Six Ways to Fight Inflation

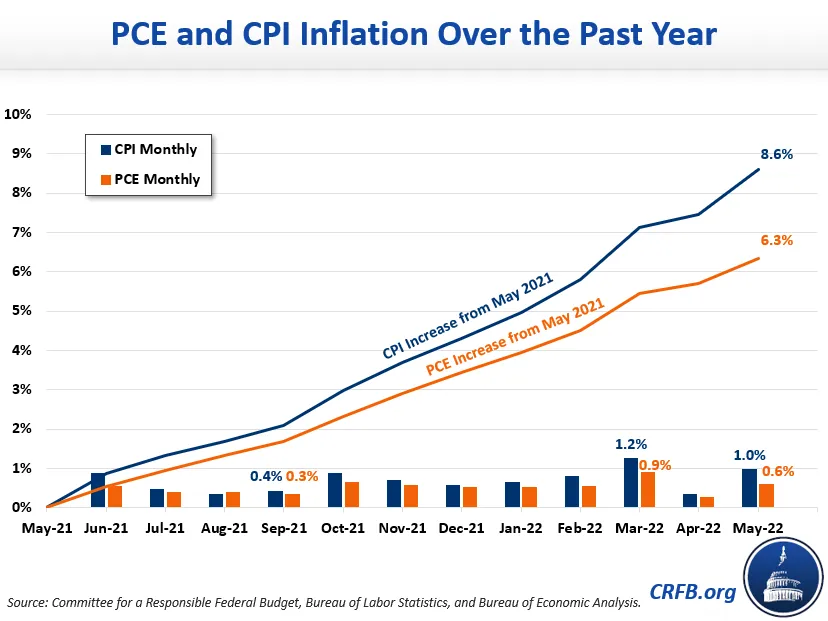

Personal Consumption Expenditure (PCE) inflation rose by 6.3 percent over the past year and 0.6 percent last month according to new data from the Bureau of Economic Analysis, well above the Federal Reserve’s 2 percent annual (0.166 percent monthly) target. Consumer Price Index (CPI) inflation is up 8.6 percent – the highest in over four decades.

While it is mainly the responsibility of the Federal Reserve to fight inflation, smart fiscal policy can help assist the Fed in reducing the inflation rate while minimizing negative effects on output, employment, and financial stability.

As President Biden has remarked numerous times, “bringing down the deficit is one way to ease inflationary pressures.” This could include avoiding further deficit-boosting measures; lowering health care costs; raising tax revenue; reducing consumption-oriented spending; promoting work, savings, and investment; and/or lowering energy, trade, and procurement costs.

As the Federal Reserve continues to raise interest rates and shrink its balance sheet in order to temper demand and reduce inflationary pressures, Congress and the President should use tools at their disposal to assist in the effort to fight inflation. They could reduce inflation in the following ways:

- Stop Digging: At a minimum, Congress should avoid making the inflationary environment worse. They could do so by ending remaining COVID relief – including the student debt repayment pause and enhanced Medicaid payments to states – that are boosting price levels by 0.2 to 0.7 percentage points. They should also avoid adding more to the deficit, whether through a gas tax holiday, student debt cancellation, expanded veterans benefits, a “competitiveness" bill, aid to restaurants, retirement reforms, or new tax cuts.

- Lower Health Care Costs: The federal government directly influences many health care prices through payments to Medicare providers and Medicare Advantage plans as well as through its coverage of prescription drugs. Thoughtful health care reforms can reduce prices and the utilization of care, which would ease inflationary pressures. Based on one study, each percentage point reduction in Medicare costs would reduce the inflation rate by 5 to 15 basis points.

- Reform the Tax Code to Raise More Revenue: The size and structure of the tax code affect inflation mainly through their impacts on the size and distribution of after-tax income. Tax increases can reduce demand in a distributionally desirable way, putting downward pressure on inflation. Lawmakers can further reduce inflation by limiting tax expenditures and subsidies that drive up specific prices in the economy.

- Limit Discretionary Spending, Reduce Consumption-Oriented Spending, and Shrink Aid to States: To further temper demand, policymakers should limit the size of next year’s appropriations, reimpose discretionary spending caps to limit future spending growth, and reduce spending on various programs ranging from farm subsidies to Social Security benefits for high earners. In light of the $900 billion of federal aid sent to cash-flush state and local governments, lawmakers could also consider reducing certain state and local funding.

- Promote Work, Savings, and Investment: Increased labor supply, capital supply, productivity, and personal savings can help to reduce inflationary pressures. Policymakers could reduce barriers to work, for example, by eliminating the Social Security earnings test, allowing older workers to collect the Earned Income Tax Credit, improving work requirements in some programs, providing vocational training for disabled workers, and other reforms. They could encourage savings by promoting the purchase of inflation-indexed bonds, expanding the saver's credit, or improving tax preferences for retirement savings. They could also support investments through regulatory reforms and targeted federal funding. Importantly, failing to offset new investments will undermine any inflationary gains, as higher demand would offset higher supply.

- Lower Energy, Trade, and Procurement Costs: Beyond the normal supply and demand channels, government policies and regulations can influence the before- or after-tax price of various goods and services. For example, the government can help control inflation by ensuring it is getting the best price for its dollars, reducing tariffs that push up the price of goods, ending regulations that boost shipping costs, and encouraging extraction of fossil fuels and production of renewable energy, among other means.

The Federal Reserve is rightly responsible for maintaining price stability and should continue to take steps to bring inflation down. However, navigating a “soft landing” – in which inflation is brought under control without triggering a recession – on its own will be challenging for the Fed, particularly if lawmakers continue to use fiscal policy to worsen inflationary pressures.

Congress and the President should instead work together to assist the Federal Reserve in fighting inflation, including by paying for new policies, ending COVID relief, lowering health care costs, raising revenue, reducing spending, boosting the supply side of the economy, and lowering prices within their purview.