Tax Extenders

Latest

-

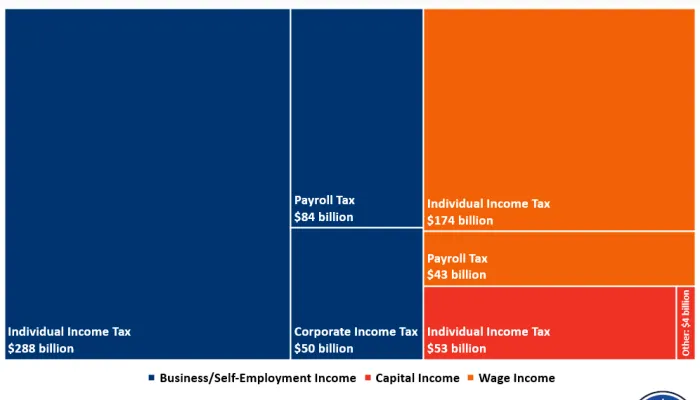

IRS Estimates a $606 Billion Tax Gap for 2022

Read moreThe Internal Revenue Service (IRS) recently published its projections of the “ tax gap” – the difference between taxes owed to and collected by the...

-

Event Recap – When the TCJA Expires: A Tax Policy Summit

Read moreOn March 28, the Committee for a Responsible Federal Budget hosted When the TCJA Expires: A Tax Policy Summit, an event focusing on the large parts of...

-

Lawmakers Should Avoid Year-End Tax Cut Binge

Read moreAccording to press reports, lawmakers are considering a year-end tax package that would combine a temporary expansion of the Child Tax Credit with the...

-

End-of-Year Changes Need Offsets

Read moreAs policymakers continue to negotiate a possible omnibus appropriations bill, there is also discussion of attaching a variety of revenue and mandatory...

-

Maya MacGuineas: Washington should make a pledge: No new debt for the rest of 2022

Read moreMaya MacGuineas is president of the Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt. She recently wrote an opinion...

-

Year-End Borrowing Could Worsen Deficits and Inflation

Read moreWith inflation surging and debt approaching record levels, policymakers should avoid worsening the deficit and should at least pledge to add no new...

-

Year-End 'Extenders' Could Worsen Deficits and Inflation

Read moreWith inflation surging and debt approaching record levels, policymakers might make the fiscal situation even worse in an end-of-the-year fiscal...

-

Build Your Own Child Tax Credit 2.0

Read moreUPDATE (August 2023): We have released an updated web-based version of the CTC model. You can find the model here. As lawmakers continue to debate if...

-

Build Your Own Child Tax Credit

Read moreUPDATE (August 2023): We have released an updated web-based version of the CTC model. You can find the model here. As the year comes to a close...

-

SALT Cap Repeal Does Not Belong in Build Back Better

Read morePress reports suggest lawmakers are considering adding a two-year repeal of the cap on the deduction for state and local taxes (SALT) to their Build...

-

Omnibus Package Includes $135 Billion of Unrelated Tax Breaks

Read moreThe omnibus package includes government funding for the rest of fiscal year 2021 and significant COVID relief, but it also contains $135 billion over...

-

$100 Billion of Giveaways Could Accompany Year-End Omnibus Package

Read moreIf lawmakers pass a short-term continuing resolution as passed by the House, they will have until December 18 to fund the government and enact COVID...