Build Your Own Child Tax Credit 2.0

UPDATE (August 2023): We have released an updated web-based version of the CTC model. You can find the model here.

As lawmakers continue to debate if and how to address the recently-expired Child Tax Credit (CTC) expansion from the American Rescue Plan, our newly-updated Build Your Own Child Tax Credit model (new web-based version here) allows you to design your own CTC policy and estimates the ten-year cost of your customized parameters.

Our updated version adds several new parameters and descriptions and continues to allow users to adjust the size of the base credit, supplement for younger workers, refundability and phase-out rules, and other parameters; it also allows users to decide how to treat the 2025 expiration of the existing credit under current law (read more in our previous write-up).

In addition, our latest Build Your Own Child Tax Credit model allows users to design a comprehensive child tax benefit reform package – including by making changes to the Child and Dependent Care Tax Credit (CDCTC), the Earned Income Tax Credit (EITC), head of household status, and the phase-out of the current law CTC.

Download the Model (new web-based version here)

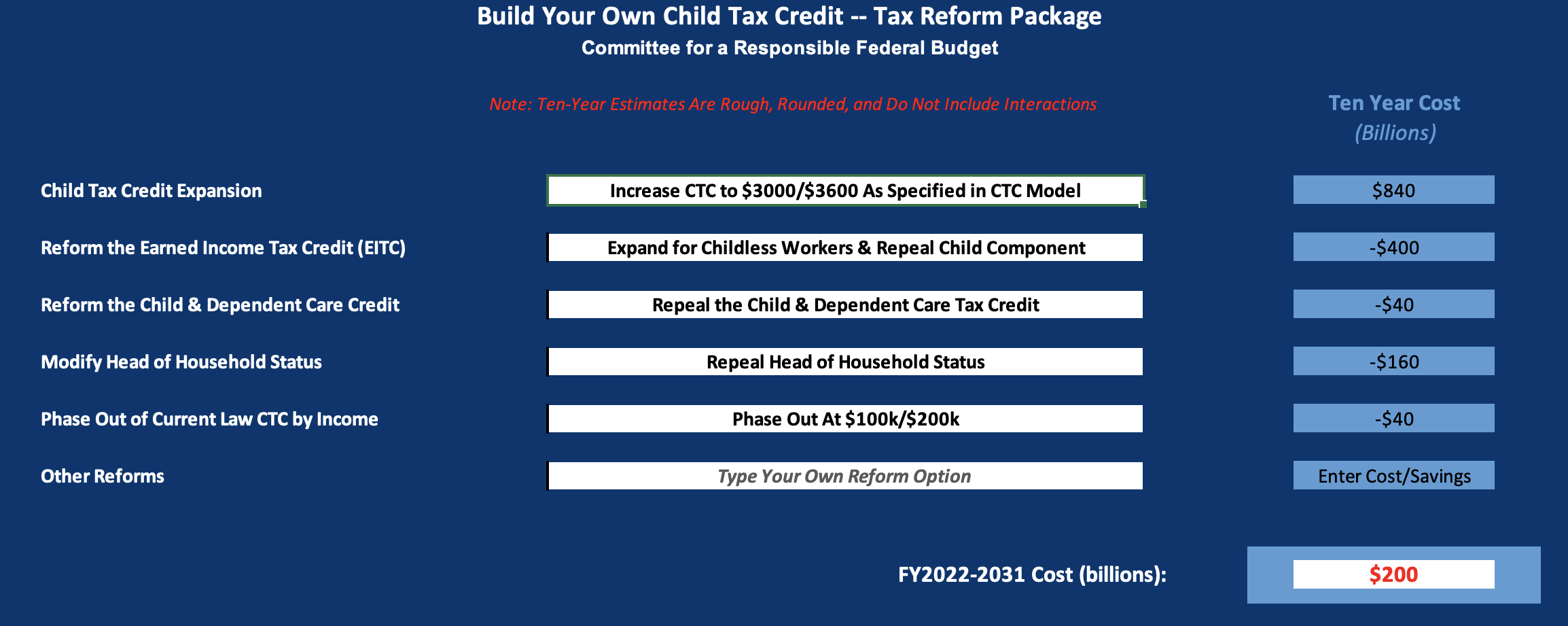

The House-passed Build Back Better Act would expand the CTC and EITC for one year (along with permanent refundability) at a cost of roughly $200 billion. For that same cost, our model shows that lawmakers could make versions of these policies permanent by using them to replace the CDCTC, the child component of the EITC, and the head of household status, while phasing out the current $2,000 CTC for families making above $200,000 per year.

