State and Local Governments Flush with Cash

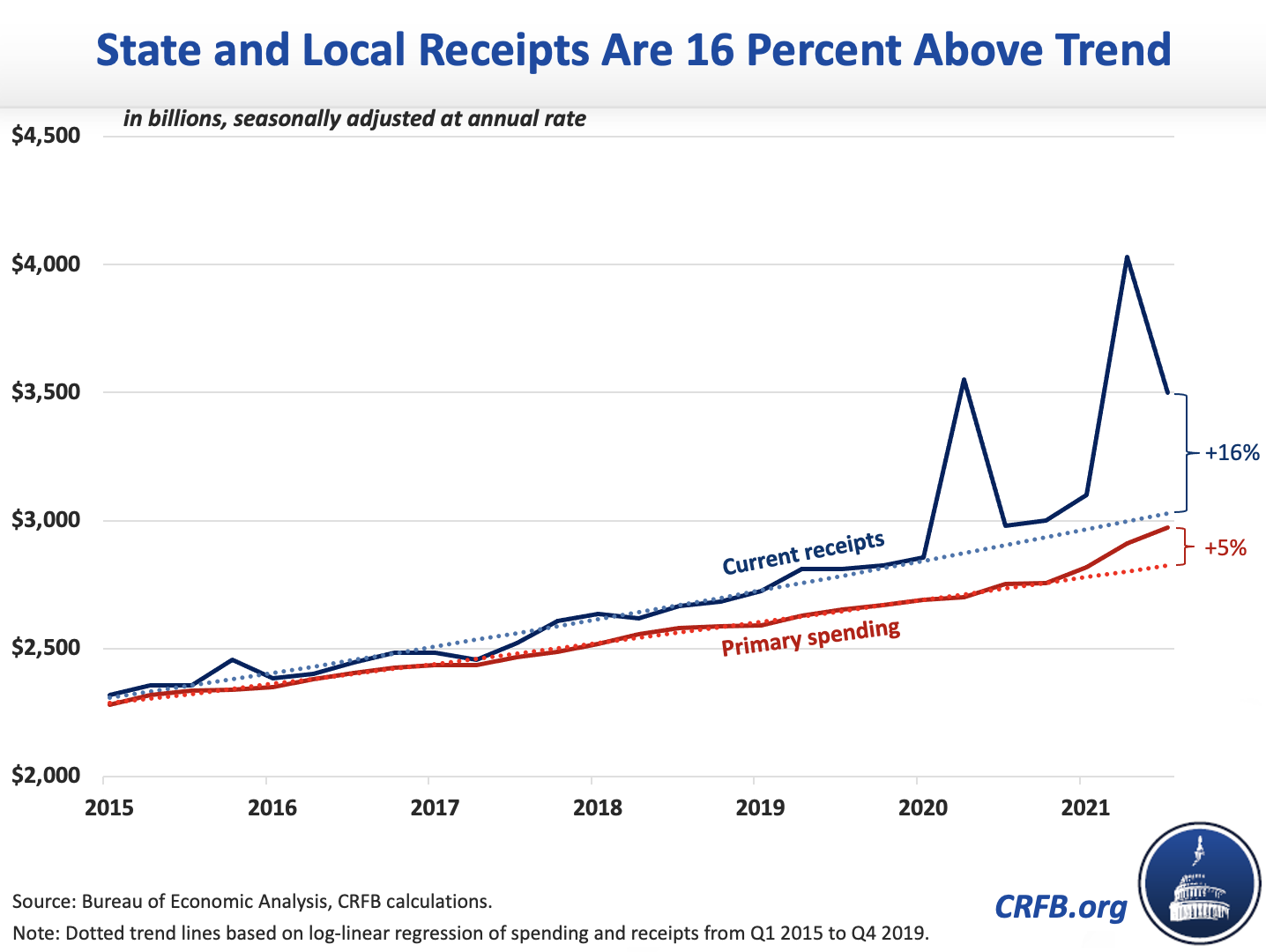

The Bureau of Economic Analysis (BEA) recently released data on state and local government spending and receipts in the third quarter of 2021. Receipts are 23 percent above pre-pandemic levels and roughly 16 percent above their pre-pandemic trend in the three-month period from July through September, thanks to massive federal transfer payments from COVID relief legislation and a strong economic recovery. Non-interest state and local government spending meanwhile is just 5 percent above trend.

