Breaking Down $800 Billion in Economic Impact Payments

The Internal Revenue Service (IRS) recently published summary statistics for the three rounds of Economic Impact Payments (EIPs) paid through early June from the CARES Act, Response & Relief Act, and the American Rescue Plan. The three rounds of advanced recovery rebate tax credits have provided over $800 billion of direct relief to households and individuals, helping to propel personal income over the course of the pandemic to record levels.

The CARES Act provided $1,200 per person and $500 per child for individual taxpayers earning up to $75,000, or $150,000 for joint filers. The Response & Relief Act provided an additional $600 per person and per child for individual taxpayers earning up to $75,000 per person, or $150,000 for joint filers. The American Rescue Plan provided $1,400 per person and for each dependent (including adult and child dependents) for individual taxpayers earning up to $75,000, or $150,000 for joint filers. Payments in all three rounds were phased out above these income thresholds, with a steeper phase out rate for payments made from the American Rescue Plan.

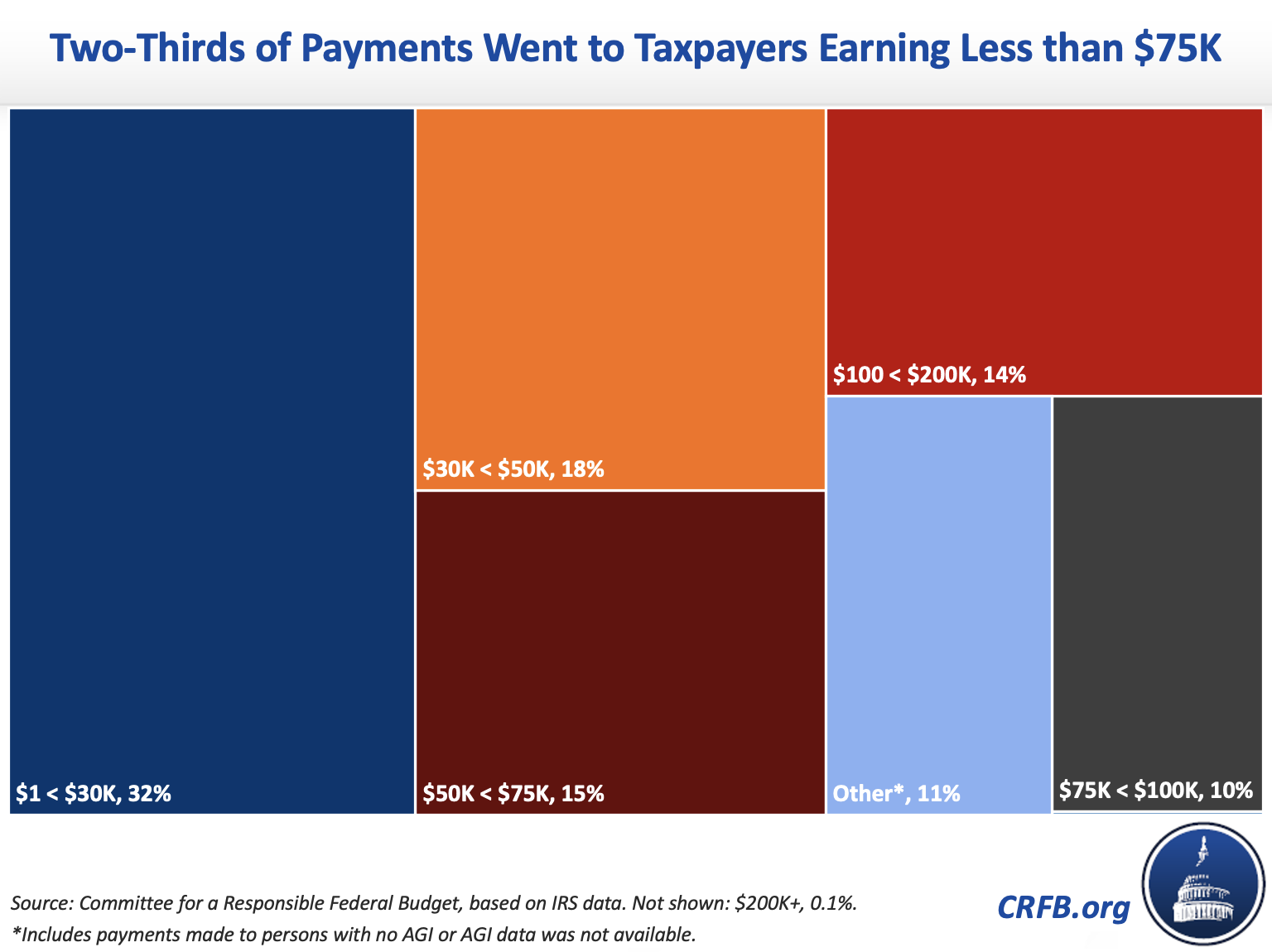

The IRS data shows that around two-thirds of the total dollar amount of payments ($523 billion) went to taxpayers earning less than $75,000, and nearly one-third of payments ($260 billion) went to taxpayers earning less than $30,000.

