | As Passed | If Permanent |

|---|---|---|

| Deficit Increasing Provisions | -$5,883 billion | -$7,176 billion |

| +Extend & Expand TCJA Individual Provisions | -$3,886 billion | -$4,051 billion |

| +Revive TCJA Business Provisions | -$772 billion | -$772 billion |

| +New Individual Tax Cuts | -$418 billion | -$826 billion |

| +New Business Tax Cuts | -$285 billion | -$502 billion |

| +Immigration & Border Spending | -$176 billion | -$293 billion |

| +Defense Spending | -$173 billion | -$457 billion |

| +Other Spending | -$173 billion | -$277 billion |

| Deficit Reducing Provisions | $2,489 billion | $2,489 billion |

| +Health Care Provisions | $1,102 billion | $1,102 billion |

| +Repeal & Reform IRA Credits | $540 billion | $540 billion |

| +Other Revenue Increases & Tax Credit Reductions | $197 billion | $197 billion |

| +Education Reforms | $295 billion | $295 billion |

| +Other Offsetting Receipts | $149 billion | $149 billion |

| +SNAP, Agriculture, & Other Savings | $206 billion | $206 billion |

| PRIMARY DEFICIT EFFECT | -$3,394 billion | -$4,687 billion |

| Interest | -$718 billion | -$836 billion |

| TOTAL DEFICIT EFFECT | -$4,113 billion | -$5,523 billion |

* "If Permanent" figures for these provisions were calculated as a group

Note: figures may not sum due to rounding

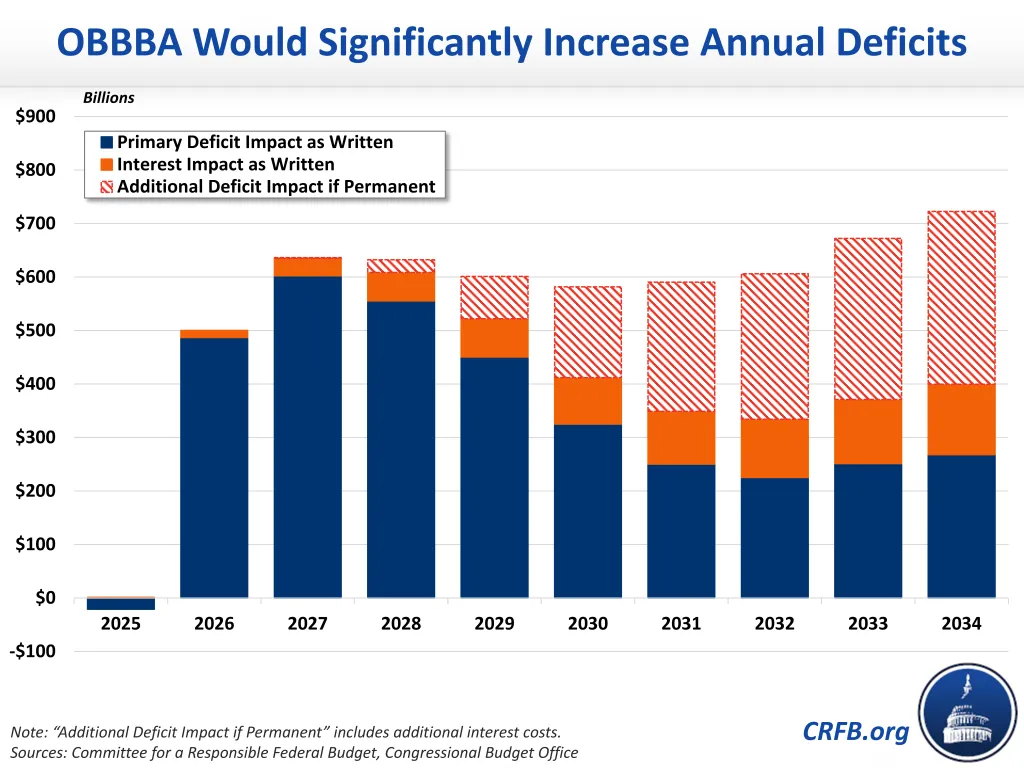

After modestly reducing deficits in Fiscal Year (FY) 2025 by reducing the present value cost of the student loan program, the reconciliation law is projected to add significantly to near-term deficits, boosting the deficit by $500 billion in 2026 and $635 billion in 2027, including interest. The annual borrowing impact would decline to below $400 billion per year in the final few years of the budget window as various tax cuts and spending provisions expire and offsets are phased in. If temporary provisions are made permanent, we estimate deficits would increase by $723 billion in 2034.

As a share of Gross Domestic Product (GDP), the reconciliation bill will increase deficits by 2.0 percent of GDP in FY 2027 and an average of 1.1 percent of GDP over the decade – or 1.5 percent of GDP if the law's temporary provisions are made permanent. By FY 2034, debt will grow by 10 percent of GDP above prior law projections, or 13 percent if made permanent.

At $5.5 trillion through FY 2034, the permanent cost of OBBBA is substantially larger than the deficit impact of simply making the 2017 Tax Cuts & Jobs Act (TCJA) permanent. The debt impact is likely to grow even higher on a dynamic basis. CBO estimated that the (less costly) House version of the bill was $430 billion more expensive on a dynamic basis, as the cost of higher interest rates outweighed the revenue from stronger growth.

The law itself includes $5.9 trillion of tax cuts and spending, $2.5 trillion of offsets, and $718 billion of interest costs. If permanent, we estimate the tax cuts and spending would cost $7.2 trillion and interest costs would increase by nearly $840 billion.

Most significantly, the law reduces revenue by $3.9 trillion to extend and expand the expiring individual TCJA tax changes. It reduces revenue by an additional $1.1 trillion to enact new and renewed business tax breaks – especially full expensing of equipment, research, and factories. It cuts taxes by more than $400 billion on the individual side, largely for temporary tax breaks discussed on the campaign trail – including tax breaks for tips, overtime, and senior income. And it increases spending by over $500 billion – largely on defense, immigration and border enforcement, and farm subsidies. It would cost an additional $1.3 trillion to make all expiring provisions permanent.

On the offset side, the law includes $1.1 trillion in health care savings, largely from changes to Medicaid and Affordable Care Act subsidies. The law saves $540 billion from restricting and phasing out tax credits for clean energy and electric vehicles enacted by the Inflation Reduction Act (IRA), nearly $300 billion from reforms to student loan programs, and over $200 billion from reforms to SNAP, agricultural programs, and other spending programs. Finally, the law includes about $350 billion in other revenue increasing provisions and offsetting receipts.

The estimates above do not account for the economic impact of the reconciliation law, which is likely to boost both revenue and interest rates and may add to its fiscal impact. When CBO releases dynamic estimates, they will be incorporated into this analysis.