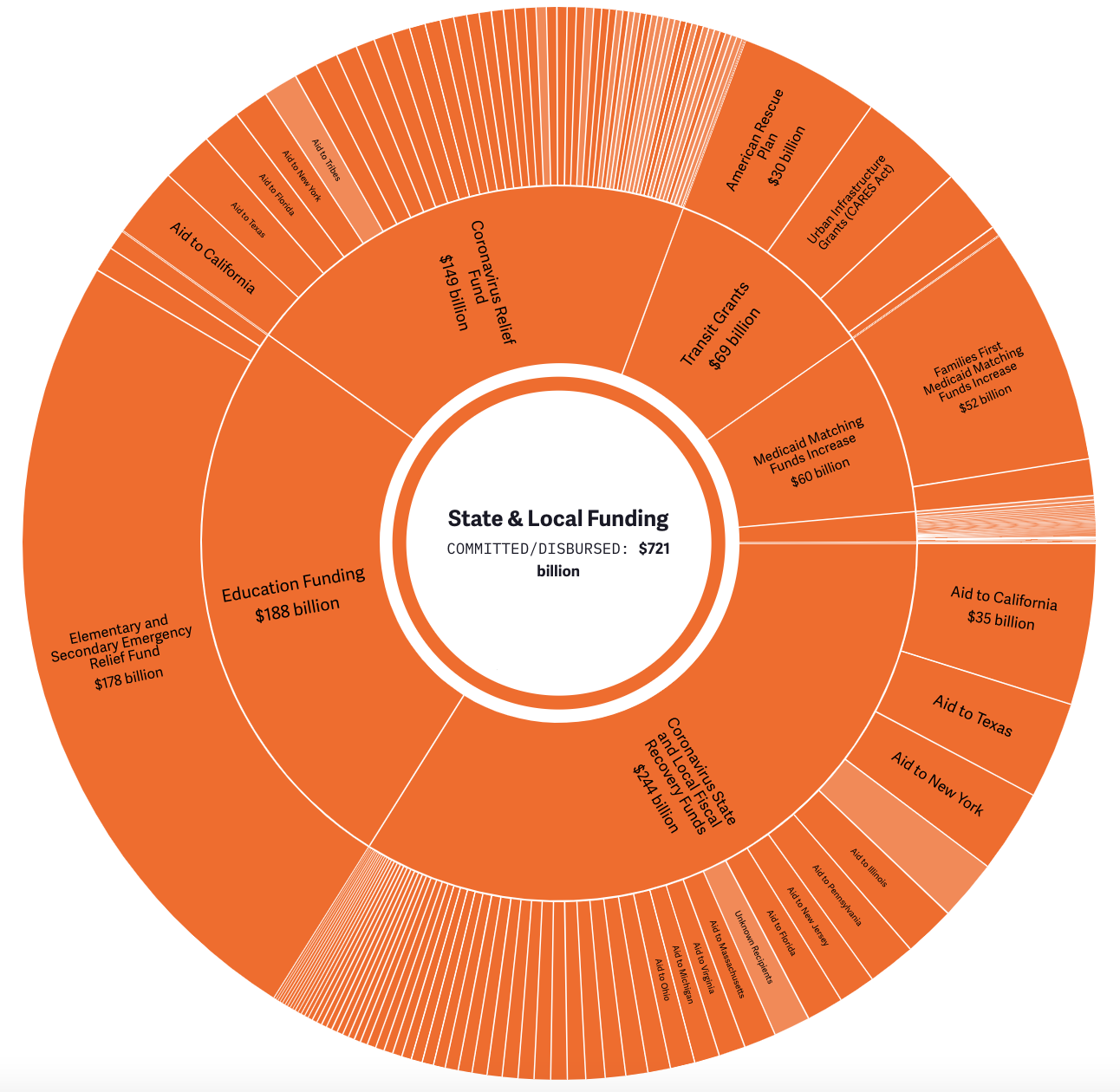

In total, Congress has allocated around $885 billion in direct aid to state and local governments and entities through various COVID relief bills, including $525 billion from the American Rescue Plan. This includes $500 billion in grants to state and local governments, $100 billion from a higher Medicaid matching rate, more than $200 billion for public schools, and over $70 billion for transit.

Thus far, we estimate around $720 billion — or 81 percent — of the $885 billion in allocated funding has been committed or disbursed to date. You can explore all of this support broken down by state at COVIDMoneyTracker.org.

State and local governments have also been the indirect beneficiaries of other assistance in COVID relief legislation, such as taxable unemployment benefits and spillover effects from stronger economic growth, support for loans, and funding where state and local governments act primarily as a pass-through. All told, state and local governments are likely to be well over $1 trillion better off as a result of COVID relief legislation.

State and Local Finances Have More than Stabilized

In our previous analysis, published before the American Rescue Plan was enacted, we made the case that states did not need an additional half a trillion dollars of COVID relief. At the time, we showed that state and local revenues had stabilized and, inclusive of federal aid, receipts in the fourth quarter of 2020 were 6 percent higher than in the fourth quarter of 2019.

In the third quarter of 2021, total receipts are 23 percent higher than pre-pandemic levels, while revenues and primary spending are 10 and 11 percent higher, respectively. In the second quarter, receipts were up 41 percent from pre-pandemic levels. Total receipts are up 25 percent, revenues are up 11 percent, and primary spending is up 12 percent over a two-year period from the third quarter of 2019.

