Senate Retirement Bill Would Cost $84 Billion Without Gimmicks

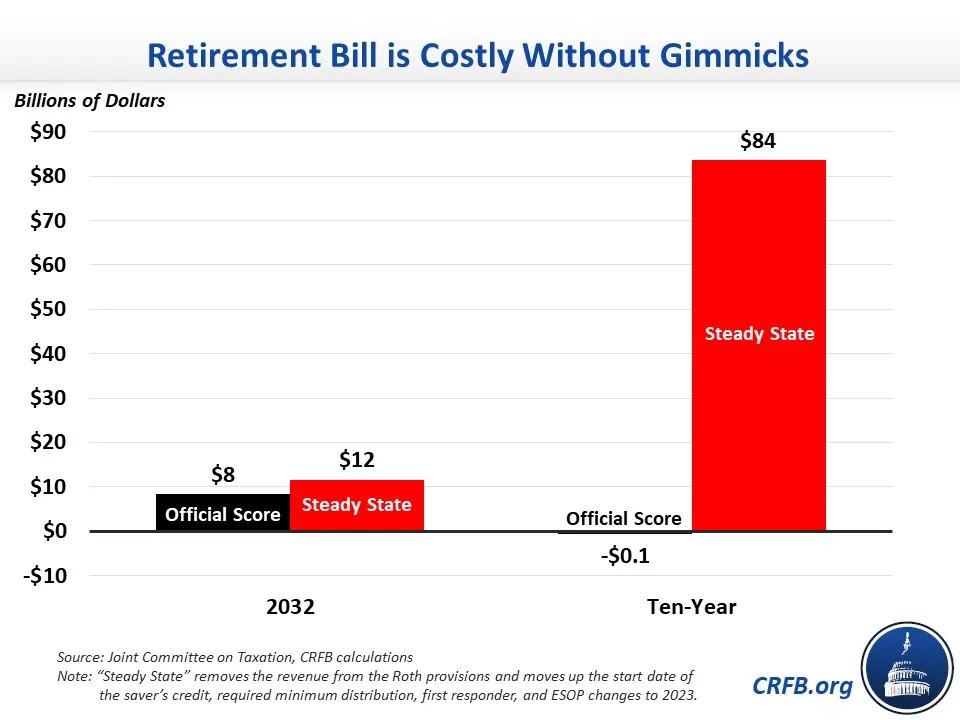

The Senate Finance Committee recently advanced the Enhancing American Retirement Now (EARN) Act, a bill designed to encourage private retirement savings. The $39 billion cost of the bill is offset entirely with timing gimmicks related to Roth IRAs. Even with the gimmicks, the bill would increase annual deficits from 2028 onward. In the steady state, we estimate the bill would cost $84 billion over a decade, including $12 billion in 2032 alone. Lawmakers should instead pass a fiscally responsible retirement bill, free of gimmicks and timing shifts.

The EARN Act would make several changes to encourage more retirement savings, including expanding the saver's credit and reforming it to be a matching contribution rather than cash, increasing the "catch-up" contribution limit for people in their early 60s, increasing the age for required minimum distributions, and allowing penalty-free withdrawals in certain instances. In total, these changes would cost $39 billion through 2032, including $12 billion in 2032.

This cost is offset on paper by provisions allowing employer contributions to 401(k)s to be put in a Roth IRA and requiring catch-up contributions to be put in Roth IRAs. As a result, the Joint Committee on Taxation (JCT) has scored the bill as reducing deficits by $0.1 billion over a decade and increasing them by $8 billion in 2032.

However, the bill relies on gimmicks and timing shifts to achieve this supposed budget-neutrality. The legislation expands the saver's credit and ABLE accounts and reduces taxes for first responders employee stock ownership plans but delays the start of these policies for 4 or 5 years. And it increases the required minimum distribution age for IRAs from 72 to 75 but not until 2032.

Perhaps most egregiously, the legislation is offset by policy changes that would shift the timing rather than the amount of tax collections. Specifically, the legislation would require and allow greater use of "Roth contributions" to retirement accounts, which are taxable when made but allow for tax-free withdrawal (conventional retirement accounts are the opposite). While these provisions would raise $39 billion over the first decade, they would reduce future revenue as retirement funds were withdrawn. The net effect is somewhat uncertain, but it is very likely these provisions would be net deficit-increasing on a present value basis.

Ten-Year Budgetary Effect of Senate Finance Retirement Bill

| Policy | Official Cost/Savings (-) | Steady State Cost/Savings (-) |

|---|---|---|

| Reform saver's credit | $10 billion | $18 billion |

| Increase required minimum distribution age | $4 billion | $30 billion |

| Exclude from taxation first responder retirement payments | $3 billion | $7 billion |

| Defer 10% of gain for ESOPs sponsored by S corporations | $2 billion | $6 billion |

| Provide tax credit for small employer contributions | $3 billion | $3 billion |

| Increase "catch-up" limit in early 60s and index to inflation | $2 billion | $2 billion |

| Other provisions | $15 billion | $17 billion |

| Subtotal | $39 billion | $84 billion |

| Allow or require conversions to Roth IRAs | -$39 billion | * |

| Total | -$0.1 billion | $84 billion |

Sources: Joint Committee on Taxation and Committee for a Responsible Federal Budget calculations. Numbers may not add up due to rounding.

Note: Steady state removes revenue from Roth provisions and assumes saver's credit, required minimum distribution, first responder, and ESOP changes start in 2023.

*The Roth provisions will raise revenue in the short term but lose revenue over the long term. We expect the provisions would ultimately lose revenue on a present value basis but assume zero net cost here.

Under a steady-state score, where benefit expansions were enacted in full by 2023 or 2024 and the timing-shift effects of the Roth provisions were removed, we estimate the EARN Act would cost $84 billion over a decade, rather than being deficit neutral. In 2032, the net cost of the legislation would total $12 billion on a steady state basis, up from $8 billion as written. And even as written, the second-decade cost would very likely exceed $100 billion, possibly significantly so.

In short, the Finance bill would increase deficits over the long term even with the Roth gimmicks and arbitrary delays in place. It would clearly worsen deficits when these gimmicks are excluded. As with the House retirement bill, lawmakers need to find real and larger pay-fors to actually make the bill fiscally responsible.