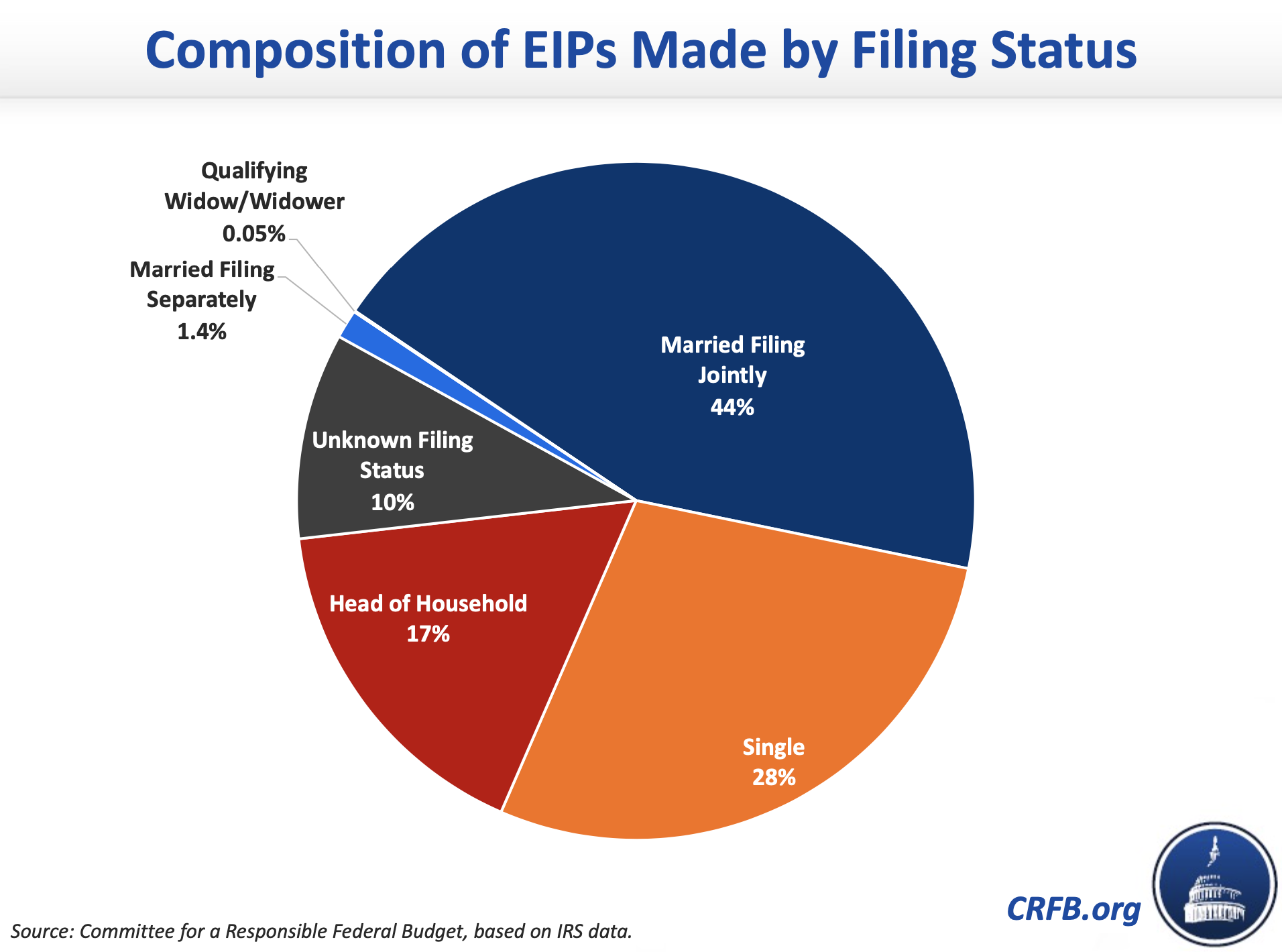

By filing status, around 44 percent of payments ($351 billion) were sent to joint filers, 28 percent ($227 billion) to individual filers, 17 percent ($134 billion) to heads of households, 1.4 percent ($11 billion) to married filing separately, and 0.05 percent ($0.4 billion) to qualifying widow or widower households. Around a tenth of payments ($79 billion) went to those whose filing status was not available, which included those who did not file tax returns for tax years 2018, 2019, or 2020 but were eligible to receive payment based on benefits they receive from the Social Security Administration, Department of Veterans Affairs, or Railroad Retirement Board. Other non-filers who were eligible for payment were also able to submit their payment information via an online portal, which is now closed.

The methods of payment for each round of payments included electronic payments (via direct debit into a bank account), paper checks, or via prepaid debit cards. Over three-quarters of payments made in the first round of payments were made electronically, with over one-fifth sent via check. By the third round of payments, 85 percent of payments were made electronically, with just over one-tenth of payments made by check. The increase in electronic payments made from each round to the next was likely a function of the IRS’ Get My Payment tool that helped taxpayers ensure that the IRS had the correct direct deposit information on file.