States are doing so well on revenue growth alone that eleven of them have decided to cut individual and/or corporate tax rates this year, financed by revenue growth from fiscal year (FY) 2019 to FY 2021. The American Rescue Plan will distribute over $44 billion to these eleven states despite them averaging general revenue growth of 16 percent from FY 2019 to FY 2021.

State and Local Aid in American Rescue Plan and FY 2019-21 Revenue Growth, Select States

| State | State Allocation | Local Allocation | Total Allocation | General Revenue Growth (FY 19 – FY 21) |

|---|---|---|---|---|

| in billions | ||||

| Arizona | $4.18 | $2.64 | $6.83 | 21% |

| Idaho | $1.09 | $0.58 | $1.67 | 35% |

| Iowa | $1.48 | $1.17 | $2.65 | 13% |

| Louisiana | $3.01 | $1.81 | $4.82 | 6% |

| Missouri | $2.69 | $2.47 | $5.16 | 17% |

| Montana | $0.91 | $0.34 | $1.25 | 19% |

| Nebraska | $1.04 | $0.66 | $1.70 | 23% |

| New Hampshire | $0.99 | $0.46 | $1.46 | 11% |

| Ohio | $5.37 | $5.29 | $10.66 | 13% |

| Oklahoma | $1.87 | $1.32 | $3.19 | 5% |

| Wisconsin | $2.53 | $2.32 | $4.86 | 9% |

| Totals | $25.16 | $19.06 | $44.25 | N/A |

Sources: U.S. Treasury, Tax Foundation.

States are allowed to cut taxes under the terms of the federal assistance from the American Rescue Plan if they offset them with other tax increases, spending cuts, or if their annual revenue is higher than (or less than one percent below) their 2019 baseline revenue. Clearly, these states have leeway to cut taxes financed by revenue growth alone without making other concessions, and still be in compliance with Treasury guidelines.

In February (reiterated in May) we warned that the direct state and local aid in the American Rescue Plan was not proportional to the effect the pandemic had on state finances, especially given the amount of federal support states had received up till that point.

BEA data for the third quarter shows that state and local governments did, in fact, receive far more funding than was necessary.