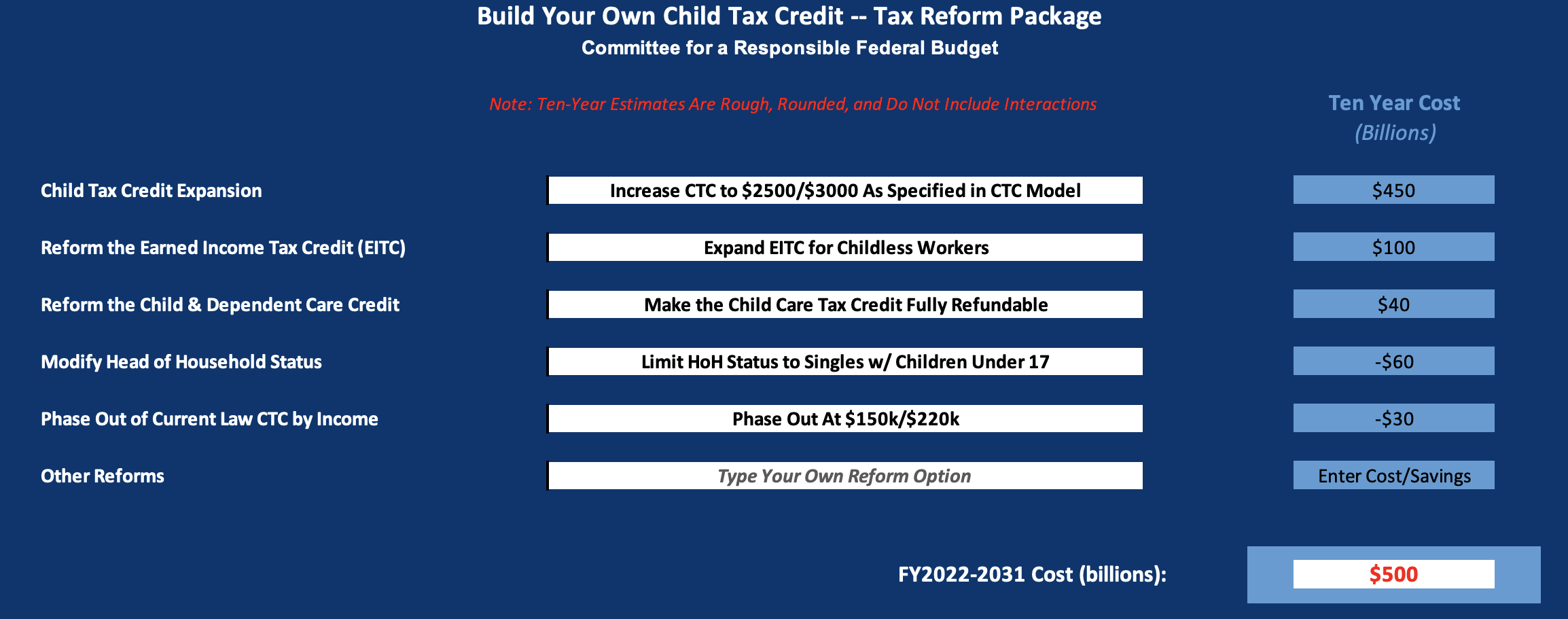

As another example, for $500 billion, lawmakers could expand the CTC to $2,500 ($3,000 for young children), expand the EITC, and make the existing CDCTC fully refundable while limited the head of household status and improving means-testing of the base credit.

Download the Model (new web-based version here)

Users can continue to design their own expanded CTC. For example, a package that strictly made the credit fully refundable and extended it to 17 year olds would cost just over $100 billion over a decade.

Download the Model (new web-based version here)

Importantly, the Build Your Own Child Tax Credit model is not a micro-simulation model and is meant only to provide rough estimates of various choices. It is also still in beta-testing mode, so please contact us if you identify any errors or believe we should add additional features.

To design your own CTC proposal, download our model here (new web-based version here). Tweet your results with the hashtag #BuildYourOwnCTC.

Update (1/25/2022): This model has been updated to add an additional option for refundability.