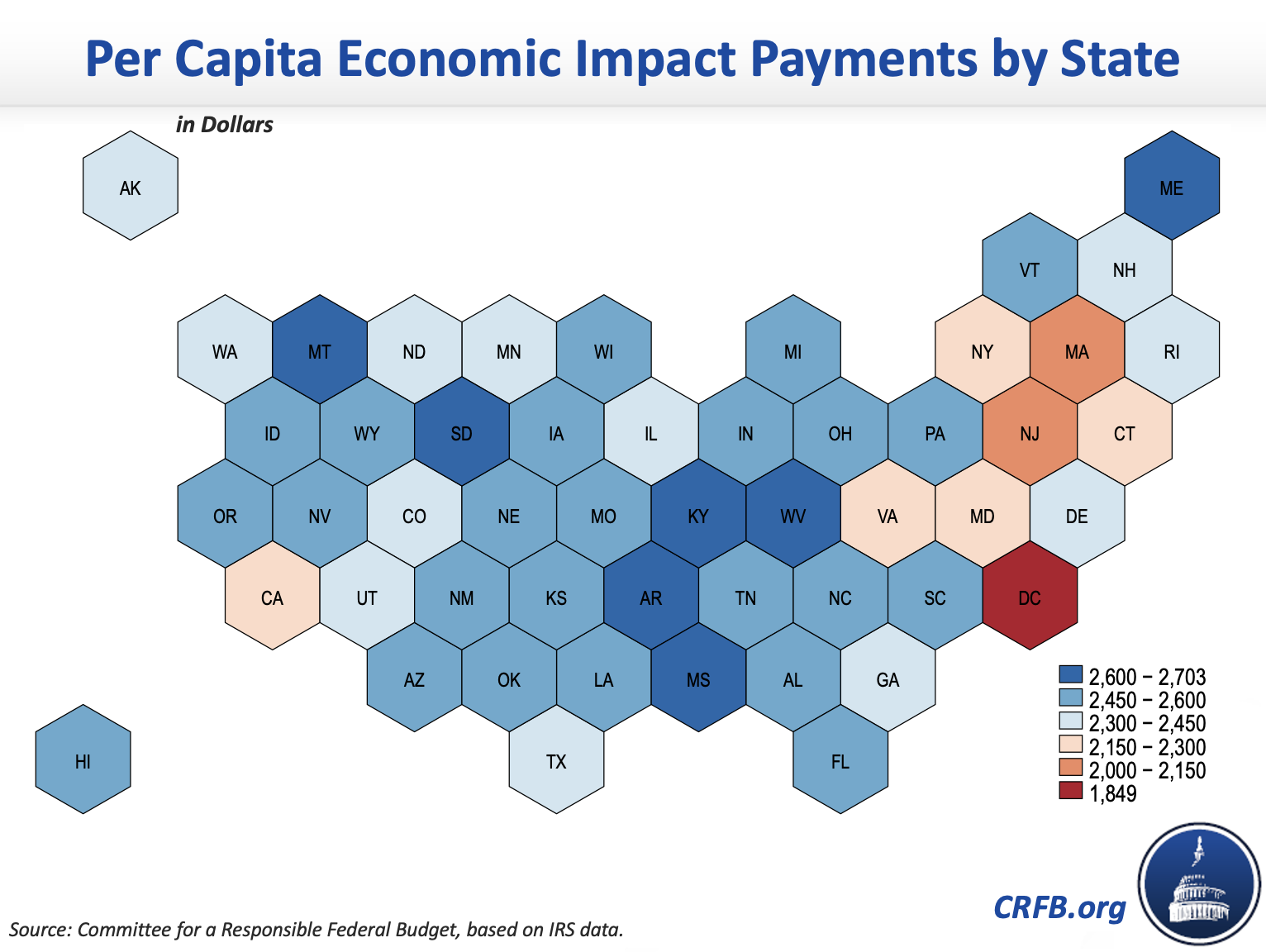

Individuals in the 50 states and District of Columbia received an average of over $2,450 per person over the course of the three rounds of payments, with some states receiving a greater share than others in part due to income differences between states, the share of children in each state, and the number of non-resident aliens in each state, among other factors. West Virginia received the highest average per person amount, at around $2,705 per resident, with the District of Columbia receiving the least amount per person, at around $1,850.

The vast majority of Economic Impact Payments from the three pieces of authorizing legislation have now been disbursed, helping propel personal disposable income to record levels over the course of the pandemic. Recent analysis by the Federal Reserve Bank of New York shows that the average marginal propensity to consume the three rounds of EIPs was 26 percent, with around 38 percent of stimulus payments saved, and the rest going toward debt payments. Given the relatively high percentage of EIPs saved, there may yet be delayed consumption effects from these payments as the economy continues to reopen and recover from the pandemic.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.